Results of 2023 Audits: Technical and Further Education Institutes

Audit snapshot

Data dashboard

View the dashboard full screen

Dashboard data

Download CSV copies of the following datasets:

1. Audit outcomes

We provided clear audit opinions on financial reports and performance statements across the Technical and Further Education (TAFE) sector. Parliament and the community can confidently use these reports.

Financial reports and performance statements are reliable

Victorian TAFE sector

There are 12 TAFEs and 9 controlled entities in the Victorian TAFE sector.

We audit the TAFEs' financial reports and performance statements. They each prepared a financial report and performance statement for 2023.

We also audit the financial reports of the 9 entities controlled by the TAFEs.

Appendix B has more information about the sector, including its annual reporting requirements.

Controlled entity

A controlled entity is an entity that another party has the power to govern and make financial and operating decisions about.

We did not need to modify any of our audit opinions

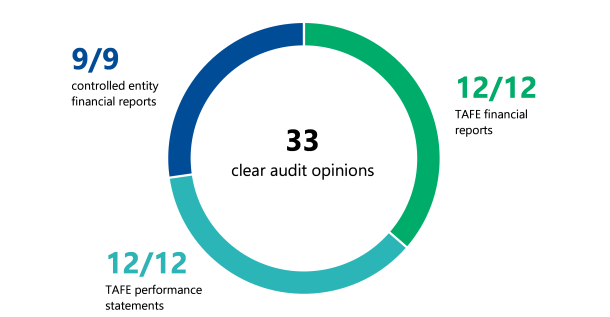

Figure 1 shows we provided clear audit opinions on:

- the 12 TAFEs' financial reports and performance statements

- the 9 controlled entities' financial reports.

Figure 1: Audit opinions issued for 2023

Source: VAGO.

Clear audit opinion

A ‘clear’ or ‘unmodified’ audit opinion means we have reviewed an entity's financial report and believe it is reliable and complies with relevant reporting requirements.

TAFEs met their reporting timeframes with good-quality reports in 2023

Financial reports were timely

Under the Financial Management Act 1994, TAFEs have 8 weeks from the end of their financial year, or 'balance date', to give us their draft financial report to audit.

All TAFEs provided us with their 2023 draft financial reports within the 8-week deadline, similar to 2022.

The quality of financial reports submitted for audit continued to improve

The nature, number and size of errors in financial reports submitted for auditing are measures of their quality and the effectiveness of the entity's systems and processes used to compile them. During an audit we sometimes find an item that an entity has not prepared in line with relevant reporting requirements.

We classify these errors as either material or immaterial.

| If an error is ... | Then ... |

|---|---|

| material | the entity needs to correct it before we can issue a clear audit opinion. |

| immaterial | we recommend the entity corrects it, but we can still issue a clear audit opinion without the correction. |

We did not find any material errors in the TAFEs’ financial reports, the same as last year. We found:

- 3 immaterial financial errors, compared with 5 in 2022

- 5 immaterial classification and disclosure differences, compared with 7 in 2022.

Material

We consider an error material if it could influence a user’s decision-making or understanding about an entity's financial report.

Performance statements continue to be high quality

Each year, TAFEs are required under a ministerial instruction to report against 4 mandatory key performance indicators (KPI) in their performance reports:

- training revenue diversity

- employment costs as a proportion of training revenue

- training revenue per teaching full-time equivalent (FTE)

- operating margin percentage.

They must establish targets, report on actual results for each KPI and disclose the prior year's results. Descriptions of the 4 KPIs and the formulas used to calculate them are provided in Appendix H.

We did not find any material errors in the TAFEs' performance statements and issued clear audit opinions for all 12 TAFEs, which is a good outcome. This is consistent with the previous year.

We analyse the information presented in these performance statements in Section 2.

2. Financial analysis

The sector’s reported net surplus was underpinned by capital grants received to fund campus redevelopment. Without these grants, the sector would have had a net deficit from their operations, which has been a consistent trend for the last 5 years.

Although course enrolments have improved compared to 2022, TAFEs have yet to recover to pre–COVID-19 levels. Fee-for-service revenue increased for most TAFEs compared to 2022, outpacing contestable government funding.

Expenses continued to rise. Most of the sector’s spending was for staff costs, with this expenditure increasing by more than 10 per cent for 4 TAFEs.

Employment costs as a proportion of training revenue continued to be greater, with 9 TAFEs not receiving enough revenue from training services and programs to cover their direct employment costs in 2023.

The financial outcomes of 4 loss-making TAFEs worsened this year, with 2 TAFEs requiring letters of support from the government to confirm their ongoing financial viability in the short term.

KPI targets remained largely unmet for all TAFEs, with a noticeable disconnect between estimated and actual figures.

Financial performance improved due to once-off capital funding

The sector's net result

For 2023, the sector reported a net surplus of $72 million. This is a $25 million increase from the net surplus of $47 million reported in 2022.

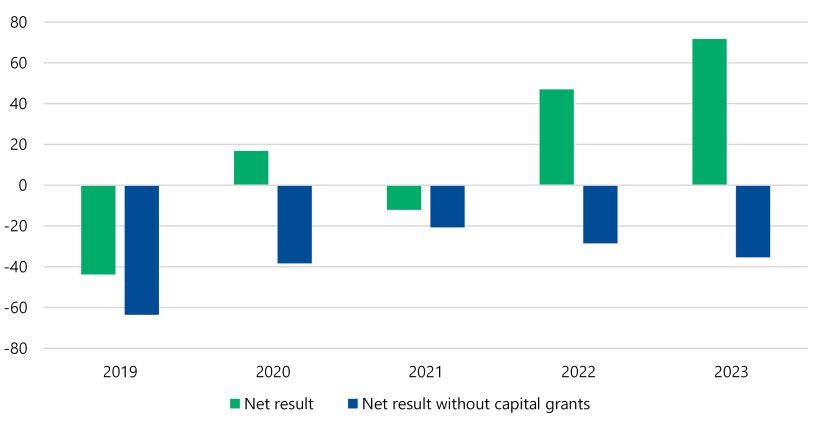

Capital grants from the government of $107 million contributed to the 2023 result ($76 million in 2022). These grants are 'once-off' and not available for TAFEs' day-to-day operations. Without these capital grants, the net result for the sector would have been a $35 million deficit. This is a consistent trend for the last 5 years, as Figure 2 shows.

Figure 2: TAFE sector's net result as reported and excluding capital grants ($ million)

Source: VAGO.

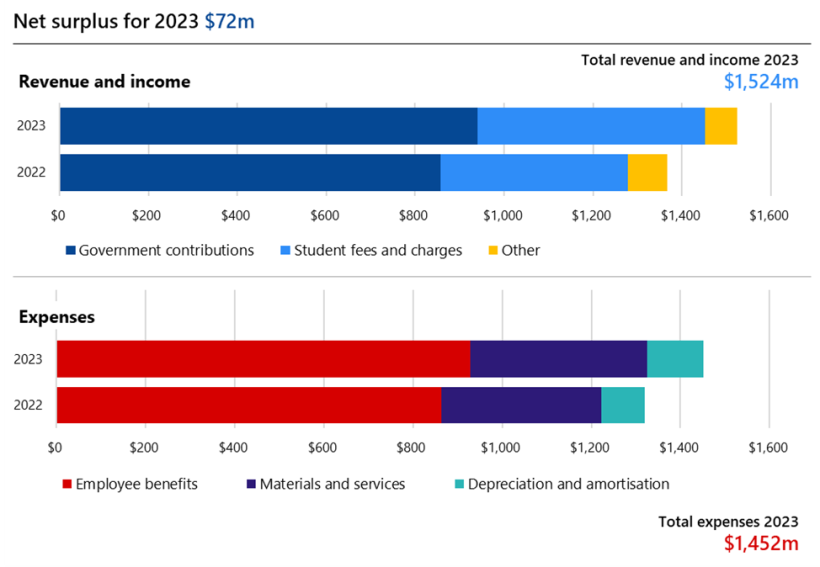

Financial performance snapshot

TAFEs earn most of their revenue from government contributions and student fees and charges. They spend most of their funds on staff costs and materials and services.

Figure 3: Total TAFE sector revenue and expenses in 2022 and 2023 ($ million)

Note: Totals may not add due to rounding.

Source: VAGO.

Individual TAFEs’ net results

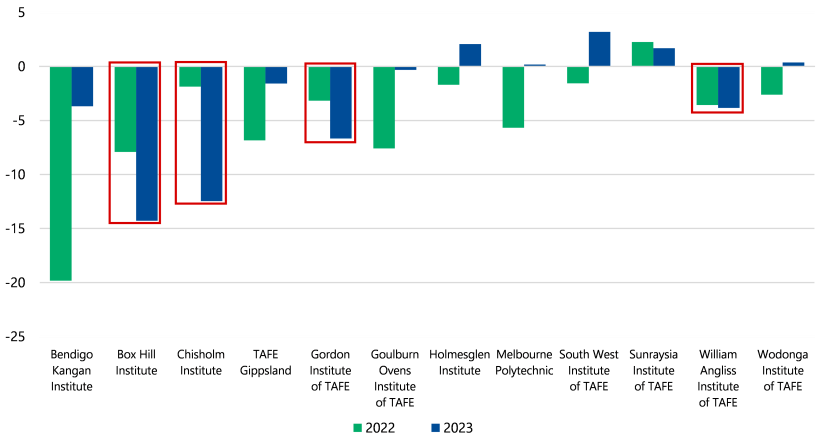

Nine of the 12 TAFEs reported net surpluses in 2023. However, once the impact of capital grants is removed, only 5 TAFEs had underlying surpluses.

Figure 4 shows that for 2022 and 2023, excluding once-off types of revenue – capital grants across both years ($76 million in 2022 and $107 million in 2023) and loans forgiven in 2022 of $32 million – the net underlying result of 7 TAFEs improved, and 5 TAFEs continued to decline.

There were 4 TAFEs that experienced worsening deficits. These were:

- Box Hill Institute

- Chisholm Institute

- Gordon Institute of TAFE

- William Angliss Institute of TAFE.

While these TAFEs have shown variability in their contestable funding, operating grants and fee for-service revenue, their spending markedly increased at a rate faster than their revenue growth, causing the net underlying result to decline.

The profitability of a TAFE indicates its ability to generate revenue and manage expenses to achieve a net surplus. While TAFEs are not designed to make large profits, generating a small surplus is important to ensure they have sufficient funds for future operations. Ideally, these surpluses can be reinvested to maintain and improve the quality of education and services offered by the TAFEs.

Figure 4: TAFEs' net results excluding capital grants and loans forgiven for 2022 and 2023 ($ million)

Note: The TAFEs with worsening deficits are outlined with red boxes.

Source: VAGO.

If the declining net deficit trend continues for these TAFEs, without effective management of expenditure or own-source revenue growth, their long-term financial sustainability is at risk.

To remain financially sustainable, a TAFE must meet current and future expenditure requirements from revenue earned, absorb foreseeable changes and materialising risks and manage the impact from these factors to changing revenue and expenditure requirements.

Revenue increased because of more government funding and higher course enrolments

Revenue sources

| In 2023, TAFEs got … | Which is a … | From … | Because … |

|---|---|---|---|

$940 million from government contributions, made up of:

| $82 million, or 9.6 per cent, increase | $858 million in 2022 | TAFEs received more funding for various initiatives to attract and retain students as part of the TAFE services fund and increased capital funding for campus redevelopments. |

$512 million from student fees and charges, made up of:

| $91 million, or 21.6 per cent, increase | $421 million in 2022 | more students enrolled in fee for service TAFE courses. |

| $72 million from other revenue sources | $16 million, or 18.2 per cent, decrease | $88 million in 2022 | in 2022 other revenue included $32 million in a once-off loan forgiveness for some TAFEs. |

Note: Totals may not add due to rounding.

Government contributions

The Victorian Government funds TAFEs to deliver tertiary education services to students and to deliver capital projects to build and maintain the facilities needed to deliver these services.

The funding varies each year depending on demand in the training market, government initiatives and capital projects the government agrees to.

In 2023, the government gave TAFEs $415 million in operating grants. This is a $26 million increase from the $389 million paid in 2022. These operating grants were provided to:

- meet additional workforce needs

- maintain existing assets

- deliver student learning, wellbeing and specific support initiatives.

The government also gave TAFEs $107 million in once-off capital grants – $31 million more than 2022. In 2023, over 85 per cent of these capital grants went to 3 TAFEs for their campus redevelopment projects:

- Chisholm Institute

- Melbourne Polytechnic

- Bendigo Kangan Institute.

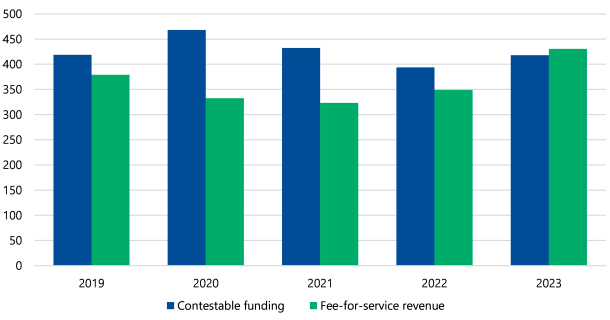

Revenue from fee-for-service courses outpaced revenue from contestable placements

In 2023 the sector earned $431 million from fee-for-service courses. This is an $82 million increase from the $349 million it earned in 2022.

As shown in Figure 5, revenue earned from fee-for-service courses in 2023 surpassed the overall revenue earned from contestable funding, a shift in what was experienced since 2019. Fee for service revenue increased because citizenship and visa applications were normalised post–COVID-19, which increased demand for the skills assessments and migrant English programs these TAFEs run.

Figure 5: TAFEs' total contestable funding and fee-for-service revenue from 2019 to 2023 ($ million)

Source: VAGO.

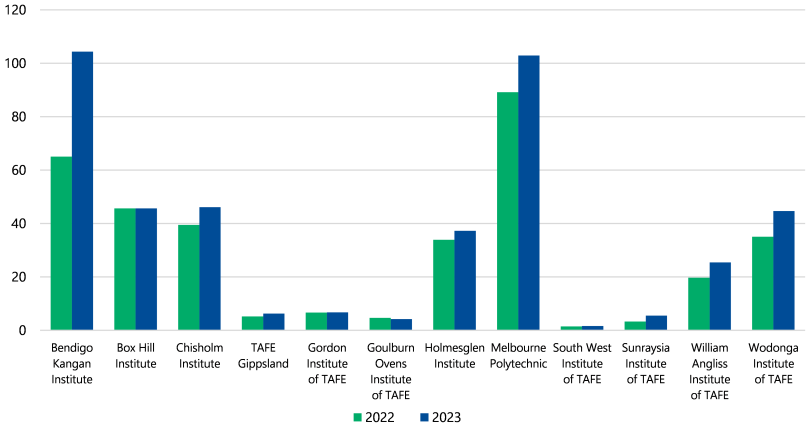

Most of the increase in fee-for-service revenue was experienced by 3 TAFEs, as Figure 6 shows:

- Bendigo Kangan Institute

- Melbourne Polytechnic

- Wodonga Institute of TAFE.

Figure 6: TAFEs' fee-for-service revenue for 2023 compared with 2022 ($ million)

Source: VAGO.

Fee-for-service revenue

Fee-for-service revenue is income TAFEs generate from providing educational and training services that students, employers or other clients pay for directly, rather than through government subsidies.

Contestable funding

Contestable funding is financial support from the Victorian Government that TAFEs must compete for, allowing both public and private training providers to apply for the same pool of funding based on criteria, such as quality and efficiency.

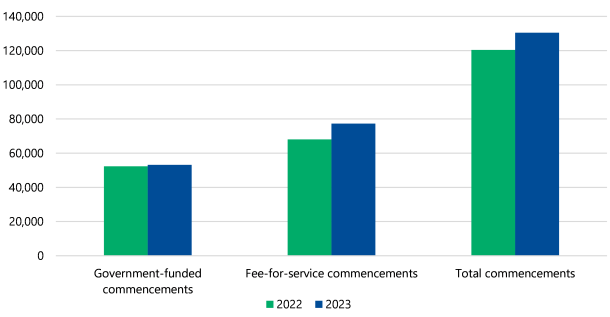

Total enrolments

Course enrolments are the number of students who begin their courses or programs within a given period. Figure 7 shows the total number of course enrolments for 2022 and 2023.

Figure 7: Total number of course enrolments for 2022 and 2023

Source: VAGO.

Most of the course enrolment increase is from fee-for-service courses, which have shown a 14 per cent increase in 2023. Government-funded commencements have stayed flat from 2022 to 2023 due to high competition from private training providers.

Nearly two-thirds of the sector’s expenses relate to employee costs that continued to increase

Changes in the sector's expenses

In 2023 TAFEs spent $1,452 million, a $132 million increase from the $1,320 million spent in 2022.

Expenses increased for all TAFEs because of:

- enterprise bargaining agreement pay increases and an overall increase in staff numbers (in line with increased service delivery)

- general increases in utility and supply costs due to persistent inflationary increases.

| In 2023, the sector spent … | Which is a … | From … | Because of … |

|---|---|---|---|

| $929 million on employee expenses | $65 million, or 7.5 per cent, increase | $864 million in 2022 | an overall increase of 4 per cent as a result of conditions in the sector’s enterprise bargaining agreements, together with some increases in the number of teaching staff employed across all TAFEs to assist with greater service delivery. |

| $397 million on materials and services | $38 million, or 10.6 per cent, increase | $359 million in 2022 | general increases in the market price for supplies and general utilities. |

| $126 million on depreciation and amortisation | $28 million, or 28.6 per cent, increase | $98 million in 2022 |

|

Note: Totals may not add due to rounding.

Changes in TAFEs’ expenses

Spending for 7 TAFEs increased by more than 10 per cent in 2023. These TAFEs were:

- Box Hill Institute

- Chisholm Institute

- Melbourne Polytechnic

- South West Institute of TAFE

- Sunraysia Institute of TAFE

- Goulburn Ovens Institute of TAFE

- Wodonga Institute of TAFE.

For 4 of these TAFEs (Box Hill Institute, Chisholm Institute, Melbourne Polytechnic and Sunraysia Institute of TAFE), their overall expenditure increased at a faster rate than their revenue before capital contributions.

The largest expense for the sector was for employee costs. Four TAFEs (Bendigo Kangan Institute, Goulburn Ovens Institute of TAFE, South West Institute of TAFE and William Angliss Institute of TAFE) had this expense grow by more than 10 per cent in 2023.

Employment costs as a proportion of training revenue

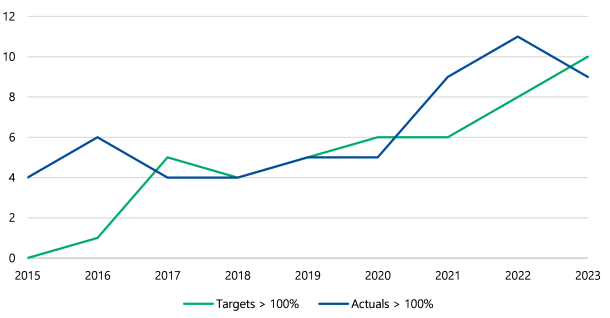

One of the mandatory KPIs TAFEs report on in their performance statement is 'employment costs as a proportion of training revenue'.

This indicator shows the total staffing costs for each TAFE divided by the total revenue earned from providing training services and programs. TAFEs set their targets for this indicator at the beginning of each year based on their budget forecast data.

Employee costs are often more than the training revenue earned. Figure 8 illustrates that over the last 8 years, a growing number of TAFEs have been setting annual targets for this KPI, assuming that training revenue alone cannot fully cover employment costs.

Specifically, in 2015 all TAFEs set the target with the assumption they would recover employment costs fully with training revenue earned.

However, by 2023, this assumption deteriorated significantly, with 10 out of the 12 TAFEs assuming they would not recover employment costs with revenue earned from training students.

When assessing the trend against the actual result, we found that, similarly, the number of TAFEs not breaking even on their employment costs has risen over the last 8 years.

Figure 8: Number of TAFEs that have targets and actuals for employment costs as a percentage of training revenue above 100 per cent from 2015 to 2023

Source: VAGO.

Possible factors impacting this trend are:

- growing employee expenses under enterprise bargaining agreements

- provision of training services and programs in regional campuses where demand is low, resulting in a high average cost per student

- ongoing low unemployment levels, impacting enrolment demand.

This trend requires further exploration by TAFEs and the Department of Jobs, Skills, Industry and Regions (DJSIR), to effectively manage the sector’s financial sustainability into the long term. We also intend to explore this area further in the future.

The sector's balance sheet remained strong due to its significant land and building assets and low debt levels

Financial position snapshot

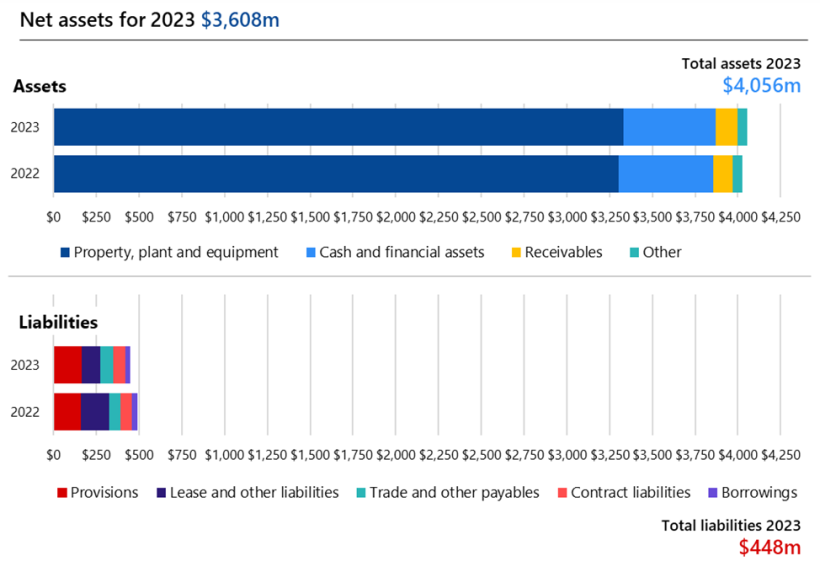

As Figure 9 shows, the sector had $4,056 million in assets and $448 million in liabilities in 2023. Most of the sector's assets are land and buildings.

The sector's largest liabilities are employee benefit provisions and leased buildings.

Figure 9: TAFEs' total assets and liabilities in 2022 and 2023 ($ million)

Note: Totals may not add due to rounding.

Source: VAGO.

| In 2023 the sector reported … | Which is a … | From … | Because … |

|---|---|---|---|

| $4,056 million in assets | $30 million, or 0.7 per cent, increase | $4,026 million in 2022 | of increased capital works at 3 TAFEs. Depreciation on existing buildings partially offset this. |

| $448 million in liabilities | $41 million, or 8.4 per cent, decrease | $489 million in 2022 | revenue received in advance in previous years was recognised as income in 2023 because different stages of the capital works were completed. |

Note: Totals may not add due to rounding.

TAFEs required letters of support to prepare financial reports on a going-concern basis

Going-concern assumption is at risk without government support

Financial reports are prepared on a going-concern basis. This assumes that an entity is able to continue operating for at least the next 12 months unless its management either intends or has no realistic alternative but to liquidate the entity or stop operating.

In order for us to be able to assess a TAFE’s going-concern assumption, we consider various indicators, such as its financial results, key financial indicators (for example, liquidity ratio), operating cashflows, budget forecasts, and trends in revenue and expenditure over the last few years compared to budget projections.

Our analysis of these indicators across the sector showed that both Goulburn Ovens Institute of TAFE and Melbourne Polytechnic had a number of negative indicators, including a liquidity ratio of less than one (indicating that these TAFEs had fewer short-term assets than the balance of their short-term liabilities), consistent negative trends when comparing budget to actual results over the last 3 years, and budget forecasts that show significant cash deficits for each year out to 2027.

These negative trends and outlook meant that both TAFEs had to request the Minister for Skills and TAFE provide them with a letter of financial support to enable them to confirm a going concern assumption for 2023 on which the financial report was then prepared under.

We did not modify our audit opinion for these TAFEs because of the letters of support provided to meet their financial obligations.

DJSIR has placed a representative to sit on these 2 TAFE boards to give them greater oversight into the TAFEs’ operational and financial management.

Budgeting challenges and variances in KPIs

Budgeting process and the statements of priorities

The budgeting process is a fundamental aspect of financial management within any organisation, encompassing the systematic planning and allocation of financial resources to achieve strategic objectives.

Each TAFE agrees on its budget figures with the Minister for Skills and TAFE at the start of each year when they develop its statement of priorities. This statement is a document that outlines the key priorities a TAFE has agreed to work on for the year and outlines key financial and performance measures that a TAFE will achieve in the following year.

The financial measures form the basis of the KPI targets that each TAFE reports individually as part of its performance statement, which help to demonstrate whether a TAFE has met its overall aim of delivering quality training services within agreed financial budgets. At the end of the relevant financial year, TAFEs publish their actual KPI results against their targets in their performance statements.

Analysis of the trends in budget forecasts

Our analysis of the trends in budget forecasts compared with actual TAFE results over the previous 5 years revealed that most TAFEs had significant variances in actual revenue and operating expenditure when compared with original budget targets.

In particular, there was a general tendency to over-budget expenditure and under-budget course enrolment figures and related revenue. While TAFEs were successful in managing their expenditure month to month (and were able to accurately re-estimate revenue and expenditure targets closer to the end of the year), initial budgets set at the start of the year tended to be significantly different when compared to actuals over the last 5 years.

A number of TAFEs also had to make multiple revisions to their budget forecasts in the last 2 years before being able to finalise their budget figures and obtain approval from the Minister for Skills and TAFE for their performance statement targets.

Analysis of current budget forecasts from 2024 to 2027 shows that there are at least 8 TAFEs that are forecasting they will run into cash deficits over the next 3 to 4 years. However, given the significant variances found in their budget to actual figures over the last 5 years, it is uncertain as to whether the assumptions underpinning the current budget forecasts are reliable.

Combined with the trend of the majority of TAFEs not meeting their targets for at least 2 of their KPI metrics outlined in their performance statements in 2023, and targets being set for their KPIs with assumptions that they will not break even on their operations over the last 5 years, we recommend that TAFEs need to focus on analysing the reasons why these significant variances exist within their budgets.

Why accurate budgeting is important

TAFE budget forecasts and targets are crucial for a number of reasons. Firstly, TAFE boards rely on accurate data to make informed decisions about operational and financial matters. They must also ensure accurate reporting to the Minister for Skills and TAFE on their TAFE’s sustainability. DJSIR needs this information to inform funding requirements and policy decisions and make recommendations to the minister accordingly.

If financial forecasts and course enrolment expectations are not reasonably accurate, financial management of individual TAFEs and the sector as a whole is impeded.

We have been advised by DJSIR that:

- board-endorsed draft budgets for 2025 are to be submitted to DJSIR for review by October 2024

- DJSIR will then work with each TAFE to finalise budgets for the minister’s approval by the end of 2024.

Our analysis of previous years' budgets shows that this timing has generally not been met over the last few years.

Recommendation

All TAFEs

We recommend that:

- all TAFEs review and critically analyse their current budgeting processes to determine why there have been such significant variances in budgets when compared with actual results, and determine whether the approach to developing these assumptions requires enhancement

- as TAFEs continue to work with the Department of Jobs, Skills, Industry and Regions to achieve balanced budgets into the future, the budgeting process commences earlier to ensure budgets are in place before the year they are to apply.

3. Internal controls

TAFEs’ internal controls are adequate for them to prepare reliable financial reports and performance statements. The overall internal control environment at TAFEs is improving, but they need to resolve their information technology (IT) issues found in past years. These issues, if not resolved, could prevent TAFEs from preparing reliable financial reports or protecting their sensitive data.

TAFEs need to focus on IT controls and keep improving them

Internal control snapshot

TAFEs must have effective internal controls that are relevant for financial reporting. When developing our audit procedures, we assess the design and implementation of these internal controls to determine whether they allow TAFEs to prepare reliable financial reports and performance statements.

TAFEs had fewer unresolved new control issues in 2023 compared to 2022, suggesting that the internal control environment at TAFEs is improving. But TAFEs still need to make further improvements to their IT controls to address the unresolved IT issues we found in previous years. We note that all TAFEs have migrated to a common general ledger system, TechnologyOne, which seems to have benefited in reducing the outstanding IT issues.

Raising internal control issues

We report on internal control and financial reporting issues to each TAFE's board and audit committee every year. This includes:

- reporting on new issues identified in the current year

- giving updates on issues we raised in previous years that remain unresolved in the current year.

Issues observed in 2023

In 2023, we have observed the following high and moderate-rated issues:

| We found ... | Which we rated as … | And recommended management acts to … |

|---|---|---|

| one new internal control issue | moderate risk | resolve within 3 to 6 months. |

| 14 unresolved issues from previous years, including 9 that related to IT controls |

| resolve the:

|

TAFEs can strengthen their internal controls and financial reporting processes by promptly resolving these issues.

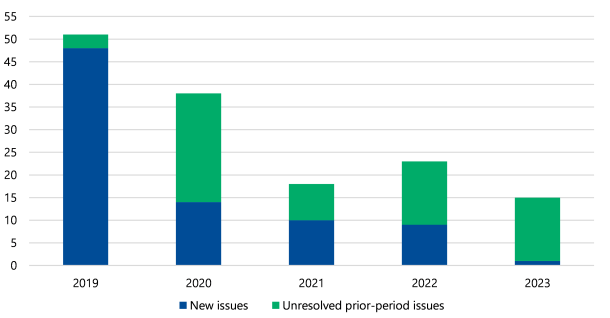

As Figure 10 shows, the number of new issues has gone down since 2019. But the number of unresolved issues from previous years has fluctuated since 2019.

Figure 10: New and unresolved issues from 2019 to 2023

Note: We excluded low-risk issues because we consider these to be minor opportunities for improvement.

Source: VAGO.

Unresolved internal control issues from prior years

During 2023, we observed 14 unresolved prior-period issues, 9 of which relate to IT controls. The remaining 5 issues relate to other financial processing controls.

IT controls are still the sector's key weakness

Why IT controls are important

Effective IT controls are important because they reduce the risk of:

- unauthorised users accessing and changing a system

- cyber attacks.

TAFEs need these controls to protect their data and prepare reliable financial reports.

IT control issues we found in 2023

In 2023, we did not note any new common IT issues across the sector compared with 5 issues in the previous year. This is a significant improvement from last year.

Prior-year unresolved IT issues

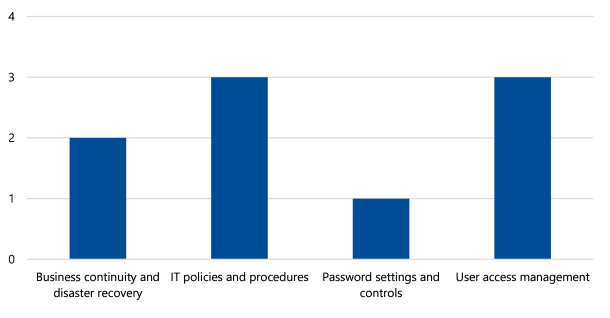

In 2023, the unresolved prior-year IT control issues mostly related to:

- business continuity and disaster recovery

- IT policies and procedures

- password settings and controls

- user access management.

Figure 11 shows the number of unresolved prior-year IT control issues. Out of the 9 issues relating to IT controls, 8 issues only related to 2 TAFEs.

Figure 11: Unresolved IT issues from previous years

Source: VAGO.

Business continuity and disaster recovery

Business continuity and disaster recovery focuses on continuing operations and restoring data access and IT infrastructure during and after a disaster.

We found 2 TAFEs had not tested their business continuity and disaster recovery plan.

Failure to test and review the effectiveness of these plans may result in an inability to smoothly restore business operations and data in the event of a disaster or data disruption.

IT policies and procedures

Effective IT policies and procedures tell staff how they should set up, maintain and use an IT system. This helps an entity protect its data.

We found that 2 TAFEs need to update their policies and procedures to tell staff how to manage:

- user access

- logs

- patches

- data and data breaches

- IT assets

- job monitoring

- information security

- change management.

We found that these TAFEs also need to regularly review their IT policies and procedures.

If a TAFE does not regularly review its policies and procedures, there is a greater risk that staff will not:

- understand their duties

- follow appropriate control procedures

- have formalised guidance to follow if they run into any problems.

Password settings and controls

A strong password combined with multifactor authentication reduces the risk of cybersecurity threats and confidential information being compromised.

We found one TAFE whose current password policy does not meet the requirements of the Australian Government's Information Security Manual. This could increase the risk of cybersecurity threats and unauthorised access to confidential information.

User access management

We observed one TAFE that lacked:

- periodic reviews of user access rights

- timely cessation of terminated users

- a user matrix that defined roles.

These 3 issues increase the risk of an unauthorised user:

- accessing the TAFE's system

- changing or stealing its data.

Recommendation

All TAFEs

We recommend that all TAFEs:

- prioritise and promptly address the internal control and financial reporting issues we raise with them and that their audit committees monitor this

- review the actions and timelines established to resolve internal control weaknesses, with a focus on older and higher-risk issues.

Appendix A: Submissions and comments

Download a PDF copy of Appendix A: Submissions and comments.

Appendix B: Sector context

Appendix C: Our audit approach

Appendix D: Acronyms and glossary

Download a PDF copy of Appendix D: Acronyms and glossary.

Appendix E: Audit opinions

Appendix F: Control issue risk ratings

Download a PDF copy of Appendix F: Control issue risk ratings.

Appendix G: Financial sustainability indicators

Download a PDF copy of Appendix G: Financial sustainability indicators.

Appendix H: Mandatory performance indicators

Download a PDF copy of Appendix H: Mandatory performance indicators.