Public Asset Valuation

Overview

Valuer-General Victoria (VGV) has been a branch of the

former Department of Sustainability and Environment but has

now transferred to the Department of Transport, Planning and Local

Government under recent machinery of government changes.

VGV provides independent valuations to public sector agencies.

It is not subject to oversight or independent review of its

valuation services. Therefore VGV's governance arrangements and

processes for assuring high quality advice and valuations should be

of the highest order.

VGV's processes for assuring the validity of its valuations are not

rigorous. Its quality assurance is based on a review of compliance

with relevant standards and directions without in-depth scrutiny of

valuation decisions, and additional quality assurance checks are

required. Further, VGV lacks strong governance arrangements to

guide its operations.

VGV has inadequate business management processes and it does not

have effective performance management targets or benchmarks to

guide its monitoring and reporting of performance.

VGV's unsatisfactory client engagement means that a number of

government agency clients have reservations about the quality of

its financial reporting valuation advice, and are not satisfied

with the service provided.

Although VGV operates autonomously as an independent provider of

public asset valuations, the Department of Treasury and Finance

(DTF) has an important role in administering the financial

reporting framework for public agencies. DTF’s financial reporting

direction has not provided sufficient guidance to VGV and public

sector agencies about how infrastructure assets are to be

valued.

Public Asset Valuation: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER April 2013

PP No 220, Session 2010–13

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on the audit Public Asset Valuation.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

17 April 2013

Audit summary

Background

Victorian public sector agencies manage more than $170 billion in land, buildings, infrastructure, and other non-current assets and they account for the value of these assets through annual financial reports.

Accurate and timely asset valuations are essential to the quality, accuracy and reliability of these financial reports. Any major misstatements of asset values in these reports can lead to inaccuracies in assessing the state’s financial position, determining public revenue, allocating resources and planning for future public services.

Under Financial Reporting Direction 103D, administered by the Department of Treasury and Finance (DTF), Valuer-General Victoria (VGV) is mandated as the state’s independent valuation service provider.

VGV’s role is to manage all government valuations. This involves around 4 500 valuation requests each year, with a request relating either to a single asset or to multiple assets needing to be valued. In any given year assets requested to be valued, whether for sale, purchase, lease, compulsory acquisition or financial reporting purposes are worth approximately $10 billion. VGV also oversees municipal rating valuations for Victoria’s 79 councils. VGV is administratively a branch of the Department of Sustainability and Environment's (DSE) Land Victoria division. However, in its role as valuer to public sector agencies, VGV operates largely as an independent and autonomous body.

The focus of this audit is on VGV's valuation of public assets for financial reporting purposes. VGV oversees 60 to 182 financial reporting valuation requests annually. A request relates either to a single asset or to multiple assets. These are prepared by qualified valuers at VGV or by a panel of about 70 approved private sector firms.

Therefore, VGV’s role in providing agencies with quality, accurate and timely asset valuations is important for enabling public sector agencies to meet their financial reporting requirements and obligations.

Conclusions

VGV provides independent valuations to public sector agencies. It is not subject to oversight or independent review of its valuation services. Instead, it relies on its own quality assurance mechanisms for ensuring that it meets relevant international and Australian valuation standards.

Therefore VGV's governance arrangements and processes for assuring high quality advice and valuations should be of the highest order.

VGV's processes for assuring the validity of its valuations are not rigorous. Its quality assurance is based on a review of compliance with relevant standards and directions. However, additional quality assurance checks are required to provide greater confidence that the methods and professional judgements adopted by valuers, who are largely external to VGV, have been applied appropriately.

Further, VGV lacks strong governance arrangements to guide its operations, which has resulted in a range of substandard operational arrangements and flow-on impacts for overall effectiveness.

VGV has inadequate business management processes. These include poor project management, inadequate reporting to management and mainly paper-based rather than electronic records management. It does not have effective performance management targets or benchmarks to guide its monitoring and reporting of performance. As a consequence, it operates inefficiently and is often late in providing valuations to clients.

VGV's unsatisfactory client engagement—including not being transparent about its valuation assumptions and methodology—means that a number of government agency clients have reservations about the quality of its financial reporting valuation advice, and are not satisfied with the service provided. Concerns that some agencies have had about their valuations have not been addressed. Although VGV's financial reporting valuations team has recently improved its interaction with agencies, a history of inadequate client engagement and subsequent poor communication has allowed concerns to persist.

If VGV is to be fully effective, a comprehensive stakeholder engagement strategy needs to be developed to turn these perceptions around and embed good client engagement in its operations. Client agencies also need to provide accurate and timely asset information due to the high reliance VGV has on this information.

In the current climate of fiscal restraint, the government has signalled the need to increase public sector productivity, and significant work is underway to find new ways to increase efficiency across all departments. Given this current government priority, and the fundamental importance of VGV's valuations in accurately measuring the state's overall financial position, better governance practices are urgently required to improve operations and create the efficiencies expected of the rest of the Victorian public sector.

Although VGV operates autonomously as an independent provider of public asset valuations, DTF has an important role in administering the financial reporting framework for public agencies and providing guidance for public asset valuations. DTF’s financial reporting direction has not provided sufficient guidance to VGV and public sector agencies about how infrastructure assets are to be valued. DTF should develop more detailed practical guidance to assure the consistency of public asset valuations.

Findings

Assuring valuation advice

Agencies are responsible for the asset valuations included in their financial reports and are required to assess the reasonableness of those valuations independently of VGV. However, VGV is responsible for providing valuations that can be relied upon and should apply the highest standards of assurance in so doing.

VGV has a quality assurance system but it is limited to checking compliance with relevant standards. It does not scrutinise the rigour and professional judgement of the valuation decisions. This is of particular concern given that most financial reporting valuations are conducted by a panel of external valuers.

While VGV is subject to DSE's fraud and anti-corruption policies, it has not developed policies and protocols which specifically relate to its valuation function. This is of concern given the sensitive nature of the valuation task and the need to provide the highest levels of confidence for clients that valuations are reliable and the result of expert, independent processes.

VGV should boost the assurance about its valuation service by increasing the number of field audits and second valuer reviews it conducts. These improvements would provide greater monitoring of processes and methods used by panel valuers and provide important assurance about VGV advice given its dependence on these external valuers.

Improving operational efficiency

VGV has poor governance arrangements to guide its operations, which impacts on its effectiveness. It has no strategic plan to guide operations or role specific risk management plans. VGV has no effective benchmarks to gauge performance. Further, well over half its financial reporting valuations were late in 2010–11 and 2011–12, and it cannot provide any evidence to show that it is providing a cost-effective service to the public sector.

VGV senior management does not have a clear line of sight over these important operational issues of timeliness and cost effectiveness because it does not receive regular performance reporting of the kind that would be expected of an agency charged with producing such important advice.

Additionally, VGV's high dependence on paper records reduces its efficiency, increases the chance of errors and is a further example of how it has not kept up with changing business practices.

As VGV is a branch within the Land Victoria division at DSE, the department should commission an independent party to conduct a triennial review of VGV's governance, administrative processes and performance management system, with the aim of identifying opportunities for improvement. A triennial review should also assess VGV's progress in implementing improvements identified in the previous review process.

Improving stakeholder engagement

VGV does not effectively engage its stakeholders in the valuation process.

It does not have a client engagement strategy to help it communicate appropriately with its government agency clients over the various stages of the valuation process. Poor client engagement has created misunderstanding of the basis for valuation decisions by some agencies and adversely affected their confidence in VGV's valuation service.

Recent improvement in client engagement is promising and shows that VGV is moving in the right direction. These early signs of better practice need to be sustained and expanded to achieve fully effective relationships with clients in the future.

Improving guidance from the Department of Treasury and Finance

DTF is responsible for administering the financial reporting framework that guides VGV’s valuations.

Following a 2002 Public Accounts and Estimates Committee report recommendation, DTF developed Financial Reporting Direction 103D for non-current physical assets.

However, this direction does not provide adequate guidance. This lack of guidance was evident in the 2010–11 water sector asset revaluations, which required the valuation methodology to be revised and caused significant client dissatisfaction.

Two areas of methodology have caused particular client concerns and relate to:

- the calculation of indices to estimate value for reporting purposes between full valuations undertaken every five years

- the calculation and consistency of discount rates used to determine value, taking into account the restrictions on use of public assets.

Recommendations

Valuer-General Victoria should:

- develop appropriate management, performance measurement, and reporting systems to improve quality and timeliness of valuations

- increase the number of client agencies surveyed annually, record issues raised by agencies and act on the feedback received

- review the implementation of its quality management system to:

- develop a risk-based selection process for each type of review increase

- the number of audits (or reviews) undertaken

- subject larger and more complex valuations to further scrutiny by the second reviewer

- improve the quality of feedback to valuers following these audits and reviews

- develop a comprehensive risk management system

- develop an overarching client engagement strategy for communicating with public agencies about the methods and assumptions used in valuations.

- The Department of Sustainability and Environment should engage a suitably qualified, independent body to review Valuer-General Victoria's operations and practices on a triennial basis.

The Department of Treasury and Finance should:

- lead the process to develop comprehensive guidance for valuing physical non-current assets at fair value and include guidance on discount rates

- identify possible alternatives for assessing movements in asset values between formal revaluations.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994 a copy of this report, or relevant extracts from the report, was provided to Valuer-General Victoria, the Department of Sustainability and Environment, and the Department of Treasury and Finance with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments are included in Appendix B.

1 Background

1.1 Introduction

Victorian public sector agencies manage more than $170 billion in land, buildings, infrastructure, and other non-current physical assets. Reliable and timely asset valuations are essential for public sector agencies to prepare accurate financial reports.

Under Financial Reporting Direction (FRD) 103D, administered by the Department of Treasury and Finance (DTF), Valuer-General Victoria (VGV) is mandated as the state’s independent valuation service provider unless the Chief Reporting Officer of the relevant portfolio agency approves an exemption and notifies DTF and VAGO.

1.2 The role of Valuer-General Victoria

The position of Valuer-General is a statutory appointment under the Valuation of Land Act 1960.

As the government’s valuation authority, VGV is responsible for:

- valuing public assets for financial reporting purposes

- valuing assets sold, purchased and leased by government agencies

- overseeing valuations provided by private sector valuers to local councils for rating purposes.

In organisational terms, VGV is a branch of the Department of Sustainability and Environment's (DSE) Land Victoria division and uses DSE systems such as human resources and information technology support. The Valuer-General reports to the Executive Director, Land Victoria in DSE for administrative purposes. However, the Valuer-General has a statutory role and VGV's valuation functions are independent of the public or private sector.

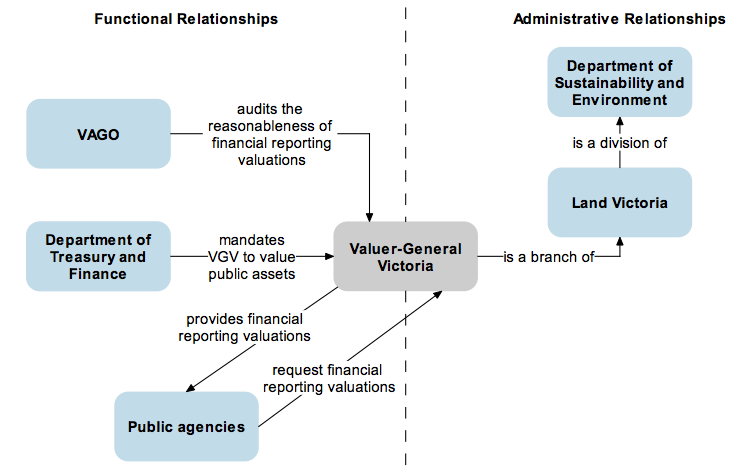

Figure 1A shows VGV's functional and administrative relationships in providing valuations for financial reporting purposes.

Figure 1A

Valuer-General Victoria's relationships in its valuations role

Source: Victorian Auditor-General's Office.

VGV’s role is to manage all government valuations. This involves around 4 500 valuation requests each year. A request relates either to a single asset or to multiple assets needing to be valued. In any given year assets requested to be valued, for sale, purchase, lease, compulsory acquisition or financial reporting purposes are worth approximately $10 billion.

Of the 4 500 valuation requests responded to each year, 60 to 182 are valuation requests for financial reporting purposes and are prepared by qualified valuers at VGV or through an approved panel of about 70 private sector firms. In the years 2008–09 to 2010–11, 98 per cent of the financial reporting valuations were conducted by the private sector panel. In 2011–12, this proportion dropped to 57 per cent.

VGV has been responsible for the financial reporting valuations of public assets, within a five-year cycle, since the issue of FRD 103D in March 2009. This audit focuses on VGV's valuations for financial reporting purposes.

In addition to the financial reporting directions administered by DTF, VGV undertakes financial reporting valuations in accordance with:

- Australian Accounting Standard AASB 116 Property, Plant and Equipment and AASB 136 Impairment of Assets

- International Valuation Application 3, Valuation of Public Sector Assets for Financial Reporting

- Australian Property Institute’s, Australian Valuation Guidance Note 1 Valuations for Use in Australian Financial Reports.

1.3 The role of the Department of Treasury and Finance

In addition to administering FRDs, DTF is also responsible for setting requirements for agency financial reporting, including how asset valuations are reported in financial statements.

1.3.1 Accounting standards and legislation

The Financial Management Act 1994 (the FMA) and Local Government Act 1989 detail the financial responsibilities and reporting requirements of public sector authorities and local government entities respectively.

Each public sector entity must prepare its financial report in accordance with the Australian accounting standards. In addition, those entities that report under the FMA must also comply with FRDs issued by the Minister for Finance.

When preparing and presenting a financial report, an entity’s management or responsible body makes certain assertions about the entity’s financial results and position. In total, there are nine assertions that essentially relate to the recognition, measurement, valuation, and presentation of the income, expenses, assets, liabilities, and equity components of a financial report.

Australian Accounting Standard AASB 116 Property, Plant and Equipment allows an entity to measure its non-current physical assets, that is, its infrastructure assets, property, plant, and equipment, either at cost or at valuation.

1.3.2 Financial Reporting Direction 103D

For entities required to report under the FMA framework, FRD 103D requires public sector entities to measure assets at fair value. The appropriate recognition amount for land, buildings, and infrastructure assets is their fair value less any subsequent accumulated depreciation and impairment losses. Therefore, when presenting its financial report, management is asserting that it has reported the land and buildings at an appropriate value or amount.

1.4 VAGO's role in the valuation process

Australian Auditing Standard ASA 315, Identifying and Assessing the Risks of Material Misstatement through understanding the Entity and its Environment, requires VAGO to use the financial report assertions to identify and assess the risk of potential material errors in the financial report’s material components.

Once VAGO has identified assertions at risk, it must then perform procedures aimed at obtaining evidence to support the appropriateness of the assertions made by management to mitigate the risk of material misstatement of the component.

The evidence for each assertion and component is then accumulated to support VAGO’s overall conclusion that it has obtained reasonable assurance that the financial report as a whole is free from material misstatement. VAGO is then in a position to form an opinion that the financial report is fairly presented.

Generally, land, buildings, and infrastructure assets are material components of a public sector’s financial report. As a result, VAGO's financial audits focus on the risk of material misstatement of the valuation financial report assertion.

If there is a risk that land, buildings and/or infrastructure assets have not been recognised in the financial report at an appropriate value, VAGO's financial auditors will design audit procedures to reduce the risk associated with the valuation assertion. These procedures generally include an assessment of the valuation expert engaged by management, including their qualifications and methodology, and a reasonableness test of the assumptions and review of the property details used in the fair value calculation. The auditors then use the evidence obtained in tandem with other evidence to support their overall opinion on the financial report.

1.5 Client agencies' role

Agencies are responsible for the asset valuations included in their financial reports and are required to assess the reasonableness of those valuations independently of the VGV. Client agencies also play an important role in ensuring the timeliness of valuations, and are responsible for providing accurate asset information required by valuers in a timely manner so that deadlines can be met. It is also important that agencies understand the basis of valuations, as they must be confident in using these in their financial reporting.

Under FRD 103D, an agency must use VGV to value its assets, unless the Chief Reporting Officer—the officer responsible for an agency’s submission of financial statements to DTF—approves the use of an alternative valuer. When deciding on a request for an alternative to VGV, the Chief Reporting Officer must consult with VAGO and VGV. If an alternative valuer to VGV is engaged, DTF and VAGO need to be advised of this.

1.6 The asset valuation function

Public asset valuation is important to individual agencies and the state as a whole. It underpins agencies' ability to account, through annual financial reports, for the value of assets they hold. At the aggregate level, any major misstatements of asset values in these financial reports can lead to inaccuracies in the assessment of the state’s financial position, determination of public revenue, allocation of resources and planning for future public services.

Due to the specialised nature of the valuation process, management need to engage expert valuers to prepare the fair value calculations and therefore support the amount at which the asset is recognised in the financial report submitted for audit.

Consequently, VGV’s role in providing agencies with reliable asset valuations is a highly important function.

1.6.1 Fair value

Fair value is defined by accounting standards as the amount for which an asset could be exchanged between knowledgeable, willing parties in an arm’s length transaction. However, if no market evidence exists because of the specialised asset type or because the asset is rarely sold as a stand-alone unit, fair value may be estimated using other approaches.

Fair value will be significantly influenced by which valuation approach or methodology is being applied. The choice of valuation methodology should consider, among other things, the:

- uses of the asset

- expected method of return on the asset

- availability of comparable sale information

- purpose of the asset

- legal constraints on the asset.

Therefore, the value of public sector assets, such as land used to provide government services, may be based on the value of surrounding properties discounted to reflect the government restrictions on the use of the asset. For example, the value of land under or around schools will be less than the surrounding residential land of a similar size because the land can only be used for school purposes.

1.6.2 The challenge of public asset valuations

While some of the assets held by public sector agencies are similar to those used for commercial purposes, many assets are specialised and create unique valuation challenges, as there are no ready sources of comparison to assist in assigning values.

If no relevant market evidence exists, fair value must be estimated and this can pose challenges for consistency in valuations.

The challenge in valuing public assets is not unique to Victoria. The Australian Government Financial Reporting Council report on Managing Complexity in Financial Reporting 2012 found that, despite the drive towards a common international accounting framework, there are instances where significantly different values have been assigned to similar, if not identical, assets and liabilities.

Recognising the challenges in certain valuations, the Public Accounts and Estimates Committee's 2002 report on the valuation of infrastructure and arts assets recommended that DTF develop a comprehensive asset valuation implementation strategy to provide policy guidance, training, and support to agencies and to facilitate the exchange of knowledge and experience among agencies. FRD 103D was introduced in March 2009 as part of DTF’s response to these recommendations.

1.7 Audit objective and scope

The audit assessed whether VGV provides an efficient and effective valuation service to the public sector for financial reporting. The audit examined whether VGV:

- effectively engages with agencies receiving valuation services

- manages its valuation services efficiently and effectively

- provides valuations in a timely manner and at a reasonable cost

- has appropriate quality assurance processes over valuations, including those prepared by the panel of valuers.

It also examined DTF's role in the valuation process in terms of guidance provided.

This audit has adapted the Audit Office of New South Wales’ ‘lighthouse model’ of good public sector governance to assess VGV’s efficiency. The model is based on the Australia Stock Exchange’s Corporate Governance Principles and Recommendations and the components of the model relevant to VGV’s assessment are:

- solid foundations for management and oversight

- ethical and responsible decision-making

- recognition and management of risk

- management of key stakeholders.

In addition to discussions with DTF staff and an examination of relevant departmental documentation, the audit focused on VGV’s valuations prepared for financial reporting purposes. This included:

- an examination of VGV’s documentation and discussions with VGV staff

- a survey of public agencies that had recently used the financial reporting valuation services of VGV and discussions with agency staff

- a survey of members of the VGV panel of valuers who undertake financial reporting valuations for VGV.

1.8 Audit method and cost

The audit was conducted in accordance with section 15 of the Audit Act 1994 and Australian Auditing and Assurance Standards. Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated, any persons named in this report are not the subject of adverse comment or opinion.

The cost of the audit was $370 000.

1.9 Structure of the report

Part 2 assesses the Valuer-General Victoria's role in public asset valuation.

Part 3 examines the guidance for the public asset valuation process.

2 Valuer-General Victoria

At a glance

Background

Valuer-General Victoria (VGV) is the state's mandated valuer for financial reporting asset valuations. Given the impact of VGV's valuations on public sector agencies and the state's financial position, VGV needs to have effective governance systems in place to ensure that its valuations are reliable, robust, timely and cost-effective.

Conclusion

VGV has poor governance arrangements and its processes for assuring the validity of valuations are not rigorous. There is insufficient information for management to track effectively the delivery and timeliness of valuations. Past client engagement has also not been effective, although there is evidence of some recent improvement.

Findings

- VGV does not have a strategic plan, a risk management program or a stakeholder engagement strategy. It has insufficient reporting internally to management and externally to stakeholders about performance.

- It has inadequate management oversight of performance and operates without effective benchmarks to gauge performance. The result is that it operates inefficiently and the service provided to a client is often late.

- VGV's quality assurance is based on compliance checking. It needs to conduct more in-depth scrutiny of methods and apply professional judgement to generate an acceptable level of assurance of its valuations.

- There has been no independent review of VGV's valuation services.

Recommendations

Valuer-General Victoria should:

- develop appropriate management, performance measurement, and reporting systems to improve quality and timeliness of valuations

- increase client surveys and act on the feedback received

- review the implementation of its quality management system

- develop a comprehensive risk management system

- develop an overarching client engagement strategy.

The Department of Sustainability and Environment should engage an independent body to review Valuer-General Victoria's operations.

2.1 Introduction

As the state's independent valuation authority, it is important that Valuer-General Victoria (VGV) provides valuations that are reliable, timely, cost-effective and supported by robust assurance and governance processes. In carrying out its duties, VGV should engage and communicate effectively with its stakeholders.

2.2 Conclusion

In certifying their financial statements, agencies are required to assess the reasonableness of valuations included in those statements, and rely on VGV’s valuations in doing so.

As the government's mandated professional authority, VGV provides independent valuations to clients who are required to use its services. Despite essentially being a monopoly service provider, it is not subject to oversight or independent review and is itself responsible for ensuring that it meets relevant standards and its own quality assurance mechanisms. As a result, VGV's governance arrangements and processes for assuring high quality advice and valuations should be of the highest order.

This audit has identified a number of weaknesses in VGV’s governance arrangements. These include:

- inadequate management oversight, with no strategic plan, insufficient reporting internally to management and externally to stakeholders about performance

- no risk management program aligned to its role as the government's mandated professional valuations authority

- no stakeholder engagement strategy.

VGV's processes for assuring the validity of its valuation are not rigorous. Its quality assurance is based on a compliance review system relating to relevant standards and directions. Although compliance checking is an important threshold requirement, additional quality assurance checks are required to provide confidence that methods and professional judgements have been appropriately applied. Nevertheless, client agencies must decide whether to accept VGV’s valuations.

VGV has inadequate business management processes. These include poor project management, inadequate reporting to management and mainly paper-based rather than electronic records management. It does not have effective performance management targets or benchmarks to guide its monitoring and reporting of performance.

2.3 Current issues with Valuer-General Victoria’s operations

There are four main issues with VGV’s services. These relate to timeliness, ensuring cost-effectiveness, relationships with agencies and transparency of valuation advice.

2.3.1 Timeliness

The timeliness of VGV's valuations is critical to agencies being able to meet their financial reporting obligations. Agencies need sufficient time to consider valuation reports to meet their financial reporting time lines. To enable this VGV needs to establish clear milestones in the valuation process and monitor progress against these.

While VGV provides agencies with a due date for the final report in its valuation initiation letter, it does not adequately monitor whether it meets these due dates. Consequently, it frequently does not meet the standards of timeliness that agencies expect and that VGV has committed to.

In 2011–12, approximately 50 per cent of valuations completed were delayed. Of these nearly 70 per cent were two or more weeks late. As part of this audit, a survey of VGV's client agencies showed that 50 per cent of all respondents were dissatisfied with VGV’s timeliness in delivering the final report. In the 2010–11 water sector revaluations, 10 of the 11 agencies were dissatisfied with timeliness. Additionally, since 2008, VGV’s own annual client surveys have shown that timeliness has been an ongoing issue for a number of years.

While agencies play an important role in the timeliness of valuations, and are responsible for providing information to VGV within reasonable time frames, VGV's project management of the process has a greater influence on when valuation advice is finally delivered.

Despite timeliness being a recurring issue, VGV has not taken action to reduce late valuations. VGV needs to improve its performance by actively monitoring how it is meeting time lines and managing any issues affecting its timeliness. It should also plan for and start the valuation process earlier where warranted.

VGV's 2012–13 business plan, produced in November 2012, has a target that ‘90 per cent of its valuations supporting major government projects would be completed within agreed time frames’.

However, it is not clear whether this 90 per cent target applies to other valuations, including those for financial reporting, which are the focus of this audit.

It is also not clear how time frames are agreed with the government project clients.

VGV should establish delivery milestones and report progress against these to management regularly to enable tracking of timeliness and overall targets. These matters are discussed further in Section 2.5, which relates to VGV's governance arrangements. Better communication with agency clients about their responsibility in providing timely inputs to the valuations would also assist the process.

2.3.2 Cost-effectiveness

VGV has established a panel of valuers and uses a competitive quoting process to select a suitable valuer for each financial reporting valuation. To be on the panel, firms have to have competitive hourly rates in addition to the prerequisite skills and experience. This model has the necessary attributes to enable VGV to drive cost efficiencies in the conduct of financial valuation services.

However, VGV does not have any documented benchmarks or targets around the typical cost (or fees), size, and scope of valuations for particular sectors. As a result, it is difficult to assess the extent to which the valuations represent value for money.

VGV imposes an administration fee for its valuation services. However, it does not apply a transparent, documented and consistent method of determining this fee. This administration fee varies between 10 to 20 per cent of the total fee charged, but the basis for the different charges is not documented. VGV’s administrative fee should reflect the actual cost of administration and quality assurance undertaken on individual valuations.

VGV has advised that it intends to use the historical cost data collected to benchmark its valuation fees. Adopting such an approach will provide a valuable means of both assessing future performance and driving efficiency improvements.

However, VGV should also benchmark its costs and fees against those of other valuers, particularly those of Valuer-General offices in other Australian jurisdictions. Although care needs to be taken to make sure that like is compared with like, Victoria's valuation service could be benchmarked against a similar state such as New South Wales. Alternatively, segments of the valuation service, such as valuations conducted for schools, could be benchmarked against this area of activity in a range of other states. This benchmarking could provide further valuable information on different cost components and the comparisons used to identify cost drivers that apply in Victoria as a first step in improving the cost-effectiveness of the valuation service

2.3.3 Relationships with agencies

There are problems in the relationship between VGV and many of its agency clients. This audit conducted a survey of a sample 41 agencies that had used VGV's services during the 2010–11 and 2011–12 reporting cycles. Of the 28 agencies that responded 56 per cent (15) were satisfied with the valuation services provided by VGV, while 29 per cent (eight) were dissatisfied, and 15 per cent (four) were very dissatisfied. The dissatisfaction rate was much higher among the water agencies.

Dissatisfaction among water agencies was particularly evident when VAGO's report, Water Entities: Results of the 2010–11 Audits, identified a range of issues that affected the valuation services provided to that sector. This included industry engagement, project management and quality assurance processes.

The issues the water agencies raised included VGV’s communication and client engagement on valuation methodology used, type of asset information required and the sufficiency of contact maintained throughout the valuation process. These issues are examined in Section 2.5.1.

2.3.4 Transparency of valuation advice

As an independent body that public sector agencies are required to use for valuations, VGV should provide a high degree of transparency about its processes and advice. However, this is not the case.

There is not enough detail in the final valuations reports for clients to readily understand and have confidence in VGV's advice.

Lack of transparency has resulted in some agencies having concerns about valuations for financial reporting that have not been addressed. VGV could have addressed these problems earlier if it:

- provided more information to public sector agency clients about the process and approach to the valuations and the factors that ultimately influenced the final valuation

- had a more rigorous quality assurance system (discussed in Section 2.4.1)

- had a stakeholder engagement strategy, which enabled it to communicate with stakeholders about the mechanisms used to assure valuation advice.

2.4 Assuring valuation advice

Agencies are responsible for the asset valuations included in their financial reports and are required to assess the reasonableness of those valuations independently of the VGV. There are instances where this has led to significant valuation amendments. In addition to reasonable agency scrutiny, the VGV has a key responsibility to provide valuations that can be relied on and to do this should apply the highest standards of assurance.

VGV has a quality assurance system in place but this focuses on compliance checking rather than in-depth scrutiny of valuation decisions.

2.4.1 Valuer-General Victoria’s quality assurance

VGV has to comply with a number of Australian accounting and international valuation standards, as well as Financial Reporting Direction (FRD) 103D.

VGV has a system of quality assurance mechanisms in place to check that it meets these various requirements and has ISO accreditation. This accreditation means that VGV has a quality management system that meets the standard of the International Organization for Standardization. Although this accreditation is an important threshold requirement, it cannot and does not provide assurance about the quality of the actual valuations that VGV produces.

VGV’s quality management system (QMS) applies to all its valuations and not just those conducted for financial reporting purposes. It principally consists of a series of audits and reviews applied to valuations. It includes:

- file audits

- field audits

- panel audits, of external valuers on the VGV panel

- second valuer reviews

- VGV’s yearly surveys of agencies.

Although VAGO’s audit focused on valuations provided for financial reporting purposes, analysis of the mechanisms that apply to all valuations was necessary. These audit and review mechanisms are chiefly compliance based.

Further, it is not clear that the files sampled in these audits and reviews are based on any consistent risk-based methodology.

VGV needs to conduct more in-depth scrutiny of methods and professional judgement applied to generate an acceptable level of assurance of its valuations. It should consider strengthening its existing quality control mechanisms to provide greater assurance about the rigour and quality of its valuations. The role of the various QMS elements and the numbers completed are summarised in Figures 2A and 2B, respectively.

Figure 2A

Valuer-General Victoria quality assurance mechanisms

Quality assurance mechanism |

Purpose |

Comment |

|---|---|---|

File audits |

To check compliance with QMS processes that correct forms used |

Limited quality assurance as only checks compliance with set process |

Panel audits |

Checks that panel members meet requirements for being on panel |

Compliance check only at an organisational level |

Field audits |

To allow VGV staff to check processes and methods being used by panel valuers |

Provides more in depth quality assurance, but is limited by the low number of audits undertaken |

Second valuer review |

A VGV internal valuer checks each financial reporting valuation |

Could be used as a more in depth check but in practice works more as a compliance check |

Annual survey of clients |

To get feedback from clients about issues to improve |

Not apparent how the feedback is used for continuous improvement |

Source: Victorian Auditor-General's Office based on information from Valuer-General Victoria.

Figure 2B

Valuer-General Victoria quality assurance mechanism numbers

Quality assurance mechanism |

Goal |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

|---|---|---|---|---|---|---|---|

File audits |

330 |

247 |

272 |

284 |

338 |

303 |

344 |

Panel audits |

17 |

15 |

11 |

19 |

19 |

17 |

16 |

Field audits |

8 |

19 |

15 |

13 |

49 |

8 |

8 |

Second valuer review |

All |

All |

All |

All |

All |

All |

All |

Annual survey of clients(a) |

n.a. |

n.a. |

n.a. |

45 |

60 |

60 |

23 |

(a) 'Annual survey of clients' is for the financial year, i.e. the figure for 2009 is for 2008–09 year.

Source: Victorian Auditor-General's Office based on information from Valuer-General Victoria.

File audits

File audits are based on standardised checklists, and are conducted for all areas of VGV's valuation services. VGV sets a goal for file audits of 330 valuations per year (or around 7 per cent of the total 4 500 valuations requests) but actual audits have fallen short of this goal in some years, with 303 completed in 2011 and 284 in 2009. By the end of 2012, VGV completed 344, which is 14 more than the annual goal.

File audits cover compliance with QMS processes, particularly valuation files in the use of standard forms, appropriate approvals, and letters. Any compliance-based deficiencies identified are reported on a standard form and an improvement form is generated where further action is required to improve processes. However, VGV does not record any of these improvement forms or actions centrally, and therefore cannot analyse this information for systemic trends, use it to guide improvement and readily understand whether the improvements have occurred.

These audits provide assurance that valuations meet the basic standards required in valuation reports. Developing and using a risk-based methodology for selecting the files to sample has the potential to provide a more robust check that the valuations comply with the required standards.

Panel audits

VGV requires that all valuers who undertake valuations for financial reporting, and internal valuers who provide other valuation services, be appropriately qualified and skilled and that their independence is maintained during the process.

VGV undertakes panel audits, which involve it attending a panel member’s office to check its compliance with VGV requirements for being on the panel. This includes checking whether the firm is ISO certified, the qualifications of staff undertaking valuations and continuing professional development and work capacity, as well as retention, quality, and security of valuation documentation.

Panel audits do not examine individual valuation projects. On average, VGV conduct 16 panel audits per year (or 22 per cent) of the approximately 70 panel members. A targeted approach for identifying valuers that are of the highest concern, particularly if the concern was informed by systematic reporting of issues identified in file audits, would provide greater assurance about external valuers' ability to perform valuations.

Field audits

Field audits check whether panel valuers have used an appropriate methodology. In these audits VGV staff observe and monitor the processes and methods used by panel valuers.

Field audits are also important because VGV is heavily dependent upon external valuers to deliver its program of valuations for financial reporting purposes. This makes it even more important to have rigorous checks to assure the quality and consistency of the advice provided through the panel members.

VGV aims to conduct only eight field audits per year on financial reporting valuations, out of a total of about 60 to 182 conducted each year (or 4 to 13 per cent). VGV completed eight field audits in 2012.

Field audits have the potential to improve the consistency of the valuations and form an important component of VGV’s quality assurance methodology. Increasing the number of field audits conducted would increase assurance that appropriate methodologies were used.

Second valuer review

In a second valuer review, VGV allocates a valuer to each financial reporting valuation undertaken. VGV’s QMS outlines the responsibilities of the second valuer for financial reporting valuations as part of the standard operating procedures and for checking the valuation before issue of the report.

The second valuer signs a checklist as evidence that review processes have been undertaken. While the checklist covers a range of matters including methodology, the review is limited to an examination of the draft report provided by the valuer—it does not include a review of the valuer’s supporting working papers.

VGV advised that the second valuer could call for working papers of the panel valuer if there are concerns over the content and accuracy of the valuation report. It would be reasonable to expect that from time to time the second valuer would need to review these working papers to assure themselves of the rigour of the approach and because of the range of size and complexity of asset valuations. However, this audit found no evidence of such reviews.

As with field audits, there is scope to provide greater assurance about the rigour and quality of the valuations by enhancing the second valuer review mechanism to increase the level of in-depth scrutiny of the working papers and other details undermining the valuations.

Annual survey of clients

VGV engages an independent external contractor to conduct an annual survey of its client agencies, including financial reporting clients. Numbers surveyed have dropped recently, with 45 agencies surveyed in 2008–09, 60 in 2009–10, and 2010–11, and only 23 in 2011–12. A larger sample size would provide results that are more robust. VGV has advised that it will be surveying 60 client agencies in 2012–13.

VGV's past surveys have highlighted issues around communication and time lines. However, although these surveys have the potential to improve VGV's service, there is no evidence that VGV has used any of the analysis presented in the survey reports to improve performance. VGV should use this feedback for continuous improvement.

2.5 Improving operation through better governance

Good governance arrangements make for efficient and effective operations. The issues discussed above in relation to operational shortcomings and weak quality assurance, together with a range of poor internal business management processes, are linked to poor governance.

This section examines governance problems that give rise to the issues set out in Sections 2.3 and 2.4.

2.5.1 Assessing Valuer-General Victoria’s governance

This audit assessed VGV’s operations against the ‘lighthouse model’ of public-sector governance, developed by the Audit Office of New South Wales. This assessment shows that VGV is not operating efficiently and effectively.

Figure 2C details VGV’s current practices against model practice.

Figure 2C

Valuer-General Victoria’s current practices against model practices

Governance component(a) |

Model practice(b) |

Current VGV practice |

Rating |

|---|---|---|---|

Management oversight |

|||

Strategic and business plans |

Requirement for agencies to prepare a rolling (for example, three years) strategic plan and a yearly business plan, distributed to key stakeholders. |

VGV does not have any strategic plan in place. It has a business plan, but it does not cover all of its operations. |

Partly met |

Reporting against plans |

Regular performance reporting on the implementation of plans to stakeholders. |

VGV does not have adequate reporting to allow senior management to oversee its performance and operations. It does not report performance data to external stakeholders. |

|

Ethics and standards |

|||

Ethics and code of conduct |

Requirement for a comprehensive code of conduct which includes conflict of interest policy, standard of professional and ethical behaviour and a training requirement for employees. |

VGV uses the Australian Property Institute’s (API) code of conduct for its valuations work. VGV’s valuations work is based on the standards set by API, International Valuations Standards Council, AASB, and the Department of Treasury and Finance’s FRD 103D. |

Partly met |

Compliance with standards and legislation |

Compliance policy and plan that cover how compliance is identified, monitored and reported |

VGV’s ISO certified quality assurance framework provides a review process for compliance with these standards. However, the framework needs to be improved to provide a greater degree of assurance. |

|

Fraud and corruption control policy including plan for controlling fraud. |

There are no fraud and corruption policies or plans specifically for the valuation function. |

||

Risk management |

|||

Risk management program |

Agencies should detail organisation-wide risks and develop practical and sufficient internal controls to minimise risks to as low as reasonably possible. |

VGV does not have an organisation-wide risk management program aligned to its role in managing all government valuations. |

Not met |

Key stakeholder engagement |

|||

Agencies should establish a consultative forum or other official consultative process. Agencies should tailor communications to the needs and requirements of the clients. |

VGV does not have a client engagement strategy in place, although there have been recent initiatives aimed at improving communication with clients. |

Not met |

|

(a) Based on the Audit Office of New South Wales’ ‘lighthouse model’ for public-sector governance.

(b) Based on Clayton Utz’s work on the ‘lighthouse model’.

Source: Victorian Auditor-General's Office based on information from Valuer-General Victoria.

Management oversight

VGV does not have a strategic plan and has indicated that it relies on the Department of Sustainability and Environment’s (DSE) strategic plan. VGV needs its own strategic plan, given the highly specialised nature of its business and its operational autonomy. Any strategic plan developed by DSE or Land Victoria cannot provide the level of detail required for real strategic direction setting for VGV.

VGV finalised a 2012–13 business plan in November 2012. This plan includes VGV's objectives to:

- manage the municipal revaluation program

- provide quality government valuations

- review rating authority valuations

- ensure that it has the capability to deliver its core business requirements.

VGV's business plan states that it will complete all valuations on time and on budget in accordance with legislation and certification requirements. However, the business plan does not contain deliverables or the related targets to cover all of its valuation services.

In addition to a lack of strategic planning, there are problems with the day-to-day arrangements for running the business. VGV management and administrative systems and processes are out-dated which, in turn, impact on the effectiveness of its business operations.

There are fortnightly reports to senior management on the number of valuations assigned to each valuer. However, these reports have no performance measures for budget and timeliness, or metrics to assist senior management in overseeing its financial reporting valuation services, or to highlight where there are problems.

There are no formal systems in place to assign valuation projects to valuers or to assist in scheduling valuations. Many of the administrative systems, processes, and documents used by VGV for financial reporting valuations are manual and paper based, with significant risk for administrative errors and inefficiencies. This means that information on valuations is not always readily available when required.

VGV’s poor systems and processes limit its ability to identify systemic weaknesses and drive improvements in internal operations and service outcomes.

There has been no independent review of VGV's operational arrangements and performance. Given the nature of governance issues identified in this audit, and the implications for VGV's efficiency and timeliness in delivering financial reporting valuations to the public sector, VGV's operational arrangements and performance should be independently reviewed on a regular basis.

As VGV is administratively a branch in DSE's Land Victoria division, DSE should engage a suitably qualified independent body to review VGV's operations and practices on a triennial basis.

Ethics and standards

VGV bases its practices on API’s Code of Professional Conduct. All of VGV’s valuers—internal or external—have professional certification from API. API also coordinates all ongoing issues around valuations with the International Valuation Standards Council.

VGV’s ISO certified quality assurance framework provides a review process for compliance with these standards. However, as noted in Section 2.4, improvements need to be made to this framework to provide a greater degree of assurance.

Additionally, VGV does not have fraud and corruption prevention policies or plans which have been developed specifically for the valuation function. This is of concern, given the nature of the valuation function, the need for confidence in VGV advice and the lack of external scrutiny. Fraud and corruption prevention policies or plans are an important means of VGV demonstrating the integrity of its operations to government and to it agency clients.

Risk management

Risk management and mitigation are very important for the efficient operations of any public sector agency. However, VGV does not have an organisation-wide risk management program in place. It cannot rely on DSE or Land Victoria’s risk frameworks, as these do not address the specific nature of the valuation function and attendant risks. VGV should detail its organisation-wide risks and develop practical and sufficient internal controls to minimise these risks as far as reasonably possible.

Key stakeholder engagement

As noted in Section 2.3, there are problems in the relationship VGV has with many of its agency clients. VGV does not have a client engagement strategy, and as a result, communication between parties is not always effective. If VGV had provided clear information to clients about the methodology chosen, the reasons for this choice and the assumption and other inputs used to derive valuations, some of these communication problems could have been avoided or dealt with early.

In addition to concerns not being addressed, the poor relationship and lack of effective communication has led to some agencies misunderstanding certain key aspects of the valuation process.

For example, this audit identified that staff from some agencies expected that they could use financial reporting valuations for a variety of purposes despite VGV providing contrary advice that valuations conducted under FRD 103D apply for financial reporting purposes only. VGV has acknowledged that there continues to be a lack of understanding by public agency staff about valuations and their various uses. This reaffirms the need for VGV to more actively inform and educate agencies about the valuation process and function.

When public sector agencies present their financial reports, they are asserting that they have reported the land and buildings at an appropriate value or amount. Given this responsibility, VGV in turn has a responsibility to explain clearly the basis for its valuation so that more agencies are confident that the valuations used in financial reporting are appropriate.

In the past 18 months, VGV has employed a financial reporting valuations manager who, from the client agencies that VAGO surveyed, has had a positive impact on VGV's stakeholder engagement. There has been more contact with some clients early in the valuation process. This is a positive step and shows that VGV is moving in the right direction in this important area of business operations. However, VGV needs to develop a comprehensive stakeholder engagement strategy, and embed good client engagement in its operations.

Recommendations

Valuer-General Victoria should:

- develop appropriate management, performance measurement, and reporting systems to improve quality and timeliness of valuations

- increase the number of client agencies surveyed annually, record issues raised by agencies and act on the feedback received

- review the implementation of its quality management system to:

- develop a risk-based selection process for each type of review

- increase the number of audits (or reviews) undertaken

- subject larger and more complex valuations to further scrutiny by the second reviewer

- improve the quality of feedback to valuers following these audits and reviews

- develop a comprehensive risk management system

- develop an overarching client engagement strategy for communicating with public agencies about the methods and assumptions used in valuations.

The Department of Sustainability and Environment should:

- engage a suitably qualified independent body to review Valuer-General Victoria’s operations and practices on a triennial basis.

3 Guidance for public asset valuation

At a glance

Background

Clear and practical guidance to public agencies and valuers for public asset valuations is important for consistency and reliability in asset reporting in financial statements.

Public agencies use indices calculated by Valuer-General Victoria (VGV) and distributed by the Department of Treasury and Finance (DTF) to estimate asset valuations between formal revaluations every five years. VGV also uses discount rates to take into account constraints on use of public assets which mean they cannot be valued at market rates, but need to be 'discounted' based on their use.

Conclusion

DTF’s financial reporting direction for non-current physical assets, Financial Reporting Direction (FRD) 103D, does not provide sufficient guidance to VGV on valuation of infrastructure assets.

Findings

- Following a 2002 Public Accounts and Estimates Committee report recommendation, DTF developed a financial reporting direction for non-current physical assets.

- However, DTF has not provided sufficient guidance on valuation of infrastructure assets. This deficit became evident with the 2010–11 revaluations of water sector assets.

- There have been ongoing stakeholder issues related to usage of discount rates and indices.

Recommendations

The Department of Treasury and Finance should:

- lead the process to develop comprehensive guidance for valuing physical non‑current assets at fair value and include guidance on discount rates.

- identify possible alternatives for assessing movements in asset values between formal revaluations.

3.1 Introduction

For reliable and consistent reporting in financial statements, it is important that public sector agencies and valuers have clear and practical guidance.

The Department of Treasury and Finance (DTF) is administratively responsible for the Financial Reporting Directions (FRD) and setting government requirements for agency financial reporting, including how asset valuations are reported in financial statements.

Clear and practical guidance to public agencies and valuers for public asset valuations is important for consistency and reliability in asset reporting in financial statements. Although Valuer-General Victoria (VGV) operates autonomously, DTF has an important role in administering the financial reporting framework for public agencies and providing guidance for public asset valuations.

Recognising the requirement for such guidance, the Public Accounts and Estimates Committee (PAEC) in its 2002 report on valuing infrastructure and arts assets, recommended that DTF develop a comprehensive asset valuation implementation strategy to provide policy guidance, training and support to agencies and to facilitate the exchange of knowledge and experience among agencies. DTF, in its response to PAEC's report, did not support these recommendations.

3.2 Conclusion

DTF has designed a financial reporting direction for non-current physical assets—FRD 103D. However, this direction does not provide sufficient guidance to VGV and public sector agencies on valuation of infrastructure assets. To assure the consistency of public asset valuations, DTF should, using VGV as a key informant, develop and provide detailed practical guidance to assist the valuation of public sector assets. This guidance should, at a minimum, seek to address inconsistencies with discount rates used to assign value to government assets and indices used to estimate value between full valuation processes.

3.3 Agency issues with asset valuations

There are two specific aspects of asset valuations of concern to some public agencies:

- interim revaluations using indices

- inconsistent discount rates.

3.3.1 Indices

Valuations are time consuming and costly so full valuations are only required every five years for financial reporting on assets.

Between the scheduled five yearly revaluations, public agencies use indices calculated by VGV and distributed by DTF on its website to estimate the value of their assets each year for their financial reports. The methodology to determine these indices was proposed by DTF and accepted by VAGO and VGV. It has been in place since 2007.

These indices are based on sales data and postcodes. For example, an index of 1.02 for a certain postcode means that, based on sales data in that area, the value of assets in the area has risen by 2 per cent for the year.

As public agencies are the end-users of the indices and have to sign-off and accept the asset valuations calculated, it is important that indices work as intended, which is to provide a reasonable estimate of asset values between formal revaluations. The survey of agencies undertaken as part of this audit indicates that the accuracy of indices to determine movements in asset values between revaluations has not been satisfactory to them. This widespread concern with the model provides impetus for its review.

A formal revaluation by VGV is mandated by FRD 103D if an estimate increases asset value by 40 per cent or more. The 40 per cent variation threshold has never been reached. It may be that this threshold is too high to serve as an effective trigger for review.

DTF has advised that this 40 per cent threshold was established and agreed with VAGO to balance the need to update asset values and provide useful and relevant information for financial reporting against the high costs of undertaking formal valuations by external valuers. It further stated that this process has been developed to comply with the requirement of the Australian Accounting Standard AASB 116 Property, Plant and Equipment, as shown in Figure 3A.

Figure 3A

Frequency of revaluations – AASB 116

On the frequency of revaluations, AASB 116 states that:

‘...the frequency of revaluations depends upon the changes in fair values of the items of property, plant, and equipment being revalued.

When the fair value of a revalued asset differs materially from its carrying amount, a further revaluation is required.

Some items of property, plant and equipment experience significant and volatile changes in fair value, thus necessitating annual revaluation.

Such frequent revaluations are unnecessary for items of property plant and equipment with only insignificant changes in fair value. Instead, it may be necessary to revalue the item only every three or five years.’

Source: Victorian Auditor-General's Office from the Australian Accounting Standard AASB 116 Property, Plant and Equipment.

DTF should, in consultation with VGV, VAGO and agencies, review whether the 40 per cent figure used to trigger formal revaluations by VGV is adequate for both the current economic conditions and the range of assets being valued.

DTF should also review the methodology used to determine these indices and consider whether an alternative approach may be justified.

3.3.2 Discount rates

The FRD 103D requires fair valuations of assets to take into account the highest and best use of assets for which market participants would be prepared to pay. Highest and best use is the most probable use of the asset after consideration of any legal or constructive restrictions imposed on the asset, and any public announcements or commitments made in relation to the intended use of the asset. This is likely to result in government assets being valued based at market value and then discounted to reflect their restricted use.

Discount rates applied to highest and best valuations to determine the fair value of public assets have a significant impact on the value of the assets recorded in the financial statements of agencies. The amount of discount applied to a property’s value depends on risk factors—including political, planning, social, economic, commercial and court precedent.

The value of the asset in the market place is discounted to reflect the degree of restriction or use. For example, heritage parks are likely to be discounted somewhere in the vicinity of 60 per cent. For cemeteries and national parks, the likelihood of the asset being sold is low, which is reflected in the higher discount rates applied to these properties.

The valuer is responsible for determining the discount rates. Relevant international and local valuation standards provide little or no advice on how the valuer is to determine these discount rates.

Discount rates can have a significant impact on asset values. A survey of agencies, undertaken as part of this audit, found that using different discount rates in the valuation of the same or similar assets has led to some confusion. There is a need for better guidance on discount rates to be used for particular types of assets. DTF should lead the process to develop comprehensive guidance for valuing physical non-current assets at fair value and include guidance on discount rates and valuing different types of assets. DTF should use VGV as a key informant in developing this guidance.

3.4 The Department of Treasury and Finance’s role in providing clear guidance

The PAEC 2002 report on the valuation of infrastructure and arts assets recommended that DTF provide guidance on the valuation of these assets. DTF, in its response to PAEC's report, did not support these recommendations. Appendix A provides further detail on the recommendations the PAEC report made to DTF.

DTF has designed a financial reporting direction for non-current physical assets—FRD 103D. However, this direction and the related guidance notes issued by DTF, together with existing professional advice do not provide sufficient guidance to VGV and public sector agencies on valuation of infrastructure assets. This deficit was evident with the 2010–11 revaluations of the water sector infrastructure assets.

FRD 103D should provide greater guidance to VGV valuers. As noted above, there is a role for clearer guidance on such things as the calculation of discount rates, so that consistent rates are used for the same type of asset.

New South Wales Treasury’s 2007 accounting policy paper for valuing physical non‑current assets at fair value for general purpose financial reporting provided detailed guidance with examples to assist valuers and agencies.

DTF should consider this guidance document in developing clearer guidelines for VGV to assist in providing greater clarity about, and consistency in, valuations.

DTF should also develop a process to regularly review and update the guidance in consultation with VGV and public sector agencies to ensure it is sufficiently detailed and robust.

Recommendations

The Department of Treasury and Finance should:

- lead the process to develop comprehensive guidance for valuing physical non‑current assets at fair value and include guidance on discount rates

- identify possible alternatives for assessing movements in asset values between formal revaluations.

Appendix A. PAEC's report on valuing infrastructure

The Public Accounts and Estimates Committee’s (PAEC) October 2002 report, The Valuation and Reporting of Cultural, Heritage and Infrastructure Assets, concluded that:

'...the Department of Treasury and Finance needs to develop a comprehensive Asset Valuation Implementation Strategy focused on providing policy guidance, training and support to agencies as well as facilitating the exchange of knowledge and experience among agencies. This will ensure that a more consistent, reliable and cost-effective approach is applied across the Victorian Public Sector'.

The relevant recommendations in the report are:

Recommendation 3.2: The Department of Treasury and Finance issue practical guidance to agencies on:

- the intent and objectives of the prescribed valuation methods

- the application of the optimisation process to determine the optimised depreciated replacement cost for infrastructure assets

- the valuation of road and bridge infrastructure

- the appropriate accounting treatment for determining items to be capitalised or charged as maintenance (for example, periodic resealing of roads)

- the application of the recoverable amount test to those commercial agencies that are subject to price control or receive community service obligation payments from the government

- the valuation approach to be adopted for those cultural or heritage assets that are difficult to value in a reliable manner

- the application of sampling methods to asset valuation (including the valuation of collection assets)

- the determination of the replacement cost for collection assets, including whether the preparation and documentation costs should be added to the re-collection costs.

Recommendation 4.1: The Department of Treasury and Finance:

- provide further detailed practical guidance to agencies on depreciation methods

- facilitate the exchange of information across agencies so benchmarking of depreciation practices within specific sectors can be established.

Recommendation 4.2: The accounting approach to depreciation be fully integrated into the asset management processes of agencies.

Recommendation 4.3: A whole-of-government approach be applied to improve the asset management systems of agencies and to facilitate agencies’ migration to best practice.

Recommendation 4.4: The Department of Treasury and Finance establish clear guidelines on how depreciation and maintenance expenses are to be determined by agencies for accounting, budgeting and pricing purposes.

Recommendation 5.1: Agencies establish formal arrangements, with the assistance of the Department of Treasury and Finance, to facilitate:

- the sharing of knowledge, experience and information on valuation methods across the public sector

- the development of cost-minimisation techniques for future valuations.

Appendix B. Audit Act 1994 section 16—submissions and comments

In accordance with section 16(3) of the Audit Act 1994 a copy of this report was provided to Valuer-General Victoria, the Department of Sustainability and Environment (DSE) and the Department of Treasury and Finance with a request for submissions or comments. Following machinery of government changes, DSE became part of the new Department of Environment and Primary Industries.

The submissions and comments provided are not subject to audit nor the evidentiary standards required to reach an audit conclusion. Responsibility for the accuracy, fairness and balance of those comments rests solely with the agency head.

Responses were received as follows:

Further audit comment:

Acting Auditor-General’s response to the Department of Treasury and Finance

The Department of Treasury and Finance (DTF) has commented that it has responsibility for articulating the State’s financial reporting framework, but does not see itself as the lead agency in developing valuation guidance for public assets. Audit opinion is that to articulate the financial reporting framework and meet its responsibilities under the Financial Management Act 1994, DTF is required to provide direction on a range of financial matters to the public sector. Leading the development of better valuation guidance for public assets is therefore consistent with DTF’s responsibilities.

In addition to DTF's leadership role in the development of better valuation guidance for public assets, Valuer-General Victoria has the important function of providing technical expertise.