Water Entities: Results of the 2010–11 Audits

Overview

This report covers the results of our financial audits of 20 entities in the water industry, comprising 19 water entities and one controlled entity. The report informs Parliament about significant issues arising from the audits of financial and performance reports and augments the assurance provided through audit opinions included in the respective entities’ annual reports.

The report comments on the quality and timeliness of financial reporting, the financial sustainability of water entities, performance reporting and the effectiveness of internal controls over asset valuations, declarations of interest and outsourcing.

Parliament can have confidence in the 20 financial reports and 16 performance reports that received clear audit opinions.

The internal control structures over financial reporting within audited entities were adequate, that is they enabled production of accurate, complete and reliable information for reporting. However, controls over information technology, asset valuations, declarations of interest and outsourcing can be improved.

Overall the financial sustainability risk for the water industry is low. However, the risk is uneven across the metropolitan, regional urban and rural categories. The longitudinal trends indicate that the risk profile for the industry is deteriorating and deeper analysis of indicators suggests that the sustainability of entities within the regional urban category could be at risk over time unless these trends are reversed.

Debt levels continue to increase and a number of sustainability indicators such as liquidity and interest cover show deteriorating trends.

The ability of water entities to increase the price they charge for water and the provision of sewerage services is regulated and based on five-year water plans developed by each entity. The plans were developed over a period of drought, below-average rainfall and the imposition of water restrictions. There is now a risk that assumptions in the plans are no longer appropriate, that revenue and expenditure will not be as forecast.

Water Entities: Results of the 2010–11 Audits: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER November 2011

PP No 83, Session 2010–11

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on Water Entities: Results of the 2010–11 Audits.

Yours faithfully

![]()

D D R PEARSON

Auditor-General

9 November 2011

Audit summary

Background

This report covers the results of our financial audits of 20 entities in the water industry, comprising 19 water entities and one controlled entity. It informs Parliament about significant issues arising from the audits of financial and performance reports and augments the assurance provided through audit opinions included in the entities' annual reports.

The report comments on the quality and timelines of financial reporting, the financial sustainability of water entities, and the effectiveness of internal controls over asset valuations, declarations of interests and outsourcing.

Conclusion

Clear audit opinions were issued on all 20 financial reports and 16 performance reports for the financial year ended 30 June 2011.

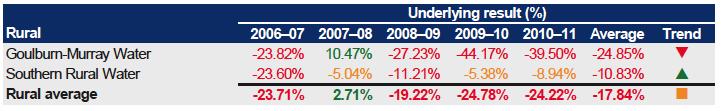

The 19 water entities reported a net profit before tax of $405.4 million in 2010–11, a decrease of $18.5 million or 4.4 per cent from 2009–10. However, while the four metropolitan water entities continue to generate strong profits year‑on‑year, eight of the 13 regional urban water entities (62 per cent) reported a lower net profit before tax in 2010–11 relative to the prior year, and five reported a net loss before tax. The two rural water entities continued to report losses.

The overall risk to financial sustainability for the water industry is low. However, the risk is uneven across the metropolitan, regional urban and rural categories. The longitudinal trends indicate that the risk profile for the industry is deteriorating and deeper analysis of indicators suggests that the sustainability of other entities within the regional urban category could be at risk over time unless these trends are reversed.

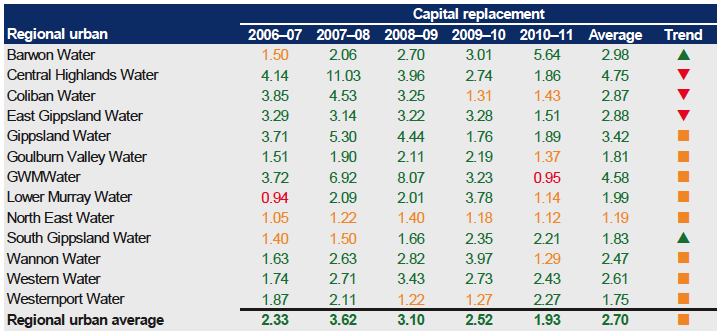

Debt levels continue to increase and a number of sustainability indicators, such as liquidity, interest cover, and capital replacement ratio show deteriorating trends.

The ability for water entities to increase the price they charge for water and the provision of sewerage services is regulated by the Essential Services Commission (ESC), based on five-year water plans developed by each entity. The funding model, therefore, restricts the ability of water entities' boards to take key decisions on the cost of water to offset the increasing costs of service provision.

The approved water plans cover from 2008–09 to 2012–13 and were developed over a period of ongoing drought, a decade of below-average rainfall and the imposition of water restrictions. There is now a risk that assumptions in those plans are no longer appropriate and that revenue and expenditure will not be as forecast. In the event that revenue reduces due to reduced demand for water, the financial sustainability of entities can be adversely affected.

Consequently, it is timely to revisit the ESC's pricing model and the planning activities of water entities to determine their suitability in a time of changing environmental conditions.

Findings

Audit opinions and quality of financial reporting

Audit opinions issued on financial reports

Clear audit opinions were issued on the financial reports of all 20 entities, consistent with the prior year result.

An emphasis of matter paragraph was included in the audit report issued on the financial report of Watermove, a controlled entity of Goulburn-Murray Water (G-MW). It outlined Watermove's reliance on the continuing financial support of its parent entity to sustain its operations. Without this support, the entity would not have met the 'going concern' requirement of the Australian Accounting Standards at 30 June 2011.

Audit opinions issued on performance reports

Melbourne Water, the 13 regional urban water corporations, and the two rural water corporations each prepared and submitted for audit a performance report. Clear audit opinions were issued on all 16 performance reports.

Quality of reporting

Overall, the financial and performance report preparation processes of water entities were adequate and produced accurate, complete and reliable information, but there were opportunities for improvement in:

- establishing preparation plans outlining processes, resources, milestones, oversight and quality assurance practices for financial and performance reporting

- preparing and providing timely shell financial and performance reports to enable issues to be identified and resolved earlier

- preparing materiality assessments to identify potential errors in the financial and performance reports

- performing rigorous quality control and assurance to improve the accuracy of the draft financial and performance reports

- performing rigorous analytical reviews to help improve the accuracy of the financial and performance reports.

All entities, except for Watermove, finalised their financial report, and performance report where applicable, within the 12-week legislative reporting time frame, consistent with the prior year. Watermove's financial report was finalised after 16.6 weeks, compared to 8.9 weeks in 2009–10. Material uncertainty regarding its ability to continue as a going concern required an assessment of the financial viability of the business, and resulted in additional disclosures and adjustments to the financial report.

The average time taken by the 16 water corporations to finalise their financial and performance reports was 9.0 weeks in 2010–11, compared to 7.4 weeks in 2009–10, due to delays in the revaluation of infrastructure assets for the regional urban and rural entities.

The average time for the three metropolitan retail distribution companies to finalise their financial reports was 8.2 weeks in 2010–11 compared to 8.0 weeks in 2009–10.

Financial results

The 19 water entities reported a net profit before tax of $405.4 million in 2010–11, a decrease of $18.5 million or 4.4 per cent from 2009–10. The decrease was predominantly due to higher finance costs, depreciation expenses, and the write-off of impaired assets. Regular rainfall during the financial year resulted in lower water consumption. This reduced the revenue generated by the entities and nullified the impact of approved price increases.

While the four metropolitan water entities continue to generate strong profits year‑on‑year, eight of the 13 regional urban water entities (62 per cent) reported a lower net profit before tax in 2010–11 relative to the prior year, and five reported a net loss before tax (three in 2009–10). The two rural water entities continued to report losses.

Revenue increased by $411.2 million or 12.6 per cent from 2009–10 due to higher service and usage charges.

Our analysis of the service and usage charges revealed that a large portion of the customer total water bill is fixed, especially for the regional urban and rural sectors. This means that for many customers, reducing water consumption will not result in a substantially lower water bill.

Financial sustainability

To be financially sustainable, entities need to be able to meet current and future expenditure as it falls due. They must also be able to absorb foreseeable changes and the effect of financial risks materialising, without significantly changing their revenue and expenditure policies.

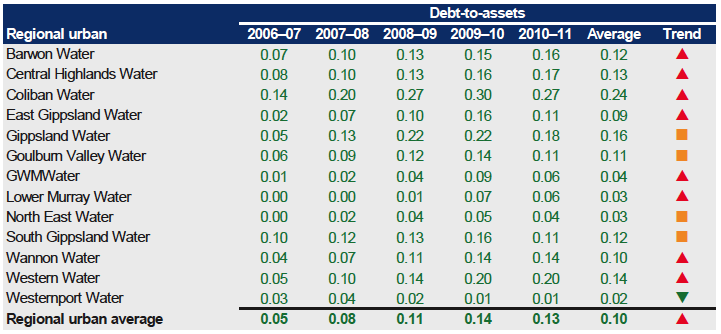

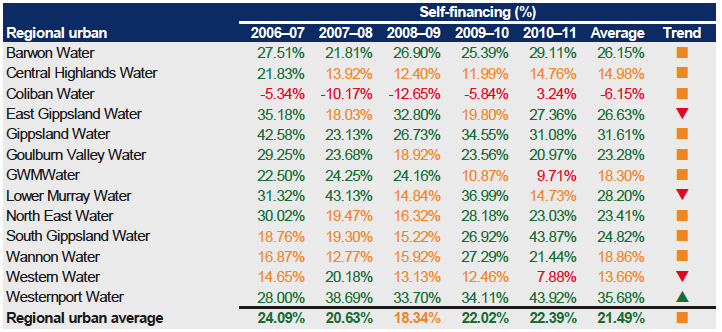

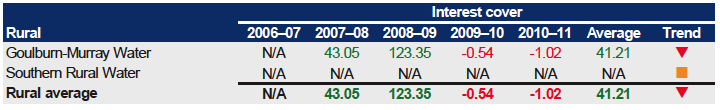

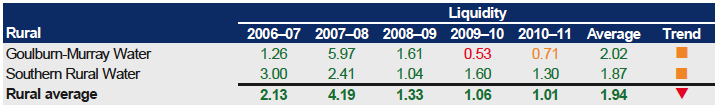

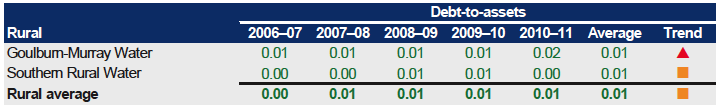

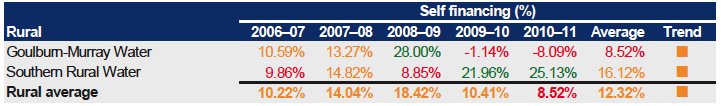

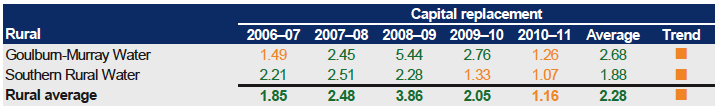

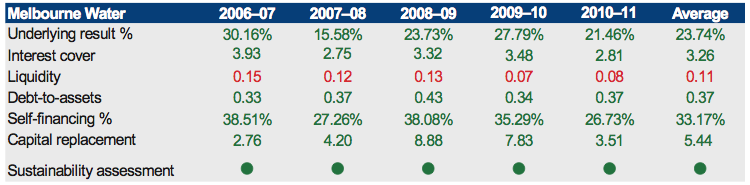

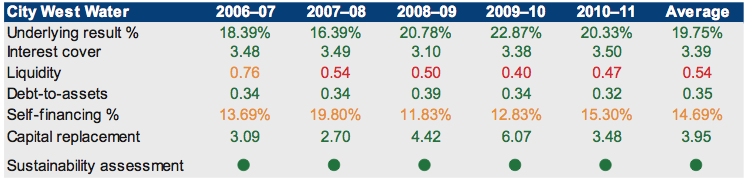

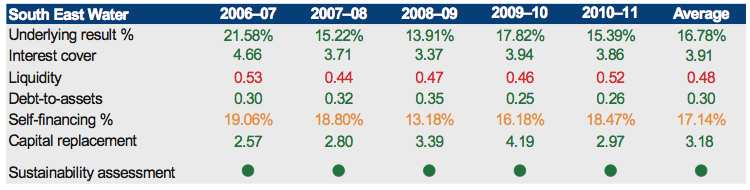

The six financial sustainability indicators, analysed for the five years from 2006–07 to 2010–11 were:

- the underlying result

- interest cover

- liquidity

- debt-to-assets

- self-financing

- capital replacement.

These indicators were reviewed and revised during 2010–11. This year we considered the liquidity and interest cover ratios collectively rather than individually to assess financial sustainability given the treasury management policies of the water entities. The 'debt-to-equity' ratio was replaced by the 'debt-to-assets' ratio as this measure is more widely applied across the water industry.

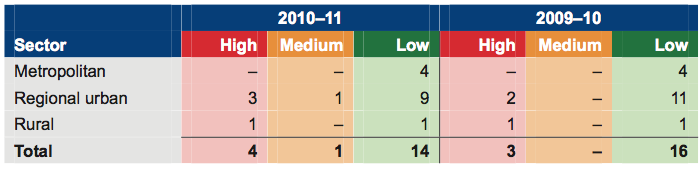

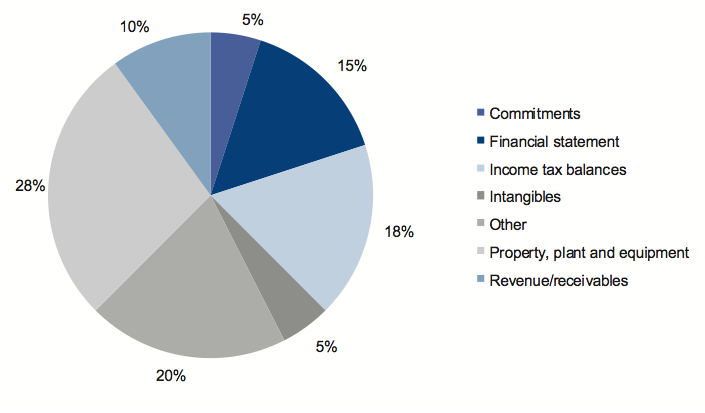

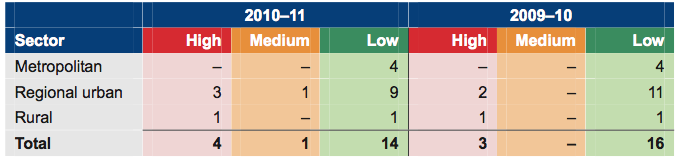

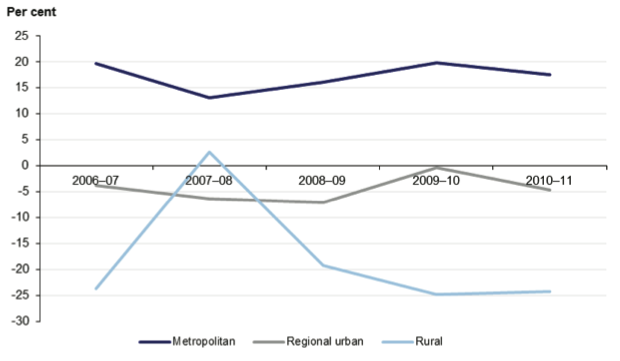

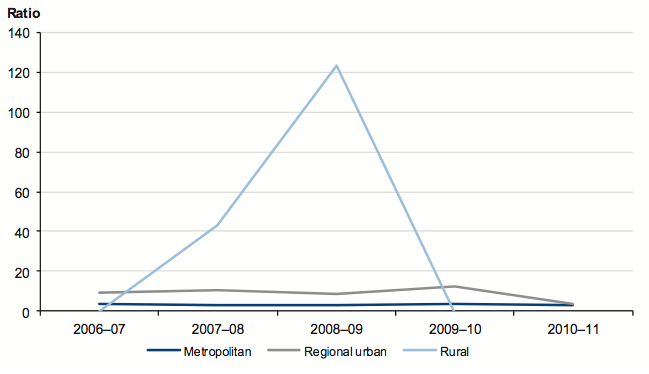

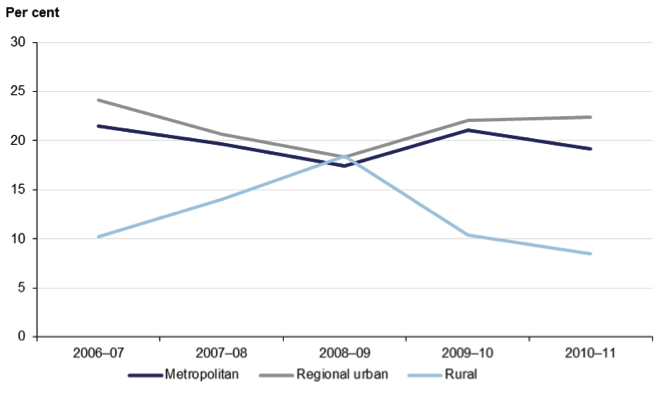

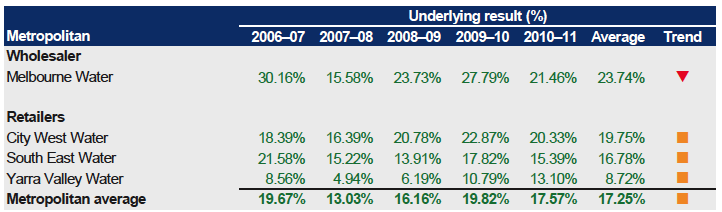

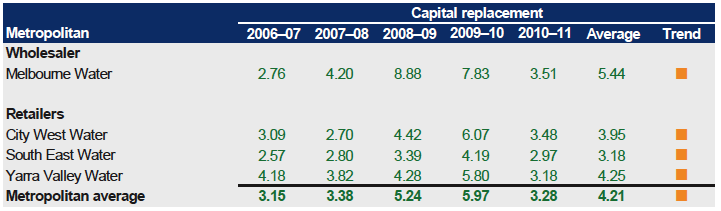

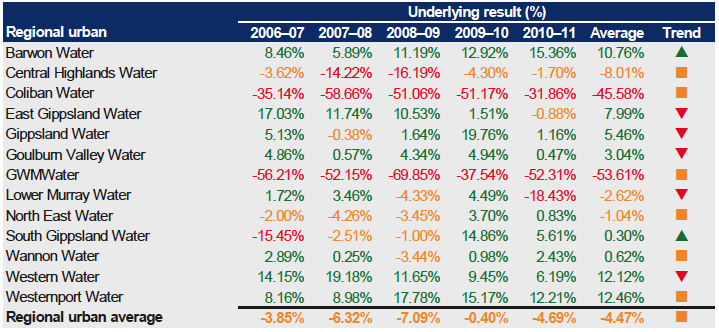

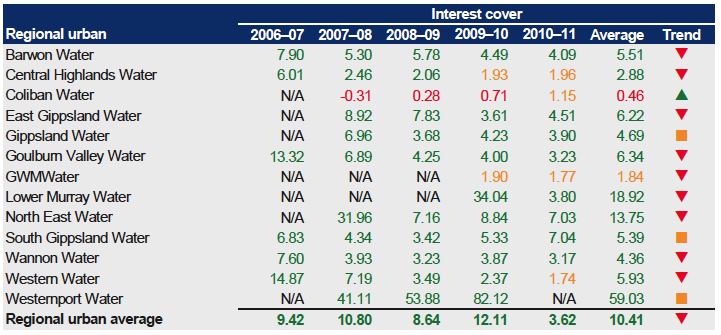

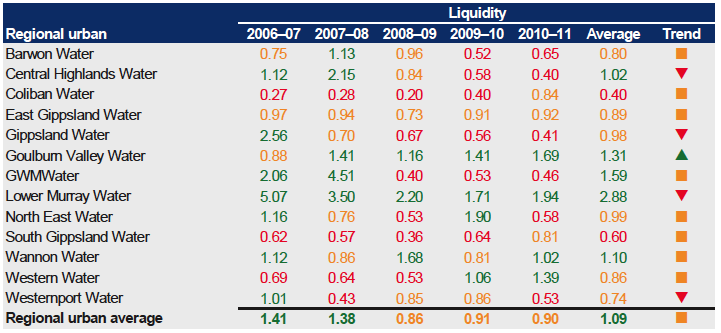

The results of our analysis of the 19 water entities, at the entity sector level are provided in Figure A.

Figure A

Financial sustainability risk assessment by water sector for 2010–11 and 2009–10

Source: Victorian Auditor-General's Office.

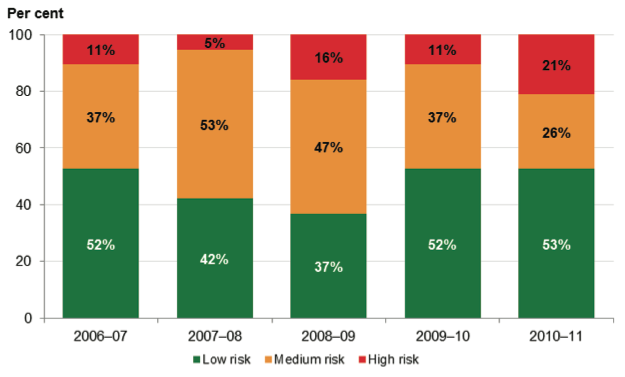

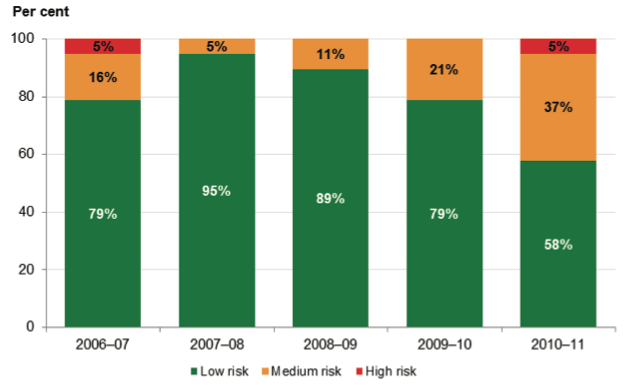

Four entities (three entities in 2009–10) rated as being a high financial sustainability risk at 30 June 2011 had poor liquidity, inadequate interest cover, or large operating losses. Three of the four were identified as high risk in most years over the past five‑year period.

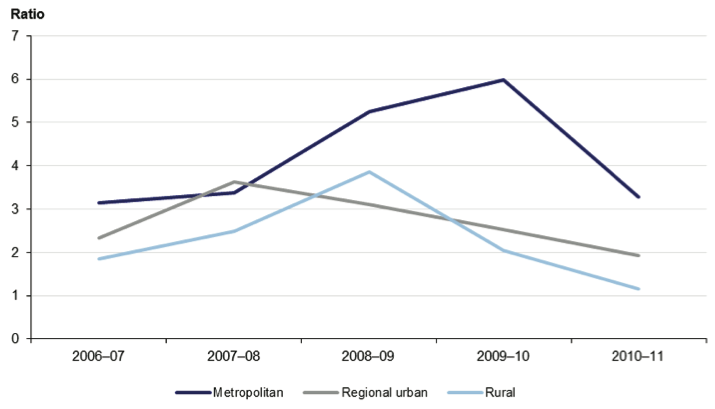

Our analysis of the trend in financial sustainability risk results over the five years to 2010–11 showed a deteriorating risk profile for the industry as a whole.

Analysis of the trend in sustainability indicators over the same period showed the trend for the metropolitan water entities to be relatively stable. They have a large customer base and continue to generate strong profits and positive cash flows from operations annually.

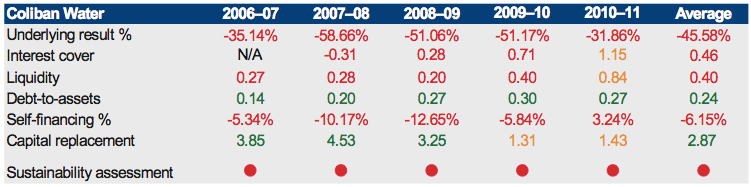

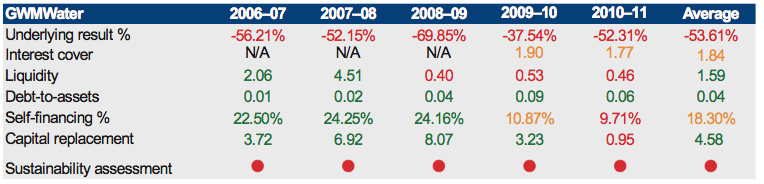

The regional urban water entities, as a cohort are also relatively well placed. However, the results for Coliban Water and Grampians Wimmera Mallee Water Corporation over the past five years are less favourable and require monitoring. Deeper scrutiny indicates that the sustainability of other entities within the sector could be at risk over time unless downward trends are redressed.

For the rural water entities, the results for G-MW are unsustainable and overshadow the results for that sector. In 2010–11 the entire G-MW board resigned and a number of senior managers departed. A new board was appointed late May 2011 and a new managing director in August 2011. The impact of these changes and of decisions they take to improve the financial performance and position of the entity should become more evident in subsequent reporting periods.

Regulation of water prices

Over and above the analysis of financial sustainability indicators, trends and risks, the capacity of management and the governing body to take decisions necessary to affect an entity's operations needs to be taken into account in assessing the entity's performance.

Since 1 January 2004 the ESC has been responsible for regulating and approving the price a water entity may charge its customers for the supply of water and the provision of sewerage services.

The price is determined based on an entity's water plan which specifies the outcomes the entity plans to deliver, how they will be achieved, and the revenue needed to deliver them over the life of the plan. An entity's water plan also outlines the proposed operating and capital expenditure over the period of the plan. A range of assumptions underpin the proposed revenue and expenditure forecasts. Should actual and forecast figures vary or their underpinning assumptions prove to be incorrect, the actual financial performance and financial sustainability of the entity can fall short of the plan.

The current water plans cover from 2008–09 to 2012–13 and were developed during a period of ongoing drought with around a decade of below-average rainfall and the imposition of water restrictions. With many customers adopting water conservation measures the volume of water supplied in recent years has also been less than forecast resulting in revenue being less than forecast. Following a period of above average rainfall, and with water storages nearing capacity, especially in regional Victoria, there is now a risk that assumptions in the plans are no longer appropriate and that revenue and expenditure will not be as forecast. In the event that revenue further reduces due to reduced demand for water, financial sustainability may be adversely affected.

Given that the financial sustainability of some water entities and sector categories has deteriorated it would be timely to revisit:

- the duration of water plans

- the appropriateness of the funding model and its flexibility in times of unpredictable weather patterns

- the rigour of the planning and forecasting by water entities.

Performance reporting

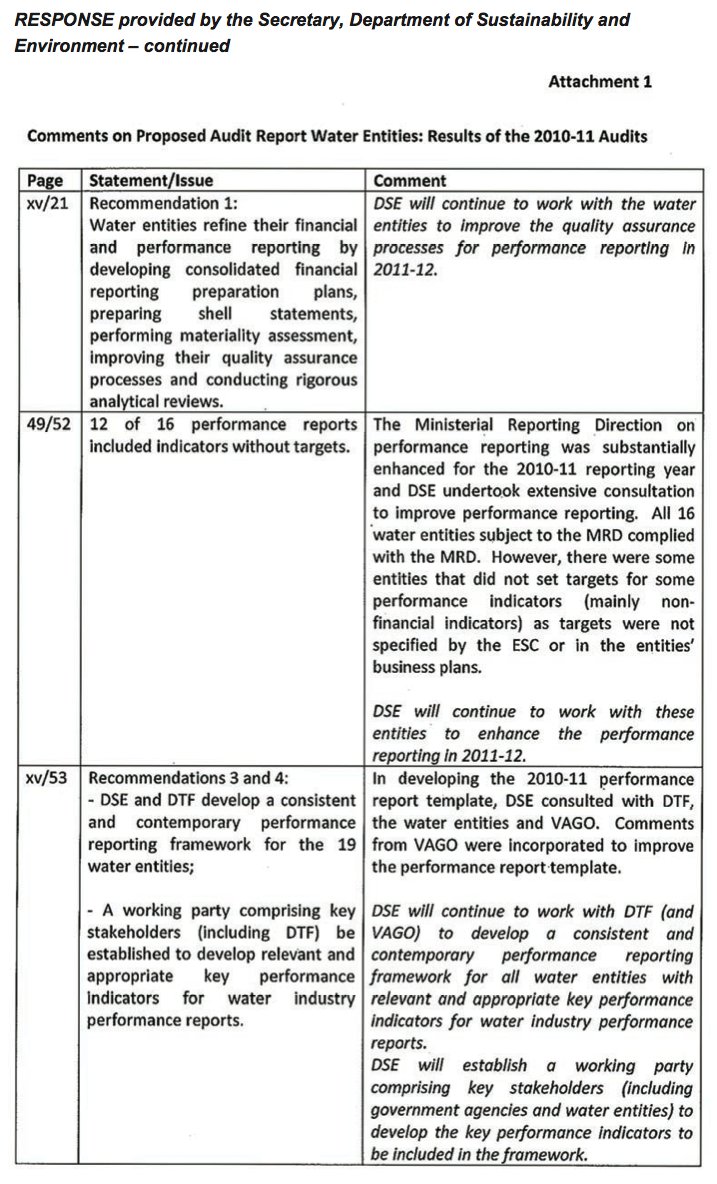

VAGO's report titled Water Entities: Results of the 2008–09 Audits recommended that the Department of Sustainability and Environment (DSE), in conjunction with the Department of Treasury and Finance, develop a consistent and contemporary performance reporting framework. The report also concluded that it was timely that the relevance, appropriateness and usefulness of the indicators be reviewed.

Key developments during 2010–11 were:

- including Melbourne Water in the list of entities required to prepare a performance report and submit it for audit

- review and revision of key performance indicators

- amendment of explanatory material, which includes a performance report template, by DSE to clarify the expectations of government and with the aim of improving the quality and consistency of reporting by the water entities.

Our key observations were:

- five of the 16 entities (31 per cent) prepared and submitted for audit a performance report that included indicators not specified by the directives issued under section 51 of the Financial Management Act 1994

- 12 of the 16 performance reports (13 of 15 in 2009–10) included indicators without targets.

When performance indicators have no related targets the usefulness of performance reports is reduced because a comparison of actual performance against the target cannot occur.

Given that performance reporting has been in place for more than five years, it is now appropriate that future audit opinions relating to the performance report conclude on the relevance and appropriateness of the performance indicators presented. It is intended that this approach be in place from 2012–13 onwards.

During consultation with my office regarding the proposed audit approach, representatives from both DSE and VicWater, the peak industry body, indicated support for the establishment of a working party with responsibility for developing relevant and appropriate indicators to be included in a performance report.

Internal controls

General internal controls

The internal control structures for all entities were adequate for producing reliable, accurate and timely financial reports. However, entities could strengthen their internal controls by:

- improving information system processes, restrictions, and access rights

- reporting and reviewing masterfile changes, access rights and termination payments relating to payroll

- reviewing and updating the methodology for calculating unbilled revenue accruals and monitoring long outstanding receivables.

Information system control weaknesses were identified at 45 per cent (nine of 20) entities which is concerning given the sensitivity of information captured by the entities, and the heavy reliance on information systems.

Controls over asset valuations

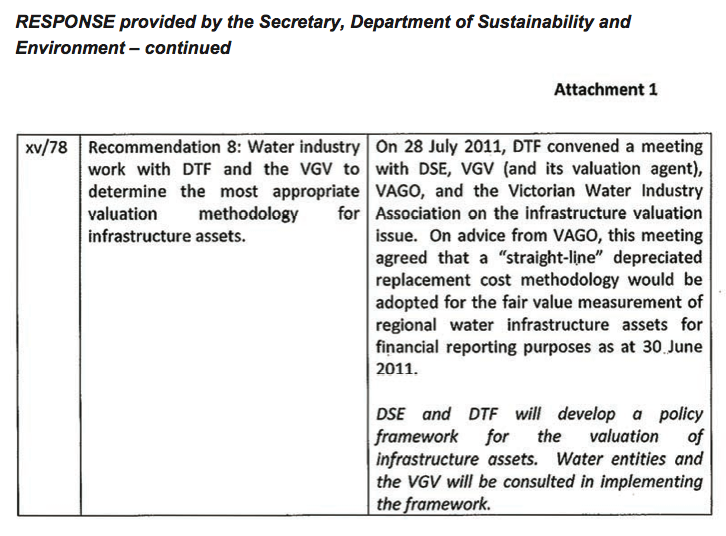

At 30 June 2011, the water industry had total assets of $35.2 billion ($27.8 billion in 2009–10). Infrastructure assets, property, plant and equipment accounted for $34 billion ($26.8 billion in 2009–10) or 96 per cent of total assets. In accordance with Financial Reporting Direction 103D Non-Current Physical Assets the 19 water entities revalued land, buildings and infrastructure assets during 2010–11.

Internal controls across the industry with respect to asset valuation were considered effective. However, there are opportunities for improvement of controls over valuations including the:

- 47 per cent of water entities that did not have asset valuation policies and procedures

- 20 per cent that had policies and procedures that were not reviewed by the governing body

- 50 per cent of policies and procedures that did not address the requirement to value assets at a component level

- 40 per cent of policies and procedures that did not specify who was authorised to make changes to them or how often they should be reviewed

- 20 per cent of policies and procedures that did not indicate how fair value should be determined.

The revaluation exercise within regional urban and rural entities identified significant differences of opinion between management and the Valuer-General Victoria (VGV) regarding the methodology adopted. It also identified a need for VGV to improve its quality assurance processes to minimise errors and adjustments in valuations.

Controls over declarations of interests

Overall, there were adequate internal controls over declarations of interests by board members or nominated officers. However, they could be strengthened by developing more comprehensive policies and procedures, and monitoring compliance with approved policies and legislative requirements.

Controls over declarations of interests could be further improved by addressing the following identified weaknesses:

- 21 per cent of water entities did not have declaration of interests policies and procedures

- 47 per cent of policies and procedures did not specify who was authorised to make changes or how often they should be reviewed

- 40 per cent of policies and procedures did not specify what records must be maintained and who was responsible for maintaining a central register

- 11 per cent of water entities did not maintain a central register

- only 53 per cent provided declarations of interest refresher training sessions to their board and nominated officers

- 68 per cent had not commissioned an internal audit of their compliance with legislative requirements in the past three years.

Controls over outsourcing

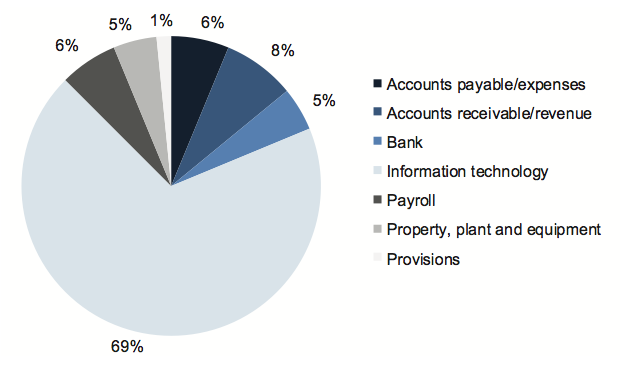

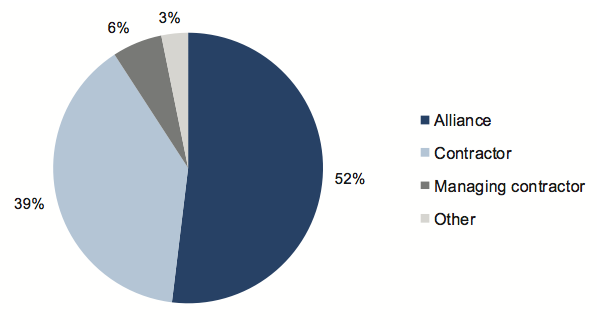

The water industry had $3.3 billion of operating expenses and $1.6 billion of capital works for 2010–11.

Controls over outsourcing were adequate, although improvements can be made by developing more comprehensive policies and by enhancing the monitoring and oversight activities.

Controls over outsourcing should be improved by the:

- 42 per cent of entities that did not have outsourcing policies and procedures

- 95 per cent that did not obtain assurance over the effectiveness of the internal controls from the outsourced provider

- 21 per cent that did not include the risks linked to outsourcing in their risk register

- 58 per cent that had not used their internal auditors to perform a review of their outsourcing activities in the last three years.

It is of concern that management of only 5 per cent of water entities obtained a letter of comfort from their outsourced provider. Outsourcing an activity does not absolve management of its responsibility for maintaining adequate internal controls. This is a control weakness in the current outsourcing arrangements across the entire water industry.

Recommendations

- That water entities further refine their financial and performance reporting processes by developing consolidated financial reporting preparation plans, preparing shell statements, performing materiality assessments, improving their quality assurance processes, and conducting rigorous analytical reviews.

- That the Essential Services Commission revisit the duration of water plans, the appropriateness of the funding model and its flexibility in times of changed weather patterns and the rigour of the planning and forecasting by water entities.

- That the Department of Sustainability and Environment in conjunction with the Department of Treasury and Finance develop a consistent and contemporary performance reporting framework for the 19 water entities.

- That a working party, comprising key stakeholders, be established to develop relevant and appropriate key performance indicators for inclusion in future performance reports of water entities.

- That water entities assess their policies and processes against the commonly identified internal control environment weaknesses and act to address them to make sure they are operating reliably and cost-effectively.

- That water entities take timely action to address identified information technology control weaknesses.

- That water entities develop and maintain comprehensive policies and procedures which are appropriately approved and subject to regular review.

- That the water industry work with the Department of Treasury and Finance and the Valuer-General Victoria (VGV) to determine the most appropriate valuation methodology for infrastructure assets.

- The VGV should ensure all valuations conducted, including those by service providers, be subjected to rigorous quality assurance processes, and that appropriate effort is invested in establishing agreement with client entities before valuations are conducted.

- That water entities obtain letters of comfort about the effectiveness of internal controls of outsourced providers.

- That water entities use internal audit to periodically review outsourcing practices and related policy compliance.

- That water entities report regularly to their boards on outsourced activities to enable effective monitoring of performance, including of actual performance against key performance indicators in contractual arrangements, risk mitigation activity, cost-benefit analysis, and actual costs against budget.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to the Department of Treasury and Finance, the Department of Sustainability and Environment, the Valuer‑General Victoria, the Essential Services Commission, the State Owned Enterprise for Irrigation Modernisation in Northern Victoria and the 20 entities with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments however, are included in Appendix H.

1 Background

1.1 Introduction

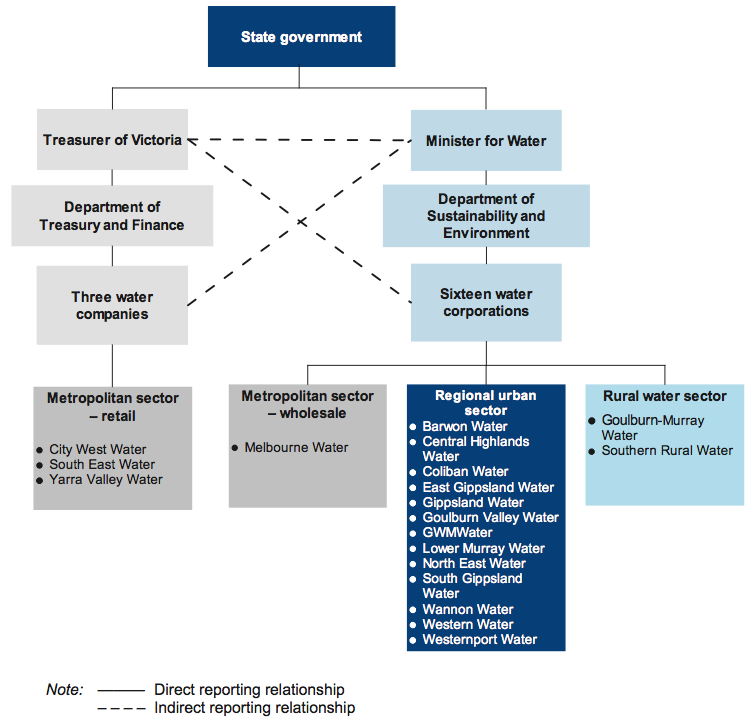

The Victorian water industry consists of 20 entities, comprising 19 water entities and one controlled entity. All entities are wholly owned by the state government. The entities are stand-alone businesses responsible for their own management and performance. Each governing board appoints a managing director responsible for the day-to-day operating activities of the entity. An overview of the accountability arrangements of the water industry is provided at Appendix B.

The entities are to adopt sustainable management practices which give due regard to environmental impacts and which allow water resources to be conserved, properly managed, and sustained.

The water industry can be divided into the metropolitan, regional urban and rural sectors. Figure 1A details the number of entities by sector.

Figure

1A

Water industry

Sector |

Water corporations |

Retail distribution companies |

Controlled entities |

Total |

|---|---|---|---|---|

Metropolitan |

1 |

3 |

– |

4 |

Regional urban |

13 |

– |

– |

13 |

Rural |

2 |

– |

1 |

3 |

Total |

16 |

3 |

1 |

20 |

Source: Victorian Auditor-General's Office.

This report addresses significant issues arising from the 2010–11 financial audits of the water industry, and augments the assurance provided through audit opinions on financial and performance reports included in the respective entities' annual reports.

The report comments on the financial sustainability of the entities and their financial management and reporting activities. It also comments on the effectiveness of internal controls, in particular, controls over asset valuations, declarations of interest and outsourcing.

This is the third of six reports to be presented to Parliament covering the results of our 2010–11 financial audits. The reports in this series are outlined in Figure 1B.

Figure

1B

VAGO reports on the results of the 2010–11 financial audits

Report |

Description |

|---|---|

Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2010–11 |

The report provided the results of the audit of the state's annual financial report. It addressed the quality and timeliness of financial reporting, explained significant financial results for the state and made observations on the status and financial implications of significant projects and developments that occurred during 2010–11 and subsequent to year-end. Tabled in Parliament on 9 November 2011. |

Public Hospitals: Results of the 2010–11 Audits |

The report provided the results of the audits of approximately 110 entities. It addressed the timeliness of their financial reporting, their financial sustainability, and aspects of how they managed procurement and information technology security. Tabled in Parliament on 9 November 2011. |

Water Entities: Results of the 2010–11 Audits |

This report provides the results of the audits of 20 entities and addresses the timeliness of their financial and performance reporting, their financial sustainability and aspects of how they manage declarations of interest, asset valuations and outsourcing. Tabled in Parliament on 9 November 2011. |

Portfolio Departments and Associated Entities: Results of the 2010–11 Audits |

The report will provide the results of the annual financial statement audits of approximately 210 entities. The report will include comment on the timeliness of their financial reporting, financial sustainability and aspects of how they manage grants administration, employee leave, information technology change, and information technology security. Proposed to be tabled in Parliament in November 2011. |

Local Government: Results of the 2010–11 Audits |

The report will provide the results of the audits of approximately 100 entities in the local government sector. The report will address the timeliness of their financial and performance reporting, their financial sustainability, their utilisation of internal audit and aspects of how they manage assets and procurement. Proposed to be tabled in Parliament in November 2011. |

Tertiary Education and Other Entities: Results of the 2011 Audits |

The report will provide the results of the annual financial audits of approximately 120 entities with a financial year-end other than 30 June 2011. The report will address the timeliness of their financial and performance reporting, their financial sustainability and aspects of how they manage capital projects, information technology security, and international student fee revenue. Proposed to be tabled in Parliament in May 2012. |

Source: Victorian Auditor-General's Office.

1.2 Financial audit framework

1.2.1 Audit of financial reports

An annual financial audit has two aims:

- to give an opinion consistent with section 9 of the Audit Act1994, on whether financial reports are fairly stated

- to consider whether there has been wastage of public resources or a lack of probity or financial prudence in the management or application of public resources, consistent with section 3A(2) of the Audit Act 1994.

The financial audit framework applied in the conduct of the 2010–11 audits is set out in Figure 1C.

Figure 1C

Financial audit framework

Planning

Planning is not a discrete phase of a financial audit, rather it continues throughout the engagement. However, initial audit planning is conducted at two levels:

- At a high or entity level, planning involves obtaining an understanding of the entity and its environment, including its internal controls. The auditor identifies and assesses: the key risks facing the entity; the entity’s risk mitigation strategies; any significant recent developments; and the entity’s governance and management control framework.

- At a low or financial reports line item level, planning involves the identification, documentation and initial assessment of processes and controls over management, accounting and information technology systems.

The output from the initial audit planning process is a detailed audit plan and a client strategy document, which outlines the proposed approach to the audit. This strategy document is issued to the client after initial audit planning and includes an estimate of the audit fee.

Conduct

The conduct phase involves the performance of audit procedures aimed at testing whether or not financial statement balances and transactions are free of material error. There are two types of tests undertaken during this phase:

- Tests of controls, which determine whether controls identified during planning were effective throughout the period of the audit and can be relied upon to reduce the risk of material error.

- Substantive tests, which involve: detailed examination of balances and underlying transactions; assessment of the reasonableness of balances using analytical procedures; and a review of the presentation and disclosure in the financial reports, for compliance with the applicable reporting framework.

The output from this phase is a final (and possibly an interim) management letter which details significant findings along with value-adding recommendations on improving controls and processes. These documents are issued to the client after any interim audit work and during the reporting phase.

Reporting

The reporting phase involves the formal presentation and discussion of audit findings with the client management, and/or the audit committee. The key outputs from this process are:

- A signed audit opinion, which is presented in the client’s annual report alongside the certified financial reports.

- A report to Parliament on significant issues arising from audits either for the individual entity or for the sector as a whole.

Source: Victorian Auditor-General's Office.

1.2.2 Audit of performance reports

Section 8(3) of the Audit Act 1994 authorises the Auditor-General to audit performance indicators included in the annual reports of a public sector entity to determine whether they fairly represent the entity's actual performance.

The Auditor-General uses this authority to audit the performance reports prepared by the water industry under Financial Reporting Direction 27B Presentation and Reporting of Performance Information.

1.2.3 Audit of internal controls

An entity's governing body is responsible for developing and maintaining its internal control framework. Internal controls are systems, policies and procedures that help an entity to reliably and cost-effectively meet its objectives. Sound internal controls enable the delivery of reliable, accurate and timely external and internal reporting.

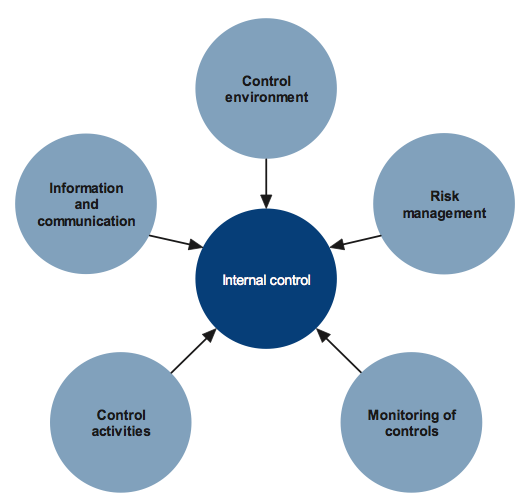

Figure 1D identifies the main components of an effective internal control framework.

Figure

1D

Components of an internal control framework

Source: Victorian Auditor-General's Office.

In the diagram:

- the control environment provides the fundamental discipline and structure for the controls and includes governance and management functions and the attitudes, awareness, and actions of those charged with governance and management of an entity

- risk management involves identifying, analysing and mitigating risks

- monitoring of controls involves observing the internal controls in practice and assessing their effectiveness

- control activities are policies, procedures and practices prescribed by management to help meet an entity's objectives

- information and communication involves communicating control responsibilities throughout the entity and providing information in a form and time frame that allows officers to discharge their responsibilities.

The annual financial audit enables the Auditor-General to form an opinion on an entity's financial report. An integral part of this, and a requirement of Australian Auditing Standard 315 Understanding the Entity and its Environment and Assessing the Risk of Material Misstatement, is to assess the adequacy of an entity's internal control framework and governance processes related to its financial reporting.

Internal control weaknesses we identify during an audit do not usually result in a 'qualified' audit opinion. A qualification is usually warranted only if weaknesses cause significant uncertainty about the accuracy, completeness and reliability of the financial information being reported. Often, an entity will have compensating controls that mitigate the risk of a material error in the financial report.

Weaknesses we find during an audit are brought to the attention of an entity's chairperson, managing director and audit committee by way of a management letter.

Section 16 of the Audit Act 1994 empowers the Auditor-General to report to Parliament on the results of audits. This report includes the results of our review of internal controls related to the financial reporting responsibilities of the water industry.

1.3 Audit conduct

The audits were undertaken in accordance with the Australian Auditing Standards.

The total cost of preparing and printing this report was $180 000.

1.4 Structure of this report

Figure 1E outlines the structure of this report.

Figure

1E

Report structure

Part |

Description |

|---|---|

Part 2: Audit opinions and quality of reporting |

Covers the results of the audits of the 2010–11 financial and performance reports of the 19 water entities and the one controlled entity, as applicable. It comments on the timeliness and accuracy of financial and performance reporting and compares practices in 2010–11 against better practice, legislated time lines and past performance. |

Part 3: Financial results |

Illustrates the financial results of the 19 water entities, including financial performance for 2010–11, and financial position at 30 June 2011. |

Part 4: Financial sustainability |

Provides insight into the financial sustainability of the 19 water entities obtained from analysing the trends in six financial sustainability indicators over a five-year period. |

Part 5: Performance reporting |

Outlines the current performance reporting framework and comments on work underway to influence the development of indicators included in performance reports in future reporting periods. |

Part 6: Internal controls |

Assesses internal controls at the 20 entities and summarises the control weaknesses commonly identified for the year‑ended 30 June 2011. |

Source: Victorian Auditor-General's Office.

2 Audit opinions and quality of reporting

At a glance

Background

Independent audit opinions add credibility to financial and performance reports by providing reasonable assurance that the information reported is reliable. The quality of an entity's reporting can be measured by the timeliness and accuracy of the preparation of the reports. This Part covers the results of the 2010–11 audits of the 19 water entities and one controlled entity. It also compares financial reporting practices in 2010–11 against better practice, legislated time lines and 2009–10 performance.

Conclusion

Parliament can have confidence in each of the 20 financial reports and 16 performance reports that received clear audit opinions. Financial reporting preparation processes were adequate although opportunity for improvement exists. The entities generally produced complete, accurate and reliable information.

Findings

- Clear audit opinions were issued on the 20 financial and 16 performance reports.

- While a clear audit opinion was issued on the financial report of Watermove, the audit report included an emphasis of matter paragraph because of the entity's reliance on the financial support from its parent entity.

- All entities except Watermove met the legislated 12-week financial reporting time frame.

- Adjustments arising from the audits resulted in a reduction of the net asset position of the water industry by $214.4 million in 2010–11.

- The quality of reporting would improve if all entities prepared shell statements, completed materiality assessments and undertook rigorous analytical reviews.

Recommendation

- That water entities further refine their financial and performance reporting processes by developing consolidated financial reporting preparation plans, preparing shell statements, performing materiality assessments, improving their quality assurance processes, and conducting rigorous analytical reviews.

2.1 Introduction

This Part covers the results from the audits of the 19 water entities and one controlled entity for the 2010–11 reporting period.

Figure 2A lists the legal and trading names of the 20 entities.

Figure 2A

Water entities and the controlled entity

|

Legal name |

Trading name |

|---|---|

|

Metropolitan sector |

|

|

Wholesaler Melbourne Water Corporation |

Melbourne Water |

|

Retail distribution companies City West Water Limited South East Water Limited Yarra Valley Water Limited |

City West Water South East Water Yarra Valley Water |

|

Regional urban sector |

|

|

Barwon Region Water Corporation |

Barwon Water |

|

Central Gippsland Region Water Corporation |

Gippsland Water |

|

Central Highlands Region Water Corporation |

Central Highlands Water |

|

Coliban Region Water Corporation |

Coliban Water |

|

East Gippsland Region Water Corporation |

East Gippsland Water |

|

Goulburn Valley Region Water Corporation |

Goulburn Valley Water |

|

Grampians Wimmera Mallee Water Corporation |

GWMWater |

|

Lower Murray Urban and Rural Water Corporation |

Lower Murray Water |

|

North East Region Water Corporation |

North East Water |

|

South Gippsland Region Water Corporation |

South Gippsland Water |

|

Wannon Region Water Corporation |

Wannon Water |

|

Western Region Water Corporation |

Western Water |

|

Westernport Region Water Corporation |

Westernport Water |

|

Rural sector |

|

|

Gippsland and Southern Rural Water Corporation |

Southern Rural Water |

|

Goulburn-Murray Rural Water Corporation |

Goulburn-Murray Water |

|

Controlled entity |

|

|

Watermove Pty Ltd |

Watermove |

Note: Watermove is a controlled entity of Goulburn-Murray Water.

Source: Victorian Auditor-General's Office.

2.2 Reporting framework

2.2.1 Financial reporting

Each of the audited water entities, including the controlled entity, must prepare its financial report in accordance with Australian Accounting Standards (AAS), including the Australian Accounting Interpretations. The AAS prescribe the accounting treatment to be adopted by for-profit and not-for-profit entities.

For financial reporting purposes the four metropolitan entities are designated as for‑profit-entities under Financial Reporting Direction (FRD) 108 Classification of Entities as For-Profit.

The principal legislation governing financial reporting by water entities are the Financial Management Act 1994 (FMA) and the Corporations Act 2001. Figure 2B summarises the number of entities reporting under each Act.

Figure 2B

Legislative framework for water entities and controlled entities

|

Legislative framework |

Water corporations |

Retail distribution companies |

Controlled entities |

Total |

|---|---|---|---|---|

|

Financial Management Act 1994 |

16 |

– |

– |

16 |

|

Corporations Act 2001 |

– |

3 |

1 |

4 |

|

Total |

16 |

3 |

1 |

20 |

Source: Victorian Auditor-General's Office.

Appendix C details the legislative framework that applies to each entity listed in Figure 2A.

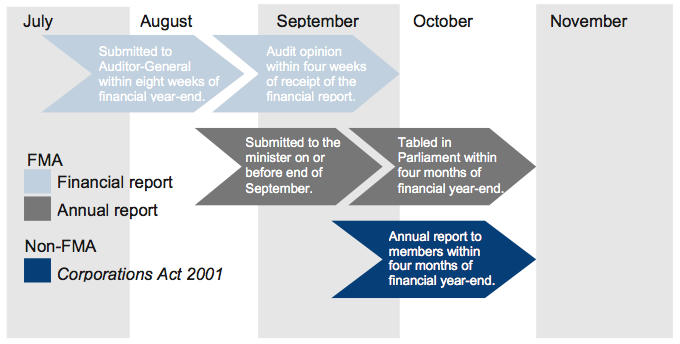

The FMA requires an entity to submit its annual report to its minister. The report should include financial reports for the entity and is to be prepared and audited within 12 weeks of the end of the financial year. The annual report should be tabled in Parliament within four months of the end of the financial year.

The Corporations Act 2001 requires a company to report to its members within four months after the end of the financial year.

However, the need to consolidate the results of controlled entities into their parent entity's financial reports means that controlled entities reporting under the Corporations Act 2001 are in effect also required to report within 12 weeks of the end of the financial year.

Figure 2C summarises the legislative reporting time frames for the water industry entities.

Figure 2C

Legislative reporting time frames

Source: Victorian Auditor-General's Office.

Despite the legislative time frames, on 18 May 2011, the Premier issued a circular requiring that annual reports of all public sector entities be tabled in Parliament by 15 September 2011.

2.2.2 Performance reporting

FRD 27B Presentation and Reporting of Performance Information requires the 16 water entities subject to the FMA, that is, Melbourne Water, the 13 regional urban water corporations and the two rural water corporations, to prepare and submit for audit a performance report. The three retail distribution companies, while not subject to the FMA, are encouraged to comply with FRD 27B.

Ministerial directives issued under section 51 of the FMA specify the form and content of the performance report. The performance report forms part of an entity's annual report tabled in Parliament.

2.3 Audit opinions issued

2.3.1 Financial reports

Clear audit opinions were issued on the financial reports for the 19 water entities and the controlled entity for the financial year ended 30 June 2011. The audit report on the financial report of Watermove included an 'emphasis of matter' paragraph. This was because of the entity's reliance on the financial support from its parent entity. In the absence of a letter of financial support from Goulburn-Murray Water, material uncertainty would have existed in relation to Watermove's ability to continue as a going concern.

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information presented is reliable. A clear audit opinion confirms that the financial report has been prepared according to the requirements of relevant accounting standards and legislation.

An auditor shall modify the opinion in the auditor's report when the auditor:

- concludes that, based on the audit evidence obtained, the financial report as a whole is not free from material misstatement

- is unable to obtain sufficient appropriate audit evidence to conclude that the financial report as a whole is free from material misstatement.

Definitions of clear and modified audit opinions are included in Appendix A.

2.3.2 Performance reports

Clear audit opinions were issued on the 16 performance reports audited.

The three retail distribution companies did not prepare and submit performance reports for audit. Performance information was included within their annual report; however it was not subject to audit.

2.4 The quality of reporting

The quality of an entity's financial reporting can be measured by the timeliness and accuracy of the preparation and finalisation of its financial and performance reports. To achieve cost-effective financial reporting, entities need to have well planned and managed financial report preparation processes.

In assessing the quality of the financial and performance reports an assessment was made against better practice criteria. The following rating scale was used:

- non-existent—function not conducted by the entity

- developing—partially encompassed in the entity's financial statements preparation processes

- developed—entity has implemented the process, however, it is not fully effective or efficient

- better practice—entity has implemented the processes which are effective and efficient.

2.4.1 Financial reporting

Figure 2D sets out better practice elements for producing complete, accurate and compliant financial reports within the legislative time frame.

Figure 2D

Selected better practice—financial report preparation

|

Key area |

Better practice |

|---|---|

|

Financial report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight, and quality assurance practices required in preparing the financial report. |

|

Preparation of shell statements |

Prepare a shell financial report and provide it to the auditors early to enable early identification of amendments, minimising the need for significant disclosure changes at year-end. |

|

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the financial report. |

|

Monthly financial reporting |

Adopt full accrual monthly reporting to assist in preparing the annual financial report. This allows the year-end process to be an extension of the month-end process. |

|

Quality control and assurance procedures |

Require rigorous review of the supporting documentation, data and the financial report itself by an appropriately experienced and independent officer prior to providing it to the auditors. |

|

Supporting documentation |

Prepare high-standard documentation to support and validate the financial report and provide a management trail. |

|

Analytical reviews |

Undertake rigorous and objective analytical review during the financial report preparation process to help to improve the accuracy of the report. |

|

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the financial report. |

|

Competency of staff |

The preparers of the financial report have a good understanding of, and experience in, applying relevant accounting standards and legislation. They also have effective project management and interpersonal skills. |

|

Financial compliance reviews |

Undertake periodic compliance reviews to identify areas of non‑compliance or changes to legislation that impact the financial report. |

|

Adequate security |

Protect and safeguard sensitive information throughout the process to prevent inappropriate public disclosure. |

Source: Victorian Auditor-General's Office, and Australian National Audit Office Better Practice Guide Preparation of Financial Statements, June 2009.

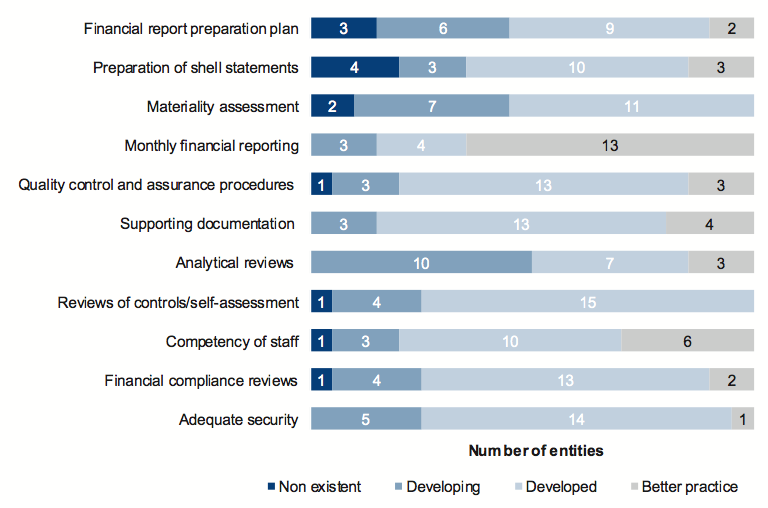

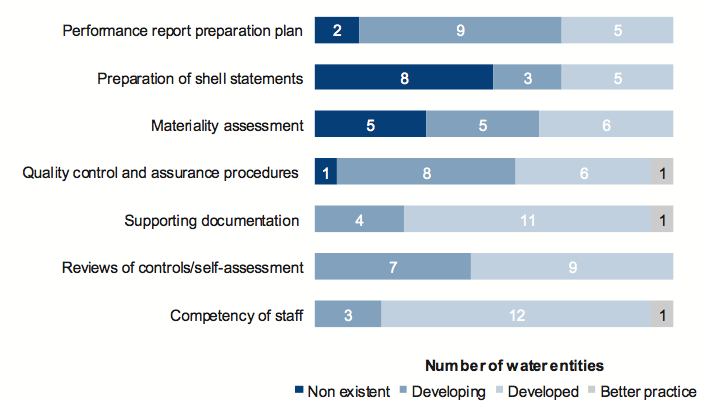

We assessed the 20 entities against the better practice elements and the results are summarised in Figure 2E.

Figure 2E

Results of assessment of financial report preparation processes against better practice elements

Source: Victorian Auditor-General's Office.

The developed or better practice elements commonly shared by the 20 entities included:

- preparation of shell statements

- monthly financial reporting

- quality control and assurance procedures

- supporting documentation

- reviews of controls/self-assessment

- competency of staff

- financial compliance reviews

- adequate security.

However, further improvement was needed in relation to:

- the financial report preparation plan

- materiality assessment

- analytical reviews.

Improving these areas will assist the timely preparation of quality financial reports, resource allocation planning and the early detection and correction of errors.

Based on our assessment of the financial reporting process, the overall quality of financial reporting in 2010–11 was substantially the same as in 2009–10.

2.4.2 Performance reporting

The performance report should be subject to the same level of internal quality assurance as the financial report. However, our review of the performance reports in previous years indicated that this was not the case.

Figure 2F sets out the best practice elements entities should aim for to assist them to produce a complete, accurate and compliant performance report within the legislative time frame.

Figure 2F

Selected better practice—performance report preparation

|

Key area |

Better practice |

|---|---|

|

Performance report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight, and quality assurance practices required in preparing the performance report. |

|

Preparation of shell statements |

Prepare a shell performance report and provide to the auditors early to enable early identification of amendments, minimising the need for significant disclosure changes at year-end. |

|

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the performance report. |

|

Quality control and assurance procedures |

Require rigorous review of the supporting documentation, data and the performance report itself by an appropriately experienced and independent officer prior to providing it to the auditors. |

|

Supporting documentation |

Prepare high-standard documentation to support and validate the performance report, and provide a management trail. |

|

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the performance report. |

|

Competency of staff |

The preparers of the performance report have a good understanding of, and experience in, applying relevant requirements and legislation. They also have effective project management and interpersonal skills. |

Source: Victorian Auditor-General's Office.

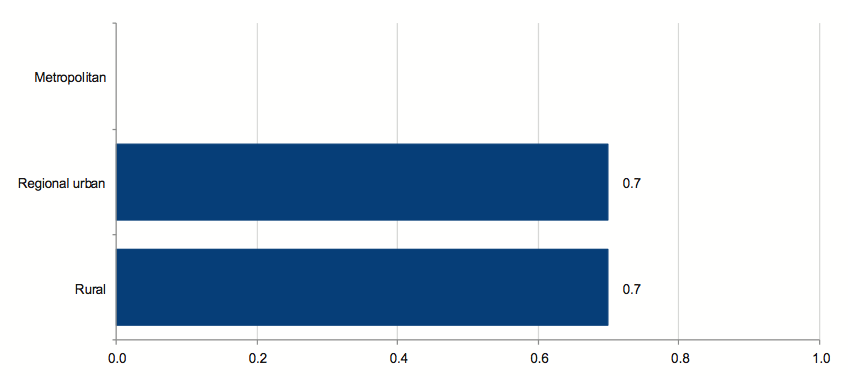

An assessment of performance against best practice criteria was undertaken for the 16 entities required to prepare and submit a performance report for audit. The results of our assessment are summarised at Figure 2G.

Figure 2G

Results of assessment of performance report preparation processes against better practice elements

Source: Victorian Auditor-General's Office.

The developed or better practice elements commonly shared by the 16 entities include:

- supporting documentation

- reviews of controls/self-assessment

- competency of staff.

However, further improvement is needed in relation to:

- the performance report preparation plan

- preparation of shell statements

- materiality assessment

- quality control and assurance procedures.

VAGO's February 2011 Acquittal Report: Results of the 2009–10 Audits recommended that where an entity is required to prepare a performance report, the financial report preparation plan should consolidate the key requirements for preparing both the financial and performance reports. However, our 2010–11 review of reporting processes of the 16 water entities revealed that only five (31 per cent) developed a financial reporting preparation plan that consolidated the key requirements associated with preparing their financial and performance reports.

2.5 Timeliness of reporting

Recognising the importance of financial and performance reports in providing accountability for the use of public monies, entities should prepare and publish their financial and performance information on a timely basis. The later the reports are produced and published after year-end, the less useful they are for stakeholders and for informing decision-making.

It was encouraging that the shortened annual reporting time frames were achieved by the 19 water entities for 2010–11, consistent with the Premier's Circular No. 2011/02 requiring all annual reports to be tabled in Parliament by 15 September 2011.

Watermove did not meet the shortened annual reporting time frame due to the existence of a material uncertainty regarding its ability to continue as a going concern. This required an assessment of the financial viability of the business, and resulted in additional disclosures and adjustments to the financial report. Its financial report was finalised on 24 October 2011.

Appendix C specifies when the financial and performance reports were finalised.

2.5.1 Water corporations

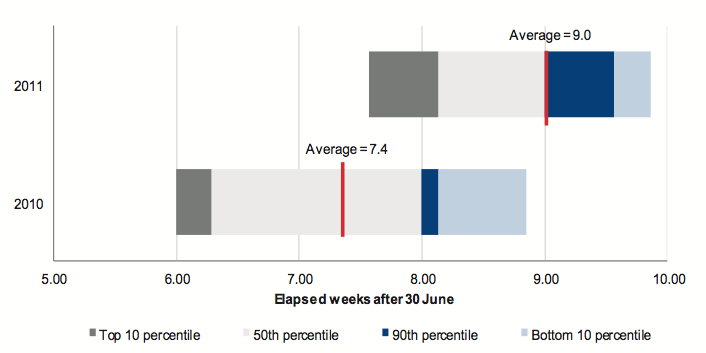

Figure 2H shows that the average time taken by the 16 water corporations to finalise their 2010–11 financial and performance reports increased from the prior year. The average time was 9.0 weeks in 2010–11 compared to 7.4 weeks in 2009–10.

Figure 2H

Average time to finalise the financial and performance reports

Source: Victorian Auditor-General's Office.

The financial reports took longer to finalise in 2010–11 due to the revaluation of infrastructure assets. Delays were initially encountered with the engagement of a qualified valuer, then issues regarding the appropriateness of the valuation methodology and data integrity had to be resolved. This delayed the finalisation and availability of the asset valuation reports which in turn delayed the preparation and finalisation of the financial reports.

2.5.2 Companies

Under the Corporations Act 2001 the three metropolitan distribution companies and the one controlled water entity are required to finalise financial reports within four months of the end of the financial year. However, because the results of controlled entities need to be consolidated into the annual financial report of the state, the reporting provisions of the FMA are also applied to the four entities.

The three metropolitan retail distribution companies met the FMA requirements in 2010–11, consistent with last year. The average time taken to finalise their financial reports was 8.2 weeks in 2010–11 compared to 8.0 weeks in the prior year. Watermove did not meet the FMA time frame. Its financial report was finalised after 16.6 weeks in 2010–11, compared to 8.9 weeks in 2009–10.

2.6 Accuracy

The frequency and size of errors requiring adjustment are direct measures of accuracy of draft financial and performance reports. Ideally, there should be no errors or adjustments arising through the audit.

When our staff detect errors in the draft financial and performances reports they are raised with management. Material errors need to be corrected before a clear audit opinion can be issued. The entity itself may also change its draft financial and performance reports after submitting them to audit, if their quality assurance procedures identify that reported information is incorrect or incomplete.

Overall, there are two types of adjustments:

- financial balance adjustments—changes to the balances being reported

- disclosure adjustments—changes to the commentary or financial note disclosures within the financial report.

2.6.1 Financial reporting

There were 11 material financial balance adjustments required in 2010–11 compared to 13 in the prior year. The adjustments resulted in changes to the net result and/or the net asset position of an entity.

Figure 2I shows the average number of material financial balance adjustments per entity, by sector.

Figure 2I

Average number of material financial balance adjustments per entity by sector

Source: Victorian Auditor-General's Office.

The net asset position of the water industry declined by $214.4 million in 2010–11 ($0.9 million in 2009–10) due to adjustments arising from the audits, with:

- assets decreased by $31.7 million ($5.0 million in 2009–10)

- liabilities increased by $182.7 million ($5.9 million in 2009–10).

A number of the adjustments were related to the revaluation of land and infrastructure assets. Other adjustments included the incorrect capitalisation of repairs as assets and the incorrect recognition of grants received as income in advance.

The net result before income tax decreased by $7.5 million in 2010–11 ($1.7 million in 2009–10) in light of adjustments arising from the audits, with:

- revenue increased by $1.0 million ($1.7 million in 2009–10)

- expenses increased by $8.5 million (nil in 2009–10).

The adjustments related to the incorrect treatment of grants as income in advance, the incorrect capitalisation of repairs and the incorrect treatment of asset impairments.

An adjustment of $40.5 million relating to income tax was also processed by a regional urban entity, resulting in a higher net result after income tax.

In addition to the financial balance adjustments, there were 29 disclosure errors that required adjustment in the 2010–11 financial reports (14 in 2009–10). Figure 2J shows the average number of material disclosure adjustments per entity, by sector.

Figure 2J

Average number of material disclosure adjustments per entity by sector

Source: Victorian Auditor-General's Office.

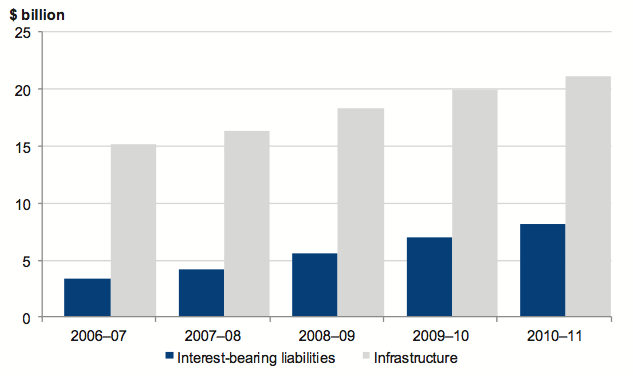

Figure 2K provides a summary of the material adjustments.

Figure 2K

Material financial balance and disclosure adjustments for 2010–11

Source: Victorian Auditor-General's Office.

The following further comment is provided on the nature of the material adjustments and classification errors:

- Commitments—were understated due to GST being omitted from the total commitment figure or lease commitment receivables not being quantified and disclosed.

- Financial statement—adjustments were required to reclassify balances within line items in the statement of comprehensive income, statement of changes in equity and cash flow statement.

- Income tax balances—tax effect accounting journals as a result of an asset revaluation were either not recorded or the disclosures were incomplete.

- Intangibles—adjustments were required to reflect the amendment of useful lives and to separately disclose newly acquired water licences.

- Other—adjustments relate to incorrect split of balances between current and non‑current, the inclusion of notes that are no longer relevant or those that lack all required disclosures, and the inclusion of additional going concern narrative.

- Property, plant and equipment—a substantial number of adjustments were required due to the valuation of land, building and infrastructure assets. The adjustments stemmed from missing data, duplicated data and errors in valuation worksheets and journals posted.

- Revenue/receivables—adjustments were required to the amount of revenue recognised where entities had incorrectly brought certain revenue to account or incorrectly classified revenue, contrary to the applicable accounting standard.

The number of adjustments to both financial balances and disclosures indicates that water entities can further improve their financial reporting preparation processes and quality assurance.

2.6.2 Performance reporting

Our audit of the 16 performance reports generated 13 queries which resulted in a minimum of 13 adjustments being processed by entities across the three sectors. At times an audit query required more than one element of the report to be amended.

Five of 16 performance reports submitted for audit included performance indicators not required by the Ministerial directives issued under section 51 of the FMA. This was disappointing as the Department of Sustainability and Environment clarified the expectations of government during 2010–11 and enhanced its explanatory material with respect to form and content of the performance report.

Figure 2L shows the average number of queries that resulted in adjustments to performance reports per entity, by sector.

Figure 2L

Average number of performance report queries resulting in adjustments per entity by sector

Source: Victorian Auditor-General's Office.

Further comment on the nature of the adjustments and errors follows:

- Performance indicators—removal of additional performance indicators from the final performance report to achieve compliance with the Ministerial directives.

- Calculation—adjustments were required because variances between the current year and the target were not correctly computed.

- Comparatives—incorrect comparatives were disclosed.

- Notes to the accounts—a number of entities did not provide any, or adequate, explanations for material variances.

The nature of the adjustments indicates that the water entities can also improve their performance reporting preparation processes and quality control.

Recommendation

- That water entities further refine their financial and performance reporting processes by developing consolidated financial reporting preparation plans, preparing shell statements, performing materiality assessments, improving their quality assurance processes, and conducting rigorous analytical reviews.

3 Financial results

At a glance

Background

The financial performance of entities is measured by their net operating result—the difference between revenue and expenses. Their financial position is measured by reference to its net assets—the difference between its total assets and total liabilities. This Part covers the financial results of the 19 water entities for the year ended 30 June 2011.

Findings

- The water industry generated a net profit before income tax of $405.4 million for the year ended 30 June 2011, a decrease of $18.5 million or 4.4 per cent from the prior year.

- Eight of the 13 regional urban water entities (62 per cent) reported a lower profit before tax in 2010–11 relative to the prior year, with five entities reporting a loss (three in 2009–10). The two rural water entities continued to report losses.

- There was a $104.8 million reduction in dividend payments in 2010–11 as there were no interim dividend payments.

- At 30 June 2011 the 19 water entities controlled $35.2 billion in total assets ($27.8 billion at 30 June 2010) and had total liabilities of $13.9 billion ($11.1 billion at 30 June 2010).

- The revaluation of land, buildings and infrastructure assets resulted in a $6 billion upward adjustment in asset values in 2010–11.

- Interest-bearing liabilities increased by $1.2 billion or 17 per cent in 2010–11, with the new borrowings financing the construction of infrastructure assets.

- The profitability of the 19 water entities will be impacted by higher depreciation expenses and finance costs in the future.

- For many customers, especially for the regional urban and rural sectors, reducing water consumption will not result in a substantially lower water bill.

3.1 Introduction

The financial objective for water entities should be to generate a sufficient surplus from operations to fund asset replacement, acquire new assets and retire debt. Their ability to achieve this objective is subject to the regulatory environment in which they operate, and on their ability to manage costs and maximise revenue. This is reflected in the composition of, and rate of change in, their operating revenue and expenses.

An entity's financial performance is measured by the net operating result—the difference between revenue and expenses. An entity's financial position is generally measured by reference to its net assets—the difference between its total assets and total liabilities.

Appendix D provides information on the composition of revenue, expenses, assets and liabilities for the 19 water entities, by sector, for 2010–11.

3.2 Financial results

3.2.1 Financial performance

Net result

The 19 water entities are subject to the National Tax Equivalent Regime, which is administered by the Australian Taxation Office. Accordingly, the net result before and after income tax is referenced in this section of the report.

Net result before income tax

The water industry generated a net profit before income tax of $405.4 million for the year ended 30 June 2011. This represented a decrease of $18.5 million or 4.4 per cent from the prior year. The decrease was predominantly due to higher finance costs, depreciation expenses, and the write-off of impaired assets. Regular rainfall during the financial year resulted in lower water consumption which in turn reduced the revenue generated by the entities and nullified the impact of approved price increases.

While it decreased, the overall net profit before income tax result was nevertheless strong, and continued to be driven by the ability of the four metropolitan entities to generate profits year-on-year. Eight of the 13 regional urban water entities (62 per cent) reported a lower net profit before tax in 2010–11 relative to the prior year, and five reported a net loss before tax (three in 2009–10). The two rural water entities continued to report losses.

Figure 3A shows the net profit or loss before income tax for each entity for the past two years.

Figure

3A

Net profit/(loss) before income tax for each water entity

2010–11 Net profit/(loss) before tax ($mil) |

2009–10 Net profit/(loss) before tax ($mil) |

|

|---|---|---|

Metropolitan sector |

||

Wholesaler |

||

Melbourne Water |

214.1 |

238.5 |

Retail distribution companies |

||

City West Water |

87.4 |

87.2 |

South East Water |

95.4 |

95.4 |

Yarra Valley Water |

86.3 |

59.9 |

Regional urban sector |

||

Barwon Water |

23.8 |

18.2 |

Central Highlands Water |

(1.3) |

(3.0) |

Coliban Water |

(24.3) |

(32.7) |

East Gippsland Water |

(0.2) |

0.4 |

Gippsland Water |

1.3 |

21.1 |

Goulburn Valley Water |

0.3 |

2.8 |

GWMWater |

(22.1) |

(17.6) |

Lower Murray Water |

(9.5) |

2.5 |

North East Water |

0.4 |

1.8 |

South Gippsland Water |

1.4 |

4.1 |

Wannon Water |

1.4 |

0.5 |

Western Water |

4.3 |

6.0 |

Westernport Water |

2.1 |

2.5 |

Rural sector |

||

Goulburn-Murray Water |

(52.9) |

(62.0) |

Southern Rural Water |

(2.5) |

(1.7) |

Total |

405.4 |

423.9 |

Source: Victorian Auditor-General's Office.

Net result after income tax

The water sector reported a net profit after income tax of $334.5 million in 2010–11, an increase of $26.1 million or 8.5 per cent from the prior year.

The recognition of deferred tax assets by a number of entities resulted in an income tax benefit rather than income tax expense in 2010–11. This contributed to the overall increase in the net result after tax.

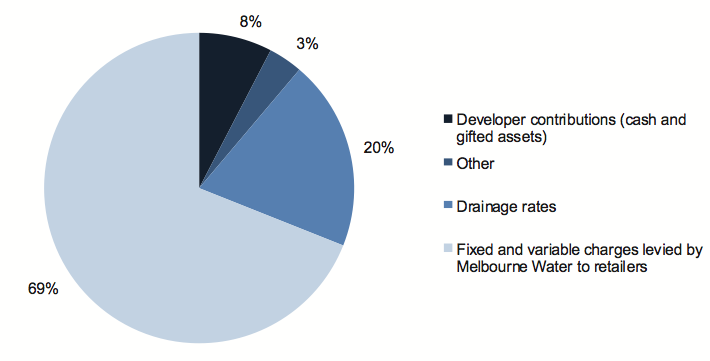

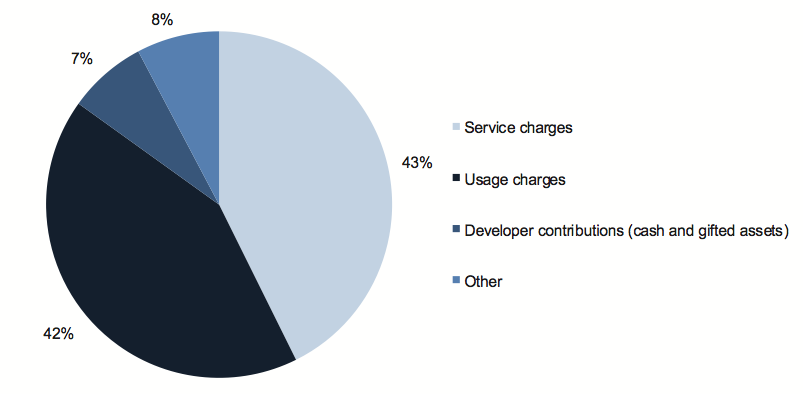

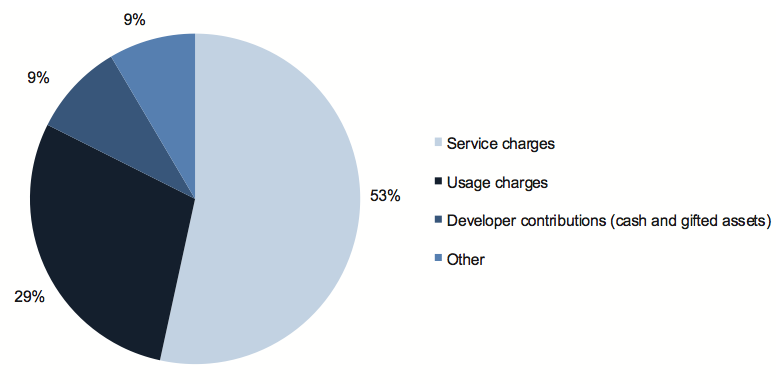

Revenue

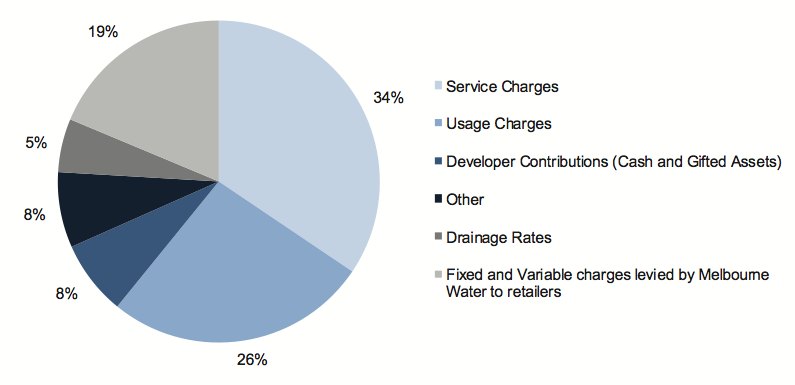

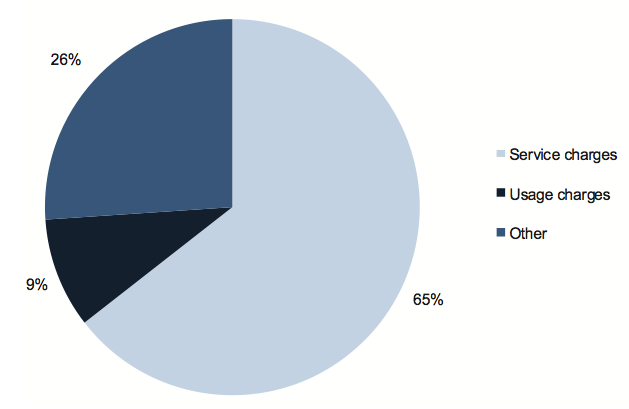

In 2010–11, the 19 water entities collectively generated revenue of $3.7 billion, an increase of $411.2 million, or 12.6 per cent from the prior year.

The increase was driven by higher service and usage charges. The current Water Plan will nearly double pricing in nominal terms over the five years to 2012–13.

The largest sources of revenue are service and usage charges. The service charge is a fixed charge levied on each property. The usage charge is a variable charge with the level of water consumption driving the amount the customer pays.

Excluding revenue arising from transactions between Melbourne Water and the three retail distribution companies, service and usage charges accounted for 83 per cent of total revenue generated in 2010–11.

Figure 3B summarises service and usage charges as a percentage of the total service and usage charges revenue for 2010–11.

Figure

3B

Service and usage charges as a percentage

of the total service and usage charges revenue

2010–11 Service Charge (Fixed) % |

2010–11 Usage Charge (Variable) % |

|

|---|---|---|

Metropolitan sector |

||

City West Water |

37 |

63 |

South East Water |

43 |

57 |

Yarra Valley Water |

42 |

58 |

Average |

41 |

59 |

Regional urban sector |

||

Barwon Water |

58 |

42 |

Central Highlands Water |

73 |

27 |

Coliban Water |

60 |

40 |

East Gippsland Water |

74 |

26 |

Gippsland Water |

67 |

33 |

Goulburn Valley Water |

61 |

39 |

GWMWater |

72 |

28 |

Lower Murray Water |

80 |

20 |

North East Water |

46 |

54 |

South Gippsland Water |

70 |

30 |

Wannon Water |

54 |

46 |

Western Water |

72 |

28 |

Westernport Water |

86 |

14 |

Average |

67 |

33 |

Rural sector |

||

Goulburn-Murray Water |

85 |

15 |

Southern Rural Water |

96 |

4 |

Average |

91 |

9 |

Note: Service and usage charges include water and wastewater charges.

Source: Victorian Auditor-General's Office.

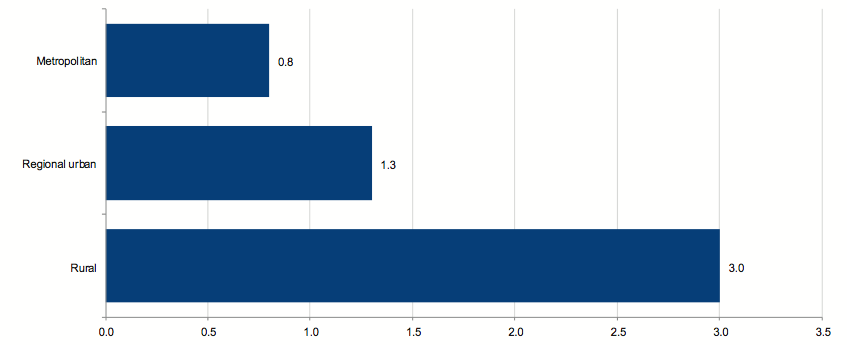

Our analysis of the service and usage charges revealed that a large portion of the total water bill is fixed, especially for the regional urban and rural sectors. This means that for many customers, reducing water consumption will not result in a substantially lower water bill.

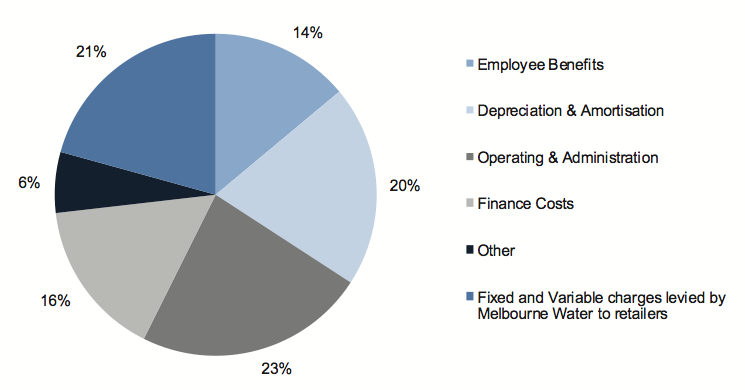

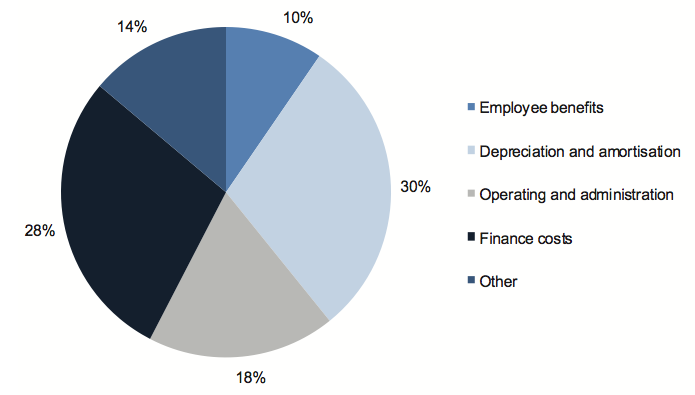

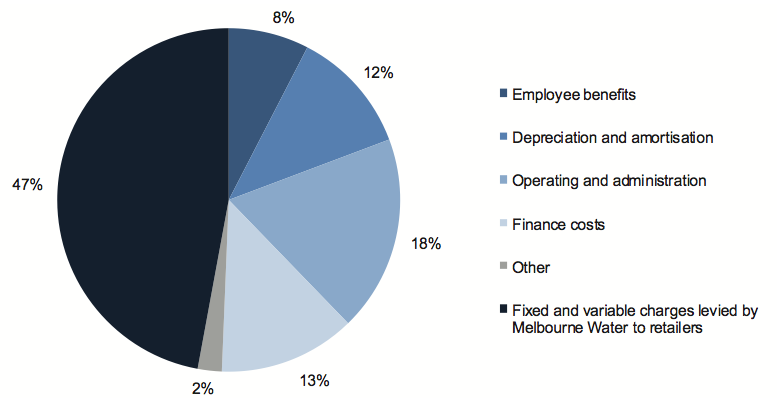

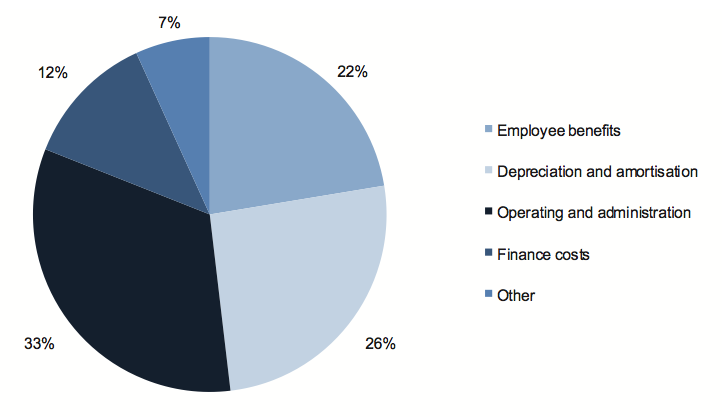

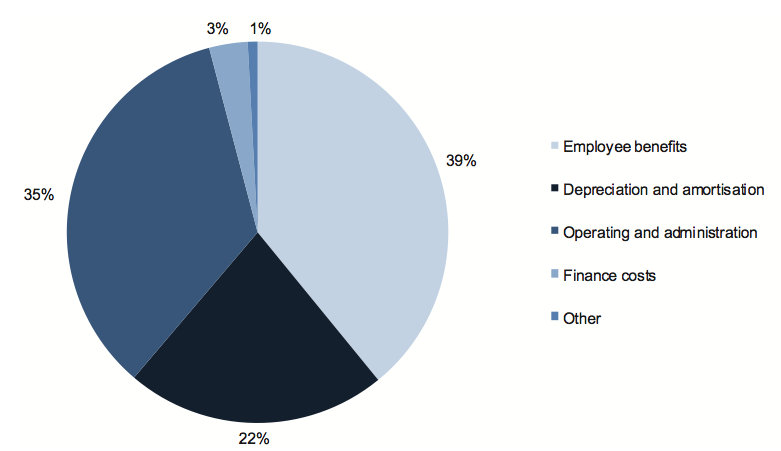

Expenses

In 2010–11, the 19 water entities collectively incurred $3.3 billion in operating expenses, an increase of $430.3 million or 15.1 per cent from the prior year. The increase was predominantly because:

- depreciation and amortisation expenses increased by $188 million (40 per cent)

- finance costs increased by $109 million (27 per cent)

- bulk water and sewerage charges increased by $111 million (21 per cent).

The revaluation of infrastructure assets by the four metropolitan water entities in 2009‑10 and construction of new infrastructure assets by the 19 entities in recent years has increased the value of assets held and depreciation.

Higher finance costs reflect the substantial increase in the level of borrowings across the industry since 1 July 2008.

Bulk water and sewerage charges relate to the services provided by Melbourne Water to the three retail distribution companies. These charges were increased to cover the costs associated with the delivery of major infrastructure projects under the Water Plan.

The largest expense items for the water entities in 2010–11 were operating and administration expenses, bulk water and sewerage charges, depreciation and amortisation expenses, finance costs, and employee costs.

Dividends

The 19 water entities are obliged to pay a dividend to the government if a formal determination to do so is made by the Treasurer, after consultation with the governing board and responsible minister.

In 2010–11, the four metropolitan water entities paid dividends of $71 million, a decrease of $104.8 million or 60 per cent compared with 2009–10. The decrease was because there were no interim dividend payments required during the year.

3.2.2 Financial position

The ability of water entities to maintain their infrastructure assets depends on the adequacy of their asset and debt management policies. Their effectiveness is reflected in the composition and rate of change of the value of their assets and liabilities over time.

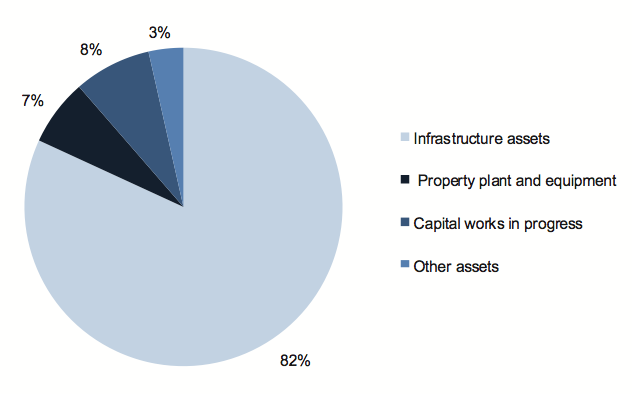

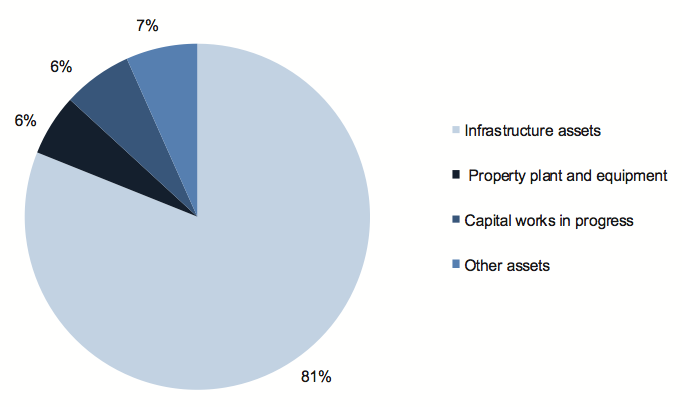

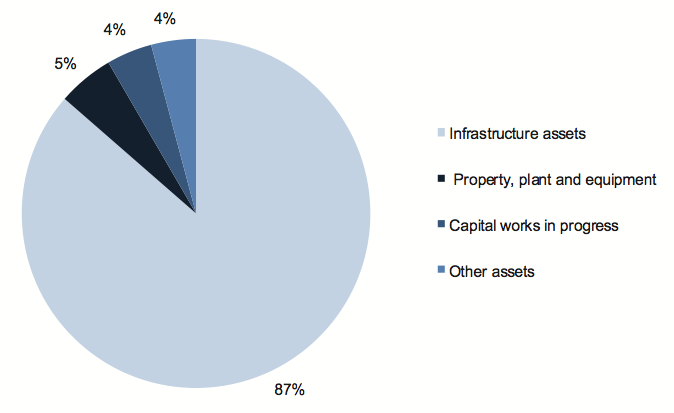

Assets

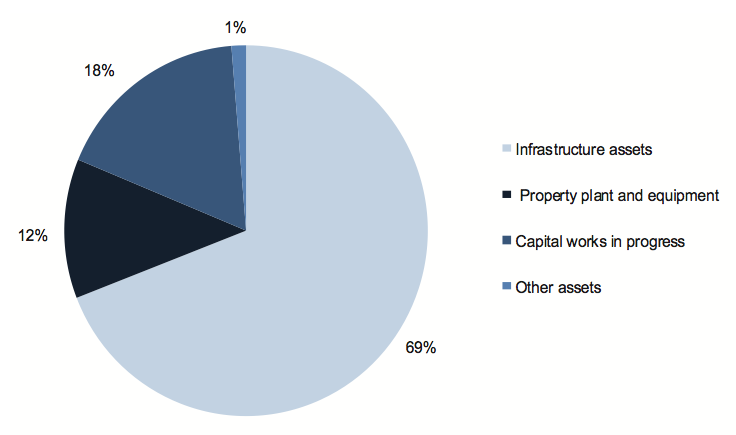

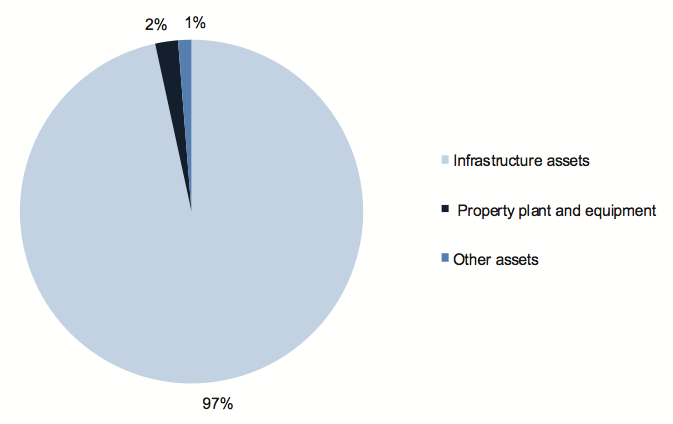

At 30 June 2011, the water industry had assets valued at $35.2 billion, an increase of $7.4 billion or 27 per cent compared to the prior year. Property, plant, equipment and infrastructure assets represented 96 per cent of total assets.

The revaluation of land, buildings and infrastructure assets contributed $6 billion or 81 per cent of the overall increase in 2010–11.

The regional urban and rural water entities recorded infrastructure assets at fair value for the first time at 30 June 2011, resulting in an increase in infrastructure asset values of $5.3 billion. The fair value of the infrastructure assets was determined using a depreciated replacement cost approach.

The four metropolitan water entities transitioned to fair value in 2009–10, with the fair value of infrastructure assets determined using an income approach. The revaluation increment in that year was $4.8 billion. A managerial or independent revaluation of infrastructure assets also occurred during 2010–11 with a revaluation increment of $0.2 billion brought to account at 30 June 2011.

Both the depreciated replacement cost and income valuation approaches comply with the requirements of the Australian Accounting Standard AASB 116 Property, Plant and Equipment. The variation in approach is driven by an entity's designation as 'for-profit' or 'not‑for‑profit' for financial reporting purposes.

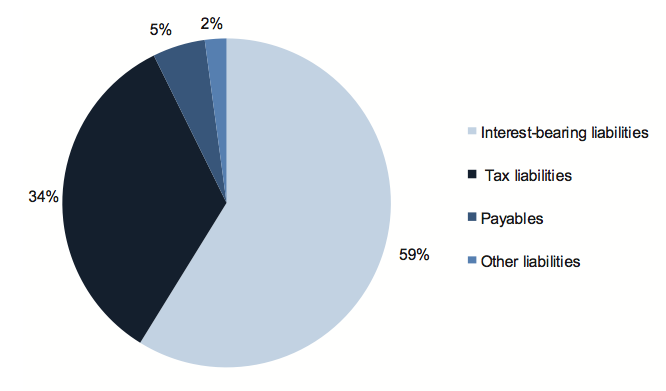

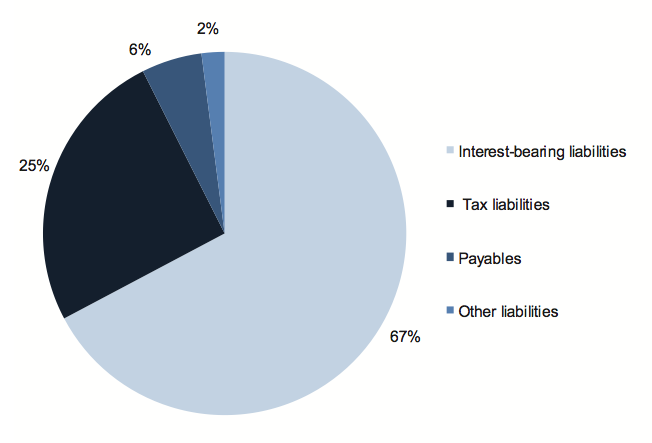

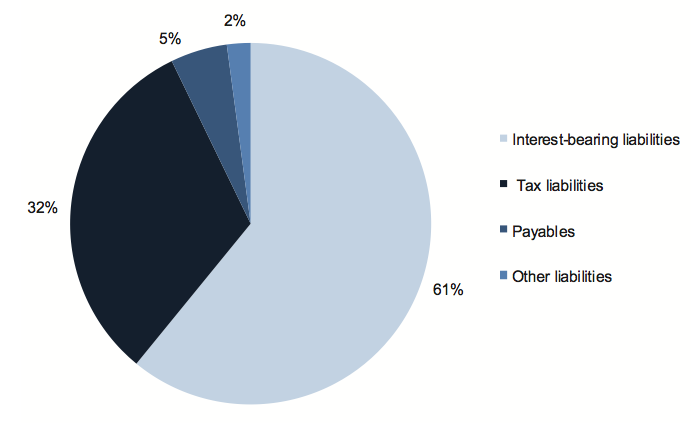

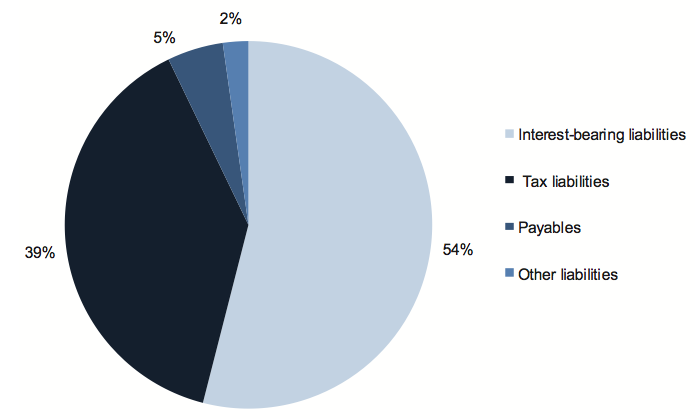

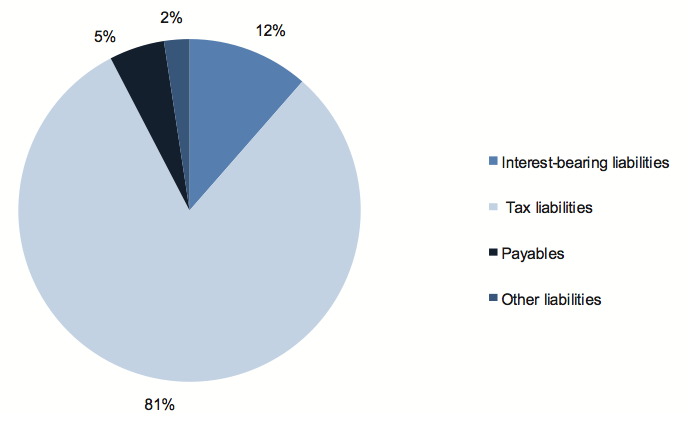

Liabilities

At 30 June 2011, the water industry had liabilities of $13.9 billion, an increase of $2.8 billion or 25 per cent in comparison with the prior year.

Deferred tax liabilities increased by $1.6 billion or 52 per cent in 2010–11, primarily due to the revaluation of infrastructure assets by the regional urban and rural entities.

Interest-bearing liabilities increased by $1.2 billion or 17 per cent in 2010–11. The new borrowings financed the construction of infrastructure assets. Over the past five years infrastructure assets, excluding the impact of the asset revaluations, increased by $6.0 billion. Interest-bearing liabilities increased over the same period by $4.8 billion.

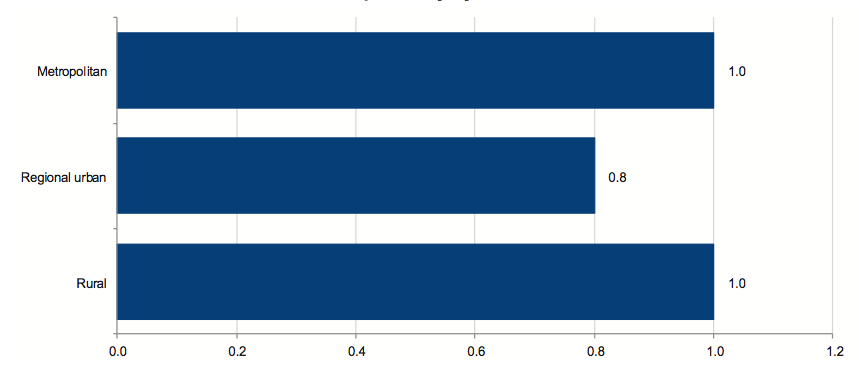

Figure 3C highlights the growth in infrastructure assets and new borrowings over the past five years. It shows that new borrowings have largely funded the growth in infrastructure assets over the period.

Figure

3C

Comparison of infrastructure assets and borrowings

Note: The infrastructure asset value excludes the effect of asset revaluations in 2009–10 and 2010–11.

Source: Victorian Auditor-General's Office.

The profitability of the 19 water entities will continue to be impacted by higher depreciation expense and finance costs in the future, as a result of the higher asset values and increased borrowings.

4 Financial sustainability

At a glance

Background

To be financially sustainable, entities need to be able to meet current and future expenditure as it falls due. They also need the ability to absorb foreseeable changes and materialising risks without significantly changing their revenue and expenditure policies. This Part provides our insight into the financial sustainability of the 19 water sector entities based on our analysis of the trends in six indicators over a five‑year period.

Conclusion

Water sector entities operate in a highly regulated environment. The five-year Water Plan prepared by each water business and approved by the Essential Services Commission (ESC) forms the basis for determining the price entities can charge their customers for water. The accuracy of assumptions underpinning the proposed revenue and expenditure streams, and the achievement of forecast results in the plans is therefore critical.

Metropolitan water entities continue to generate strong profits and positive cash flows. However, there has been an increase in the number of regional urban entities reporting losses, and the two rural entities continue to report losses. It is timely to revisit the duration of the water plans, the appropriateness of the pricing model, and the capacity to provide water entities with a sustainable revenue stream.

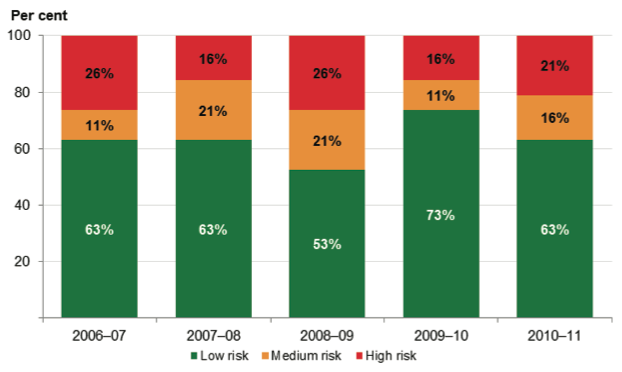

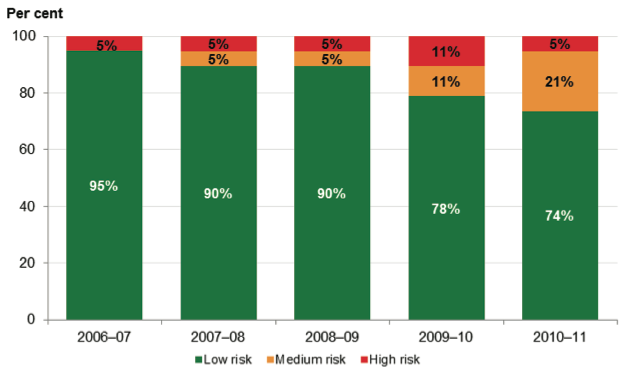

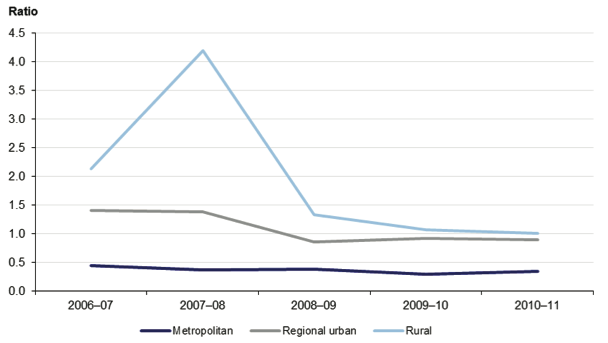

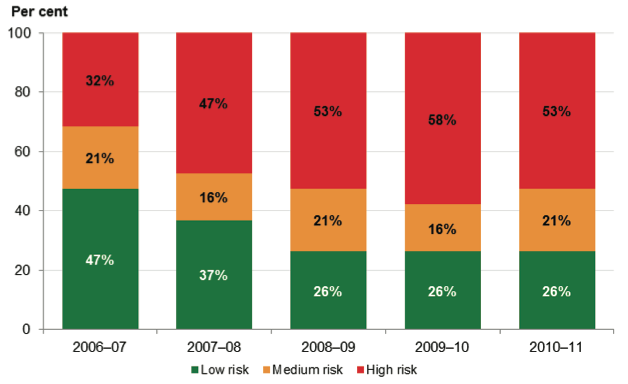

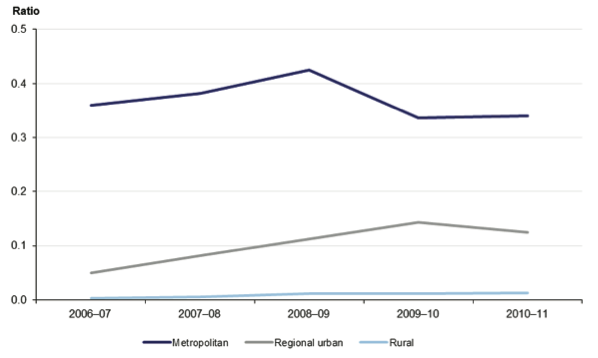

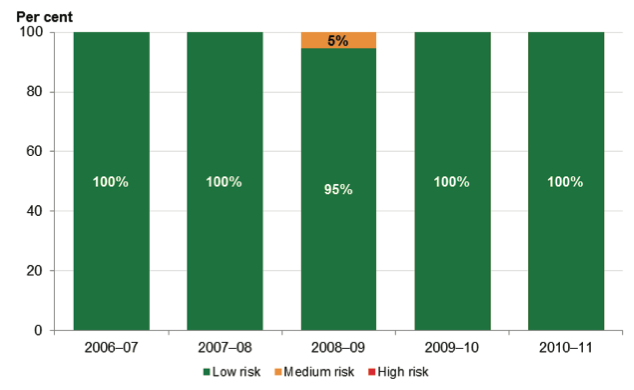

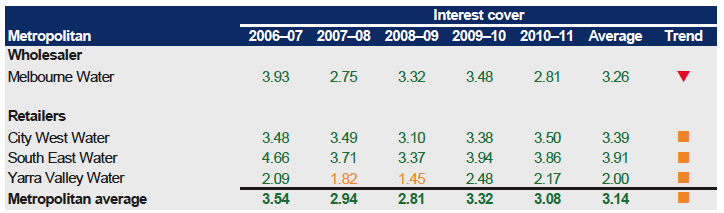

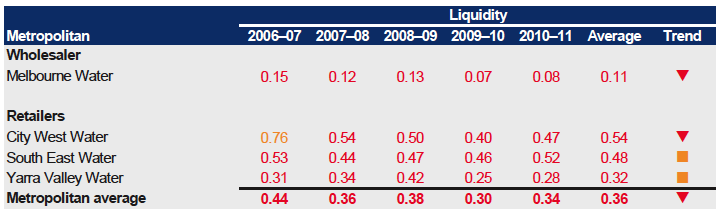

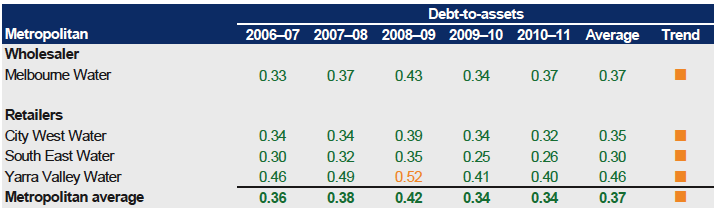

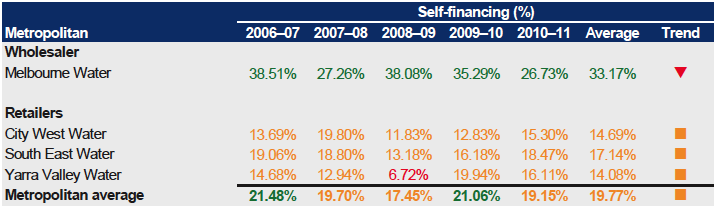

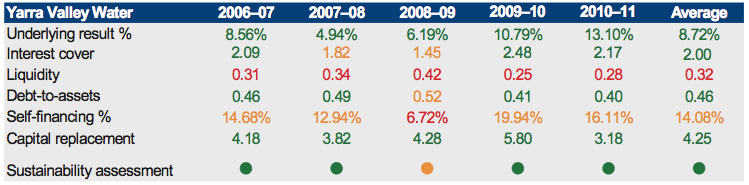

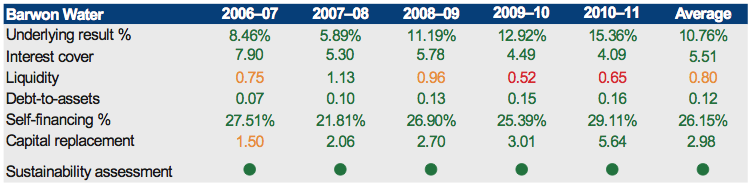

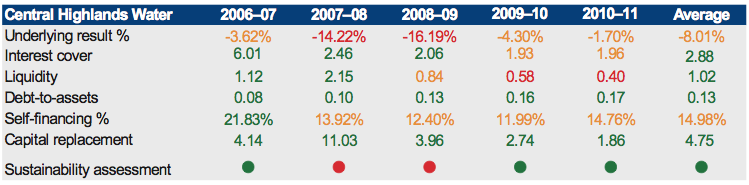

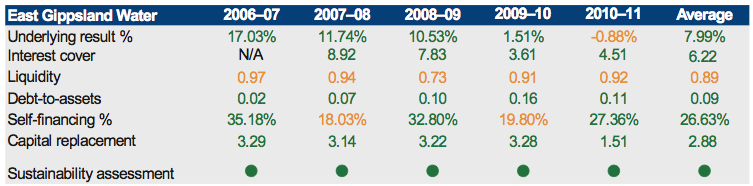

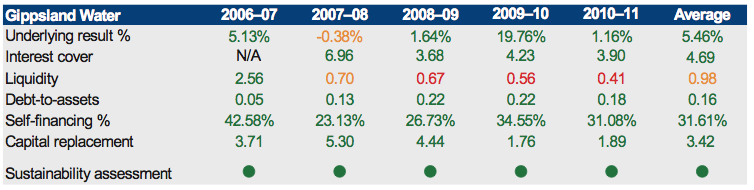

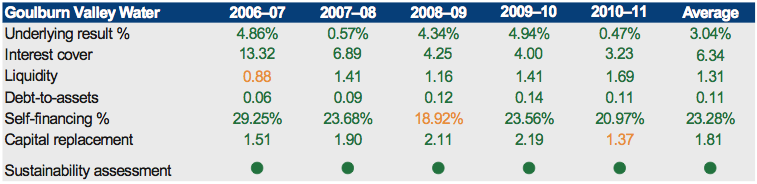

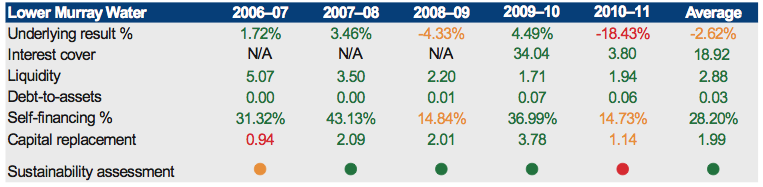

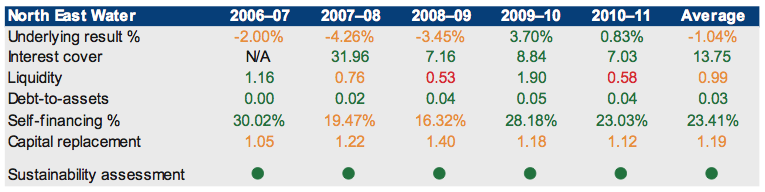

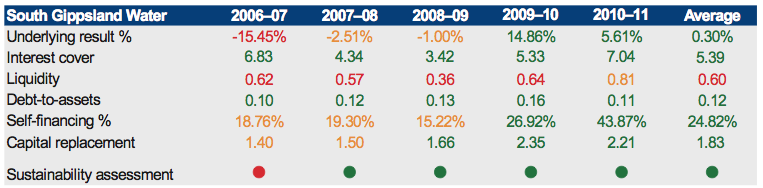

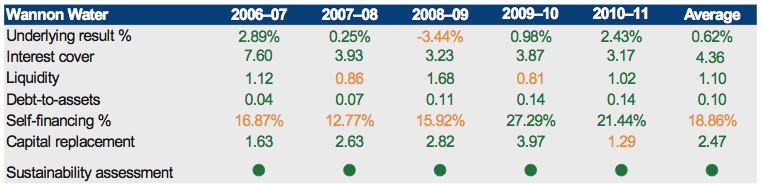

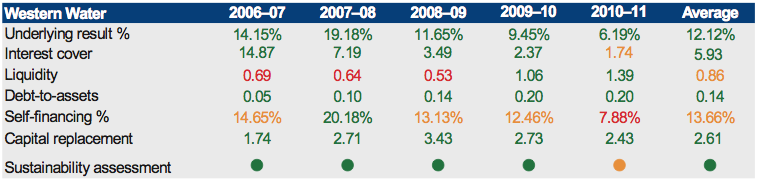

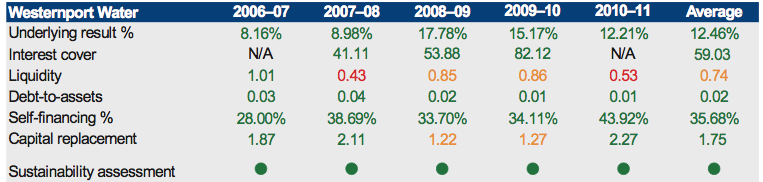

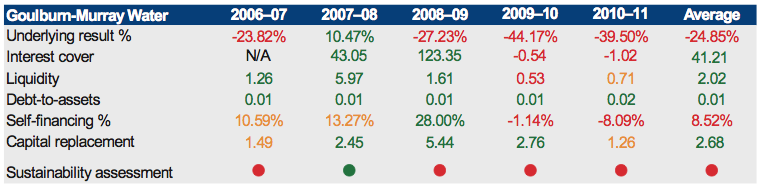

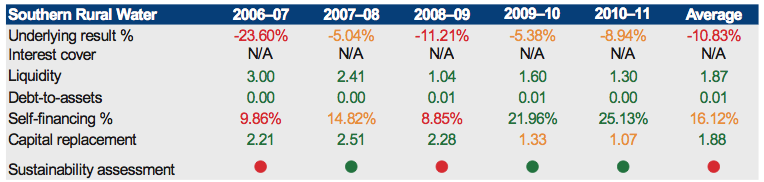

Findings