Water Entities: Results of the 2011–12 Audits

Overview

This report covers the results of our financial audits of 20 entities, comprising 19 water entities and one controlled entity.

The report informs Parliament about significant issues arising from the audits of financial and performance reports and augments the assurance provided through audit opinions included in the respective entities’ annual reports.

The report comments on the quality and timeliness of financial and performance reporting, the financial sustainability of water entities and the effectiveness of internal controls over risk management and water tariff revenue.

Parliament can have confidence in the adequacy of financial and performance reporting and the internal controls of the entities audited.

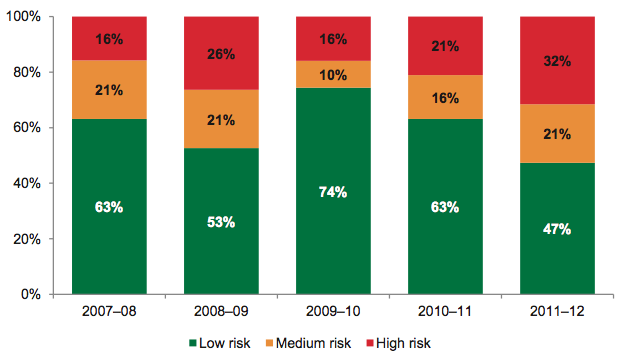

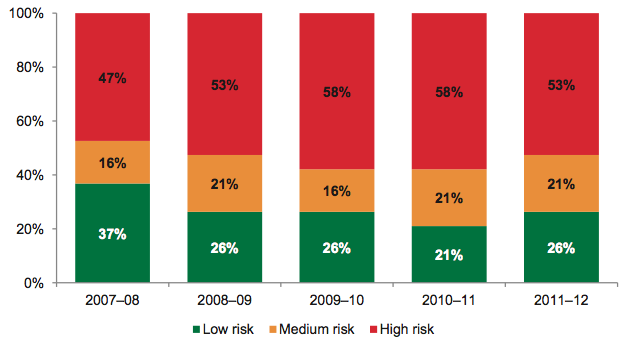

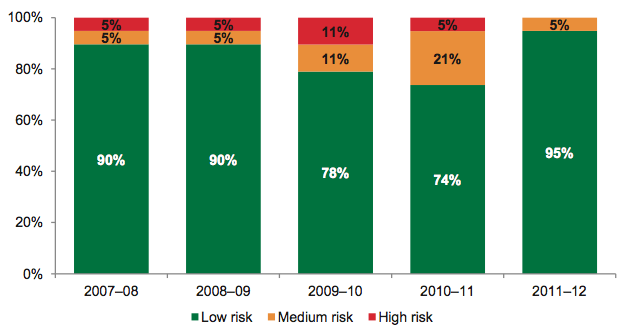

Six entities were rated a high financial sustainability risk at 30 June 2012 due to the magnitude of their operating losses. An analysis of the trends in the financial sustainability indicators shows a deteriorating position for the industry over the five years to 2011–12.

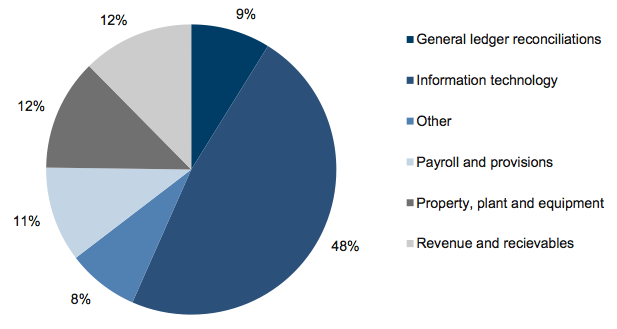

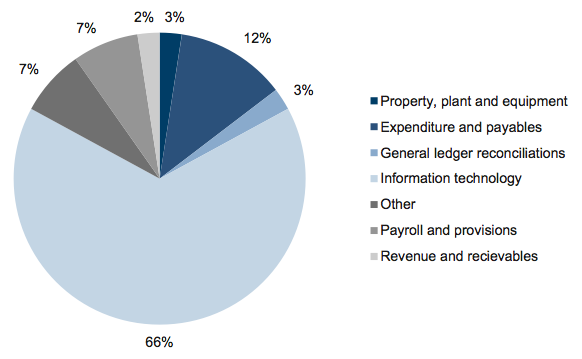

The internal controls were adequate for producing reliable, accurate and timely financial reports. However, controls over information technology, fixed assets, revenue and accounts receivable, payroll and reconciliations can be improved. A number of internal control weaknesses reported to management of 10 entities in 2010–11 or earlier are yet to be resolved by management.

Risk management practices are considered mature with all entities regularly reporting to their governing bodies on risk management matters.

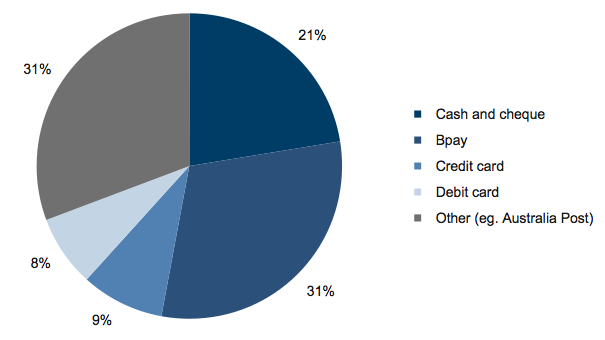

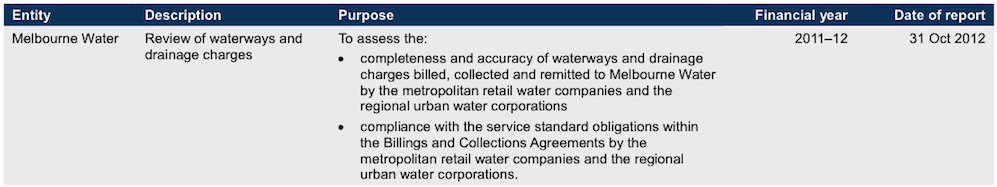

There were adequate internal controls over water tariff revenue. However, poor security controls over point of sale technology and noncompliance with the requirements for processing of credit and debit card payments increases the risk of identity theft and fraud.

Water Entities: Results of the 2011–12 Audits: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER November 2012

PP No 194, Session 2010–12

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on Water Entities: Results of the 2011–12 Audits.

Yours faithfully

D D R PEARSON

Auditor-General

14 November 2012

Audit summary

This report presents the results of our financial audits of 20 entities, comprising 19 water entities and one controlled entity. It provides a detailed analysis of financial and performance reporting, their internal controls, financial results and sustainability.

Clear audit opinions were issued on 19 financial reports for the financial year-ended 30 June 2012. At 2 November 2012 the financial report of Watermove was yet to be finalised.

Clear audit opinions were issued on all 16 performance reports for the year.

Conclusion

Notwithstanding some areas for improvement, Parliament can have confidence in the adequacy of financial and performance reporting and the internal controls of the entities audited.

Findings

Financial results and sustainability

The 19 water entities generated a combined net profit before income tax of $605 million for the year-ended 30 June 2012, an increase of $195 million or 48 per cent from the prior year, predominantly due to increased service and usage charges. Dividend payments to the state government increased by $198 million or 278 per cent in 2011–12.

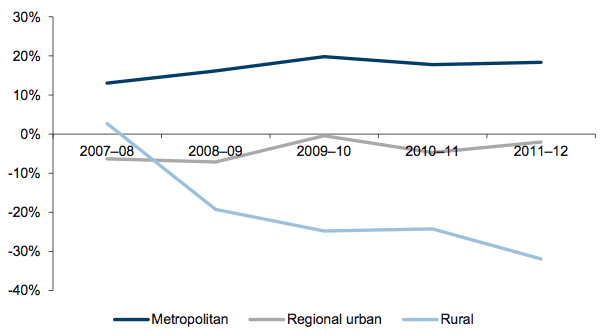

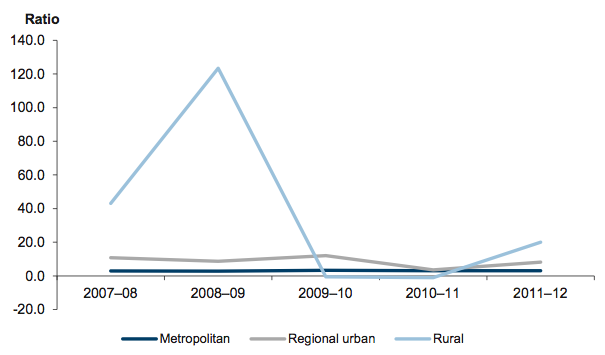

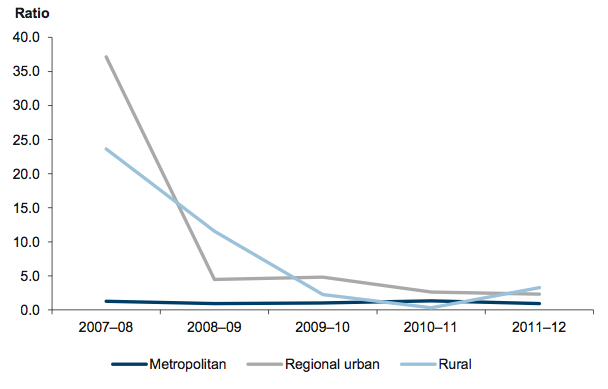

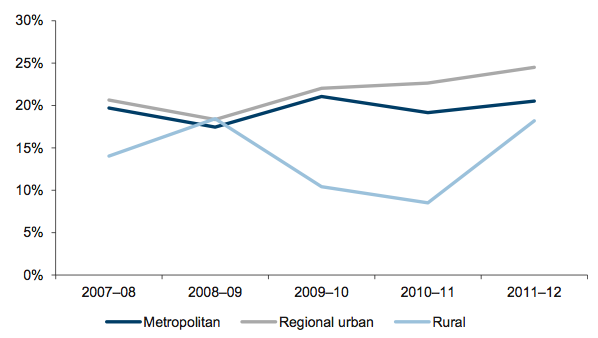

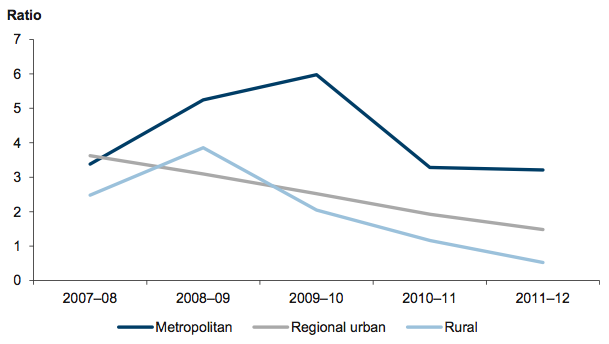

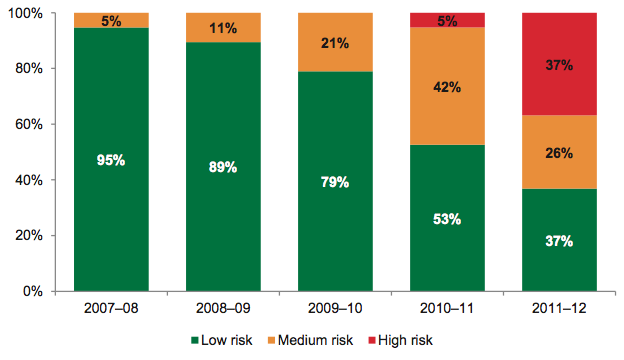

The four metropolitan water entities continue to generate strong profits year-on-year. However, four of the 13 regional urban water entities (31 per cent) reported a lower net profit before tax in 2011–12 relative to the prior year and eight reported a net loss before tax (five in 2010–11). The two rural water entities continue to report losses.

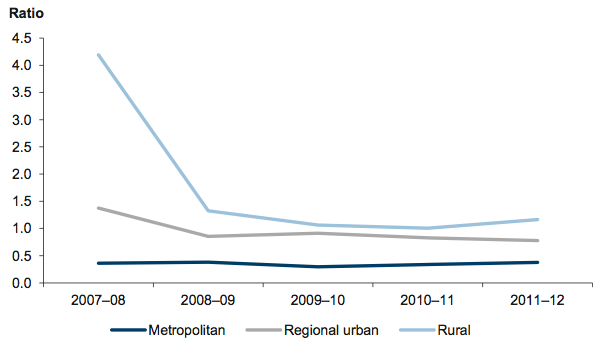

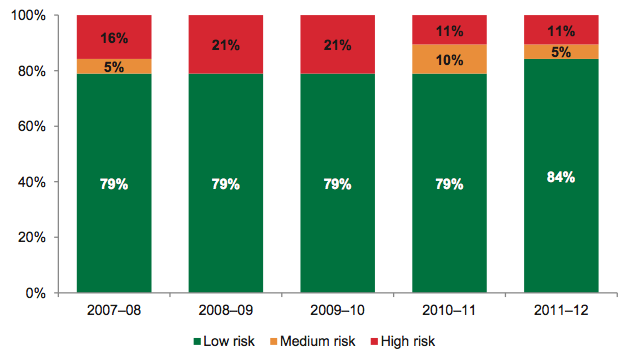

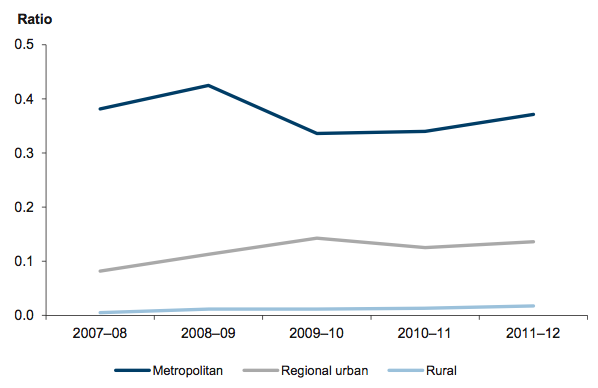

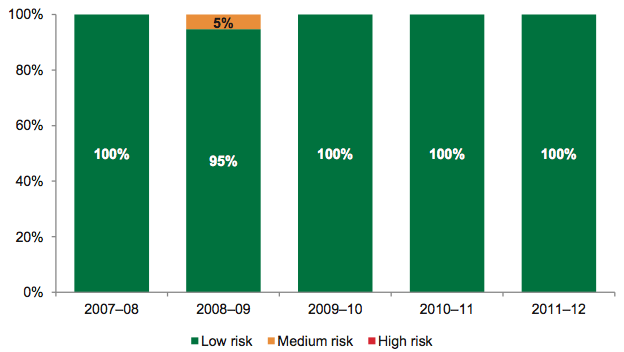

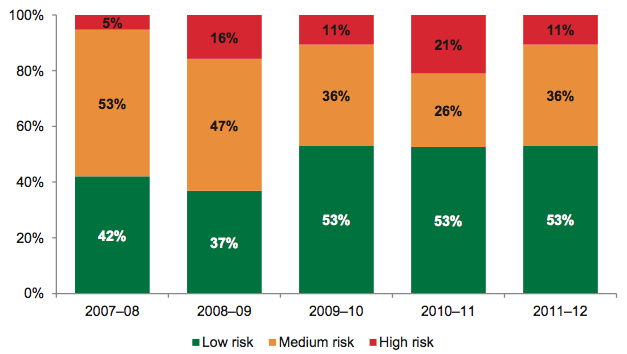

Most entities are in the low- and medium-risk categories for financial sustainability, however, the data shows a deteriorating trend for the industry as a whole over the five‑year period to 2011–12. The number of entities with a poor underlying result has doubled over the five-year period while the liquidity ratio has shown no sign of improvement in recent years. While the interest cover ratio is strong for many entities, indicating they are able to service their interest payments, the debt service cover for two metropolitan water entities indicates their ability to repay debt is low. Due to the overbilling issue of 2011–12 following delays with commissioning of the desalination plant, the 2012–13 price freeze will impact revenue and operating cash flows of the metropolitan water entities in the short term. In turn this further impacts their ability to repay debt.

Our analysis of capital expenditure for the period 2008–09 to 2011–12 revealed that actual expenditure is likely to differ from the regulatory target as outlined in the Essential Service Commission price determinations. Therefore the prices levied may result in significant under or over recovery of costs by the water entities during the regulatory period.

Performance reporting

The absence of targets continues to reduce the usefulness of performance reports because a comparison of actual performance against targets cannot be made.

A performance reporting working group was established in 2011–12 to develop a consistent and contemporary performance reporting framework for the water industry. Its intention is that the new performance reporting framework will apply from 1 July 2013.

Internal controls

The internal controls were adequate for producing reliable, accurate and timely financial reports. Nevertheless, a number of areas for improvement were identified.

Information technology control weaknesses were identified at 53 per cent of entities (10 of 19) which is concerning given the sensitivity of information captured by the entities, and the heavy reliance on information systems.

A number of internal control weaknesses reported to management of 10 entities in 2010–11 or earlier are yet to be resolved by management. The governing bodies need to take more timely action to rectify this situation and to demonstrate a commitment to ensuring sound internal controls are in place and that they are operating effectively.

Risk management practices are considered mature with all entities regularly reporting to their governing bodies on risk management matters.

Overall, there were adequate internal controls over water tariff revenue. However, poor security controls over point of sale technology and noncompliance with the requirements for processing of credit and debit card payments increases the risk of identity theft and fraud.

Recommendations

- 1 & 2. Water entities should further refine their financial and performance reporting processes by developing plans, preparing shell statements, performing materiality assessments, conducting analytical and compliance reviews, having adequate security to protect and safeguard sensitive information and improving their quality assurance processes.

- 3. The performance reporting working group should continue to develop and implement a consistent and contemporary performance reporting framework, in line with its time lines and our proposed expanded opinions from 2013–14.

- 4. Water entities should set targets for all indicators in their performance reports to enable meaningful assessment of performance.

- 5. The Essential Services Commission should revisit the duration of the water plans and the funding model's flexibility to deal with situations where the actual financial outcomes differ significantly from what was proposed in the approved water plans due to changed circumstances and/or environmental conditions.

Water entities should:

- 6. assess their policies and procedures against the common general internal control weaknesses and the better practices identified, and act in a timely manner to address shortcomings

- 7. take timely action to address identified information technology, fixed assets, payroll, billings system and accounts receivable and general ledger reconciliation control weaknesses

- 8. address long outstanding internal control weaknesses immediately, to demonstrate a commitment to management's responsibilities for ensuring sound internal controls are in place and are operating effectively

- 9. strengthen their oversight of credit notes by generating reports that detail the number and dollar value, key reason, action taken or planned and a trend analysis

- 10. develop and maintain comprehensive credit/debit card policies and procedures which are appropriately approved and subject to regular review

- 11. assess compliance against the requirements of the Payment Card Industry–Data Security Standard and act quickly to achieve compliance in order to protect the security of customer credit and debit card information and data

- 12. change the default security settings on their key information systems and databases, including point of sale systems, immediately.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to the Department of Treasury and Finance, the Department of Sustainability and Environment, the Essential Services Commission, VicWater and the 20 entities with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments however, are included in Appendix H.

1 Background

1.1 Introduction

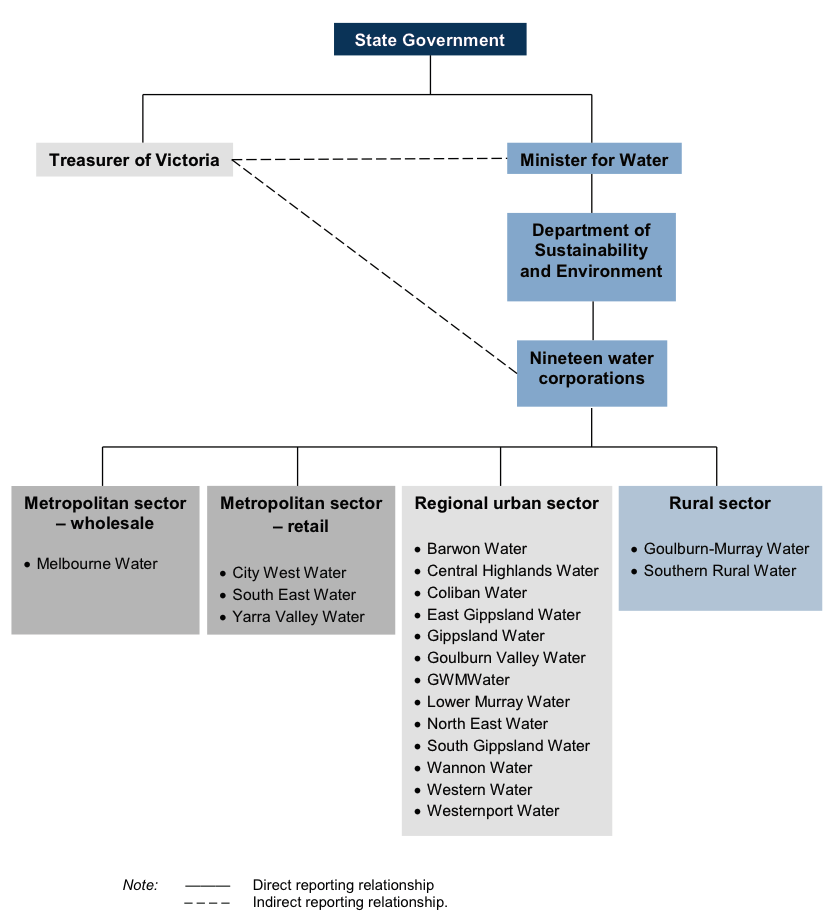

The Victorian water industry consists of 20 entities, comprising 19 water entities and one controlled entity. All entities are wholly owned by the state. The entities are stand‑alone businesses responsible for their own management and performance. Each governing board appoints a managing director responsible for the day-to-day operating activities of the entity. An overview of the accountability arrangements of the water industry is provided in Appendix B.

The entities are expected to adopt sustainable management practices which give due regard to environmental impacts and which allow water resources to be conserved, properly managed, and sustained.

The water industry can be categorised into the metropolitan, regional urban and rural sectors. Figure 1A details the number of entities by sector.

Figure 1A

Water industry sectors

|

Sector |

Water entities |

Controlled entities |

Total |

|---|---|---|---|

|

Metropolitan |

4 |

0 |

4 |

|

Regional urban |

13 |

0 |

13 |

|

Rural |

2 |

1 |

3 |

|

Total |

19 |

1 |

20 |

Source: Victorian Auditor-General’s Office.

Figure 1B lists the legal and trading names of the 20 entities.

Figure 1B

Water entities and the controlled entity

|

Legal name |

Trading name |

|---|---|

|

Metropolitan sector |

|

|

Wholesaler |

|

|

Melbourne Water Corporation |

Melbourne Water |

|

Retailers |

|

|

City West Water Corporation South East Water Corporation Yarra Valley Water Corporation |

City West Water South East Water Yarra Valley Water |

|

Regional urban sector |

|

|

Barwon Region Water Corporation |

Barwon Water |

|

Central Gippsland Region Water Corporation |

Gippsland Water |

|

Central Highlands Region Water Corporation |

Central Highlands Water |

|

Coliban Region Water Corporation |

Coliban Water |

|

East Gippsland Region Water Corporation |

East Gippsland Water |

|

Goulburn Valley Region Water Corporation |

Goulburn Valley Water |

|

Grampians Wimmera Mallee Water Corporation |

GWMWater |

|

Lower Murray Urban and Rural Water Corporation |

Lower Murray Water |

|

North East Region Water Corporation |

North East Water |

|

South Gippsland Region Water Corporation |

South Gippsland Water |

|

Wannon Region Water Corporation |

Wannon Water |

|

Western Region Water Corporation |

Western Water |

|

Westernport Region Water Corporation |

Westernport Water |

|

Rural sector |

|

|

Gippsland and Southern Rural Water Corporation |

Southern Rural Water |

|

Goulburn-Murray Rural Water Corporation |

Goulburn-Murray Water |

|

Controlled entity |

|

|

Watermove Pty Ltd |

Watermove |

Note: Watermove is a controlled entity of Goulburn-Murray Water.

Source: Victorian Auditor-General’s Office.

This report addresses issues arising from the 2011–12 financial audits of the water industry, and augments the assurance provided through audit opinions on financial and performance reports included in the respective entities’ annual reports.

The report comments on the financial sustainability of the entities and their financial management and reporting activities. It also comments on the effectiveness of internal controls, in particular, controls over risk management and water tariff revenue.

The other VAGO reports on the results of our 2011–12 financial audits are outlined in Appendix C.

1.2 Recent water industry reform

1.2.1 Changes to the metropolitan water retailers

The metropolitan water sector comprises four entities; a wholesaler and three retailers.

The three retailers, namely City West Water, South East Water and Yarra Valley Water were established under the State Owned Enterprises Act 1992. They commenced operations on 1 January 1995 with licences issued by the Minister for Water under the Water Industry Act 1994. The retailers were also subject to the requirements of the Corporations Act 2001.

Until 30 June 2012 the three retailers were public companies, with their shares held by State Trustees Limited on behalf of the state. Their primary reporting relationship was to the Treasurer of Victoria. They were also accountable to the Minister for Water.

The Water Amendment (Governance and Other Reforms) Act 2012 (Governance Act), which received royal assent on 3 April 2012, established three new statutory authorities, City West Water Corporation, South East Water Corporation and Yarra Valley Water Corporation. These bodies are the successors in law to the former bodies.

While the legal form of the three retailers changed, effective 1 July 2012, there was no change to the boundaries, operations, functions and services of the pre-existing entities. The pre-existing property, rights and liabilities were also transferred to the new statutory corporations.

The Governance Act contained transitional provisions dealing with matters such as:

- cessation of old licensees

- appointment of members of the board of directors

- appointment of authorised water officers

- transfer of assets and liabilities

- transfer of staff

- Statement of Obligations.

The three retailers now operate under the provisions of the Water Act 1989. From a financial reporting perspective they must also comply with the requirements of the Financial Management Act 1994 and the Financial Reporting Directions issued by the Minister for Finance. However, because the previous arrangements were in place at 30 June 2012, the 2011–12 financial report of each of the three entities was prepared according to the requirements of the Corporations Act 2001.

The three public companies are being voluntarily wound up. An administrator has been appointed to oversee that process.

Special resolutions to voluntarily wind up the companies and to appoint a liquidator were passed by all three companies at extraordinary general meetings. The liquidation process has commenced.

Deregistration of the companies by the Australian Securities and Investments Commission is expected to occur in December 2012.

1.2.2 Integration of the Northern Victorian Irrigation Renewal Project and Goulburn-Murray Water

The State Owned Enterprise for Irrigation Modernisation in Northern Victoria, which traded as the Northern Victorian Irrigation Renewal Project (NVIRP), was established in 2007 to plan, design and deliver the food bowl modernisation project. The project, with a budget of $2.063 billion, is now being delivered by Goulburn-Murray Water (G‑MW), following a decision during 2011–12 to integrate the operations of NVIRP with G-MW.

To facilitate the transfer of functions, activities and all the property, assets and liabilities of NVIRP to G-MW, NVIRP was declared a reorganising body under the provisions of the State Owned Enterprise Act 1992. NVIRP employees were transferred to G‑MW under the provisions of the Public Administration Act 2004. The changes were effective from 1 July 2012.

A new executive management team was announced at G-MW in July 2012, with the former NVIRP interim chief executive appointed to head the business unit responsible for day-to-day management of the food bowl modernisation project.

As a result of the NVIRP Board being disbanded on 30 June 2012 the G-MW Board was responsible for the preparation, finalisation and certification of the NVIRP financial report for 2011–12. The financial reports of NVIRP and G-MW for 2011–12 contained details of the integration.

The former chairman of NVIRP was appointed to the G-MW Board by the Minister for Water.

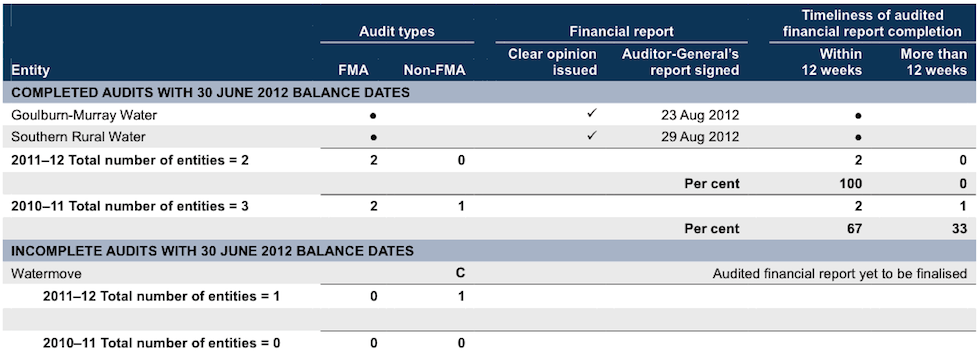

1.2.3 Watermove to cease operations

Watermove, a controlled entity of G-MW, commenced trading on 1 November 2009. It generated an operating loss each year since inception.

With G-MW keen to focus on its core business, the directors of Watermove resolved at a board meeting on 10 August 2012 to discontinue the operations. G-MW is investigating the sale of the business and assets and has agreed to take full responsibility for the repayment of all outstanding Watermove debts.

1.3 Financial audit framework

1.3.1 Audit of financial reports

An annual financial audit has two aims:

- to give an opinion consistent with section 9 of the Audit Act 1994, on whether financial reports are fairly stated

- to consider whether there has been wastage of public resources or a lack of probity or financial prudence in the management or application of public resources, consistent with section 3A(2) of the Audit Act 1994.

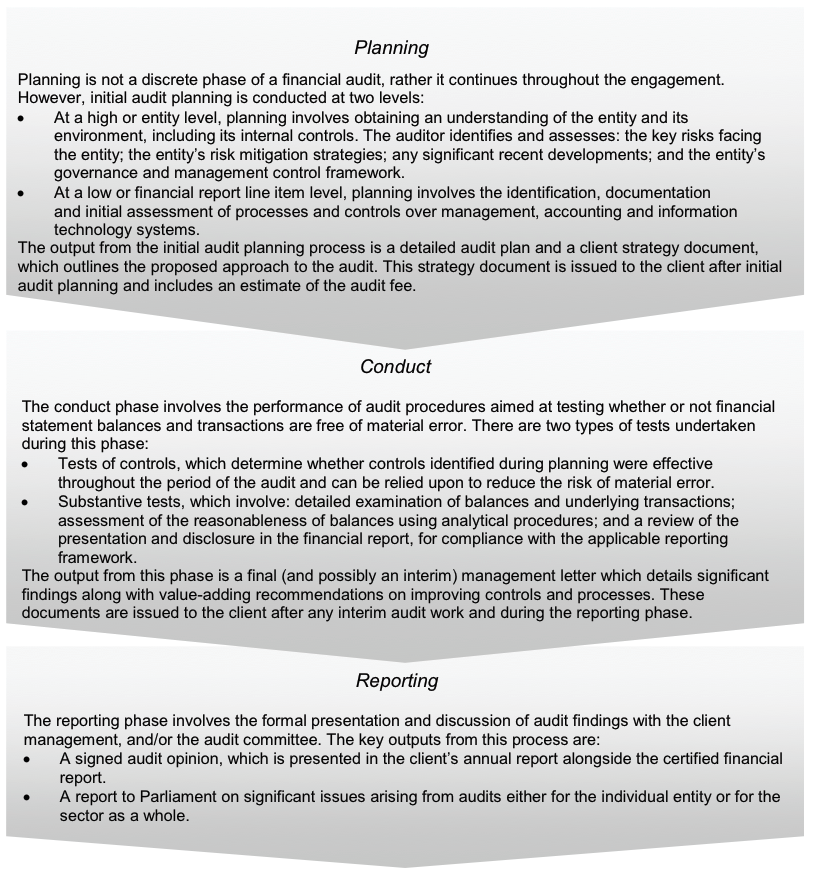

The financial audit framework applied in the conduct of the 2011–12 is set out in Figure 1C.

Figure 1C

Financial audit framework

Source: Victorian Auditor-General’s Office.

1.3.2 Audit of performance reports

Section 8(3) of the Audit Act 1994 authorises the Auditor-General to audit performance indicators included in the annual reports of a public sector entity to determine whether they fairly represent the entity’s actual performance.

The Auditor-General uses this authority to audit the performance reports prepared by the water industry under Financial Reporting Direction 27B Presentation and Reporting of Performance Information.

1.3.3 Audit of internal controls

An entity’s governing body is responsible for developing and maintaining its internal control framework. Internal controls are systems, policies and procedures that help an entity to reliably and cost-effectively meet its objectives. Sound internal controls enable the delivery of reliable, accurate and timely external and internal reporting.

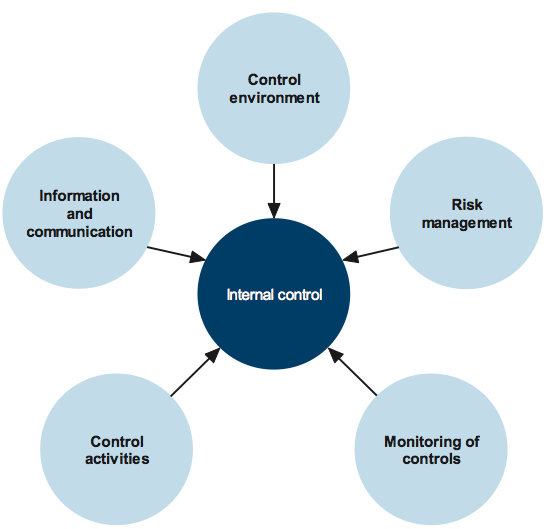

Figure 1D identifies the main components of an effective internal control framework.

Figure 1D

Components of an internal control framework

Source: Victorian Auditor-General’s Office.

In the diagram:

- the control environment provides the fundamental discipline and structure for the controls and includes governance and management functions and the attitudes, awareness, and actions of those charged with governance and management of an entity

- risk management involves identifying, analysing and mitigating risks

- monitoring of controls involves observing the internal controls in practice and assessing their effectiveness

- control activities are policies, procedures and practices prescribed by management to help meet an entity’s objectives

- information and communication involves communicating control responsibilities throughout the entity and providing information in a form and time frame that allows officers to discharge their responsibilities.

The annual financial audit enables the Auditor-General to form an opinion on an entity’s financial report. Integral to this, and a requirement of Australian Auditing Standard 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment, is to assess the adequacy of an entity’s internal control framework and governance processes related to its financial reporting.

Internal control weaknesses we identify during an audit do not usually result in a ‘qualified’ audit opinion. A qualification is usually warranted only if weaknesses cause significant uncertainty about the accuracy, completeness and reliability of the financial information being reported. Often, an entity will have compensating controls that mitigate the risk of a material error in the financial report.

Weaknesses we find during an audit are brought to the attention of an entity’s chairperson, managing director and audit committee by way of a management letter.

Section 16 of the Audit Act 1994 empowers the Auditor-General to report to Parliament on the results of audits. This report includes the results of our review of internal controls related to the financial reporting responsibilities of the water industry.

1.4 Audit conduct

The audits were undertaken in accordance with the Australian Auditing Standards.

The total cost of preparing and printing this report was $190 000.

1.5 Structure of this report

Figure 1E outlines the structure of this report.

Figure 1E

Report structure

|

Part |

Description |

|---|---|

|

Part 2: Financial reporting |

Outlines the financial reporting framework and comments on the timeliness and accuracy of financial reporting by 19 water entities and the controlled entity. It compares practices in 2011–12 against better practice, legislated time lines and past performance. |

|

Part 3: Performance reporting |

Outlines the performance reporting framework, comments on the timeliness and accuracy of performance reporting and compares practices in 2011–12 against better practice and past performance. It also details work underway to influence the development of indicators included in performance reports and reiterates our intention to further develop our audit of the performance reports in future periods. |

|

Part 4: Financial results |

Illustrates the financial results of the 19 water entities, including financial performance for 2011–12, and financial position at 30 June 2012. |

|

Part 5: Financial sustainability |

Provides insight into the financial sustainability of the 19 water entities obtained from analysing the trends in seven financial sustainability indicators over a five-year period. |

|

Part 6: Internal controls |

Assesses internal controls at the 19 entities and summarises the control weaknesses commonly identified for the year‑ended 30 June 2012. |

Source: Victorian Auditor-General’s Office.

2 Financial reporting

At a glance

Background

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information reported is reliable. The quality of an entity’s reporting can be measured by the timeliness and accuracy of the preparation of the reports. This Part covers the results of the 2011–12 audits of the 19 water entities and one controlled entity. It also compares financial reporting practices in 2011–12 against better practice, legislated time lines and 2010–11 performance.

Conclusion

Parliament can have confidence in each of the 19 financial reports that received clear audit opinions. Financial reporting preparation processes were adequate although opportunity for improvement exists. The entities generally produced complete, accurate and reliable information.

Findings

- Clear audit opinions were issued on 19 financial reports.

- At 2 November 2012 the financial report of Watermove was yet to be finalised.

- All entities, except for Watermove, met the legislated 12-week financial reporting time frame.

Recommendation

Water entities should further refine their financial reporting processes by developing plans, preparing shell statements, performing materiality assessments, conducting analytical reviews and having adequate security to protect and safeguard sensitive information.

2.1 Introduction

This Part covers the results from the audits of the 19 water entities and one controlled entity for 2011–12.

2.2 Financial reporting framework

Each of the audited water entities, including the controlled entity, must prepare its financial report in accordance with Australian Accounting Standards (AAS), including the Australian Accounting Interpretations. The AAS prescribe the accounting treatment to be adopted by for-profit and not-for-profit entities.

For financial reporting purposes the four metropolitan entities are designated as for‑profit entities under Financial Reporting Direction (FRD) 108 Classification of Entities as For-Profit.

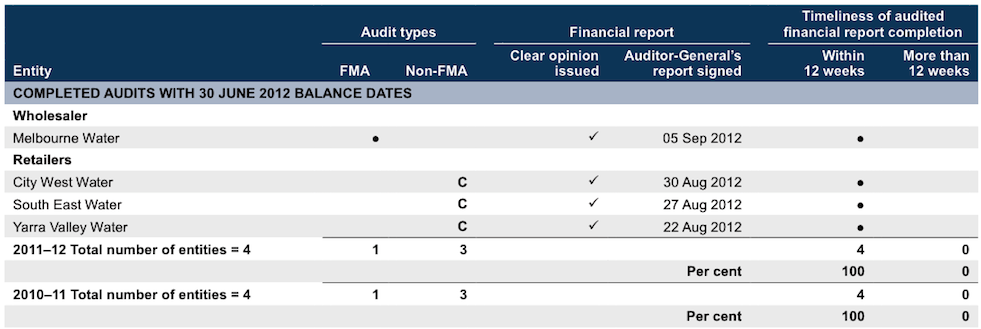

The principal legislation that governed financial reporting by water entities in 2011–12 was the Financial Management Act 1994 (FMA) and the Corporations Act 2001. Figure 2A summarises the number of entities reporting under each Act.

Figure 2A

Legislative framework for water entities and controlled entities

|

Legislative framework |

Water corporations |

Retail distribution companies |

Controlled entities |

Total |

|---|---|---|---|---|

|

Financial Management Act 1994 |

16 |

0 |

0 |

16 |

|

Corporations Act 2001 |

0 |

3 |

1 |

4 |

|

Total |

16 |

3 |

1 |

20 |

Source: Victorian Auditor-General’s Office.

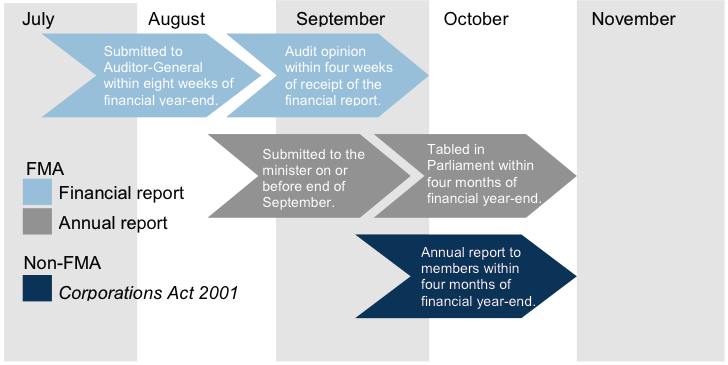

The FMA requires an entity to submit its annual report to its minister. The report should include financial reports for the entity and is to be prepared and audited within 12 weeks of the end of the financial year. The annual report should be tabled in Parliament within four months of the end of the financial year.

The Corporations Act 2001 requires a company to report to its members within four months after the end of the financial year. However, the need to consolidate the results of controlled entities into their parent entity’s financial reports means that controlled entities reporting under the Corporations Act 2001 are in effect also required to report within 12 weeks of the end of the financial year.

Figure 2B summarises the legislative reporting time frames for the water industry entities.

Figure 2B

Legislative reporting time frames

Source: Victorian Auditor-General’s Office.

To achieve more timely reporting, more consistent with current community standards, on 10 February 2012 the Premier issued a circular requiring annual reports to be tabled within three months after the end of the financial year. Ministers and government departments were to work with their portfolio public sector entities with a view of progressively tabling annual reports in Parliament from the end of the second month after year end.

2.3 Audit opinions issued

Clear audit opinions were issued on the financial reports of the 19 water entities for the financial year-ended 30 June 2012.

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information presented is reliable. A clear audit opinion confirms that the financial report presents fairly the transactions and balances for the reporting period, in accordance with the requirements of relevant accounting standards and legislation.

At 2 November 2012 the financial report of Watermove, a controlled entity of Goulburn-Murray Water, was yet to be finalised. The directors of Watermove resolved to discontinue the operations of the company on 10 August 2012. This decision has resulted in significant changes to the financial statements to reflect the intended orderly winding up of the company. Goulburn-Murray Water has resolved to take full responsibility for the repayment of all outstanding Watermove debts.

2.4 The quality of reporting

The quality of an entity’s financial reporting can be measured by the timeliness and accuracy of the preparation and finalisation of its financial reports. To achieve cost-effective financial reporting, entities need to have well planned and managed financial report preparation processes.

In assessing the quality of the financial reports an assessment was made against better practice criteria. The following rating scale was used:

- non-existent—function not conducted by the entity

- developing—partially encompassed in the entity’s financial statements preparation processes

- developed—entity has implemented the process, however, it is not fully effective or efficient

- better practice—entity has implemented the processes which are effective and efficient.

Entities should aim for the better practice elements detailed in Figure 2C to assist them to produce a complete, accurate and compliant financial report within the legislative time frame.

Figure 2C

Selected better practice—financial report preparation

|

Key area |

Better practice |

|---|---|

|

Financial report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight, and quality assurance practices required in preparing the financial report. |

|

Preparation of shell statements |

Prepare a shell financial report and provide it to the auditors early to enable early identification of amendments, minimising the need for significant disclosure changes at year-end. |

|

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the financial report. |

|

Monthly financial reporting |

Adopt full accrual monthly reporting to assist in preparing the annual financial report. This allows the year-end process to be an extension of the month-end process. |

|

Quality control and assurance procedures |

Require rigorous review of the supporting documentation, data and the financial report itself by an appropriately experienced and independent officer prior to providing it to the auditors. |

|

Supporting documentation |

Prepare high-standard documentation to support and validate the financial report and provide a management trail. |

|

Analytical reviews |

Undertake rigorous and objective analytical review during the financial report preparation process to help to improve the accuracy of the report. |

|

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the financial report. |

|

Competency of staff |

The preparers of the financial report have a good understanding of, and experience in, applying relevant accounting standards and legislation. They also have effective project management and interpersonal skills. |

|

Financial compliance reviews |

Undertake periodic compliance reviews to identify areas of noncompliance or changes to legislation that impact the financial report. |

|

Adequate security |

Protect and safeguard sensitive information throughout the process to prevent inappropriate public disclosure. |

Source: Victorian Auditor-General's Office, and Australian National Audit Office Better Practice Guide: Preparation of Financial Statements by Public Sector Entities, June 2009.

We assessed the 20 entities against the better practice elements and the results are summarised in Figure 2D.

Figure 2D

Results of assessment of financial report preparation processes against better practice elements

Source: Victorian Auditor-General's Office.

The developed or better practice elements commonly shared by the 20 entities included:

- monthly financial reporting

- quality control and assurance procedures

- supporting documentation

- reviews of controls/self-assessment

- competency of staff

- financial compliance reviews.

However, further improvement was needed in relation to:

- the financial report preparation plan

- preparation of shell statements

- materiality assessment

- analytical review

- adequate security.

Improving these areas will assist the timely preparation of quality financial reports, resource allocation planning and the early detection and correction of errors.

Based on our assessment of the financial reporting process, the overall quality of financial reporting in 2011–12 is consistent with 2010–11.

2.5 Timeliness of reporting

Recognising the importance of financial reports in providing accountability for the use of public monies, entities should prepare and publish their reports on a timely basis. The later the reports are produced and published after year end, the less useful they are for stakeholders and for informing decision-making.

Appendix D specifies when the financial reports were finalised.

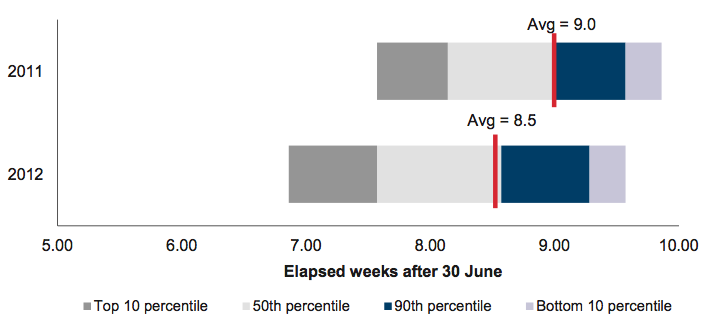

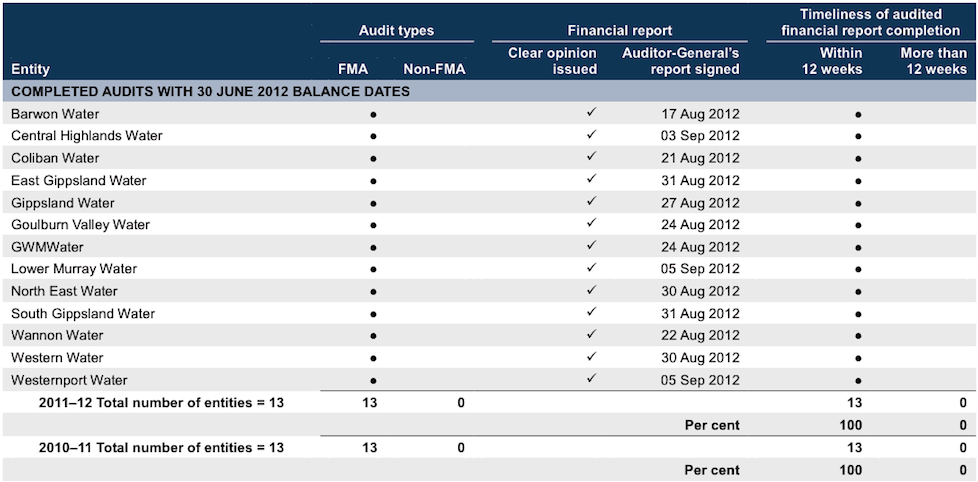

2.5.1 Water corporations

Figure 2E shows that the average time taken by the 16 water corporations to finalise their 2011–12 financial reports decreased from the prior year. The average time was 8.5 weeks in 2011–12 compared to 9.0 weeks in 2010–11.

Figure 2E

Average time to finalise the financial reports

Source: Victorian Auditor-General's Office.

2.5.2 Companies

Under the Corporations Act 2001 the three metropolitan retail distribution companies and the one controlled water entity were required to finalise financial reports within four months of the end of the financial year. However, because the results of controlled entities need to be consolidated into the annual financial report of the state, the reporting provisions of the FMA also apply to the four entities.

The three metropolitan retail distribution companies met the FMA requirements in 2011–12, consistent with last year. The average time taken to finalise their financial reports was 8.2 weeks in 2011–12 and in 2010–11. At 2 November 2012, the financial report of Watermove was yet to be finalised. In 2010–11 this took 16.6 weeks.

2.6 Accuracy

The frequency and size of errors requiring adjustment are direct measures of accuracy of draft financial reports. Ideally, there should be no errors or adjustments arising through the audit.

When our staff detect errors in the draft financial reports they are raised with management. Material errors need to be corrected before a clear audit opinion can be issued. The entity itself may also change its draft financial reports after submitting them to audit, if their quality assurance procedures identify that reported information is incorrect or incomplete.

Overall, there are two types of adjustments:

- financial balance adjustments—changes to the balances being reported

- disclosure adjustments—changes to the commentary or financial note disclosures within the financial report.

There were 41 material financial balance adjustments required in 2011–12 compared to 11 in the prior year. The adjustments resulted in changes to the net result and/or the net asset position of an entity. On average, there were two material financial balance adjustments per entity.

In addition to the financial balance adjustments, there were 23 disclosure errors that required adjustment in the 2011–12 (29 in 2010–11). On average, there was one material disclosure adjustment per entity.

Two events caused the increase in material financial reporting adjustments for 2011–12:

- An industry defined benefit superannuation fund advised the water entities prior to balance date that the latest actuarial investigation resulted in an unfunded liability. Employers with staff who are members of the fund were required to meet their share of the funding shortfall. Water entities were notified of the unfunded amount and their required funding contribution subsequent to year end with the shortfall subsequently recognised as an expense and liability at balance date.

- An environmental contribution levy has been paid by the 19 water entities since 2004–05. The levy was payable until 30 June 2012. The government extended the levy for a further four years prior to balance date. Water entities were informed of the amount that was required to be paid over the next four years subsequent to balance date and disclosed the amount as a commitment in the notes to the financial report.

While the water entities were dependent on information from third parties, they also have a responsibility to be aware of developments that have the potential to impact their financial report.

A large number of water entities were required to amend their financial statements to account for these two events.

Recommendation

- Water entities should further refine their financial reporting processes by developing plans, preparing shell statements, performing materiality assessments, conducting analytical reviews and having adequate security to protect and safeguard sensitive information.

3 Performance reporting

At a glance

Background

Sixteen of the 19 water entities are required to include an audited statement of performance in their annual report. The three metropolitan retailers are encouraged to include an audited statement of performance.

This Part outlines the performance reporting framework, comments on the timeliness and accuracy of performance reporting and compares practices in 2011–12 against better practice and past performance. It also details work underway to influence the development of indicators included in performance reports and reiterates our intention to further develop our audit of the performance reports in future periods.

Conclusion

A contemporary performance reporting framework is yet to be developed for the water industry. The usefulness of current performance reports is limited as targets were not set for a number of indicators and the relevance and appropriateness of indicators being used requires review.

Findings

- Clear audit opinions were issued on the 16 performance reports.

- Ten of 16 (12 of 16 in 2010–11) performance reports included indicators without targets.

- A performance reporting working group was established in 2011–12 to develop a consistent and contemporary performance reporting framework for the water industry.

Recommendations

- The performance reporting working group should continue to develop and implement a consistent and contemporary performance reporting framework, in line with its time lines and our proposed expanded opinions from 2013–14.

- Water entitiesshould set targets for all indicators in their performance reports to enable meaningful assessment of performance.

3.1 Introduction

The Audit Act 1994 provides the Auditor-General with a mandate to audit performance indicators in the report of operations of an audited entity to determine whether they:

- are relevant to the stated objectives of the entity

- are appropriate for the assessment of the entity’s actual performance

- fairly represent the entity’s actual performance.

The annual attest audit on the performance report of water entities is currently limited to an opinion on whether the actual results reported are presented fairly and in compliance with the legislative requirements.

This Part outlines the performance reporting framework, comments on the timeliness and accuracy of performance reporting by the water entities and compares practices in 2011–12 against better practice and past performance. It also details work underway to influence the development of indicators included in performance reports and reiterates our intention to further develop our audit of the performance reports in future periods.

3.2 Elements of effective performance reporting

Effective performance measurement and monitoring enables managers and the governing boards of entities to evaluate performance against a set of key indicators, and facilitates appropriate and timely action to achieve organisational objectives and outcomes. Reporting on performance to senior management and the community is an important part of a performance management framework and public sector accountability.

Central to effective performance measurement, management and reporting is a comprehensive suite of relevant and appropriate performance measures or indicators, and targets.

Relevant indicators have a logical and consistent relationship to an entity’s objectives and are linked to the outcomes to be achieved. Ideally they should take into account immediate deliverables and long-term sustainability.

Appropriate indicators give enough information to assess the extent to which the entity has achieved a predetermined target, goal or outcome. They can include the trends in performance over time, performance relative to the performance of similar agencies, and performance relative to predetermined benchmarks.

Fair presentation of performance results requires that the information provided is capable of measurement, represents what it purports to indicate consistently and without bias, and is accurate and auditable.

3.3 Performance reporting by the water entities

Financial Reporting Direction (FRD) 27B Presentation and Reporting of Performance Information requires water entities subject to the Financial Management Act 1994 (FMA) to include an audited statement of performance in their annual report.

The three metropolitan retailers, City West Water, South East Water and Yarra Valley Water were subject to the Corporations Act 2001 in 2011–12. They were encouraged, but not required, to comply with the direction.

Water entities introduced performance reports for audit over the following time line:

- the 13 regional urban water entities from 2003–04

- the two rural water entities since 2005–06

- Melbourne Water since 2010–11.

Directives under section 51 of the FMA specify the required format, content, and indicators to be included in the performance report. The indicators vary across the three water sectors. Figure 3A summarises the number and nature of indicators by sector.

Figure 3A

Number and nature of performance indicators by sector

|

Water sector |

Financial indicators (no.) |

Non-financial indicators (no.) |

Total (no.) |

|---|---|---|---|

|

Metropolitan |

|||

|

Wholesaler |

6 |

10 |

16 |

|

Retailers |

6 |

12 |

18 |

|

Regional urban |

4 |

12 |

16 |

|

Rural |

4 |

– |

4 |

Source: Victorian Auditor-General's Office.

Appendix G provides further detail on the financial and non-financial indicators reported against by the entities.

3.4 Audit opinions issued

Clear audit opinions were issued on the 16 performance reports audited for 2011–12.

The three metropolitan retail distribution companies did not prepare and submit a performance report for audit. Performance information was included within their annual reports; however, this was not subject to audit.

3.5 The quality of reporting

The performance report should be subject to the same level of internal quality assurance as the financial report.

In assessing the quality of the performance reports an assessment was made against better practice criteria. The following rating scale was used:

- non-existent—function not conducted by the entity

- developing—partially encompassed in the entity’s performance report preparation processes

- developed—entity has implemented the process, however, it is not fully effective or efficient

- better practice—entity has implemented the processes which are effective and efficient.

Figure 3B sets out the best practice elements entities should aim for to assist them to produce a complete, accurate and compliant performance report within the legislative time frame.

Figure 3B

Selected better practice—performance report preparation

|

Key area |

Better practice |

|---|---|

|

Performance report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight, and quality assurance practices required in preparing the performance report. |

|

Preparation of shell statements |

Prepare a shell performance report and provide to the auditors early to enable early identification of amendments, minimising the need for significant disclosure changes at year end. |

|

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the performance report. |

|

Quality control and assurance procedures |

Require rigorous review of the supporting documentation, data and the performance report itself, by an appropriately experienced and independent officer prior to providing it to the auditors. |

|

Supporting documentation |

Prepare high-standard documentation to support and validate the performance report, and provide a management trail. |

|

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the performance report. |

|

Competency of staff |

The preparers of the performance report have a good understanding of, and experience in, applying relevant requirements and legislation. They also have effective project management and interpersonal skills. |

|

Performance compliance reviews |

Undertake periodic compliance reviews to identify areas of noncompliance or changes to ministerial directives that impact the performance report. |

|

Adequate security |

Protect and safeguard sensitive information throughout the process to prevent inappropriate public disclosure. |

Source: Victorian Auditor-General's Office.

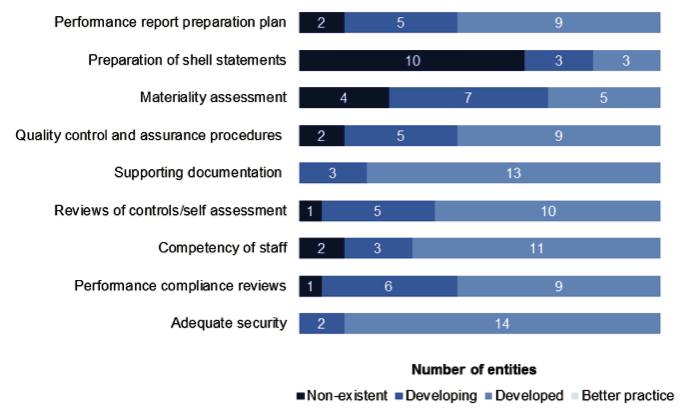

An assessment of performance against better practice criteria was undertaken for the 16 entities that prepared and submitted a performance report for audit. The results of our assessment are summarised in Figure 3C.

Figure 3C

Results of assessment of performance report preparation processes against better practice elements

Source: Victorian Auditor-General's Office.

The developed or better practice elements commonly shared by the 16 entities include:

- supporting documentation

- reviews of controls/self-assessment

- competency of staff

- adequate security.

However, further improvement is needed in relation to:

- the performance report preparation plan

- preparation of shell statements

- quality control and assurance procedures

- materiality assessment

- performing compliance reviews.

Based on our assessment of the performance reporting process, the overall quality of performance reporting in 2011–12 has not improved over 2010–11.

3.6 Timeliness of reporting

Performance reports are generally prepared and finalised in conjunction with financial reports and the common time line is provided at paragraph 2.5.1.

Appendix D sets outs when the performance report for each entity was finalised.

3.7 Accuracy

The frequency and size of errors requiring adjustment are direct measures of accuracy of draft performance reports. Ideally, there should be no errors or adjustments arising through the audit.

The key observations in 2011–12 in regard to the accuracy of the draft performance reports were:

- two of 16 entities (13 per cent) prepared and submitted a performance report that included indicators not specified in the directives issued under section 51 of the FMA

- 10 of 16 performance reports included indicators without targets (12 of 16 in 2010–11)

- commentary was not always provided for significant variations between targets and actual performance or between prior year and current year actual performance

- commentary for some significant variations in performance focused on the value of the change rather than the factors that led to it.

A particular concern was that 31 non-financial indicators reported did not have targets, although this was an improvement on the previous year (72 in 2010–11). The absence of targets reduces the usefulness of performance reports because a comparison of actual performance against targets cannot be made.

Westernport Water was required to process a large number of adjustments to its performance report, namely:

- removing indicators not specified in the directive

- including indicators that were missing

- recalculating the variance between actual performance and target on a consistent basis

- providing commentary for significant variations.

The adjustments indicate that the preparation and quality assurance processes at Westernport Water are ineffective and inefficient. A contributing factor was the lack of accountability for the performance report. Management has agreed to critically review its performance reporting processes and assign responsibility for the performance report in order to drive improved quality.

3.8 Performance reporting developments and future audit approach

When performance reporting for the sector was being established, VAGO focused on auditing whether the reports fairly presented performance, and complied with the legislative requirements. However, last year’s report titled Water Entities: Results of the 2010–11 Audits indicated our intention to progress to the stage where the Auditor‑General expresses an opinion on the relevance and appropriateness of the indicators, consistent with his audit mandate.

Recognising the growing importance of performance reporting to public sector resource management and accountability, and in response to our 2010–11 report, a performance reporting working group was established by the Department of Sustainability and Environment (DSE) during 2011–12. It has responsibility for developing a contemporary framework that facilitates the inclusion of relevant and appropriate financial and non-financial indicators in the sector's future performance reports.

The working group, led by DSE, comprises representatives from DSE, the Department of Treasury and Finance, VicWater and the water entities.

A project plan was developed and the working group has met five times since November 2011.

The working group has identified and summarised the performance indicators currently reported on by the water entities, whether they be to internal or external stakeholders. Three discussion papers were prepared and considered by the working group during the year. These were:

- performance reporting in other jurisdictions

- performance reporting and financial performance indicators utilised by utility businesses in the private sector

- criteria for selection of performance indicators.

The working group proposed a time frame for completing key tasks taking into account the water industry’s corporate planning process. This allows entities time to set targets and gather data for any new indicators. The intention is that the framework and indicators will apply to the first year of Water Plan 3, which covers the period from 2013–14 to 2018–19.

Figure 3D sets out the proposed time frame for the completion of the key tasks.

Figure 3D

Project time frame

|

Task |

Timing |

|---|---|

|

Draft criteria to assess the relevance and appropriateness of performance indicators and present to the working group for comment/consultation. |

June 2012 |

|

Release a discussion paper on the criteria for assessing the relevance and appropriateness of performance indicators. |

July 2012 |

|

Apply criteria used on existing and potential reporting indicators to determine a set of proposed reporting indicators for the new framework. |

August 2012 |

|

Present the proposed set of performance reporting indicators to the working group for comment/consultation. |

August 2012 |

|

Release a discussion paper on the performance reporting framework. |

September 2012 |

|

Consult with stakeholders on the draft performance reporting framework. |

October / November 2012 |

|

Finalise performance reporting indicators and the new framework. |

December 2012 |

|

Include the new performance reporting framework requirements in the Corporate Plan guidelines for 2013–14. |

December 2012 |

|

Corporate plan submissions by water businesses to include new performance reporting framework requirements. |

May 2013 |

|

Performance reporting framework operational. |

July 2013 |

|

Post implementation review. |

June 2014 |

Source: Victorian Auditor-General's Office.

Given the time lines, it is intended that audit opinions relating to the performance report will conclude on the relevance and appropriateness of the performance indicators and whether they fairly present performance, from 2013–14 onwards.

Recommendations

- Water entities should further refine their performance reporting processes by developing plans, preparing shell statements, performing materiality assessments, conducting compliance reviews and improving their quality assurance processes.

- The performance reporting working group should continue to develop and implement a consistent and contemporary performance reporting framework, in line with its time lines and our proposed expanded opinions from 2013–14.

- Water entities should set targets for all indicators in their performance reports to enable meaningful assessment of performance.

4 Financial results

At a glance

Background

Accrual-based financial statements enable an assessment of whether water entities are generating sufficient surpluses and positive cash flows from operations to maintain services, fund assets maintenance and retire debt. This Part analyses the financial results of the 19 water entities for the year-ended 30 June 2012.

Findings

- The 19 water entities generated a combined net profit before income tax of $605 million for the year-ended 30 June 2012, an increase of $195 million or 48 per cent from the prior year.

- Dividends paid to the state increased by $198 million or 278 per cent in 2011–12.

- At 30 June 2012 the 19 water entities controlled $36.3 billion in total assets ($35.2 billion at 30 June 2011) and had total liabilities of $14.8 billion ($13.9 billion at 30 June 2011).

- Interest-bearing liabilities increased by $931 million or 11.4 per cent in 2011–12, with new borrowings financing the construction of infrastructure assets and the payment of dividends.

- For many customers, especially for the regional urban and rural sectors, fixed charges represent 64 and 87 per cent respectively of their water charges. Reducing water consumption will not substantially lower their water bills.

- Capital expenditure for the past four years of twoentities was less than 70 per cent of the target set in their five-year water plan expiring 2012–13, while six entities have already exceeded their capital expenditure targets.

Recommendation

- The Essential Services Commission should revisit the duration of the water plans and the funding model's flexibility to deal with situations where the actual financial outcomes differ significantly from what was proposed in the approved water plans due to changed circumstances and/or environmental conditions.

4.1 Introduction

Accrual-based financial statements enable an assessment of whether water entities are generating sufficient surpluses and positive cash flows from operations to maintain services, fund assets maintenance and retire debt. Their ability to generate surpluses is subject to the regulatory environment in which they operate, and their ability to minimise costs and maximise revenue.

An entity’s financial performance is measured by its net operating result—the difference between its revenues and expenses. An entity’s financial position is generally measured by reference to its net assets—the difference between its total assets and total liabilities.

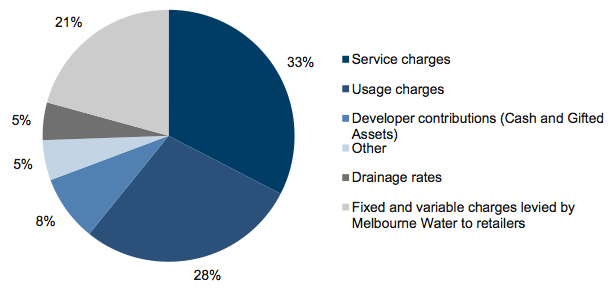

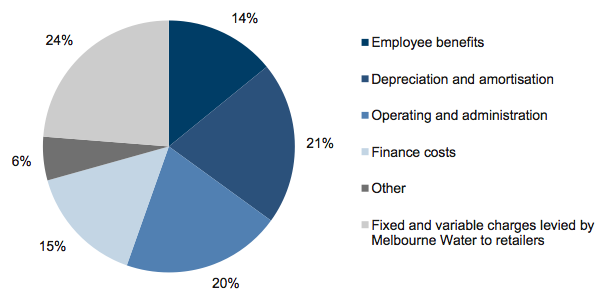

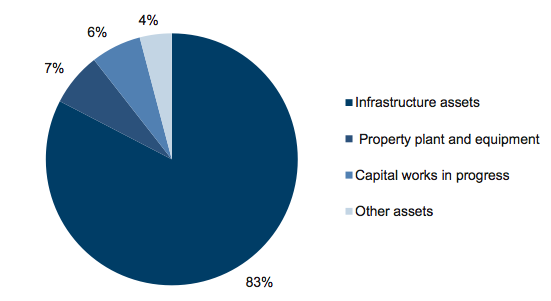

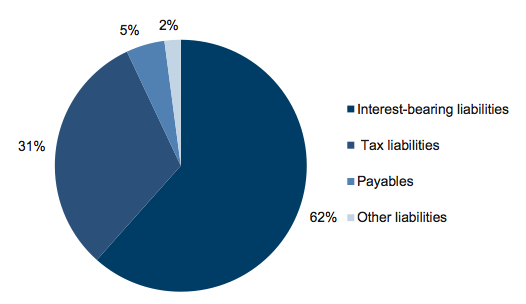

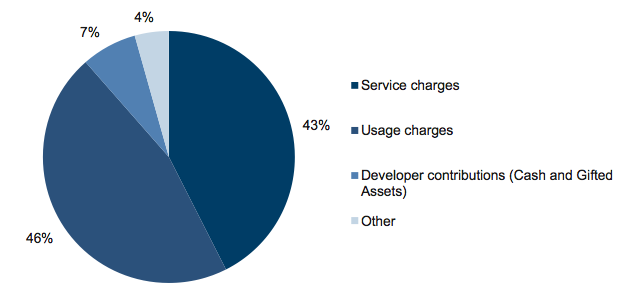

Appendix E provides information on the composition of revenue, expenses, assets and liabilities for the 19 water entities, by sector for 2011–12.

4.2 Financial results

4.2.1 Financial performance

The 19 water entities are subject to the National Tax Equivalent Regime administered by the Australian Taxation Office. Therefore their net result both before and after income tax is addressed in this section of the report.

Net result before income tax

The water industry generated a net profit before income tax of $605 million for the year‑ended 30 June 2012. This was an increase of $195 million or 48 per cent over the prior year. This was predominantly due to an increase in:

- service charges of $178 million or 14 per cent

- usage charges of $279 million or 29 per cent

- developer contributions of $99 million or 36 per cent.

The net profit before income tax was strong, and continued to be driven by the four metropolitan water entities. Four of the 13 regional urban water entities reported a lower net profit before tax in 2011–12 relative to the prior year (eight in 2010–11), and eight reported a net loss before tax (five in 2010–11). The two rural water entities continued to report losses.

Figure 4A shows the net profit or loss before income tax for each entity for the past two years. It shows that 10 entities delivered a loss before income tax for 2011–12.

Figure 4A

Net profit/(loss) before income tax, by water entity

|

Entity |

2011–12 |

2010–11 |

|---|---|---|

|

Metropolitan sector |

||

|

Wholesaler |

||

|

Melbourne Water |

372.8 |

214.1 |

|

Retailer |

||

|

City West Water |

71.7 |

87.7 |

|

South East Water |

129.3 |

99.7 |

|

Yarra Valley Water |

87.1 |

86.3 |

|

Regional urban sector |

||

|

Barwon Water |

50.6 |

23.9 |

|

Central Highlands Water |

(6.1) |

(1.3) |

|

Coliban Water |

(20.3) |

(24.3) |

|

East Gippsland Water |

3.7 |

(0.2) |

|

Gippsland Water |

(4.2) |

1.3 |

|

Goulburn Valley Water |

(6.8) |

0.3 |

|

GWMWater |

(8.3) |

(22.1) |

|

Lower Murray Water |

(12.7) |

(9.5) |

|

North East Water |

(2.4) |

0.4 |

|

South Gippsland Water |

(1.1) |

1.4 |

|

Wannon Water |

4.9 |

1.4 |

|

Western Water |

5.2 |

4.3 |

|

Westernport Water |

3.0 |

2.2 |

|

Rural sector |

||

|

Goulburn-Murray Water |

(52.2) |

(52.9) |

|

Southern Rural Water |

(9.0) |

(2.5) |

|

Total |

605.2 |

410.2 |

Source: Victorian Auditor-General's Office.

Unrequired desalination payments collected

Melbourne Water generated a substantial increase in its net result for 2011–12. Delays in commissioning the desalination plant meant that expenses during the period were lower than anticipated. Six months of estimated costs did not eventuate. Higher bulk water and sewerage charges were levied on the metropolitan water retailers as per Melbourne Water's approved price determination, generating additional revenue.

City West Water, South East Water, Yarra Valley Water and Western Water increased their water prices, as per their approved price determinations, as they anticipated increased operating costs due to the desalination plant. Because of the commissioning delays, the four entities collected more revenue than required from their customers.

The Minister for Water announced on 19 June 2012 that:

- all unrequired desalination payments collected will be returned to customers

- Melbourne Water and the retailers were freezing prices and price increases of 9.6 per cent scheduled for 2012–13 will not be implemented until all monies collected from customers are returned and interest paid.

The government requested that the Essential Services Commission (ESC) oversee and independently verify the return of payments, adjusted for interest and inflation. The ESC will also conduct an audit of customer bills with the audit findings to be published on its website.

The ESC is to report on the progress of the return of unrequired desalination payments through a quarterly report published on its website, which is to summarise:

- the amount of money returned to customers

- the amount of money expected to be returned by the end of 2012–13

- a forecast of any remaining amounts to be returned in 2013–14.

In late September 2012, the ESC released the Opinion Report – Return of Additional Desalination Payments. The ESC estimated that the additional amounts that might be returned to customers in 2012–13 could range from $23 million to $243 million, depending on the desalination plant's cost and completion date.

Net result after income tax

The sector reported a combined net profit after income tax of $434.4 million in 2011–12, an increase of $114.9 million or 36 per cent from the prior year.

Ten entities delivered a loss after income tax for 2011–12.

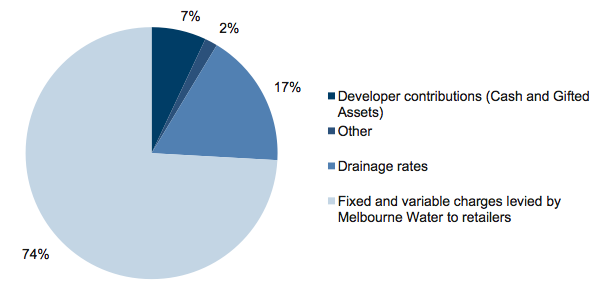

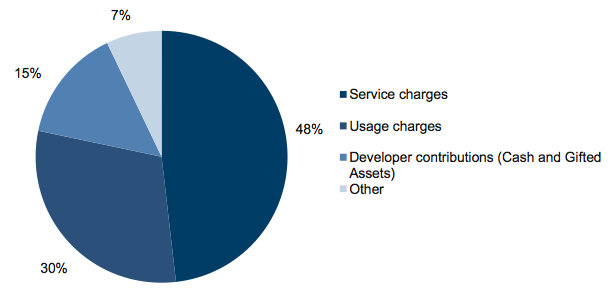

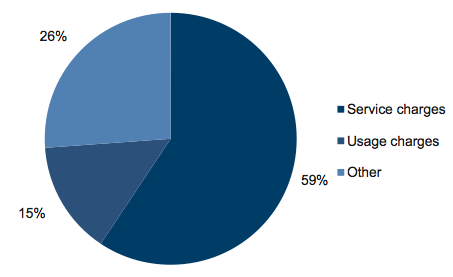

Revenue

In 2011–12, the 19 entities collectively generated revenue of $4.4 billion, an increase of $751.7 million, or 20.4 per cent from the prior year. The increase was driven by higher service and usage charges.

Service and usage charges

Excluding revenue from transactions between Melbourne Water and the three retail distribution companies, service and usage charges accounted for 76.8 per cent of total revenue generated in 2011–12. They were the largest sources of revenue for the entities.

Figure 4B shows service and usage charges revenue in 2011–12 as a percentage of the total service and usage charges per entity for the year. The service charge is a fixed charge levied on each property. The usage charge is a variable charge with the level of water consumption driving the amount the customer pays.

The service charge for rural customers also includes a volumetric entitlement charge.

Figure 4B

Service and usage charges as a percentage of the total service and usage charges revenue, 2011–12

|

Entity |

Service charge |

Usage charge |

|---|---|---|

|

Metropolitan sector |

||

|

City West Water |

34 |

66 |

|

South East Water |

41 |

59 |

|

Yarra Valley Water |

41 |

59 |

|

Average |

39 |

61 |

|

Regional urban sector |

||

|

Barwon Water |

56 |

44 |

|

Central Highlands Water |

71 |

29 |

|

Coliban Water |

58 |

42 |

|

East Gippsland Water |

74 |

26 |

|

Gippsland Water |

67 |

33 |

|

Goulburn Valley Water |

53 |

47 |

|

GWMWater |

66 |

34 |

|

Lower Murray Water |

73 |

27 |

|

North East Water |

43 |

57 |

|

South Gippsland Water |

59 |

41 |

|

Wannon Water |

53 |

47 |

|

Western Water |

71 |

29 |

|

Westernport Water |

85 |

15 |

|

Average |

64 |

36 |

|

Rural sector |

||

|

Goulburn-Murray Water |

77 |

23 |

|

Southern Rural Water |

97 |

3 |

|

Average |

87 |

13 |

Note: Service and usage charges include water and wastewater charges.

Melbourne Water does not levy service and usage charges as it sells water to the metropolitan water bodies rather than individual customers.

Source: Victorian Auditor-General's Office.

While charges relating to water comprise a fixed and variable charge, the sewerage charges levied by some entities comprise a fixed charge only.

As the proportion of the charge that is fixed is higher in many cases, for many customers, reducing water consumption will not substantially lower their water bill.

An entity's decision about the ideal tariff structure, including the split between fixed and variable can be influenced by whether or not the entity is subject to seasonal fluctuations in consumption. For example, coastal towns that experience an increase in visitor numbers during the summer holiday period. To generate sufficient revenue over the financial year to cover their operating costs such entities may set a higher proportion of a customer's bill as a fixed rather than variable charge.

Developer contributed infrastructure assets

Developers are required to provide water supply and sewerage facilities in the new subdivisions they develop. Once built, the infrastructure is gifted to the water entities, which assume responsibility for ongoing maintenance and eventual replacement of the facilities.

The fair value of developer contributions is recognised as income in the financial report of water entities once the facilities are gifted to them, that is, when they gain control of the assets. This non-cash income is recorded as 'developer contributed assets'. Over the past five years, water entities have recognised $716 million in developer contributions.

In the absence of developer contributions, the number of entities reporting a net loss before income tax in 2011–12 would have increased from 10 to 12.

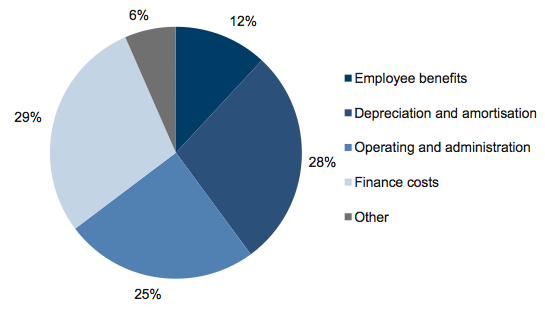

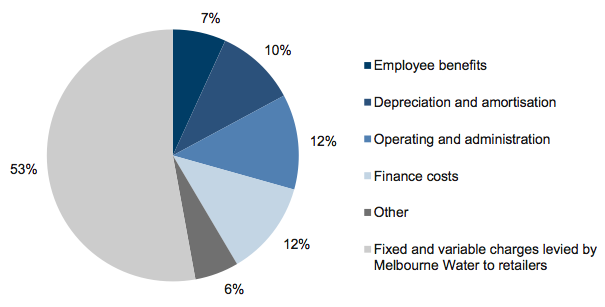

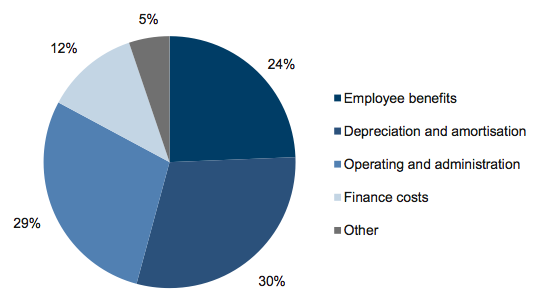

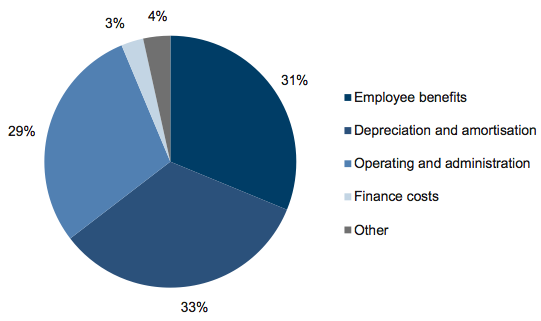

Expenses

In 2011–12, the 19 entities collectively incurred $3.8 billion in operating expenses, an increase of $556 million or 17 per cent from the prior year. The increase was predominantly because:

- depreciation and amortisation increased by $136.0 million or 20.5 per cent

- employee benefits increased by $84.1 million or 18.4 per cent

- finance costs increased by $65.5 million or 12.7 per cent.

The largest expense items for the water entities in 2011–12 were depreciation and amortisation, and employee benefits.

Dividends

The 19 entities are obliged to pay a dividend to the state if the Treasurer after consultation with the governing board and responsible minister makes a formal determination to do so.

Until 2009–10 the four metropolitan water entities paid an interim and final dividend within a particular financial year. The interim dividend was based on the half-yearly result of that particular financial year and the final dividend was linked to the full-year result for the prior financial year.

During 2010–11 only a final dividend in relation to 2009–10 was paid and the payment of interim dividends based on the 2010–11 half-yearly result was deferred by the state.

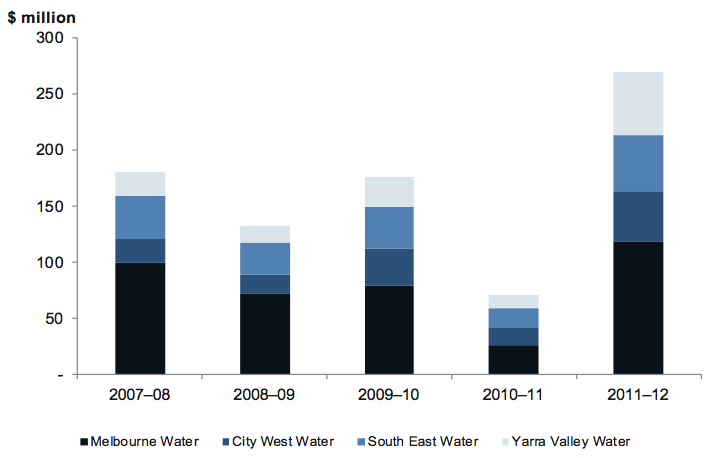

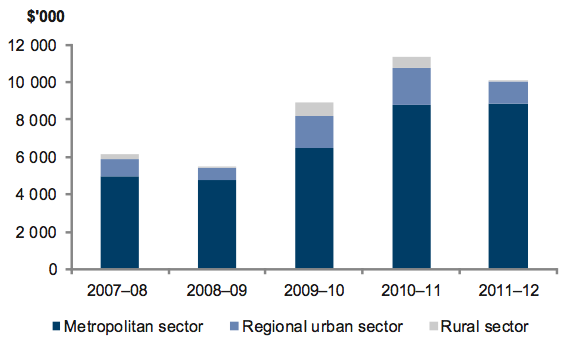

In 2011–12, the four metropolitan water entities paid dividends of $270 million, an increase of $198 million or 278 per cent over with those paid in 2010–11. The increase in part reflects the impact of deferring the payment of an interim dividend in 2010–11 until 2011–12. Like the prior year, there were no interim dividends paid based on the 2011–12 half-yearly results.

To pay the dividends in 2011–12, the four metropolitan water entities borrowed funds from the Treasury Corporation of Victoria.

Figure 4C shows the dividends paid by the four metropolitan water entities over the past five years.

Figure 4C

Dividends paid by metropolitan water entities, 2007–08 to 2011–12

Source: Victorian Auditor-General’s Office.

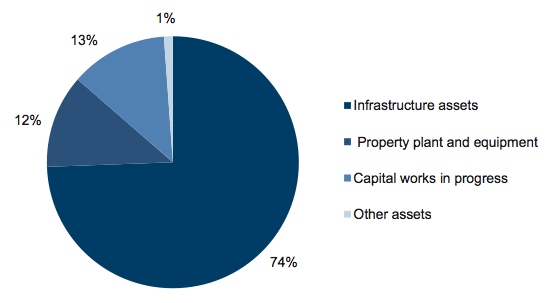

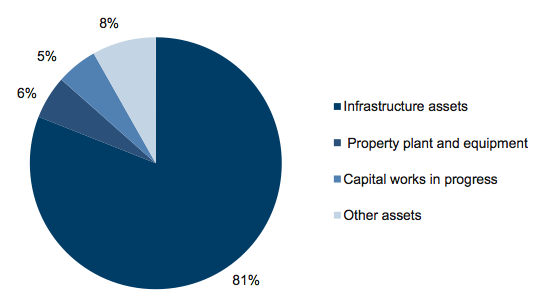

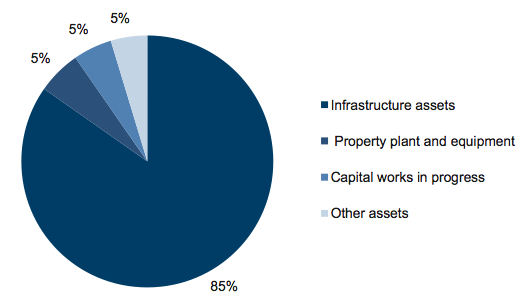

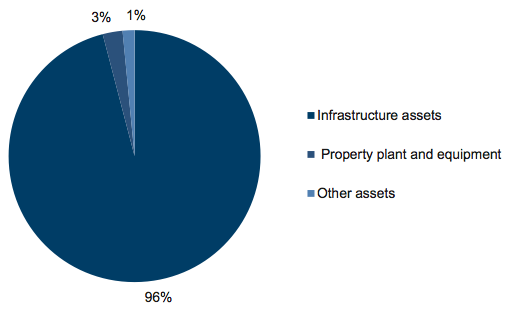

4.3 Financial position

The ability of water entities to maintain their infrastructure assets depends on the adequacy of their asset and debt management policies or the level of surpluses achieved. Their effectiveness is reflected in the composition and rate of change of the value of their assets and liabilities over time.

4.3.1 Assets

At 30 June 2012, the 19 entities had combined assets valued at $36.3 billion, an increase of $1.04 billion or 3.0 per cent compared to the prior year. Property, plant, equipment and infrastructure assets represented 96 per cent of total assets.

An $814 million or 2.4 per cent increase in the value of property, plant, equipment and infrastructure assets at 30 June 2012, was predominantly driven by the construction of infrastructure assets.

Receivables also increased by $86 million or 17 per cent due to higher service and usage charges levied by the water entities.

Asset Revaluation and Depreciation Guidelines Working Group

The four metropolitan water entities recorded infrastructure assets at fair value for the first time in 2009–10, with the fair value of infrastructure assets determined using an income approach. The regional urban and rural water entities transitioned to fair value at 30 June 2011. The fair value of their assets was determined using a depreciated replacement cost approach.

Both approaches comply with Australian Accounting Standard AASB 116 Property, Plant and Equipment. The variation in approach is driven by an entity’s designation as ‘for-profit’ or ‘not for profit’ for financial reporting purposes.

As a result of difficulties experienced during the 2010–11 revaluation of infrastructure assets, a Victorian water industry working group has been formed. Its focus is on long‑lived water infrastructure assets and asset revaluation impacts on depreciation. Its purpose is to determine the best method for allocating economic value to long-lived infrastructure assets and developing guidelines for the revaluation of all assets.

The working group includes representatives from:

- VicWater

- Metropolitan sector water entities

- Regional urban sector water entities

- Rural sector water entities

- the Department of Sustainability and Environment

- the Department of Treasury and Finance.

The working group has proposed time frames for completing tasks as set out in Figure 4D.

Figure 4D

Working group time frames

|

Task |

Timing |

|---|---|

|

Prepare draft guidance on useful lives for use in the industry |

March 2013 |

|

Test and analyse impacts of assumptions on depreciation |

September 2013 |

|

Consult with the water industry |

October 2013 |

|

Obtain water industry agreement and finalise guidelines |

December 2013 |

|

Working group endorses and government agencies approve guidelines |

February 2014 |

|

Implement guideline |

July 2014 |

Source: Victorian Auditor-General’s Office.

The time frames are subject to change pending consultation with the water industry.

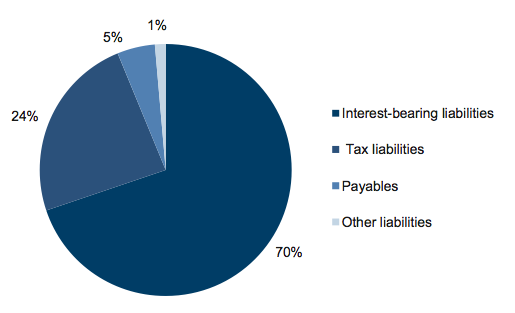

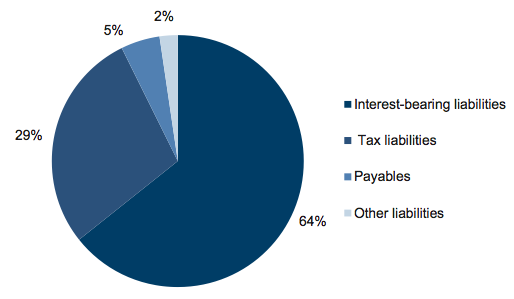

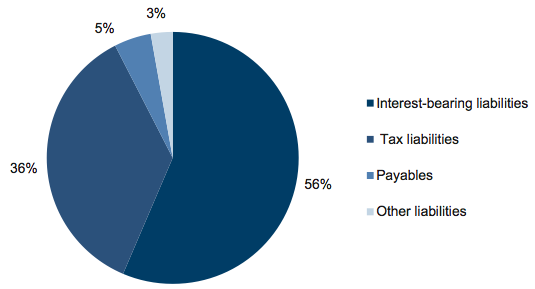

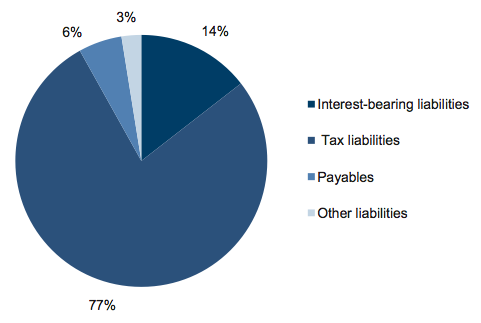

4.3.2 Liabilities

At 30 June 2012, the water industry had combined liabilities of $14.8 billion, an increase of $870 million or 6.3 per cent in comparison with the prior year.

Deferred tax liabilities decreased by $82 million or 1.7 per cent in 2011–12.

Interest-bearing liabilities increased by $931 million or 11.4 per cent in 2011–12. The new borrowings financed the construction of infrastructure assets and facilitated the payment of dividends.

The profitability of the 19 water entities will continue to be impacted by higher depreciation expense and finance costs in the future, as a result of higher asset values and increased borrowings.

4.4 Performance against the 2008–09 to 2012–13 water plan

In approving the price an entity can charge its customers, the ESC considers an entity’s water plan. The plan specifies the outcomes the entity plans to deliver, how they will be achieved, and the revenue needed to deliver them over the life of the plan. It also outlines the entity’s proposed operating and capital expenditure over the period of the plan.

A range of assumptions underpin the proposed revenue and expenditure forecasts. If the assumptions prove wrong, actual financial outcomes can differ significantly from what was proposed in the approved water plan. This in turn can also result in the customer being under or overcharged. The ESC has the ability to re-open or review prices in the event of unforeseen circumstances if a water entity makes a submission.

The current water plans cover the period from 2008–09 to 2012–13. They provide for substantial increases in water prices to fund significant capital works, with price increases generally higher in the early years.

4.4.1 Capital expenditure

The ESC reviewed the 2008–09 to 2012–13 water plans submitted by the 19 water entities. The price determinations approved by the ESC indicate a regulatory target of $8.5 billion for capital expenditure for the industry as a whole over the five-year period.

Our analysis of actual capital expenditure for the period 2008–09 to 2011–12 revealed that as at 30 June 2012:

- actual capital expenditure over the four-year period by the water industry was $8.05 billion or 95 per cent of the five-year regulatory target

- six entities had already exceeded their five-year capital expenditure regulatory target

- two entities may not reach their regulatory target given their capital expenditure was less than 70 per cent of their regulatory target.

This indicates that the actual expenditure is likely to differ from the forecast expenditure as outlined in the ESC price determination. Therefore the prices levied may result in significant under or over recovery of costs by the water entities during the regulatory period.

Figure 4E summarises capital expenditure to date compared to the target specified in the ESC price determinations.

Figure 4E

Capital expenditure, comparison between five-year target per ESC price determination and actual expenditure for the period 2008–09 to 2011–12

|

Entity |

Regulatory Target |

Actual |

Variance |

Actual against target |

|---|---|---|---|---|

|

Metropolitan sector |

||||

|

Melbourne Water |

3 361.9 |

3 345.8 |

(16.1) |

99.5 |

|

City West Water |

623.7 |

479.8 |

(143.9) |

76.9 |

|

South East Water |

787.8 |

659.3 |

(128.5) |

83.7 |

|

Yarra Valley Water |

1 254.8 |

938.8 |

(316.0) |

74.8 |

|

Regional urban sector |

||||

|

Barwon Water |

437.4 |

562.5 |

125.1 |

128.6 |

|

Central Highlands Water |

169.9 |

168.5 |

(1.4) |

99.2 |

|

Coliban Water |

196.4 |

187.8 |

(8.6) |

95.6 |

|

East Gippsland Water |

56.2 |

58.9 |

2.7 |

104.8 |

|

Gippsland Water |

233.0 |

225.0 |

(8.0) |

96.6 |

|

Goulburn Valley Water |

113.1 |

102.5 |

(10.6) |

90.6 |

|

GWMWater |

341.5 |

368.7 |

27.2 |

108.0 |

|

Lower Murray Water |

115.0 |

137.2 |

22.2 |

119.3 |

|

North East Water |

109.8 |

67.3 |

(42.5) |

61.3 |

|

South Gippsland Water |

54.0 |

49.2 |

(4.8) |

91.1 |

|

Wannon Water |

125.4 |

124.5 |

(0.9) |

99.3 |

|

Western Water |

129.5 |

138.6 |

9.1 |

107.0 |

|

Westernport Water |

29.4 |

28.2 |

(1.2) |

95.9 |

|

Rural sector |

||||

|

Goulburn-Murray Water |

222.4 |

375.8 |

153.4 |

169.0 |

|

Southern Rural Water |

116.5 |

36.5 |

(80.0) |

31.3 |

|

Total |

8 477.7 |

8 054.9 |

(422.8) |

95.0 |

(a) The target figures represent the gross capital expenditure as specified in the ESC price determinations for 2008 and 2009, as applicable. The targets are expressed in 2007 dollars; they exclude the impact of CPI.

(b) The actual figures reflect payments made from 1 July 2008 to 30 June 2012.

Note: The price determination of rural sector entities can include projects which are dependent on government funding. In the absence of government funding the projects may not be delivered.

Source: Victorian Auditor-General’s Office.

On face value, it appears that many entities are at risk over overspending against their regulatory capital expenditure target. While true in some cases, in others the figures may be misleading.

Factors contributing to the variations outlined in Figure 4E may include:

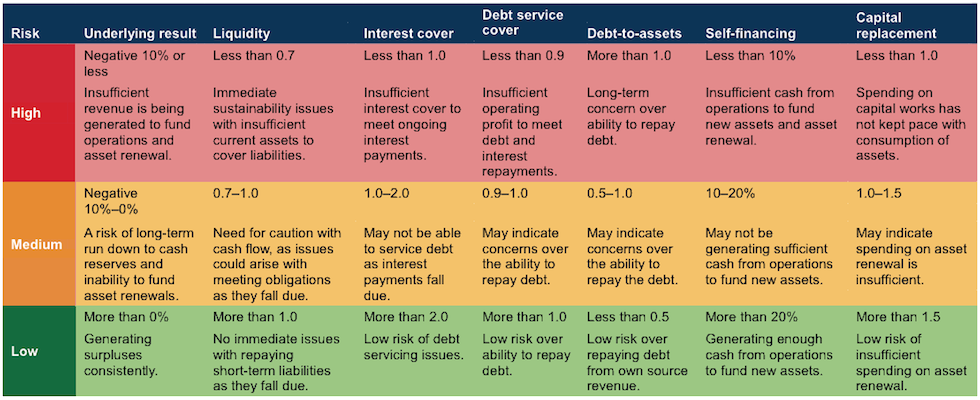

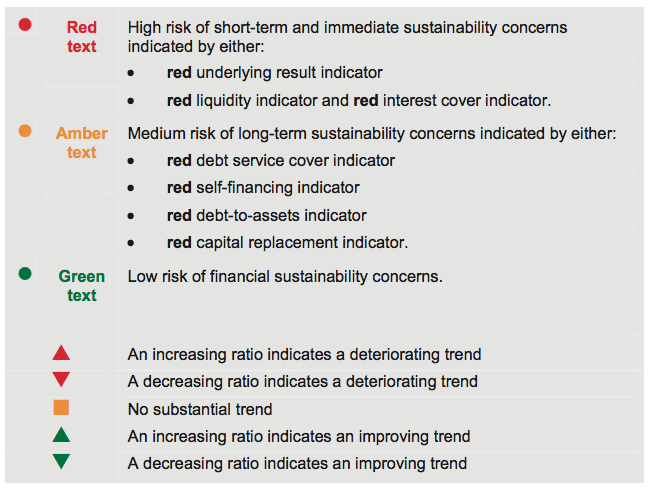

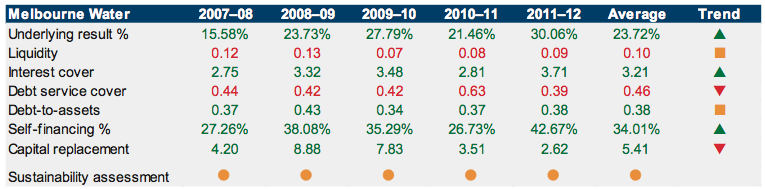

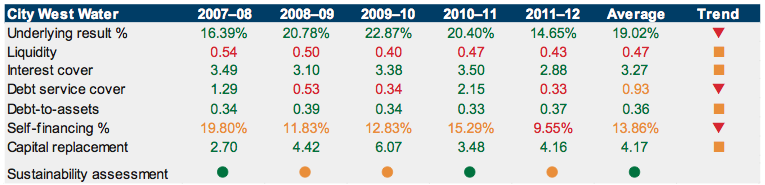

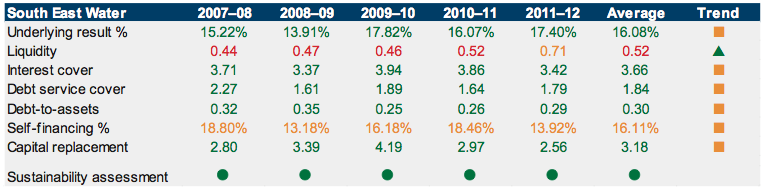

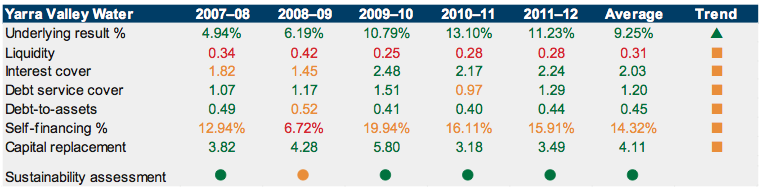

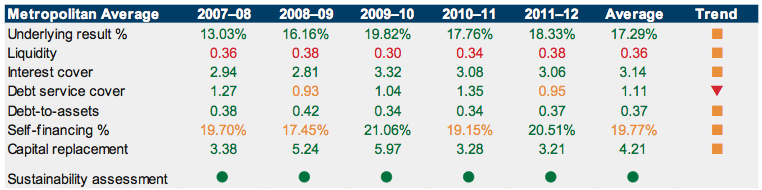

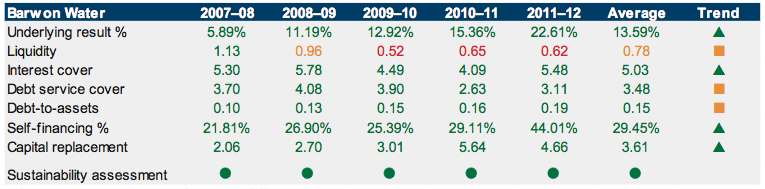

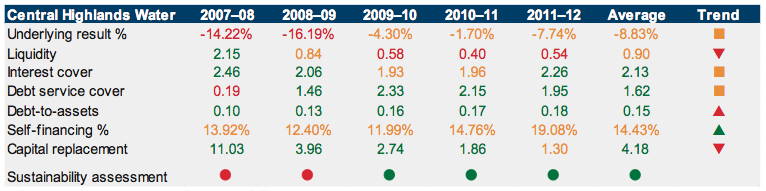

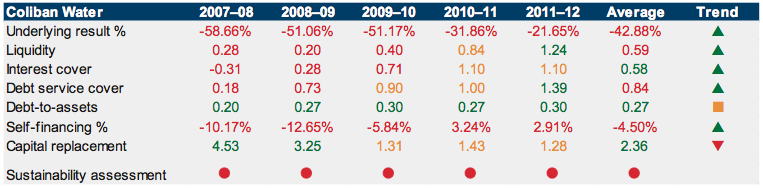

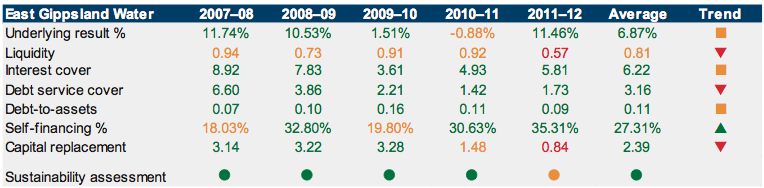

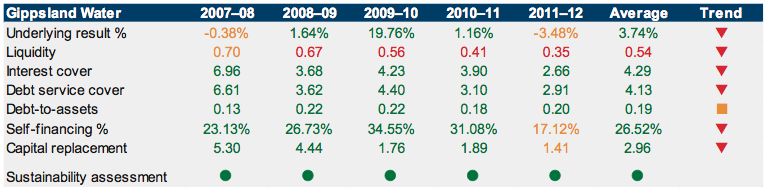

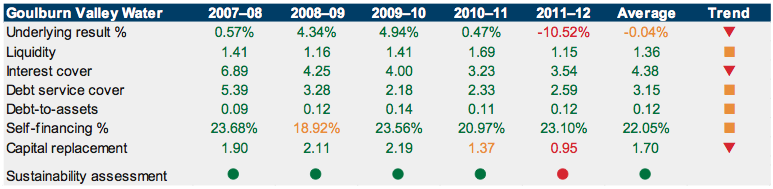

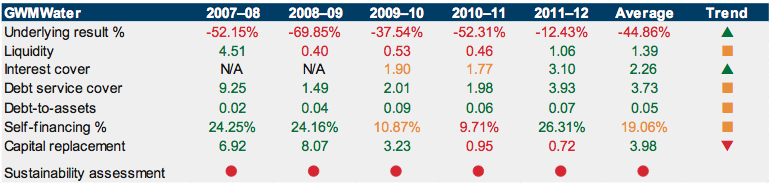

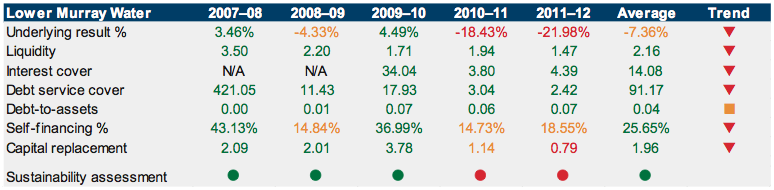

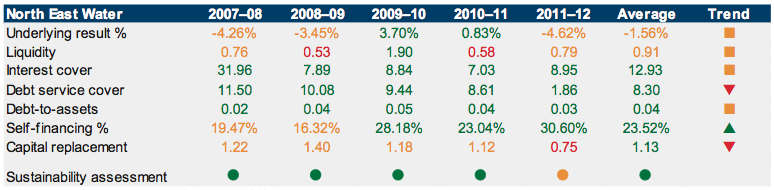

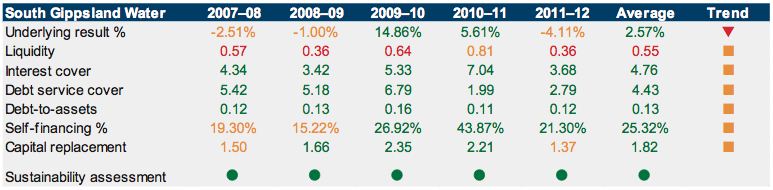

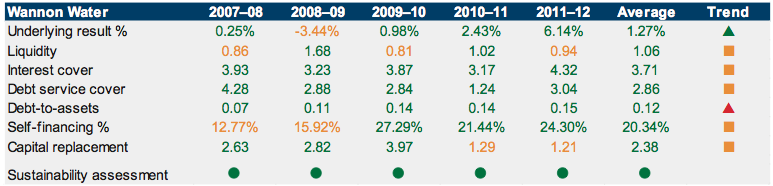

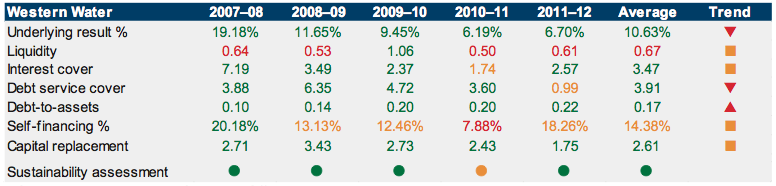

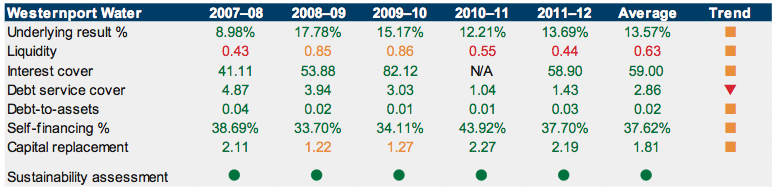

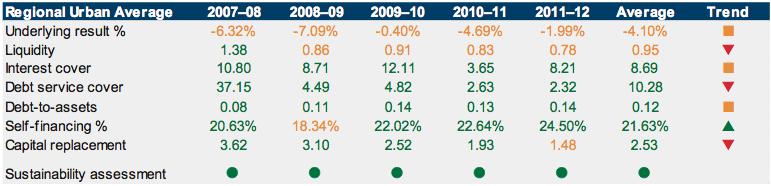

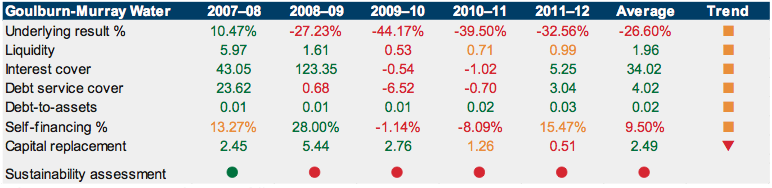

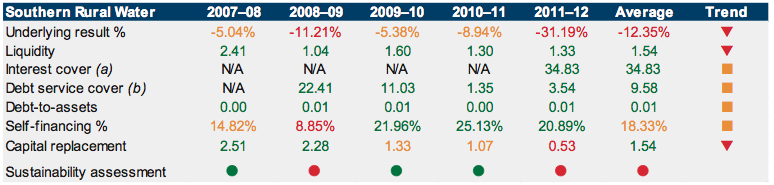

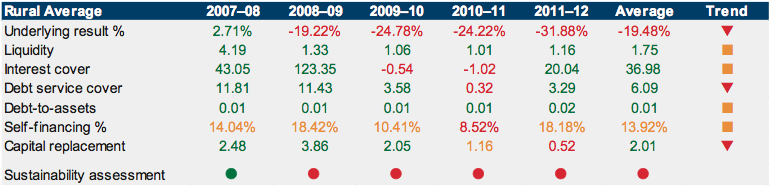

- planned capital works program over the five-year period not optimally scheduled