Results of 2022 Audits: Technical and Further Education Institutes

Data dashboard

Data dashboard

Click here to view the dashboard full screen

Dashboard data

Click the links below to download CSV copies of the following datasets:

Key facts

Source: VAGO.

1. Audit outcomes

We provided clear audit opinions on financial reports and performance statements across the Technical and Further Education (TAFE) sector. Parliament and the community can confidently use these reports.

Financial reports and performance statements are reliable

The TAFE sector

There are 12 TAFEs and 14 controlled entities in the Victorian TAFE sector.

We audit their financial reports and performance statements. They all prepared a financial report and performance statement for 2022.

See Appendix B for more information about the sector, including its annual reporting requirements.

Controlled entity

A controlled entity is an entity that another party has the power to govern and make financial and operating decisions about.

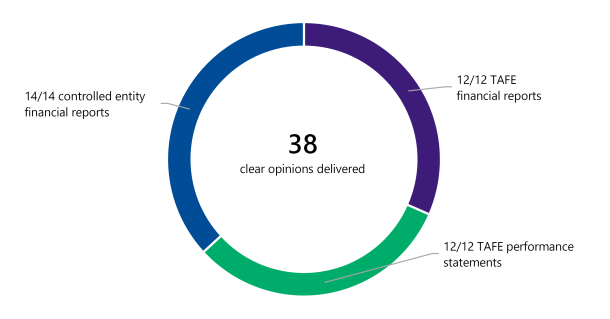

Number of clear audit opinions

As Figure 1 shows, we provided clear audit opinions on:

- all 12 TAFEs' financial reports and performance statements

- all 14 controlled entities' financial reports.

Figure 1: Clear audit opinions issued for 2022

Source: VAGO.

Clear opinion

A ‘clear’ or ‘unmodified’ audit opinion means we have reviewed an entity's financial report and believe it is reliable and complies with relevant reporting requirements.

TAFEs met their reporting timeframes with better quality reports in 2022

Timeliness of financial reports

Under the Financial Management Act 1994, TAFEs have 8 weeks from the end of their financial year, or 'balance date', to give us their draft financial report to audit.

All 12 TAFEs gave us their 2022 draft financial reports within the 8-week deadline, similar to 2021.

Errors in financial reports

The nature, number and size of errors in financial reports submitted for auditing are measures of their quality, and the effectiveness of their systems and processes used to compile them. During an audit we sometimes find an item that an entity has not prepared in line with relevant reporting requirements.

We classify these errors as either material or immaterial.

|

If an error is ... |

Then ... |

|---|---|

|

material |

the entity needs to correct it before we can issue a clear audit opinion. |

|

immaterial |

we recommend the entity corrects it, but we can still issue a clear audit opinion without it being corrected. |

This year we did not find any material errors in TAFEs’ financial reports. We only found:

- 5 immaterial financial errors, compared to 7 in 2021

- 7 immaterial classification and disclosure differences, compared to 20 in 2021.

This shows that the sector improved the quality of its financial reports in 2022.

Material

We consider an error material if it could influence a user’s decision or understanding about an entity's financial report.

Errors in performance statements

We did not find any material errors in the TAFEs' performance statements.

This shows that their performance reporting is mature.

Going concern

Financial reports are prepared on a going-concern basis. This assumes that an entity is able to continue operating unless its management intends to either liquidate the entity, cease operating, or has no realistic alternative but to do so.

Due to financial pressures, 4 TAFEs faced uncertainty about their ability to continue as a going concern in 2022.

To mitigate the risk of these TAFEs being unable to pay their debts when they fall due, the Department of Jobs, Skills, Industry and Regions issued letters of comfort to them. Letters of comfort are an undertaking that the department will provide adequate cashflow to those TAFEs, should the need arise, until April 2024. This enabled the following TAFEs to prepare their financial reports on a going-concern basis:

- Gordon Institute of TAFE

- TAFE Gippsland

- Goulburn Ovens Institute of TAFE

- Melbourne Polytechnic (conditional based on asset sales).

We did not modify our audit opinion for these TAFEs because of the financial support provided by the department.

2. Financial analysis

The sector’s financial performance improved in 2022 because of financial support received from government to TAFEs. This support helped pay employee costs and maintain assets. Four TAFEs also had loans forgiven by the Victorian Government. Financial performance would have declined without this financial assistance.

Overall, student enrolments for government-funded places declined. While half of the sector were able to increase their fee-for-service student revenue in 2022, these increases were mostly with metropolitan TAFEs, and were $16 million less in total than the decline in revenues from funded places.

Onsite operations and teaching returned post pandemic, driving expenditure up. The rising cost of materials and services and declining enrolments mean that TAFEs will need to maintain a strong focus on sound budget and financial management to actively manage their costs.

The sector’s overall net result improved from 2021

Financial performance snapshot

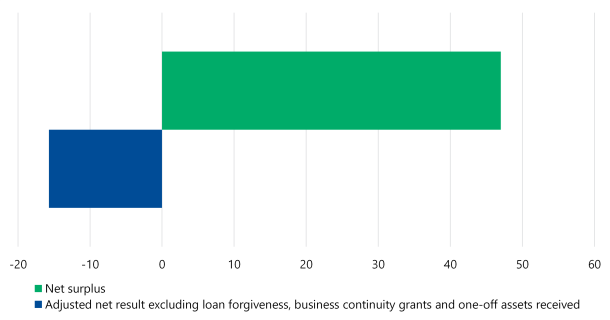

As Figure 2 shows, TAFEs had a combined net surplus of $47 million in 2022.

Figure 2: TAFEs' net result for 2022

Source: VAGO.

The 2022 result is a $59.1 million turnaround from their net deficit of $12.1 million in 2021. However, most of this increase is attributable to once-off financial assistance from the Victorian Government in the form of loan forgiveness ($31.6 million), business continuity grants ($12.4 million) and once-off assets received by one TAFE ($18.8 million).

|

In 2022 the sector reported … |

Which is ... |

From ... |

|---|---|---|

|

$1,367.3m in revenue and income |

an 8.7% increase |

$1,258.2m in 2021. |

|

$1,320.3m in expenses |

a 3.9% increase |

$1,270.3m in 2021. |

Four TAFEs incurred a net deficit in 2022 – Box Hill Institute, Goulburn Ovens Institute of TAFE, William Angliss Institute and Bendigo Kangan Institute. If the once-off financial assistance was not provided by the government, four more TAFEs would have reported a net deficit in 2022, and the overall net result for the sector would have been a net deficit of $15.7 million, as shown in Figure 3.

Figure 3: TAFEs’ net surplus and adjusted net result for 2022 ($ million)

Source: VAGO.

TAFEs got more government funding in 2022

Revenue sources

In 2022 TAFEs got most of their revenue from:

- government contributions, including operating grants

- fee-for-service courses.

But the government gave TAFEs fewer capital grants and subsidies.

|

TAFEs got ... |

Which is a ... |

Because ... |

|---|---|---|

|

$857.2m from government contributions

|

$48.1m, or 5.9%, increase from $809.1m in 2021 |

they received once-off business continuity grants amounting to $12.4 million in 2022, along with additional funding for new student learning, wellbeing and support initiatives, marginally offset by reduction in capital grants. |

|

$423.4m from fee for service revenue |

$21.4m, or 5.3%, increase from $402.0m in 2021 |

more courses were delivered during 2022. |

|

$86.7m from other revenue sources |

$39.6m, or 84.1%, increase from $47.1m in 2021. |

4 TAFEs received one-off loan forgiveness deeds from the Victorian Department of Education (totalling $31.6 million). |

Government grants

TAFEs get funding from the Victorian Government each year, both to support the delivery of tertiary education services, and also to fund large capital projects. How much they receive varies each year depending on the training market demand, government initiatives and capital projects.

In 2022 the Victorian Government gave TAFEs $386.6 million in operating grants. This is a $112.3 million increase from the $274.3 million TAFEs received in 2021.

The government gave TAFEs more operating grants in 2022 to:

- help pay for increased staff salaries and running costs due to the return of onsite operations and teaching

- maintain their existing assets

- introduce new student learning, wellbeing and support initiatives.

These grants led to the sector reporting a surplus for 2022. TAFEs may not receive these grants in future years.

The government also gave TAFEs $75.5 million in capital grants, a $26.9 million decrease from $102.4 million in 2021. This was because many TAFEs finished their existing building projects during 2021.

Business continuity grants

The Victorian Government started giving TAFEs business continuity grants in 2020 to help them keep running during the COVID-19 pandemic.

Contestable funding

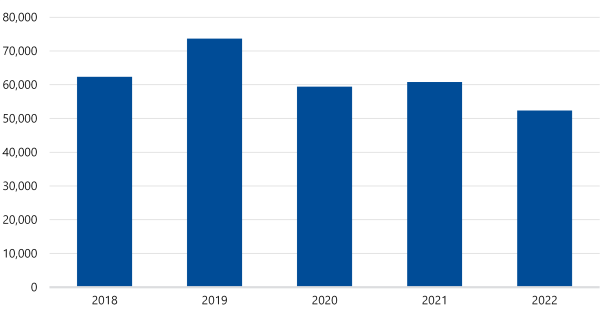

TAFEs received $395.0 million in government subsidies, or 'contestable funding' in 2022. This is a $37.4 million decrease from $432.4 in 2021. This was because fewer students commenced government-funded courses in 2022. The decline was consistent across the sector.

As Figure 4 shows, the number of students who started a government-funded TAFE course increased significantly in 2019 because the Free TAFE program was introduced.

Student enrolments then rapidly declined in 2020 and remained low in 2021, due to the restrictions placed on in-person teaching at TAFEs’ by the government, when the COVID-19 pandemic occurred.

In 2022, enrolments dropped further – according to data that is tracked by the Victorian Department of Education, the number of early school leavers from year 9 to 12 increased in 2022. Of these early leavers, most moved into employment. This could indicate that the strong labour market and favourable employment conditions may have contributed to the drop in student enrolments into TAFE in 2022. Students have likely shown a preference for moving straight from school into employment, rather than undertaking further study at TAFE.

Figure 4: Government-funded commencements for the years ended 31 December 2018 to 2022

Source: VAGO.

Contestable funding

The Victorian Government gives TAFEs contestable funding for domestic students who are studying courses eligible for a government grant.

Free TAFE

Under the Free TAFE program, the government covers the cost of priority courses for eligible students.

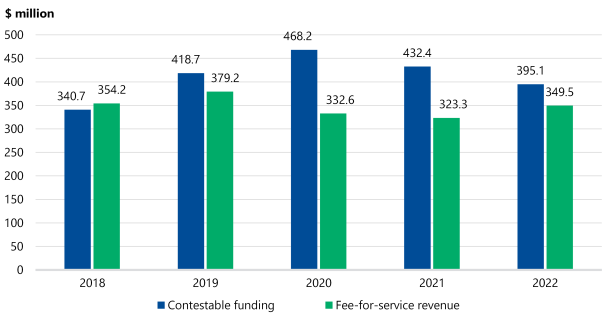

Fee-for-service revenue

As Figure 5 shows, while TAFEs' contestable funding continued to go down in 2022, their fee for service revenue started to increase.

Figure 5: TAFEs' contestable funding and fee-for-service revenue from 2018 to 2022

Source: VAGO.

TAFEs started running more fee-for-service courses when COVID-19 lockdowns ended.

The sector received $349.5 million from fee-for-service courses in 2022. This is a $26.2 million increase from $323.3 million received in 2021. However, most of this increase was driven by 4 TAFEs – Box Hill Institute, Chisholm Institute, Bendigo Kangan Institute of TAFE and Melbourne Polytechnic – with the remaining TAFEs unable to grow in this type of revenue.

Other fee-for-service revenue

In 2022 TAFEs increased their fee-for-service revenue from other sources by $9.3 million from $71.7 million in 2021 to $81.0 million.

But $7.3 million, or 78.5 per cent, of this increase was at 2 TAFEs: Bendigo Kangan Institute and Melbourne Polytechnic. Most of this increase is once-off and unlikely to occur in future years.

Other revenue

In 2022, revenue from other sources increased by $39.6 million. This was largely due to loans forgiven by the Victorian Government. These loans were provided to four TAFEs – Box Hill Institute, TAFE Gippsland, Melbourne Polytechnic and Sunraysia Institute of TAFE – in prior periods.

The government determined it did not require these loans to be repaid. When loan forgiveness occurs, the amount is recognised in the financial report as other revenue.

TAFEs spent more in 2022 because they ran more in-person courses

Changes in expenses

TAFEs spent $1,320.3 million in 2022. This is a $50 million increase from $1,270.3 million in 2021.

The sector's expenses have gone up each year since 2018, except for 2020. In 2020 TAFEs reduced their spending due to the COVID-19 pandemic.

In 2022 the sector spent the most on employee expenses. But these costs only increased by 1.3 per cent from $853.0 million in 2021 to $864.0 million. This is because TAFEs focussed on keeping these costs down.

|

In 2022 the sector spent ... |

Which is ... |

Because ... |

|---|---|---|

|

$863.9m on employee expenses |

an increase of $10.9m or 1.3% from $853.0m in 2021 |

staff salaries went up under teaching enterprise bargaining agreements. |

|

$358.5m on materials and services |

an increase of $39.8m or 12.5% from $318.7m in 2021 |

TAFEs ran more in-person courses, which they largely stopped doing during the pandemic, and higher costs due to inflationary impacts. |

|

$97.8m on depreciation and amortisation |

consistent with what it spent in 2021. |

|

The sector's net asset position has improved

Financial position snapshot

As Figure 6 shows, the sector had $4,026.3 million in assets and $488.7 million in liabilities in 2022, equating to net assets of $3,537.6 million.

Figure 6: TAFEs' total assets and liabilities in 2022

Source: VAGO.

|

In 2022 the sector reported … |

Which is a ... |

From ... |

|---|---|---|

|

$4,026.3m in assets |

11.1% increase |

$3,623.1m in 2021. |

|

$488.7m in liabilities |

0.6% decrease |

$491.7m in 2021. |

Total assets

TAFEs’ assets went up in value by $403.1 million from $3,623.1 million in 2021 to $4,026.3 million in 2022.

This is because:

- TAFEs revalued their land and buildings, which increased their value by $348.5 million

- TAFEs finished capital projects, which led to them reporting $105.7 million of new assets.

The valuation increases of land and buildings were mainly in the outer metropolitan regions. The escalating costs of construction and current market conditions were factors contributing to the increases.

Cash balances and liquidity

TAFEs' cash balances have declined from $447.0 million in 2019 to $370.4 million in 2022. This is because student numbers have not returned to pre-pandemic levels requiring TAFEs to access cash reserves to fund their day-to-day operations and capital asset acquisitions.

TAFEs spent less at the height of the COVID-19 pandemic in 2020. But they started spending more in 2022 to:

- run courses in-person again

- buy new land and buildings.

Three TAFEs hold nearly 60 per cent of the sector’s cash balance – these being Chisholm Institute, Holmesglen Institute and Bendigo Kangan Institute.

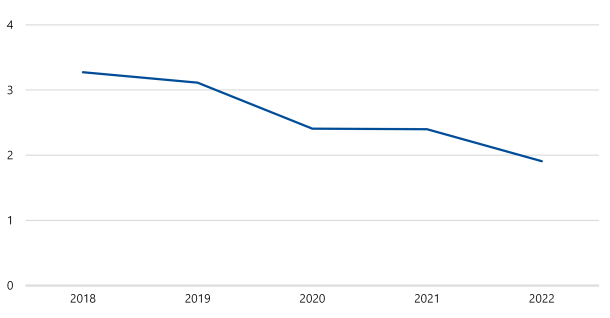

While the sector’s overall balance sheet remains strong, this is because TAFEs hold significant land and building portfolios. But these are not liquid assets nor are they held as investments, meaning that TAFEs cannot rely on them to generate their own revenues or to pay down their short-term debts where funds are needed quickly. As Figure 7 shows, the sector’s average liquidity ratio has been declining since 2018. But it was still positive in 2022 at 1.84.

If the sector's liquidity ratio keeps going down, TAFEs may be in a position where they do not have enough cash to meet their immediate liabilities.

Figure 7: The sector's liquidity ratio from 2018 to 2022

Source: VAGO.

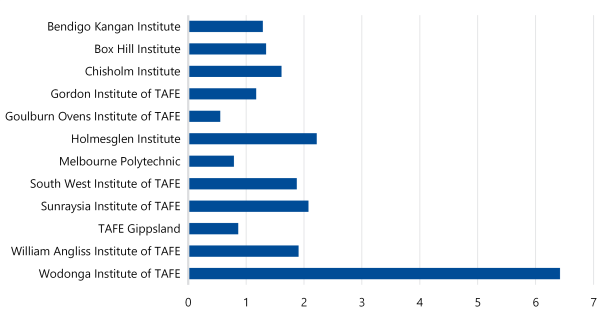

As can be seen in Figure 8, there are 3 TAFEs that have a liquidity ratio below one – these being Goulburn Ovens Institute of TAFE, Melbourne Polytechnic and TAFE Gippsland. These TAFEs received letters of comfort from the Victorian Government to meet their short-term liabilities where required, as explained in Section 1.

Figure 8: TAFEs liquidity ratio 2022

Source: VAGO.

Liquid assets

A liquid asset is an asset that an entity can easily convert into cash.

Liquidity ratio

A liquidity ratio measures if an entity can likely pay its debts in the immediate future using cash and liquid assets. To calculate a TAFE's liquidity ratio we divide its current assets by its current liabilities.

Financial sustainability challenges persist for the sector

Challenges

TAFEs' revenue from student fees and charges still has not returned to pre-pandemic levels. This is because fewer students overall enrolled in 2022.

Given the strong labour market being seen in 2023 and cost of living pressures, the decline in student enrolments could continue for the next few years.

TAFEs and the Victorian Government may need to consider revisiting their course structures and the types of courses being offered through the Free TAFE program in an effort to attract higher enrolments.

Further, from the continued financial assistance received by the sector and the rising cost of materials and services across Australia, it is clear TAFEs need to actively manage their spending. Sound financial management and budgeting practices are critical to effective and realistic cost management and should be a core focus for TAFEs in managing these financial pressures.

3. Internal controls

TAFEs’ internal controls are adequate for them to prepare reliable financial reports and performance statements. But they need to improve their information technology (IT) controls. These issues could prevent TAFEs from preparing reliable financial reports or protecting their sensitive data.

TAFEs need to focus on IT controls and keep improving them

Internal control snapshot

TAFEs must have effective internal controls to keep proper accounts and records. These controls should cover people, systems and processes.

We assess if TAFEs' internal controls allow them to prepare reliable financial reports and performance statements.

Overall, TAFEs’ internal controls are adequate. But TAFE boards need to improve their IT controls to address the:

- new issues we found in 2022

- unresolved issues we found in previous years.

Raising internal control issues

We raise internal control and financial reporting issues to a TAFE's board and audit committee. This includes:

- reporting new issues

- giving updates on unresolved issues we raised in previous years.

Issues we found in 2022

In 2022, there were 5 common IT issues across a number of TAFEs, as well as 4 financial reporting issues across the sector, including these high and moderate-rated issues:

|

We found ... |

Which we rated as ... |

And recommended management act to ... |

|---|---|---|

|

One new financial reporting issue |

high risk |

resolve within one month. |

|

5 new IT issues related to managing user access and IT policies and procedures |

moderate risk |

resolve within 3 to 6 months. |

|

3 new financial reporting issues related to fixed assets |

||

|

14 unresolved issues from previous years, including 11 that related to IT controls |

|

resolve the:

|

TAFEs can strengthen their internal controls and financial reporting processes by promptly resolving these issues.

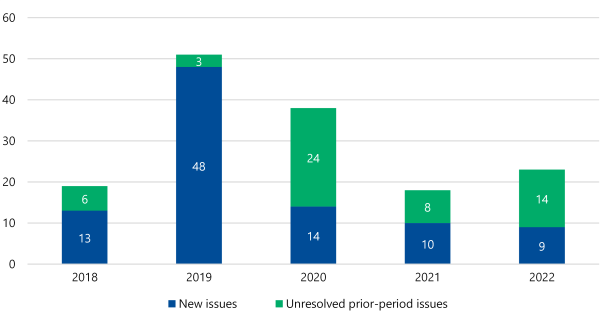

As Figure 9 shows, the number of new issues has gone down since 2019. But the number of unresolved issues from previous years has fluctuated since 2018.

Figure 9: New and unresolved issues from 2018 to 2022

Note: We excluded low-risk issues because we consider them as minor or opportunities for improvement.

Source: VAGO.

Financial reporting issues

TAFEs manage over $3 billion worth of fixed assets, including land, buildings and equipment.

TAFEs must appropriately account for these assets in their financial reports.

In 2022 we found 3 TAFEs had the following financial reporting issues:

- no evidence to support how they determined the transfer of capital works to fixed-asset registers

- did not undertake impairment assessments, where required

- did not include a significant number of nil written-down value assets in their asset registers

- did not recognise all their material assets.

These issues increase the risk of TAFEs materially misstating their financial reports.

IT controls are still the sector's key weakness

Why IT controls are important

Effective IT controls are important because they reduce the risk of:

- unauthorised users accessing and changing a system

- cyberattacks.

TAFEs need these controls to protect their data and prepare reliable financial reports.

IT control issues we found in 2022

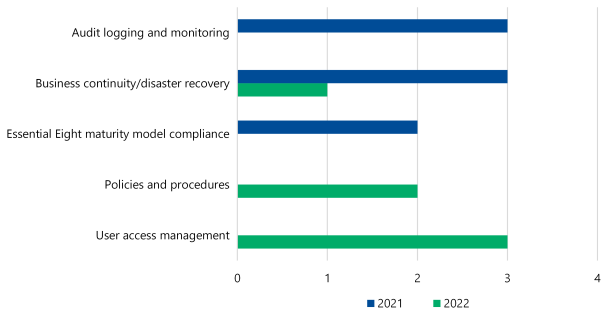

In 2022 the IT control issues we found mostly related to:

- managing user access

- IT policies and procedures.

Figure 10 shows the number of IT control issues we found by type in 2021 and 2022.

Figure 10: Medium and high-risk IT control issues by type in 2021 and 2022

Source: VAGO.

User access controls

User access controls manage who has access to a system or network.

We found that 2 TAFES do not regularly review which users have access to their IT applications. This led to one terminated user still having access. TAFEs need strong controls for users with privileged access because they can often make significant changes to a system or database.

We also found that one TAFE had not set up multi-factor authentication for all users. Multi-factor authentication is a security control that requires a user to verify their identity before they can log into a system.

These issues increase the risk of an unauthorised user:

- accessing a TAFE's system

- changing or stealing its data.

IT policies and procedures

Effective IT policies and procedures tell staff how they should set up, maintain and use an IT system. This helps an entity protect its data.

We found that 2 TAFEs need to update their policies and procedures to tell staff how to manage:

- user access

- logs

- patches

- data and data breaches

- IT assets.

We found that these TAFEs also need to regularly review their IT policies and procedures.

If a TAFE does not regularly review its policies and procedures there is a greater risk that staff will not:

- understand their duties

- follow appropriate control procedures

- have formalised guidance to follow if they run into any problems.

Essential Eight security framework

No IT security strategies are guaranteed to protect against all cyber threats. But the Australian Cyber Security Centre recommends organisations implement 8 essential mitigation strategies as a baseline.

This baseline, which is known as the Essential Eight, makes it much harder for people to compromise systems.

Complying with the Essential Eight security framework would help councils protect customer and sensitive data better.

The mitigation strategies that make up the Essential Eight are:

- application control

- patch applications

- configure Microsoft Office macro settings

- user application hardening

- restrict administrative privileges

- patch operating systems

- multi-factor authentication

- regular backups.

Recommendation

All TAFEs

We recommend that all TAFEs:

- prioritise and promptly address the internal control and financial reporting issues we raise with them and that their audit committees monitor this

- continue to assess against the Essential Eight Maturity Model for their key finance and other information technology systems.

Appendix A: Submissions and comments

Download a PDF copy of Appendix A: Submissions and comments.

Appendix B: Sector context

Appendix C: Our audit approach

Appendix D: Abbreviations, acronyms and glossary

Download a PDF copy of Appendix D: Abbreviations, acronyms and glossary.

Appendix E: Audit opinions

Appendix F: Control issue risk ratings

Download a PDF copy of Appendix F: Control issue risk ratings.

Appendix G: Financial and non-financial sustainability indicators

Download a PDF copy of Appendix G: Financial and non-financial sustainability indicators.

Download Appendix G: Financial and non-financial sustainability indicators