Major Projects Performance Reporting 2023

Overview

What we examined

We assessed if the public sector transparently reports how major projects are performing against cost, time, scope, and benefits.

We examined the information from major projects reported by the Department of Treasury and Finance (DTF) and the 8 public sector agencies who are responsible for 101 major projects.

Why this is important

As of May 2023 Victoria has committed to investing $200.6 billion in capital projects. This is a net increase of $16.1 billion from the same time last year.

A major project is a capital project or program of works that is expected to cost more than $100 million.

When the government spends public money on a major project, Parliament and the community deserve clear updates on the project’s progress and outcomes.

This is our third annual limited assurance review on major projects’ cost, time, scope and benefits.

What we concluded

DTF has improved how it publicly reports on major projects' performance by publishing a new public dashboard.

However, the dashboard data focuses on projects' costs and expected completion dates. It does not report on changes to a project's scope or expected benefits. It also does not say how these changes could affect a project's outcomes.

Reporting this information could help Parliament and the community hold agencies more accountable for how they deliver major projects.

What we recommended

We made 3 recommendations:

- one to agencies to improve how they report changes to major projects' completion dates in Budget Paper 4: State Capital Program

- 2 to DTF to improve its public reporting of Budget Paper 4: State Capital Program footnotes and major projects dashboard.

Video presentation

Key facts

Source: VAGO.

Our recommendations

| Key issues and corresponding recommendations | Agency responses | |||||

|---|---|---|---|---|---|---|

| Issue: Agencies do not clearly explain completion date changes | ||||||

|

Agencies we surveyed |

1 |

Improve their reporting to the Department of Treasury and Finance for Budget Paper 4: State Capital Program footnotes to explain changes in major projects' completion dates in line with the Department of Treasury and Finance's guidance, including:

|

Accepted in principle by the Department of Transport and Planning, Major Transport Infrastructure Authority and Suburban Rail Loop Authority Accepted in full by all other agencies |

|||

| Issue: The Department of Treasury and Finance does not always provide enough detail from agencies in Budget Paper 4: State Capital Program footnotes | ||||||

|

Department of Treasury and Finance |

2 |

Improve its reporting of Budget Paper 4: State Capital Program footnotes to include, where practical, agency comments that reflect any significant changes to a project in line with its guidance, including where comments are relevant across multiple years (see Section 2). |

Accepted in principle |

|||

| Issue: The Department of Treasury and Finance's Capital Investment Dashboard still has limitations | ||||||

|

Department of Treasury and Finance |

3 |

Improve its Capital Investment Dashboard to include information that can provide greater transparency about capital projects to Parliament and the community. At a minimum, it should improve the dashboard to include the information reported in our Major Projects Performance dashboard (see Section 1). |

Accepted in principle |

|||

1. Government spending on major projects

The Victorian Government's spending on major projects is increasing. It is important that Parliament and the community have up-to-date information about the progress of these projects so they can hold the responsible agencies accountable.

The Department of Treasury and Finance (DTF) published a dashboard in June 2022 to make more of this information public. But the dashboard still has some limitations.

Government spending on capital projects is increasing

Planned spending in 2023–24

DTF reports on capital projects in Budget Paper 4: State Capital Program (BP4).

The 2023–24 BP4 reported that the Victorian Government plans to spend $200.6 billion on capital projects. This:

- is $16.1 billion more than $184.5 billion in 2022–23

- includes $27.5 billion on new projects compared to $13.1 billion on new projects in 2022–23.

Over the last 9 years the government has committed to spend $161 billion on new projects. The government did not report its budget for capital projects in 2020-21.

Capital projects

A capital project is a sector project for building, improving or maintaining infrastructure. Capital projects usually have a bigger cost and scale than other projects.

Number of major projects

In this report we focus on major projects, which are capital projects or program of works worth more than $100 million.

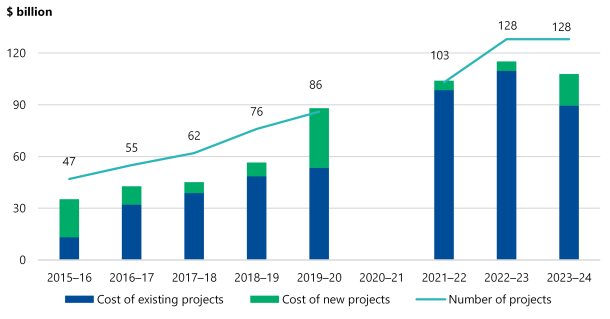

As Figure 1 shows, the government has committed to deliver 128 major projects. This is up from 47 in 2015–16.

Figure 1: Total estimated investment (TEI) and number of major projects in DTF's Capital Investment Dashboard from 2015–16 to 2023–24

Note: The government did not report its budget for capital projects in 2020–21.

This figure excludes projects less than $100m.

Source: VAGO based on DTF's Capital Investment Dashboard.

Total estimated investment (TEI)

DTF defines TEI as the total estimated amount to deliver an asset investment project, including the base cost estimate, the base risk estimate (which is the expected cost to manage all of the project's risks, including escalation) and the excess risk estimate (which is an additional risk allocation above the base risk estimate).

TEI increases

According to DTF, the total TEI of these 128 major projects is $99.5 billion. This is a 206 per cent increase from $32.5 billion in 2015–16. Both these figures do not include the full cost of some projects.

For example, the government has committed to a TEI of $11.8 billion to fund the Suburban Rail Loop East – Development, Initial and Early Works. This covers the project's initial development and planning costs. But it expects the project will cost between $30.0 and $34.5 billion by the time it is finished.

The average TEI of projects

The government is investing a significant amount in major projects. So it is important that it thoroughly plans them to reduce the risk of time and cost overruns.

The average TEI across major projects has increased by 41 per cent in the last 9 years. This does not include 26 projects without a confirmed TEI.

The average TEI of major projects with a confirmed TEI in 2023–24 is $976 million compared to $691 million in 2015–16. We have not analysed the cause of this increase because this is a limited assurance engagement.

Big budget projects

In the last 9 years the number of major projects worth over $1 billion has increased from 4 (including 2 projects worth over $5 billion) to 21 (including 7 projects worth over $5 billion).

Most capital projects are in the transport sector

General government sector spending

The general government sector is delivering $70.9 billion of capital projects.

In the general government sector, the Department of Transport and Planning (DTP) spends the most on capital projects, followed by the Department of Health, (DH), the Department of Education (DE) and the Department of Justice and Community Safety (DJCS).

As Figure 2 shows, spending on transport capital projects ($43.0 billion) is almost 3 times higher than spending on health capital projects ($14.5 billion).

Figure 2: 2023–24 general government spending on capital projects by department

Note: DTP and its portfolio agencies are responsible for delivering transport projects. DTP transfers the value of these projects to VicTrack each year.

Source: VAGO based on DTF.

General government sectors

According to DTF the general government sector 'consists of all government departments and other public sector agencies that are controlled and largely financed by government'.

Spending by public non-financial corporations

Public non-financial corporations (PNFCs) account for $129.8 billion of capital projects.

PNFCs include water, cemetery, housing, port, road, and rail entities and other authorities.

|

Most PNFC spending is by ... |

Which accounts for … |

|---|---|

|

VicTrack |

$78.2 billion of capital projects. |

|

Melbourne Water Corporation |

$15.8 billion of capital projects. |

|

State Tolling Corporation |

$14.0 billion of capital projects. |

|

Director of Housing |

$4.7 billion of capital projects. |

Note: DTP and its portfolio agencies are responsible for delivering transport projects. DTP transfers the value of these projects to VicTrack each year.

We have updated our Major Projects Performance dashboard

Major Projects Performance dashboard

This is the third year we have updated our Major Projects Performance dashboard. We analyse data from this dashboard in Section 2.

We intend to keep checking and annually reporting changes in major projects’ TEI, completion dates, scope and red, amber and green ratings until this information exists in another central location.

Our dashboard focuses on major infrastructure projects. It does not include:

- land acquisition

- maintenance, upgrade and compliance projects

- programs of smaller capital works, such as new schools

- infrastructure delivery funds

- road safety and maintenance

- information technology projects.

DTF has updated its Capital Investment Dashboard but it still has limitations

DTF's reporting on major projects

DTF publishes BP4 to report on:

- new capital investments

- progress and spending on existing and completed projects.

DTF published its Capital Investment Dashboard in June 2022.

Our Major Projects Performance Reporting 2022 report explained some limitations with DTF's dashboard. These limitations included a lack of information about projects':

- statuses and expected benefits

- scope changes, such as time and cost changes.

Since our 2022 report DTF has:

- updated its dashboard following the 2023–24 Budget

- given users access to download BP4 data for all years from 1998–99.

But DTF has not added information about scope or expected performance (benefits) changes that could affect a project's outcomes.

|

DTF's Capital Investment Dashboard should have … |

That cover/s each project's … |

|---|---|

|

metadata |

|

|

analysis |

|

|

performance metrics |

red, amber and green ratings for time, cost and scope (see Section 2) gateway reviews completed (see Section 2) an explanation for any scope changes. |

2. Exploring major project data

We surveyed 8 agencies on how 101 major projects are performing against their expected cost, completion date and scope.

This includes 12 new major projects, 71 existing projects and 18 completed projects that are collectively worth $123 billion.

This chapter explores changes to these projects' cost, time and scope to date.

We collected information from each project’s key documents, such as business cases and benefits management plans.

We also asked if agencies have evaluated projects listed as completed.

Figure 3: Major projects 2023–24

Source: VAGO based on survey data.

The TEI of major projects has increased by $11 billion

TEI changes

The TEI of 89 existing and complete major projects increased by a total of $11 billion, or 11 per cent, since they were first included in BP4.

This includes the TEI of:

- 41 projects (46.1 per cent) increasing by a total of $13.5 billion

- 12 projects (13.5 per cent) decreasing by a total of $2.6 billion

- 36 projects (40.4 per cent) not changing.

TEI by sector

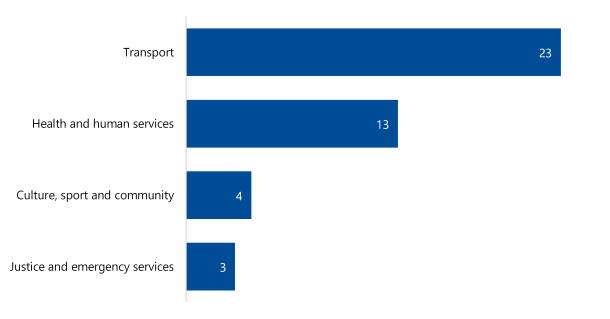

The 101 major projects we looked at this year are in 4 sectors:

- transport

- justice and community safety

- health and human services

- culture, sport and community.

Over half of these projects (60.4 per cent) are in the transport sector, compared to 53.0 per cent last year.

Transport projects also account for 82.6 per cent of the total TEI, compared to 79.0 per cent last year.

As Figure 4 shows, transport projects have the highest average TEI ($1.7 billion) and the highest median TEI ($446.6 million).

Figure 4: Average and median TEI by sector 2023–24

Note: We have included median TEI because big projects can distort the average TEI.

Source: VAGO.

TEI changes of more than 10 per cent

Of the 101 projects we reviewed:

- 28 had a TEI increase of more than 10 per cent compared to their original TEI

- 4 had a TEI decrease of more than 10 per cent compared to their original TEI.

These numbers are not significantly different to last year.

TEI increases of more than 50 per cent

This year there are 12 projects with a TEI increase of more than 50 per cent compared to their original TEI. Figure 5 lists these projects and reasons for the changes, based on BP4 footnotes or our survey.

Figure 5: Projects with a TEI increase of more than 50 per cent 2023–24

| Project | Original TEI | Current TEI | Increase | Reason given for variance* |

|---|---|---|---|---|

| Building a world class hospital for Frankston families | $562 million | $1.1 billion | 99% | **This project is a PPP [public–private partnership] where the upfront capital investment has resulted in additional scope and whole-of-life benefits whilst remaining within the project’s affordability benchmark |

| Car Parks for Commuters | $150 million | $618 million | 312% | **Increase in the number of car parks delivered |

| City Loop fire and safety upgrade (stage 2) and intruder alarm | $133 million | $465 million | 250% | **Additional funding following project development to incorporate further safety upgrades |

| Geelong City Deal – Geelong Convention and Exhibition Centre Precinct | $174 million | $296 million | 70% | **Additional funding to meet forecast capital costs to deliver the convention and exhibition centre |

| Hall Road Upgrade | $169 million | $283 million | 67% | The TEI increased due to further development work |

| Murray Basin Rail Project | $440 million | $794 million | 81% | **Received Australian Government funding and funds transferred from other rail projects Scope revised following industry consultation |

| Regional Rail Revival – Bendigo/Echuca Line Upgrade | $91 million | $175 million | 93% | **Scope variations and market conditions, including three new stations |

| Regional Rail Revival – Warrnambool and Geelong Line | $114 million | $283 million | 148% | Scope variations and market conditions |

| Royal Victorian Eye and Ear Hospital redevelopment | $165 million | $318 million | 93% | **Incremental additional funds each year since 2016–17. |

| West Gate Tunnel | $6.3 billion | $10 billion | 60% | **Capital expenditure reclassified as operating expenditure **Commercial settlement with Transurban TEI increase includes a private sector funding contribution |

| Western Plains Correctional Centre | $689 million | $1.1 billion | 55% | **Second stage of planned funding provided in 2021–22 Budget |

| Western Port Highway | $54 million | $114 million | 109% | **Received Australian Government funding The TEI increased due to further development work |

Note: See Appendix E Figure E2 for agencies. See Appendix G for survey data, including funding sources.

Source: VAGO. *Reasons given for variance based on our 2023 survey and our **Major Projects Performance Reporting 2022 report.

Note: See Appendix E Figure E2 for agencies. See Appendix G for survey data, including funding sources.

Source: VAGO. *Reasons given for variance based on our 2023 survey and our **Major Projects Performance Reporting 2022 report.

We listed 14 projects in our 2022 report. Figure 5 includes the same projects as 2022 except for 2 projects that have since been completed.

Nearly half of projects' completion dates have changed

Changes to estimated completion dates

Of the 89 existing and completed projects we looked at, 40 had different completion dates to when they were first included in BP4.

Of these projects, 17 (42.5 per cent) are in the transport sector.

These numbers are not significantly different to previous years.

Length of delays

Figure 6 shows projects delayed by more than 18 months since they were first included in the BP4. There are 14 projects in 2023 compared to 24 projects in 2022.

Of the 24 projects from 2022:

- 6 currently have 'TBC' listed as their estimated completion date

- 5 are now complete.

Figure 6: Existing projects with significant estimated completion date delays 2023–24

| Project | Original completion date | Revised completion date | Variance (quarters) | 2023–24 BP4 footnote | Reason given for variance |

|---|---|---|---|---|---|

| Western Highway duplication – Ballarat to Stawell | Qtr 3 2015–16 | TBC | Over 28 | The TEI includes $499.380 million of Commonwealth Government funding. This project may be subject to the Commonwealth Infrastructure Investment Program review. | **Works on hold while a new Cultural Heritage Management Plan is prepared The estimated completion date is to be confirmed due to legal challenges |

| Murray Basin Rail Project | Qtr 2 2018–19 | TBC | Over 20 | The TEI includes $470.400 million of Commonwealth Government funding. This project may be subject to the Commonwealth Infrastructure Investment Program review. | **Alignment with another rail project and Australian Government funding Scope revised following industry consultation |

| Carlton redevelopment – 246 units/sites | Qtr 2 2018–19 | Qtr 2 2023–24 | 20 | The project's location has changed from ‘statewide’ to ‘North-West metropolitan’ to better reflect the project’s service area. | **The construction of social housing apartments was complete in 2014 The project will be complete when the balance of the private apartments are sold |

| City Loop fire and safety upgrade (stage 2) and intruder alarm | Qtr 4 2019–20 | Qtr 2 2023–24 | 14 | The TEI has decreased by $4.322 million due to budgeted amounts being reclassified as operating instead of capital expenditure, in line with accounting standards. | Additional funding following project development to incorporate further safety upgrades **The main delivery contractor has been put into administration |

| Geelong City Deal – Geelong Convention and Exhibition Centre Precinct*** | Qtr 2 2022–23 | Qtr 4 2025–26 | 14 | There has been a net decrease in TEI of $7.250 million, resulting from a $17.100 million reduction in TEI due to budgeted amounts being reclassified as operating instead of capital expenditure, in line with accounting standards, and a $9.850 million increase in TEI due to additional funding to meet forecast capital costs to deliver the Geelong Convention and Exhibition Centre. The TEI includes $156.000 million of Commonwealth Government funding. | **Negotiations with the Australian Government |

| West Gate Tunnel | Qtr 2 2022–23 | Qtr 2 2025–26 | 12 | The TEI has decreased by $58.212 million due to budgeted amounts being reclassified as operating instead of capital expenditure, in line with accounting standards. | **Commercial settlement with Transurban TEI changes include a private sector funding contribution |

| M80 Ring Road Upgrade | Qtr 3 2020–21 | TBC | Over 12 | The TEI includes $349.130 million of Commonwealth Government funding. This project may be subject to the Commonwealth Infrastructure Investment Program Review. | **Procurement timing (dates relate to Sydney Road to Edgars Road section) |

| Suburban Roads Upgrade – Northern Roads Upgrade and South Eastern Roads Upgrade | Qtr 2 2022–23 | TBC | Over 12 | The TEI includes $1,140.000 million of Commonwealth Government funding. This project may be subject to the Commonwealth Infrastructure Investment Program Review. | **In line with public commitments. |

| Additional acute mental health beds in regional Victoria* | Qtr 2 2026–27 | Qtr 4 2028–29 | 10 | The estimated completion date has been revised to quarter 4 2028–29 in line with a revised project schedule. | No reasons for variance provided in 2023 survey response. |

| Ballarat Health Services expansion and redevelopment and new Central Energy Plant | Qtr 4 2025–26 | Qtr 2 2028–29 | 10 | The TEI has increased by $54.188 million due to a revised project scope to include a helipad and a 400 space car park. | **COVID-19 restrictions impacting worksites Additional scope |

| Goulburn Valley Health redevelopment – planning and development | Qtr 4 2020–21 | Qtr 2 2023–24 | 10 | The estimated completion date has been revised to quarter 2 2023–24 in line with a revised project schedule. | **Inclusion of refurbishment and compliance works |

| E-Class Tram Infrastructure Program* | Qtr 4 2025–26 | Qtr 4 2027–28 | 8 | The estimated completion date has been revised to quarter 4 2027–28 in line with a revised project schedule. | To enable Next Gen Trams to be deployed from, and stabled at, Brunswick Depot. |

| Men's prison system capacity* | Qtr 4 2022–23 | Qtr 2 2024–25 | 6 | The estimated completion date has been revised to quarter 2 2024–25 in line with a revised project schedule. | No reasons for variance provided in 2023 survey response |

| North East Link – Primary Package (Tunnels) and State Toll Co | Qtr 4 2026–27 | Qtr 2 2028–29 | 6 | The TEI includes the $11.100 billion contract with the Spark consortium to deliver the Primary Package and other costs associated with the operations of the State Tolling Corporation. The project includes a share of $1.750 billion of Commonwealth Government funding. The TEI excludes financing costs associated with the Primary Package. The State Tolling Corporation is responsible for providing funding contributions to the ‘North East Link – Primary Package (Tunnels)' initiative. This project may be subject to the Commonwealth Infrastructure Investment Program review. | **Changes in scope from environmental requirements |

Note: See Appendix E Figure E2 for agencies.

*These projects are new to this list this year.

**Reasons for variance provided in our Major Projects Performance Reporting 2022 report.

***This footnote relates to the full Geelong City Deal budget.

Source: VAGO based on the 2023–24 BP4, our Major Projects Performance Reporting 2022 report and our 2023 survey.

Not explaining completion date changes

DTF gives agencies guidance on how to prepare information about major projects for BP4.

The guidance says that if a project has a TEI or completion date change since the last BP4 the agency should include a footnote to explain why.

In 2023–24 DTF updated its guidance to encourage agencies to provide accurate, complete and well-structured footnotes for capital projects. The guidance gives examples to help agencies draft their footnotes, including an example for completion date changes.

Despite this, none of the footnotes for the projects in Figure 6 explain why the completion date changed in the 2023–24 BP4. Four of the 14 projects had a footnote that referred to a 'revised project schedule'. But this not a sufficient reason because it does not explain why the project schedule was revised. This type of context is important to include in the BP4 footnote for transparency.

Of the 14 projects, the remaining 10 were delayed before the 2023–24 BP4. Some agencies have explained projects changes in prior year BP4 footnotes, but they are not clearly stated in the current BP4. We have included reasons given for variance in Figure 6 to highlight context agencies provided in their survey response or in our report last year.

When agencies do not clearly explain completion date changes each year it makes it harder for Parliament and the community to hold them accountable.

Most scope changes are in the transport sector

Scope changes

In our survey agencies reported 43 government-approved scope changes across 30 projects.

Figure 7 shows the number of scope changes by sector. The transport sector had the most changes.

Transport projects had 23 scope changes over the life of a project.

Figure 7: Number of scope changes by sector 2023–24

Note: Three of the 8 agencies surveyed are in the transport sector – DTP, Major Transport Infrastructure Authority (MTIA) and the Suburban Rail Loop Authority. None of the scope changes relate to the Suburban Rail Loop Authority.

Source: VAGO.

Sixty-one per cent of high-value high-risk major projects are on track against their estimated cost, time and scope

Progress ratings

DTF uses red, amber and green ratings to track the progress of high-value high-risk (HVHR) projects against their estimated, cost, time and scope.

|

If DTF rates a project as … |

Then successfully delivering the project … |

|---|---|

|

green |

on time, within budget and to the expected quality seems highly likely. |

|

amber |

on time, within budget and to the expected quality seems feasible but significant issues exist that require timely attention. |

|

red |

on time, within budget and/or to the expected quality does not seem achievable. |

Note: DTF uses these definitions for HVHR projects. See Appendix E for the definitions we used in our survey for non-HVHR projects.

Agencies self-assess their projects and give the ratings to the Office of Projects Victoria. The Office of Projects Victoria consults with DTF and the Department of Premier and Cabinet to decide an overall risk rating for each project.

DTF reports the ratings to the government and agencies for feedback. But these reports are not available to the community.

HVHR projects

DTF uses a risk assessment tool to determine if a project is HVHR. A project is HVHR if:

- DTF assesses it as high risk

- DTF assesses it as medium risk and it has a TEI of between $100 million and $250 million

- DTF assesses it as low risk but it has a TEI over $250 million

- the government determines that it warrants the rigour applied to HVHR projects.

DTF subjects HVHR projects to extra scrutiny and monitoring.

Agencies’ cost and time ratings

We asked the agencies we surveyed to give us their red, amber and green ratings for 62 HVHR projects they reported to DTF at the end of March 2023.

Some new HVHR projects already have ratings. But we only included existing and completed projects in this section (see the full list in Appendix E).

Overall, agencies assessed 38, or 61 per cent, of their HVHR projects as on track against their estimated cost, time and scope.

Figure 8 shows the agencies' combined ratings for their projects’ cost, time and scope.

More projects have amber and red ratings for cost and time. This indicates that cost and time changes do not necessarily relate to changes in a project's scope.

Figure 8: Agencies' 2023 self-assessment ratings for projects' cost, time and scope

Note: This figure excludes the Suburban Rail Loop – Airport project's rating because MTIA listed it as 'N/A' in our survey.

Appendix E shows the agencies' self-assessments for 2023–24. Our dashboard shows the ratings and comments from the agencies that the explain amber and red ratings. Refer to Appendix G for the agencies comments to explain their ratings.

Source: VAGO.

Cost and time challenges

DTF monitors the risk of major projects, particularly HVHR projects, running over time and over budget.

The main reasons that major projects run over time and budget are:

- the cost of materials increasing

- limited access to some materials

- skill shortages

- rising labour costs.

Land acquisition also delays some projects from progressing (see Appendix D for more detail).

Some major projects do not have key planning documents

Investment Lifecycle and High Value High Risk Guidelines

DTF's 2019 Investment Lifecycle and High Value High Risk Guidelines (HVHR guidelines) explains how to successfully deliver an investment’s intended benefits on time, within budget and with the maximum benefit for Victorians.

The HVHR guidelines apply to all:

- government departments, corporations, authorities and other bodies under the Financial Management Act 1994

- government investment proposals.

The HVHR guidelines also help agencies develop business cases, which are mandatory for capital investments with a TEI of $10 million or more.

Under the HVHR guidelines, DTF requires responsible agencies to have the following key documents for each of their major projects:

- a business case

- an investment logic map

- a benefits management plan.

Key planning documents

As Figure 9 shows, of the 101 projects we looked at:

- 85 projects (84.2 per cent) have an investment logic map

- 91 projects (90.1 per cent) have a business case

- 82 projects (81.2 per cent) have a benefits management plan.

Figure 9: Number of major projects with a benefits management plan, business case and investment logic map (2023–24)

Source: VAGO.

Business cases

The HVHR guidelines see business cases as an opportunity for an agency to conceptualise a project and prove that it is worth doing. Preparing a business case is the first stage of planning a project.

If an agency goes ahead without a business case it has not assured the government, Parliament and community that the project is worthy of public funds.

We looked at 12 new projects that commenced this year. Four of these projects do not have a business case. For 3 of these projects, the responsible agency intends to complete one. The other sits under another business case that has been approved for a larger program of work (or 'work program'). These 4 projects have a total TEI of $1.8 billion.

We also looked at 18 completed projects. Two of these projects did not have a business case:

|

The responsible agency told us that the ... |

Does not have a business case because ... |

|---|---|

|

new VLocity carriages for the regional network project |

the government approved the project earlier in its decision to procure VLocity rolling stock. |

|

Regional Rail Revival – Warrnambool and Geelong Line Upgrade project |

the government approved the project earlier (in 2016) as a part of its Regional Network Development Plan. |

Agencies have not reviewed any completed projects in the last year

The gateway review process

When an agency completes a major project it should review it to assess if it delivered the planned benefits on time and within budget.

DTF introduced the gateway review process in 2003. The process is mandatory for all HVHR projects. It has 6 stages, or 'gates'.

An agency must do a Gate 6 review when it completes a project. This review typically happens 6 to 18 months after the project finishes. A Gate 6 review examines if a project has delivered its benefits as defined in its business case.

Since our 2013 Planning, Delivery and Benefits Realisation of Major Asset Investment: The Gateway Review Process report we have found that agencies inconsistently apply the gateway review process.

Gate 6 reviews

In our survey we asked agencies if they have done a Gate 6 review for 25* HVHR projects that were completed more than 18 months ago (see the full list in Appendix F).

Only 2 of these projects had a completed Gate 6 review.

Agencies told us they would not do a Gate 6 review for 3 projects because:

- 2 did not have sufficient budget allocated for the review

- gateway reviews were not required for one project.

This means agencies have not assessed if the other 20 projects delivered their intended benefits.

*We excluded 11 projects that finished very recently because agencies have 18 months to complete a Gate 6 review.

Appendix A: Submissions and comments

Download a PDF copy of Appendix A: Submissions and comments.

Appendix B: Abbreviations, acronyms and glossary

Download a PDF copy of Appendix B: Abbreviations, acronyms and glossary.

Appendix C: Review scope and method

Download a PDF copy of Appendix C: Review scope and method.

Appendix D: Reasons projects change

Download a PDF copy of Appendix D: Reasons projects change.

Appendix E: Agencies’ self-assessments for 2023–24

Download a PDF copy of Appendix E: Agencies’ self-assessments for 2023–24.

Appendix F: Gateway reviews of completed HVHR major projects

Download a PDF copy of Appendix F: Gateway reviews of completed HVHR major projects.

Download Appendix F: Gateway reviews of completed HVHR major projects

Appendix G: Data sources used in this review

Download a PDF copy of Appendix G: Data sources used in this review.