Management of the Provincial Victoria Growth Fund: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER December 2012

PP No 171, Session 2010–12

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER December 2012

PP No 171, Session 2010–12

In accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to all portfolio departments and named agencies with a request for comments or submissions. The comments and submissions provided for publication are not subject to audit nor the evidentiary standards required to reach an audit conclusion. Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

Public sector agencies are required, from time to time, to prepare acquittal statements to certify the spending of money has occurred for the purpose for which it was provided. Typically, these acquittals are prepared for Commonwealth-funded activities or capital works. Acquittal statements can be required to be audited by the Auditor‑General, or the Auditor-General can be asked to audit them in accordance with the requirements of a funding agreement.

This Appendix discloses the acquittal statements signed in the 2011–12 financial year.

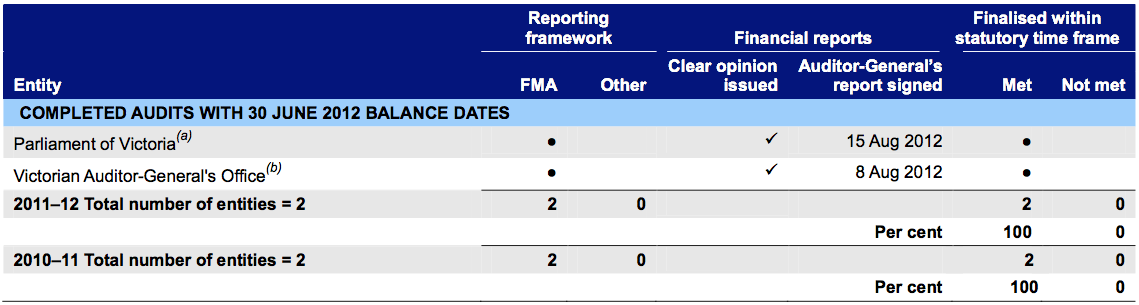

(a) The Parliament of Victoria is an audit by arrangement pursuant to section 16G of the Audit Act 1994 and is not required to prepare a general purpose financial report, however does so in accordance with the Financial Management Act 1994.

(b) The Victorian Auditor-General’s Office was audited by a private sector auditor, pursuant to section 7B of the Audit Act 1994.

Figure C1

Four core indicators of financial sustainability

Indicator |

Formula |

Description |

|---|---|---|

Underlying result (%) |

Adjusted net surplus/total underlying revenue |

A positive result indicates a surplus, and the larger the percentage the stronger the result. |

Responsibility of public sector entities to achieve their objectives, with regard to reliability of financial reporting, effectiveness and efficiency of operations, compliance with applicable laws, and reporting to interested parties.

The systematic allocation of an intangible asset’s capital value as an expense over its expected useful life to take account of normal usage, obsolescence, or the passage of time.

Figure A1

VAGO reports on the results of the 2011–12 financial audits

Report |

Description |

|---|---|

Auditor-General’s Report on the Annual Financial Report of the State of Victoria, 2011–12 |

Effective risk management is an important element of governance. In this Part we comment on risk management practices at the 11 portfolio departments against the Victorian Government Risk Management Framework and the international risk management standard.

Trust funds are discrete accounts that receive and distribute money for designated purposes. At 30 June 2012, the state had 111 trust funds that collectively held $2.7 billion. This Part reports on our review of key aspects of the controls, governance, oversight and reporting of trust funds.