Water Entities: 2014–15 Audit Snapshot

Overview

For the financial year ended 30 June 2015, 15 water entities received clear audit opinions for both their financial and performance reports. The four metropolitan water entities received modified audit opinions for their financial reports, due to errors with the valuation of their infrastructure assets. These errors led to a combined overstatement to the value of infrastructure assets of $1.3 billion at 30 June 2015. Modified opinions were also issued on the performance reports for these entities as the errors also impacted the calculation of three financial performance indicators.

Our review of the financial sustainability risks of the water sector shows that, despite an increase in the sector’s net profit before income tax as compared to the prior year, there are short-term liquidity risks for the metropolitan and regional urban water entities given the amount of short-term debt held at 30 June 2015. There are also longer-term financial sustainability risks associated with the water sector's ability to replace and renew assets, and to repay debt.

The water entities continue to have a significant dependency on debt to finance capital projects, and other obligations, as they don’t generate sufficient revenue from operations to be able to fund this investment.

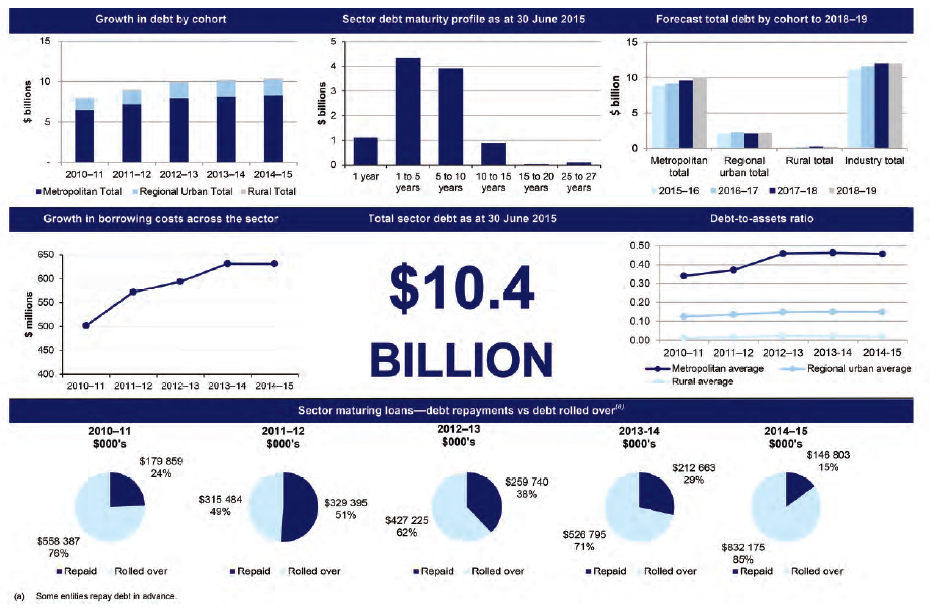

Over the past five years the Victorian water sector has increased their level of debt by 29 per cent. At 30 June 2015, the water sector had borrowings of $10.4 billion. This also represents a quarter of all borrowings held by the state at this date.

Further, over the past five years, over 70 per cent matured loans (equating to $2.7 billion) have not been repaid by the sector––they have been rolled over. Eight entities across the sector did not repay any debt over this period, and only three water entities have a formal debt management plan or strategy. Longer-term financial risks exist for the sector if this situation continues.

Water Entities: 2014–15 Audit Snapshot: Message

Ordered to be published

VICTORIAN GOVERNMENT PRINTER December 2015

PP No 109, Session 2014-15

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on Water Entities: 2014–15 Audit Snapshot.

This report comments on the outcomes of the financial audits of the 19 water entities for the year ended 30 June 2015. It informs Parliament about significant issues arising from the audits of both the financial and performance reports.

Qualified audit opinions were issued on the four metropolitan water entities' financial reports for 2014–15, as they contained errors in the fair valuation of infrastructure assets. These errors triggered consequential impacts to the performance reports of these entities, therefore qualified audit opinions were also issued on their performance reports.

The report also highlights the sector's financial outcomes, risks to financial sustainability and trends in debt across the sector for the past five years.

Yours faithfully

Dr Peter Frost

Acting Auditor-General

10 December 2015

Auditor-General's comments

|

Dr Peter Frost Acting Auditor-General |

Audit team Roberta Skliros—Engagement Leader Jan-Michael Perez—Team Leader Jie Yang—Team member Richard Ly—Team member Engagement Quality Control Reviewer Travis Derricott |

The Parliament and community can have confidence in the 2014–15 financial and performance reports of 15 of the 19 water entities.

I issued qualified audit opinions on the four metropolitan water entities' financial reports for 2014–15, as they contained errors in how the entities struck the fair value of their infrastructure assets. These errors led to a combined overstatement to the value of infrastructure assets of $1.3 billion at 30 June 2015. These errors also impacted the accuracy of three of the financial performance indicators reported in the metropolitan water entities' performance reports, therefore, I also issued qualified audit opinions on those reports.

The sector generated a combined net profit before income tax of $430.6 million for the year ended 30 June 2015, an increase of $109.7 million from 2013–14. Fifteen water entities reported an improvement in their net result (including a reduction in deficits), with only four delivering a loss before income tax, compared to six last year. Despite the improvement in short-term results for the majority of the sector, when analysing risks to financial sustainability there is liquidity risk for the metropolitan and regional urban water entities given the quantum of short-term debt held, and there are also longer-term risks associated with the water sector's ability to replace or renew assets and to repay debt.

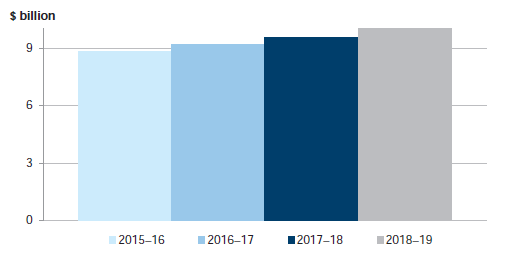

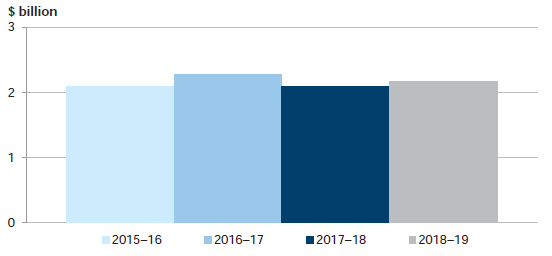

The level of borrowings in the water sector increased by 29 per cent, from $8 billion in 2010–11 to $10.4 billion in 2014–15, representing a quarter of the state's borrowings. The metropolitan cohort holds 80 per cent of the total debt portfolio. The growth in borrowings has funded the delivery of major capital projects and has been held to meet certain other payments, such as dividends. Borrowings are also expected to increase by a further 19 per cent in the period to 2018–19, based on forecasts from the entities' 2014–15 corporate plans.

There continues to be significant dependency on debt to finance capital projects, as water entities do not generate sufficient revenue from operations to be able to fund this investment. Further, over the past five years, of the $3.7 billion of loans maturing, $2.7 billion, or greater than 70 per cent, of these loans have not been repaid—they have been rolled over. Eight entities across the sector did not repay any debt over the five-year period. Longer-term financial risks exist for the sector if the sole source of funding capital projects continues to be predominantly from debt and the debt continues to be rolled over and not repaid at similar rates. Lastly, only three water entities had formal debt management plans or strategies.

Dr Peter Frost

Acting Auditor-General

December 2015

Audit Summary

This report details the outcomes of the 2014–15 financial audits of Victoria's 19 water entities.

The report identifies and discusses the key issues within the water sector that arose during our audits, and provides an analysis of information included in water entity financial reports and performance reports. It is one of a suite of Parliamentary reports on the results of the 2014–15 financial audits conducted by VAGO.

Conclusions

Fifteen water entities received clear audit opinions on their financial reports for the financial year ended 30 June 2015, and four entities received qualified audit opinions. The Parliament and the community can have confidence in those reports with clear opinions.

Qualified opinions were issued to the four metropolitan water entities as they had an error in the fair valuation of infrastructure assets, leading to a combined overstatement of the value of infrastructure assets and the corresponding infrastructure asset revaluation reserve of $1.3 billion at 30 June 2015 ($417.0 million at 30 June 2014).

All four metropolitan water entities had inappropriately accounted for deferred tax benefits in their fair value calculation. In addition, Melbourne Water had also inappropriately accounted for developer contributions in their fair value calculation. These errors constitute a departure from Australian Accounting Standard AASB 13 Fair Value Measurement and triggered consequential impacts to the performance reports of these entities Therefore, qualified audit opinions were also issued on their performance reports.

The overall financial performance of the water sector has shown an improvement for the 2014–15 reporting period.

Despite the improvement in short-term results for the majority of the sector, when analysing risks to financial sustainability there are liquidity risks for the metropolitan and regional urban water entities given the quantum of short-term debt held, and there are also longer-term risks associated with the sector's ability to replace or renew assets and to repay debt.

The level of borrowings in the water sector increased by 29 per cent, from $8 billion in 2010–11 to $10.4 billion in 2014–15. Over the past five years, of the $3.7 billion of loans maturing, $2.7 billion, or greater than 70 per cent, of these loans have not been repaid—they have been rolled over. Further, only three water entities had separately identifiable debt management strategies.

Findings

Financial outcomes

The overall financial performance of the water sector has shown an improvement for the 2014–15 reporting period, on an already positive result recorded last year.

The sector generated a combined net profit before income tax of $430.6 million for the year ended 30 June 2015, an increase of $109.7 million from the prior year. Fifteen water entities reported a growth in their net result—including a reduction in their net deficits—with only four delivering a loss before income tax, compared to six in 2013–14.

In 2014–15, dividends paid by the four metropolitan water entities totalled $120.8 million, an increase of $82.4 million on 2013–14.

Despite the improvement in short-term results for the majority of the sector, when analysing risks to financial sustainability, there are liquidity risks for the metropolitan and regional urban water entities given the quantum of short-term debt held, and there are also longer-term risks associated with the sector's ability to replace or renew assets and to repay debt.

General internal controls

At the commencement of the 2014–15 reporting period, 54 high- and medium-risk issues raised by VAGO since the 2011–12 reporting period remained unresolved. At the end of the reporting period, two high-risk and 16 medium-risk issues raised in prior years remain unresolved.

Our Water Entities: Results of the 2013–14 Audits report, tabled in Parliament in February 2015, analysed the management of gifts, benefits and hospitality across the four metropolitan water entities and the operations of audit committees across all 19 water entities. Nine issues were raised across the water sector. At the end of the 2014–15 reporting period, three issues relating to gifts, benefits and hospitality and two issues relating to audit committees remain unresolved.

Performance reporting

Clear audit opinions were issued on 15 of the 19 performance reports for the 2014–15 reporting period, with four qualified opinions being issued to the metropolitan water entities. This was because three of the financial performance indicators were impacted by the valuation errors included in their financial reports.

Last year's Water Entities: Results of the 2013–14 Audits report highlighted that the performance reporting processes of the water entities were not as mature or developed as those for financial report preparation. This is again apparent for the 2014–15 reporting period.

Water entities need to place a greater focus on the processes employed to prepare performance reports, such as:

- designating responsible officers for the overall preparation of reports

- maintaining a central repository for collation of data used to support the performance report

- implementing a formalised independent quality review process

- preparing quality shell performance reports.

Trends in debt management

At 30 June 2015, the Victorian water sector debt held 25 per cent of the state's overall borrowings. The level of borrowings in the water sector increased by 29 per cent, from $8 billion in 2010–11 to $10.4 billion in 2014–15.

The growth in borrowings has funded the delivery of major capital projects and has been used to meet certain other operating costs. There has been, and continues to be, significant dependency on debt to finance capital projects, as water entities do not generate sufficient revenue from operations to be able to fund this investment. Over the past five years, of the $3.7 billion of loans maturing, $2.7 billion of these loans or greater than 70 percent have not been repaid—they have been rolled over. Eight entities across the sector did not repay any debt over the past five years.

Based on the water entities' 2014–15 corporate plans, borrowings are expected to increase by a further 19 per cent in the period to 2018–19. This is largely driven by the metropolitan water cohort. The increase in debt has been forecast to fund capital expenditure programs and to meet other obligations, such as dividend and tax payments.

Funding capital projects from borrowings is an appropriate mechanism, particularly when the funds are used to construct larger-scale assets with extended useful lives, as costs associated with the assets are spread across future generations. However, longer-term financial risks exist for the sector, if the sole source of funding capital obligations continues to be predominantly from debt and the debt continues to be rolled over at similar rates.

We identified that only three water entities had formal debt management plans or strategies. For the remainder of the sector, some elements of a debt management plan were captured within other corporate documents such as corporate plans and treasury policies.

There is no mandatory requirement for a water entity to have a separate debt management plan, however, given the financial impact and longer-term risk debt has on water entities, we recommend that water entities have in place a dedicated plan or strategy, that maps out their approach to debt management and usage over the medium and longer term.

Recommendations

-

That water entities: address issues raised in audit management letters on a timely basis so that any weaknesses in their control environment are rectified promptly.

-

That metropolitan water entities: change their current valuation model used to estimate the fair value of infrastructure assets to correct the errors identified by audit in the qualification.

-

That water entities: enhance their performance reporting processes to:

- designate a responsible officer for the overall preparation and production of the performance report

- maintain a central repository for collation of data used to support the performance report

- implement a formalised, independent quality review process over the preparation processes and presentation of the performance report

- prepare quality shell performance reports

- critically assess the requirements of Ministerial Reporting Direction (MRD) 01 Performance Reporting, including providing adequate training or guidance to staff preparing the performance reports.

-

That the Department of Environment, Land, Water & Planning: conducts a more robust review of water entities' draft corporate plans to detect any disparities with MRD 01 and undertakes a comprehensive review of MRD 01 non-financial KPIs for consistency.

-

That water entities: establish a dedicated debt management strategy or plan that maps out their approach to debt management and usage over the medium and longer term.

Submissions and comments received

We have professionally engaged with all 19 water entities, the Department of Environment, Land, Water & Planning, the Department of Treasury & Finance, the Essential Services Commission and the Treasury Corporation of Victoria throughout the preparation of this report. In accordance with section 16(3) of the Audit Act 1994 we provided a copy of this report, or relevant extracts, to named agencies and requested their submissions or comments.

We have considered those views in reaching our audit conclusions and have represented them to the extent relevant and warranted. Their full section 16(3) submissions and comments are included in Appendix F.

1 Context

1.1 Introduction

This report details the outcomes of the 2014–15 financial audits of Victoria's 19 water entities. In addition, there are two controlled entities, where one no longer actively trades, and the other is captured in the consolidated results of the parent entity. As a result, no further comments are made on the results of these audits throughout this report.

The report identifies and discusses the key issues within the water sector that arose during our audit conduct, and provides an analysis of information included in water entity financial reports and performance reports. It is one of a suite of Parliamentary reports on the results of the 2014–15 financial audits conducted by VAGO.

Figure 1A outlines the structure of this report.

Figure 1A

Report structure

|

Part |

Description |

|---|---|

|

Part 1 Context |

Provides an overview of the Victorian water sector, results of the financial and performance report audits and discusses key emerging matters for the sector. It also discusses the internal control and financial reporting issues identified during the 2014–15 financial audits, and provides an update on prior year issues raised. |

|

Part 2 Financial outcomes |

Comments on the financial outcomes of the 19 water entities for the 2014–15 financial year, including a discussion of some key financial issues impacting the 2014–15 financial reports. Provides insight into the financial sustainability risks of the water sector based on the trends of financial sustainability indicators over a five-year period. |

|

Part 3 Performance reporting |

Comments on performance reporting in the water sector. |

|

Part 4 Trends in debt management |

Comments on the trend in borrowings, repayments and costs of servicing debt across the water sector over the past five years. It also comments on the extent of debt refinancing (or rollover) and explores the risks to financial sustainability in light of current debt management practices. |

Source: Victorian Auditor-General's Office.

Pursuant to section 20(3) of the Audit Act 1994, unless otherwise indicated any persons named in this report are not the subject of adverse comment or opinion.

The total cost of this report was $212 000.

1.2 Victorian water sector

1.2.1 Snapshot of the sector

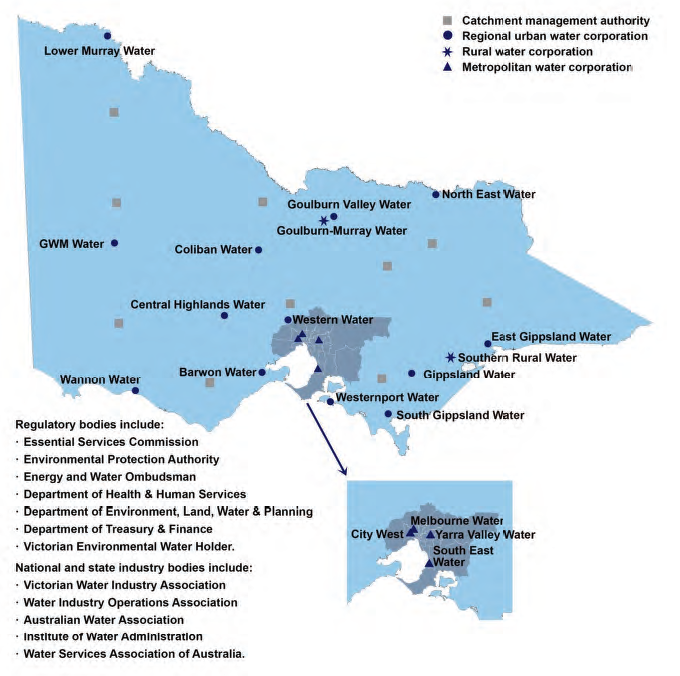

Figure 1B outlines the Victorian water sector:

Figure 1B

Victorian Water Sector

Source: Victorian Auditor-General's Office.

The Victorian water sector includes 21 public sector entities, comprising 19 water entities and two controlled entities. Appendix A of this report includes a list of all 21 entities. This report solely focuses on the results of audits relating to the 19 water entities.

The entities are stand-alone businesses responsible for their own management and performance and provide a range of water services, including the supply of water and/or sewerage services to customers across the state. Several of them also manage bulk water storages and specific recreational areas throughout Victoria.

The 19 water entities are split into three operating areas—metropolitan, regional urban and rural—with each entity providing services within its designated area. Each water entity is governed by a constituted board that has a range of responsibilities, including:

- steering the entity

- setting objectives and performance targets

- ensuring compliance with legislation and government policy.

The board of each water entity reports to the Minister for Environment, Climate Change and Water via the Department of Environment, Land, Water & Planning (DELWP). In turn, the minister is responsible for reporting to Parliament on the performance of each water business.

The Water Act 1989 is the central legislation for the Victorian water industry. Its objectives include:

- promoting the orderly, equitable and efficient use of water resources

- ensuring that water resources are conserved and properly managed for sustainable use for the benefit of all Victorians

- maximising community involvement in the making and implementation of arrangements relating to the use, conservation or management of water resources.

In addition to these water entities, there are 10 catchment management authorities (CMA), established under the Catchment and Land Protection Act 1994 (Vic). The CMAs are responsible for coordinated catchment management in their region and are provided with regional waterway, floodplain, drainage and environmental water reserve management powers under the Water Act 1989. The results of the audits for the CMAs are not captured by this report, they are included in our Portfolio Departments and Associated Entities: 2014–15 Audit Snapshot.

The water sector is also regulated by a number of key agencies, as shown in Figure 1B, who are responsible for setting economic, environmental and social obligations upon water entities, such as the Essential Services Commission (ESC) and DELWP.

Figure 1B also highlights some key industry bodies, such as the Victorian Water Industry Association (VicWater), which plays an important role by seeking to influence government policy, providing forums for industry discussions on priority issues, and disseminating news and information to key industry stakeholders.

1.2.2 Regulatory pricing model for the sector

Since 1 January 2004, the ESC has been responsible for regulating and approving the maximum prices each water entity may charge its customers for the supply of water and the provision of sewerage services. The ESC sets prices in accordance with the requirements of the Essential Services Commission Act 2001 (the Act), the Water Industry Act 1994, and the Water Industry Regulatory Order. The ESC has approved prices for metropolitan and regional urban businesses since 1 July 2005 and for rural businesses since 1 July 2006.

Its role includes the regulation of prices and monitoring of service standards, and market conduct.

The Act states that the ESC's objective is to promote the long-term interests of Victorian consumers with regard to the price, quality and reliability of essential services.

In order to achieve this, the ESC needs to take into consideration:

- efficiency in regulated entities and incentives for long-term investment

- the financial viability of regulated entities

- existing and potential competition within the sector

- the relevant health, safety, environmental and social legislation

- the benefits and costs of regulation for consumers—including low income or vulnerable consumers—and regulated entities

- consistency in regulation between state jurisdictions and on a national basis.

Taking this into consideration, the ESC has conducted a price review every three to five years since 2004. As part of this review, water entities are required to provide the ESC with a water plan. The ESC then determines the maximum prices for each water entity's prescribed goods and services.

Water Plan 3, 2013–14 onwards

In October 2012, the 19 water entities submitted water plans that covered the period 1 July 2013 to 30 June 2018 to the ESC for assessment.

Each entity was required to set out in its plan:

- expected costs of delivering water and sewerage services

- planned capital works programs

- forecast volumes of water to be delivered

- level of service to customers

- proposed prices that would raise sufficient revenue to recover expected costs.

The ESC assessed the proposed prices and revenue against the regulatory principles set out in the Water Industry Regulatory Order 2012.

The ESC's final price determinations in relation to Water Plan 3 were released in June 2013. They apply for all entities except Goulburn-Murray Water and Melbourne Water from 1 July 2013 to 30 June 2018—or when the ESC makes a new determination. The determinations of Goulburn-Murray Water and Melbourne Water cover a three-year period to 30 June 2016.

Overall, the ESC's final decision reduced the water entities' proposed revenue by:

- $1 billion for metropolitan water entities—this includes revenue estimates for years four and five for Melbourne Water

- $200 million for regional urban water entities

- $13 million for rural water entities.

The ESC assessed that water entities were able to deliver services at a lower cost and thus adjusted the water entities' proposed:

- operating expenditure—for example, labour

- productivity improvements

- capital programs and, therefore, financing costs.

The average price increase for each water cohort over the third regulatory period, excluding the impact of inflation, is shown in Figure 1C.

Figure 1C

Average price increase for water entities from the third regulatory period

|

Water cohort |

Average change (per cent) |

|---|---|

|

Metropolitan retailers |

22.20 |

|

Regional urban |

1.27 |

|

Rural |

0.75 |

Source: Victorian Auditor-General's Office.

1.3 Audits for the year ended 30 June 2015

1.3.1 Financial audit opinions issued

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information reported is reliable and accurate. A clear audit opinion confirms that the financial report presents fairly the transactions and balances for the reporting period, in accordance with the requirements of relevant accounting standards and applicable legislation. Fifteen clear audit opinions and four qualified audit opinions were issued to the water entities for the financial year ended 30 June 2015.

A qualified audit opinion is issued when the auditor cannot be satisfied that the financial report is free from material misstatement.

The financial audits of the water entities were undertaken in accordance with the Australian Auditing Standards.

Qualified audit opinions

Qualified audit opinions were issued on the four metropolitan water entities' financial reports for the 2014–15 financial reporting period. The qualified opinions were issued as the reports had an error in the fair valuation of infrastructure assets.

All four metropolitan water entities had inappropriately accounted for deferred tax benefits in their fair value calculation. In addition, Melbourne Water had inappropriately accounted for developer contributions in its fair value calculation. These errors are a departure from Australian Accounting Standard (AASB) 13 Fair Value Measurement.

In our view, the error in the fair value models of each metropolitan water entity had the following estimated financial report impact on the carrying value of infrastructure assets and the infrastructure asset revaluation reserve.

Figure 1D

Estimated overstatement/(understatement) of infrastructure assets valuation and infrastructure asset revaluation reserve

|

Entity |

30 June 2015 ($ million) |

30 June 2014 ($ million) |

|---|---|---|

|

City West Water |

161.9 |

155.0 |

|

South East Water |

279.5 |

248.0 |

|

Yarra Valley Water |

391.8 |

334.0 |

|

Melbourne Water |

514.0 |

(320.0) |

|

Total impact |

1 347.2 |

417.0 |

Source: Victorian Auditor-General's Office.

The errors also had a consequential impact on the depreciation expense, income tax expense, current tax payable and net deferred tax liabilities for the year ended 30 June 2015—the effects of these errors were not determined as it was not practicable to do so.

As per the requirements of Financial Reporting Direction (FRD) 103F Non-financial physical assets issued pursuant to the Financial Management Act 1994, the metropolitan water entities' infrastructure assets are required to be reported at fair value, with fair value to be determined in accordance with AASB 13.

AASB 13 was effective for reporting periods beginning on 1 July 2013, and provided a more prescriptive definition of fair value as 'the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date'. AASB 13 brought about a key change in considering fair value from a 'market participant's perspective', placing an emphasis on the 'current exit price' that a market buyer would be 'willing to pay'.

The four metropolitan water entities determined the fair value of infrastructure assets using an 'income approach'—based on a discounted cash-flow analysis. The water entities utilised the expertise of an external accounting firm (expert valuer) to either calculate the fair valuation of infrastructure assets annually, or to assist with a review of an internal valuation model and to recommend key assumptions.

The models supporting the fair value approach are complex and involve management estimates and assumptions.

The 'income approach' methodology used by the water entities to determine the fair value of infrastructure assets is summarised in Figure 1E.

Figure 1E

Income approach methodology applied to fair value infrastructure assets

|

Step 1. Forecast the cash flows of the water entity for the next eight years—equates to approximately two regulatory periods. Step 2. Forecast terminal (subsequent) cash flows into perpetuity for the period after the end of eight years. Step 3. Calculate the net present value of these cash flows to derive an enterprise value. Step 4. From the enterprise value, deduct net debt and adjust for surplus assets (if any) to strike an equity value. Step 5. Deduct the value of non-infrastructure assets and add the value of non-infrastructure liabilities from the equity value to strike an implied infrastructure value. Step 6. Increase the infrastructure value by a 'deferred tax gross up factor'. That is, the entities added a nominal value of future tax liabilities to the value of the assets. |

Source: Victorian Auditor-General's Office.

The error identified from our audits related to a flaw in the primary methodology in step 6.

For the retail water entities, the error related solely to the 'deferred tax gross up factor' applied to increase the fair value of infrastructure assets. This factor was applied to take into account tax benefits that a potential buyer (market participant) would receive if buying the infrastructure assets. The factor applied was at nominal value.

The application of general present value techniques is a requirement when using an income approach to strike fair value under AASB 13. We concluded that when applying such a factor, any potential buyer would factor in the timing of when the cash flow savings from these tax benefits would arise and discount these benefits to net present value. Consequently, we were of the view that the fair values determined were materially overstated.

For Melbourne Water, we identified that the tax cash outflows within the discounted cash-flow model were based on an accounting rather than tax-based depreciation, which in turn were based on an accounting written down value (fair value) of the infrastructure assets rather than a tax-based written down value (cost less cumulative tax depreciation) of the infrastructure assets.

Melbourne Water had already included the present value of deferred tax benefits within their cash-flow model in steps 1 and 2, and therefore did not need to apply a 'deferred tax gross up', as this would be duplicating the impact. Consequently, we were of the view that the fair value of infrastructure assets was overstated. We also identified that Melbourne Water inappropriately accounted for developer contributions in the discounted cash-flow model.

The water entities collectively disagreed with our view that there is an 'error' in the methodology and engaged their expert to consider an alternate valuation scenario. This approach took into account the error identified by our audit, however, it also changed several significant assumptions we had not previously commented on. It was not indicative of the impact of matters identified by our audit, therefore it did not change our view. The 2015–16 financial year presents an opportunity for the metropolitan water entities to rectify this issue as it is a revaluation year, as discussed in Part 1.4.

1.3.2 Performance audit opinions issued

Clear audit opinions were issued on 15 of the 19 performance reports, with four qualified audit opinions being issued for the 2014–15 reporting period. A clear audit opinion confirms that the actual results reported on the performance report were fairly presented and complied with legislative requirements. A qualified audit opinion is issued when the auditor cannot be satisfied that the performance report is fairly presented.

We do not form an opinion on the relevance or appropriateness of the reported performance indicators as they are set by Ministerial Direction. The audits were undertaken in accordance with the Australian Auditing Standards.

Qualified audit opinions

The audits of the 2014–15 financial reports of the metropolitan water entities identified errors in the fair value of infrastructure assets. Consequently certain values used to calculate three of the financial performance indicators—gearing ratio, return on assets and return on equity—were impacted, and the actual results for 2013–14 and 2014–15 were reported in error. For further detail on the outcomes of the performance reporting for 2014–15, please refer to Part 3 Performance reporting.

1.3.3 General internal controls and financial reporting

Effective internal controls help entities to reliably and cost-effectively meet their objectives. Strong internal controls are a prerequisite for the delivery of reliable, accurate and timely external and internal financial reports.

In our annual financial audits we focus on the internal controls relating to financial reporting and assess whether entities have managed the risk that their financial reports will not be complete and accurate. Poor internal controls diminish management's ability to comply with relevant legislation, and increase the risk of fraud and error.

The governing body of each water entity is responsible for developing and maintaining internal controls that enable:

- preparation of accurate financial records and other supporting documentation

- timely and reliable external and internal reporting

- appropriate safeguarding of assets

- prevention and detection of errors and other irregularities.

The Standing Directions of the Minister for Finance require management to implement effective internal control structures. In this Section we have included:

- internal control weaknesses or financial reporting issues commonly identified across the 19 water entities in 2014–15

- analysis of the status of prior period control weaknesses or financial reporting issues.

Commonly identified internal control weaknesses or financial reporting issues

In conducting our financial audits, we observed that the financial reporting internal controls at the water entities, to the extent we tested those controls during our audit, were adequate for maintaining the reliability of financial reporting. Nevertheless, we identified a number of instances where important internal controls need to be strengthened or financial reporting matters need to be addressed.

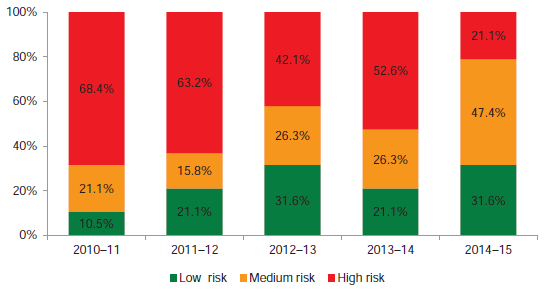

During the 2014–15 reporting period, audit teams identified 108 internal control weaknesses or financial reporting issues, which were reported to management and audit committees. Figure 1F shows the number of issues identified by risk rating for extreme, high and medium risks—it excludes 37 low-risk issues.

The definitions of each risk rating are detailed in Appendix B.

Figure 1F

2014–15 reported issues by topic and risk rating

|

Risk rating of issue |

||||

|---|---|---|---|---|

|

Area of issue |

Extreme |

High |

Medium |

Total |

|

Information technology(a) |

– |

11 |

20 |

31 |

|

Infrastructure assets, property, plant and equipment(b) |

4 |

– |

11 |

15 |

|

Revenue & receivables |

– |

– |

8 |

8 |

|

Expenses & payables |

– |

– |

4 |

4 |

|

Other |

– |

1 |

4 |

5 |

|

Reconciliations |

– |

1 |

4 |

5 |

|

Employee benefits |

– |

– |

1 |

1 |

|

General journals |

– |

– |

1 |

1 |

|

Cash and cash equivalents |

– |

– |

1 |

1 |

|

Total |

4 |

13 |

54 |

71 |

|

Percentage |

6% |

18% |

76% |

100% |

(a) Information technology issues relating to the billing system have been included in the 'revenue & receivables' area of issue.

(b) The four extreme risk issues related to the metropolitan water entities' qualification errors outlined in Part 1.3.

Note: Figure 1F excludes low-risk issues raised.

Source: Victorian Auditor-General's Office.

Extreme- and high-risk issues across the sector

In 2014–15, 17 extreme- and high-risk issues were identified across the water sector relating to:

- fair valuation of infrastructure assets at the four metropolitan water entities, leading to qualified audit opinions on both the financial and performance reports

- tax effect accounting-related matters, resulting in material prior period error restatements to a water entity's financial report

- preparation and review of key general ledger reconciliations not occurring periodically across the reporting period

- improvements required to information technology (IT) security controls such as user access management, disaster recovery capabilities, patch management and authentication controls.

Common issues across the sector

More broadly, common areas requiring improvement to controls or financial reporting processes across the sector for 2014–15 were:

- IT system related matters

- monitoring, maintenance and accounting for infrastructure assets, property, plant and equipment

- monitoring, maintenance and user access within revenue billing systems.

Information technology

IT controls protect computer applications, infrastructure and information assets from a wide range of security and access threats. They promote business continuity, minimise business risk, reduce the risk of fraud and error, and help meet business objectives.

There is extensive reliance on IT across the water sector, and systems are continually upgraded and replaced to improve information management and the quality of services provided to the community. With the implementation of new IT, the upgrade of existing systems and the continuing emergence of external threats, new security risks to the IT environment can arise regularly.

In our Financial Systems Controls Report: Information Technology 2014–15, tabled in October 2015, we noted the following emerging issues across government, which were also present in water sector management letters raised across the 2014–15 reporting period:

- improvements to IT security controls around user access management authentication controls

- audit logging and monitoring of IT environment

- patch management.

Monitoring, maintenance and accounting for fixed assets

Water entities have substantial fixed assets including infrastructure, land, buildings and plant and equipment. At 30 June 2015 the aggregate value of fixed assets was $41.7 billion. The assets need to be appropriately recorded and maintained, and their condition and use monitored, so that decisions can be made about whether they are appropriately valued and when they need to be replaced.

In addition to the errors identified with the fair valuation of infrastructure assets at the four metropolitan water entities—highlighted in Section 1.3.1—other common issues across the sector relate to:

- the untimely capitalisation of fixed assets at five of the 19 water entities in 2014–15

- untimely disposal of fixed assets from the fixed asset register

- incorrect application of indices to determine the fair value of buildings under the requirements of FRD 103F

- failure to adequately record changes in fair valuation techniques

- inconsistent application of approved useful lives.

Monitoring, maintenance and user access within the revenue billing system

In 2014–15, the 19 water entities generated revenue of $5.6 billion, of which $3.3 billion relates to the billing of service and usage charges. The billing masterfile needs to be updated, monitored and maintained appropriately, to minimise the potential risk of fraud or errors. Inadequate monitoring of the billing system can lead to inaccurate charging of revenue and potential revenue foregone—ultimately leading to misstatements in the financial report.

The key issues identified were:

- control weaknesses over the customer and billing masterfile and lack of segregation of duties over amendments to credit notes

- control weaknesses over billing system user access and password management

- weak bad debtor write-off processes.

Water entities should seek to address all issues raised in accordance with the time periods raised in management letters, to remove potential weaknesses in their control frameworks and to reduce the risk of error in their financial reports. Recommended time lines for the resolution of these issues are detailed in Appendix B of this report.

Status of prior period issues

The status of internal control weaknesses or financial reporting issues identified in prior periods are presented and communicated to water entity management and their audit committees through the current years' management letters. These issues are monitored to ensure weaknesses identified by previous audits are resolved promptly.

Figure 1G shows the internal control weaknesses and financial reporting issues raised in the prior periods, with the resolution status by risk.

Figure 1G

Prior-period issues–resolution status by risk

|

Risk rating of issue |

||||

|---|---|---|---|---|

|

Period issue raised in |

Extreme |

High |

Medium |

Total |

|

Unresolved issues |

– |

2 |

16 |

18 |

|

Resolved issues |

– |

8 |

28 |

36 |

|

Total |

– |

10 |

44 |

54 |

Note: Figure 1G excludes low risk issues raised.

Source: Victorian Auditor-General's Office.

At the commencement of the 2014–15 reporting period, 54 high- and medium-rated issues raised since the 2011–12 reporting period remained unresolved. Across the 2014–15 reporting period, 36 or 67 per cent, of these issues were resolved and closed.

Two high-risk and 16 medium-risk issues raised in prior years remain unresolved. Time frames for resolution of high- and medium-risk rated issues should be within six months of the issue being raised. This means that the control frameworks in place at these entities are not as effective as they should be.

Management should seek to address all issues raised on a timely basis, to rectify any weaknesses in their control environment to mitigate the risk of material errors occurring in their financial statements.

Refer to Appendix B for detail on time lines for resolution by risk rating.

Follow up on Water Entities: Results of the 2013–14 Audits—Focus Areas

Our Water Entities: Results of the 2013–14 Audits report tabled in February 2015 analysed the management of gifts, benefits and hospitality across the four metropolitan water entities and the operations of audit committees across all 19 water entities. Nine issues were raised across the water sector. At the end of the 2014–15 reporting period, three issues relating to gifts, benefits and hospitality and two issues relating to audit committees remain unresolved.

In response to the recommendations in our Water Entities: Results of the 2013–14 Audits report, the Minister for Environment, Climate Change and Water requested that DELWP conduct spot checks on the receipt of gifts, benefits and hospitality at the four metropolitan water entities. As a result, DELWP instigated a review at the metropolitan water entities to ascertain whether they were addressing the recommendations made, and to identify opportunities for improvement to management practices and oversight of gifts, benefits and hospitality that could be applied more broadly across the sector.

From the proactive work conducted by DELWP, an updated policy is currently being finalised, and proposed workshops for training across the sector are being developed to enhance awareness and behaviour around the receipt of gifts, benefits and hospitality. We have conducted a performance audit, Implementing the Gifts, Benefits and Hospitality Framework, scheduled for tabling in December 2015.

1.4 Emerging matters

1.4.1 Government review of water board positions

On 8 April 2015, the Minister for Environment, Climate Change and Water announced that the government would review all board positions (excluding managing directors). All current and prospective board members were encouraged by the government to participate in an expressions of interest process. More than 1 400 people expressed interest in joining one of the 19 water entities' boards following the announcement.

The minister announced the newly appointed board members on 29 September 2015, with positions effective from 1 October 2015. Figure 1H highlights the split between the newly appointed board members and reappointed board members for the 19 water entities, comprising 12 newly appointed chairpersons, with 87 of the 130 (or 67 per cent) being newly appointed members for the sector.

Figure 1H

Composition of the 19 water entities' board positions

|

Composition |

Chairpersons |

Members |

|---|---|---|

|

New members |

12 |

87 |

|

Reappointed members |

7 |

43 |

|

Total |

19 |

130 |

Source: Victorian Auditor-General's Office.

Essential Services Commission—review of water pricing approach

The Water Industry Regulatory Order was revised in October 2014, and now allows ESC to consider a broad range of pricing approaches for Victorian water and sewerage customers. As a result, ESC commenced an extensive consultative review of their pricing approach.

The selected pricing approach(es) will underpin ESC's next major water price review for the fourth regulatory period from 1 July 2018. ESC is expected to release its guidance for the 2018 price review in late 2016.

The review focuses on generating new ideas for the future pricing approach. ESC has also engaged a number of independent regulatory experts to provide their views on alternative pricing approaches. Over the remainder of the 2015 calendar year, ESC will be considering the matters raised in submissions responding to the consultation paper and other papers prepared by the regulatory experts.

Commencement of the pricing submission period effective 1 July 2016

As noted previously, Melbourne Water and Goulburn-Murray Water's current water plans cease on 30 June 2016.

Melbourne Water has commenced the process to set waterway, drainage and wholesale water and sewerage charges for 2016–17 to 2020–21, which will come into effect on 1 July 2016. Consultation closed on 1 July 2015 and the final submission was made on 30 October 2015.

ESC has also commenced its review of Goulburn-Murray Water's price submission for the period 2016–17 to 2020–21, where the final submission was made on 7 September 2015. ESC expects to release a draft decision on Goulburn-Murray Water's prices and services, and another consultation process on the draft decision will occur in March 2016.

2015–16 asset revaluation

A full valuation of property, plant, equipment and infrastructure assets for the water sector is scheduled for the 2015–16 financial year, as per the requirements under FRD 103F—this occurs every five years.

In addition to our audit qualification relating to the fair valuation infrastructure assets of the metropolitan water entities in 2014–15, our review of the 2010–11 fair valuation for regional urban and rural water entities found that improvements could be made to the processes applied to valuing infrastructure assets.

In particular, in our Water Entities: Results of the 2010–11 Audits report we recommended that:

- water entities work with the Department of Treasury & Finance and the Valuer-General Victoria (VGV) to determine the most appropriate valuation methodology for infrastructure assets

- the VGV should ensure all valuations conducted, including those by service providers ,be subjected to rigorous quality assurance processes, and that appropriate effort is invested in establishing agreement with client entities before valuations are conducted.

In preparation for the upcoming revaluation year (2015–16), the water industry has proactively formed an inter-agency working group, which is being administered by the industry body, VicWater. The group consists of representatives from the water entities, VGV, DELWP and the Department of Treasury & Finance, and observers from VAGO.

The revaluation process will be a significant area of focus for water entities during 2015–16 and a key focus area for our audit program.

Recommendations

- That water entities address issues raised in audit management letters on a timely basis so that any weaknesses in their control environment are rectified promptly.

- That metropolitan water entities change their current valuation model used to estimate the fair value of infrastructure assets to correct the errors identified by audit in the qualification.

2 Financial outcomes

At a glance

Background

This Part looks at the collective 30 June 2015 financial position of the 19 water entities. It details the main drivers behind the net results achieved, and analyses the sector's financial sustainability risks.

Conclusion

The financial performance of the water sector has shown an improvement for the 2014–15 reporting period. The sector generated a combined net profit before income tax of $430.6 million for the year ended 30 June 2015, an increase of $109.7 million from the prior year. Fifteen water entities reported a growth in their net result (or reduction in their net deficit), with only four entities delivering a loss before income tax, compared to six in 2013–14.

Despite the improvement in short-term results for the majority of the sector, when analysing risks to financial sustainability there are weak liquidity risk results for the metropolitan and regional urban water entities given the quantum of short-term debt held, and longer-term risks associated with the sector's ability to replace/renew assets and to repay debt.

Findings

- The commencement of the former Fairer Water Bills initiative led to rebates or tariff reductions being provided to Victorian customers, effective 1 July 2014.

- In 2014–15, dividends paid by the four metropolitan water entities totalled $120.8million, an increase of $82.4 million on 2013–14. No interim dividend was determined for Melbourne Water for 2014–15 due to an outstanding income tax related matter.

- At 30 June 2015, the sector controlled $42.9 billion in total assets—$41.9billion at 30 June 2014—and had total liabilities of $20.4 billion—$20.2billion in 2014.

- Interest‑bearing liabilities increased by $146.3 million during the year, largely due to increases in borrowings to fund capital and other obligations.

2.1 Introduction

This Part looks at the collective 30 June 2015 financial position of the 19 water entities. It details the main drivers behind the net results achieved, and analyses the sector's financial sustainability risks.

Accrual-based financial reports enable an assessment of whether water entities generate sufficient surpluses from their operations to maintain services, fund asset maintenance or renewal and repay debt. Their ability to generate surpluses is subject to the regulatory environment in which they operate and their ability to minimise costs and maximise revenue.

An entity's financial performance is measured by its net profit or loss—the difference between its revenues and expenses. An entity's financial position is measured by reference to its net assets—the difference between its total assets and total liabilities.

2.2 Conclusion

The financial performance of the water sector has shown an improvement for the 2014–15 reporting period.

The sector generated a combined net profit before income tax of $430.6 million for the year ended 30 June 2015, an increase of $109.7 million from the prior year. Fifteen water entities reported a growth in their net result (or reduction in their net deficit), with only four delivering a loss before income tax, compared to six in 2013–14.

Despite the improvement in short-term results for the majority of the sector, when analysing risks to financial sustainability there are weak liquidity risk results for the metropolitan and regional urban water entities given the quantum of short-term debt held, and longer-term risks associated with the sector's ability to replace or renew assets and to repay debt.

2.3 Financial overview of the sector

2.3.1 Financial performance

Figure 2A provides an overview of the financial performance and position of the Victorian water sector for the current and prior period, by relevant cohort—metropolitan, regional urban and rural.

As can be seen, the metropolitan water cohort—comprising the metropolitan wholesaler and three metropolitan retail water entities—contribute to a significant proportion of the sector's transactions and balances, followed by the 13 regional urban water entities, and then the two rural water entities.

Figure 2A

Financial overview of the sector

2014–15 |

2013–14 |

2014–15 |

2013–14 |

2014–15 |

2013–14 |

2014–15 |

2013–14 |

||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Financial performance |

|||||||||||

Revenue | |||||||||||

Water service and usage charges(a) |

3 252.2 |

3 379.1 |

2 176.8 |

2 335.7 |

917.3 |

893.7 |

158.1 |

149.7 |

|||

Developer contributions |

368.2 |

301.6 |

266.7 |

216.8 |

101.4 |

84.8 |

0.0 |

0.0 |

|||

Fixed and variable charges levied by Melbourne Water to retailers(a) |

1 326.9 |

1 375.4 |

1 326.9 |

1 375.4 |

0.0 |

0.0 |

0.0 |

0.0 |

|||

Other |

604.9 |

523.8 |

427.3 |

356.2 |

51.3 |

54.2 |

126.3 |

113.4 |

|||

Total |

5 552.1 |

5 579.8 |

4 197.7 |

4 284.1 |

1 070.0 |

1 032.7 |

284.4 |

263.1 |

|||

Percentage of total |

100% |

100% |

75.6% |

76.8% |

19.3% |

18.5% |

5.1% |

4.7% |

|||

Expenses |

|||||||||||

Employee benefits |

533.1 |

528.8 |

235.2 |

234.0 |

214.3 |

214.1 |

83.6 |

80.8 |

|||

Depreciation and amortisation |

988.5 |

947.9 |

584.6 |

552.6 |

321.4 |

313.5 |

82.4 |

81.8 |

|||

Operating, administrative and other expenses |

1 212.5 |

1 230.9 |

739.5 |

734.0 |

342.0 |

346.3 |

131.0 |

150.6 |

|||

Finance costs |

1 116.7 |

1 126.1 |

968.6 |

977.9 |

138.3 |

138.1 |

9.8 |

10.1 |

|||

Fixed and variable charges levied by Melbourne Water to retailers (a) |

1 270.6 |

1 425.2 |

1 270.6 |

1 425.2 |

0.0 |

0.0 |

0.0 |

0.0 |

|||

Total |

5 121.5 |

5 259.0 |

3 798.6 |

3 923.7 |

1 016.0 |

1 012.0 |

306.9 |

323.3 |

|||

Percentage of total |

100.0% |

100.0% |

74.2% |

74.6% |

19.8% |

19.2% |

6.0% |

6.1% |

|||

Net result |

|||||||||||

Net result before tax |

430.6 |

320.9 |

399.0 |

360.4 |

54.0 |

20.7 |

-22.4 |

-60.2 |

|||

Net result after tax |

312.2 |

224.4 |

286.1 |

253.7 |

41.5 |

12.7 |

-15.8 |

-41.9 |

|||

Financial position |

|||||||||||

Assets |

|||||||||||

Cash and cash equivalents |

374.2 |

398.2 |

44.4 |

112.4 |

150.5 |

91.6 |

179.3 |

194.2 |

|||

Receivables |

736.9 |

723.8 |

511.2 |

488.6 |

195.8 |

193.8 |

29.9 |

41.4 |

|||

Infrastructure assets, intangible assets, property, plant and equipment and work in progress |

41 699.2 |

40 698.3 |

24 488.4 |

23 579.0 |

11 790.8 |

11 712.7 |

5 420.0 |

5 406.5 |

|||

Other |

137.7 |

126.7 |

86.7 |

74.0 |

47.2 |

46.9 |

3.7 |

5.9 |

|||

Total |

42 947.9 |

41 947.0 |

25 130.7 |

24 254.0 |

12 184.3 |

12 045.1 |

5 632.9 |

5 647.9 |

|||

Percentage of total |

100.0% |

100.0% |

58.5% |

57.8% |

28.4% |

28.7% |

13.1% |

13.5% |

|||

Liabilities |

|||||||||||

Payables, accruals, provisions and other liabilities |

1 079.5 |

1 112.1 |

724.8 |

768.9 |

199.6 |

199.6 |

155.0 |

143.6 |

|||

Interest bearing liabilities (includes finance lease) |

14 791.3 |

14 645.0 |

12 512.6 |

12 374.2 |

2 144.6 |

2 113.7 |

134.1 |

157.2 |

|||

Net deferred tax liabilities |

4 577.9 |

4 429.0 |

2 833.6 |

2 692.0 |

1 076.8 |

1 062.8 |

667.6 |

674.2 |

|||

Total |

20 448.7 |

20 186.1 |

16 071.0 |

15 835.1 |

3 421.0 |

3 376.1 |

956.7 |

975.0 |

|||

Percentage of total |

100.0% |

100.0% |

78.6% |

78.4% |

16.7% |

16.7% |

4.7% |

4.8% |

|||

Equity |

|||||||||||

Contributed capital |

9 119.2 |

9 052.3 |

1 697.0 |

1 697.7 |

4 479.0 |

4 430.5 |

2 943.2 |

2 924.1 |

|||

Revaluation reserve |

8 508.9 |

8 042.6 |

4 562.0 |

4 101.1 |

2 173.0 |

2 167.6 |

1 773.9 |

1 773.9 |

|||

Retained earnings |

4 871.1 |

4 665.1 |

2 800.7 |

2 620.1 |

2 111.2 |

2 070.0 |

- 40.8 |

- 25.0 |

|||

Total |

22 499.2 |

21 760.1 |

9 059.7 |

8 418.9 |

8 763.3 |

8 668.1 |

4 676.2 |

4 673.0 |

|||

Percentage of total |

100.0% |

100.0% |

40.3% |

38.7% |

38.9% |

39.8% |

20.8% |

21.5% |

|||

(a) Inclusive of the impact of the former Fairer Water Bills Initiative contribution.

Note: The above balances

and transactions are derived directly from the published annual reports,

therefore do not eliminate inter-sector entity transactions, nor have they been

adjusted for the combined errors to infrastructure assets and the

infrastructure asset revaluation reserve of $1 347.2 million for

30 June 2015 ($417.0 million for 30 June 2014), as a result of the

metropolitan water entities qualification. Refer to Part 1 of this report for

further detail. Note: Numbers may

vary slightly due to rounding.

Source: Victorian

Auditor-General's Office.

Net result

The 19 water entities generated a combined net profit before income tax of $430.6 million for the year ended 30 June 2015, an increase of $109.7 million or 34 per cent from the prior year. Figure 2B shows the net profit or loss before income tax for each entity for the past two years.

Figure 2B

Net profit/(loss) before income tax, by water entity

Entity |

2014–15 |

2013–14 |

Change |

Change |

|---|---|---|---|---|

Metropolitan |

||||

Melbourne Water |

160.4 |

131.9 |

28.5 |

22 |

City West Water |

47.3 |

36.1 |

11.2 |

31 |

South East Water |

118.3 |

126.4 |

(8.1) |

(6) |

Yarra Valley Water |

73.0 |

66.0 |

7.0 |

11 |

Total |

399.0 |

360.4 |

38.6 |

11 |

Regional urban |

||||

Barwon Water |

16.9 |

11.3 |

5.6 |

50 |

Central Highlands Water |

14.2 |

10.3 |

3.9 |

38 |

Coliban Water |

5.8 |

(4.3) |

10.1 |

235 |

East Gippsland Water |

4.3 |

4.0 |

0.3 |

8 |

Gippsland Water |

1.8 |

4.9 |

(3.1) |

(63) |

Goulburn Valley Water |

7.0 |

2.5 |

4.5 |

180 |

GWMWater |

(9.5) |

(15.1) |

5.6 |

37 |

Lower Murray Water |

(8.4) |

(3.8) |

(4.6) |

(121) |

North East Water |

2.5 |

5.5 |

(3.0) |

(55) |

South Gippsland Water |

0.6 |

(0.4) |

1.0 |

250 |

Wannon Water |

5.0 |

2.6 |

2.4 |

92 |

Western Water |

11.7 |

1.6 |

10.1 |

631 |

Westernport Water(a) |

2.2 |

1.5 |

0.7 |

47 |

Total |

54.1 |

20.7 |

33.4 |

163 |

Rural |

||||

Goulburn-Murray Water |

(17.8) |

(55.5) |

37.7 |

68 |

Southern Rural Water |

(4.7) |

(4.7) |

0.0 |

0 |

Total |

(22.5) |

(60.2) |

37.7 |

63 |

Sector total |

430.6 |

320.9 |

109.7 |

34 |

(a) In

2014–15, Westernport Water restated their 2013–14 net result before tax. As a

result, the net result before tax comparative figure reported in the 2014–15

financial report is $0.2 million higher than that shown in their 2013–14

financial report.

Note: Numbers

may vary slightly due to rounding.

Source: Victorian

Auditor-General's Office.

The metropolitan water cohort generated $399.0 million of this net profit before income tax—a collective $38.6 million increase on the prior year. The regional urban water entities generated a combined $54.1 million of this net profit before income tax, a $33.4 million increase on the prior year—11 regional urban water entities recorded a net profit before income tax in comparison to nine water entities in the prior year.

There was also an improvement in the rural cohort where, despite recording a combined net deficit before tax of $22.5 million, one entity recorded a $37.7 million improvement to their deficit from the prior year.

The 19 water entities are subject to the National Tax Equivalent Regime (NTER) administered by the Australian Taxation Office. NTER is an administrative arrangement that results in government-owned enterprises paying a tax equivalent to the state government. The combined net profit after tax was $312.2 million, an increase of $87.8 million, or 39 per cent, on the prior year. Income tax, under the NTER, is calculated at 30 per cent—$118.4 million was incurred in 2014–15, compared with $96.5 million in 2013–14, the increase a direct result of improved financial performance.

Revenue

In 2014–15, the 19 water entities generated revenue of $5.5 billion, a decrease of $27.7 million, or 0.5 per cent, on the prior year.

Service and usage charges increased by $57.6 million, or 1.7 per cent in comparison to 2013–14. Regional urban water entities saw the greatest increase to their service and usage charges of $41.0 million due to new customer connections and drier weather conditions increasing consumption, and a slight increase in prices in year two of Water Plan 3. The increase in service and usage charges was largely offset by the Government Water Rebate—formally the Fairer Water Bills initiative—where rebates and tariff adjustments were provided to customers.

The metropolitan cohort (and Western Water) provided the most significant rebates, returning $172.4 million to eligible customers from 1 July 2014. Melbourne Water contributed to $129.1 million of this rebate—approximately 75 per cent—with the metropolitan retailers and Western Water contributing the remaining 25 per cent. Figure 2C shows the contribution break down.

Figure 2C

2014–15 Government Water Rebate returned to metropolitan customers

($ million)

Entity name |

Melbourne Water |

Individual water |

Total rebate |

|---|---|---|---|

City West Water |

27.5 |

9.2 |

36.7 |

South East Water |

48.5 |

16.1 |

64.6 |

Yarra Valley Water |

49.1 |

16.6 |

65.7 |

Western Water(b) |

4.0 |

1.4 |

5.4 |

Total |

129.1 |

43.3 |

172.4 |

(a) $56.6

million of the total contribution by Melbourne Water was recognised in 2013–14

as it related to savings in that year, however, was paid to the water retailers

and Western Water in the 2014–15 reporting period.

(b) Western Water eligible

customers were captured in the Melbourne Water boundaries for the provision of

this rebate.

Source: Victorian

Auditor-General's Office.

Melbourne Water is the wholesaler of Melbourne's water supply and is responsible for managing catchments, managing waterways and major drainage systems, treating water and transferring the water to the metropolitan water retailers—City West Water, South East Water and Yarra Valley Water. The costs incurred by Melbourne Water for these activities are charged to the metropolitan water retailers by way of bulk water and sewerage charges, which are approved by the Essential Services Commission.

Bulk water and sewerage charges, including rebates, levied by Melbourne Water, to the metropolitan water retailers also decreased by approximately $48.5 million due to their contribution of the Government Water Rebate in 2014–15, and a reduction in prices levied to take into account lower desalination plant contract costs as a result of the savings from refinancing that took place in 2013–14.

The further decrease in revenue was partially offset by an increase in developer contributed assets and new customer contributions of $66.6 million, or 22.1 per cent, across the metropolitan and regional urban cohorts, which was driven by an increase in developer activities during the year.

Expenses

In 2014–15, the 19 entities incurred $5.1 billion in total expenditure, a decrease of $137.5 million, or 2.6 per cent, from the prior year, predominantly due to:

- bulk water charges paid by the metropolitan retail water entities to Melbourne Water decreased by approximately $155 million, largely due to Melbourne Water's contribution to the Government Water Rebate offsetting the cost by $125.1 million, and the reduction in prices as a result of the desalination plant contract cost savings

- operating, administrative and other expenses decreased by $18.3 million, or 1.5per cent, across the water sector

- finance costs decreased by $9.4 million, or 0.8 per cent, largely due to Melbourne Water holding lower average borrowings as a result of repaying maturing debt and a further decrease from the desalination plant refinancing savings—while Melbourne Water's interest expense decreased by $20.4 million, this was offset by the metropolitan water retailers, as their finance costs increased by a combined $11.1 million, due to an increase in average borrowings held to fund capital and other obligations

- depreciation and amortisation increased by $40.6 million, or 4.3 per cent, due to the growth in infrastructure, property, plant and equipment balances of water entities from prior year revaluation increments and capital additions.

Dividends

The 19 entities are obliged to pay a dividend to the state if the Treasurer, after consultation with the governing board and responsible minister, makes a formal determination to do so. In the past, only the metropolitan water entities, as for-profit entities, have been required to pay a dividend. The regional urban and rural water entities have not been required to make a dividend payment in part due to historical operating results generated.

Dividends are generally paid twice a year based on a prescribed percentage of the net profit before tax:

- an interim dividend determined in April based on half-year financial results

- a final dividend determined in October based on annual financial results.

In 2014–15, dividends paid by for the four metropolitan water entities totalled $120.8 million—an increase of $82.4 million, or 215 per cent, on 2013–14. This excludes a dividend payment by Melbourne Water on 31 July 2013 of $94.5 million relating to their 2011–12 final dividend.

As reported in the Auditor-General's Report on the Annual Financial Report of the State of Victoria, 2013–14 the calling of dividends each year has had a significant impact on the general government sector achieving its key financial measure of a surplus of at least $100 million each financial year, consistent with net debt and infrastructure parameters. In 2013–14, an interim dividend was not called from the water sector. However, in 2014–15, the government called for an interim dividend.

Figure 2D details the total interim and final dividends across the current and prior period.

Figure 2D

Interim and final dividends paid over the past two years

Year |

Final dividends paid |

Interim dividends paid |

Total |

|---|---|---|---|

2013–14(a) |

38.4 |

– |

38.4 |

2014–15 |

87.7 |

33.1 |

120.8 |

Total |

126.1 |

33.1 |

159.2 |

(a) This

figure excludes $94.5 million for a final dividend paid by Melbourne Water in

respect of the 2011–12 reporting period, on 31 July 2013.

Source: Victorian

Auditor-General's Office.

It is important to note that no interim dividend has been determined for Melbourne Water in relation to 2014–15. At the date of this report, an interim dividend was only 'proposed' by the Treasurer of Victoria in June 2015. Melbourne Water requested a deferral of the determination until the resolution of an income tax related matter regarding the Victorian Desalination Plant—resolution expected by Melbourne Water on this matter in December 2015.

2.3.2 Financial position

Assets

At 30 June 2015, the 19 water entities had assets of $42.9 billion, an increase of $1.0 billion, or 2.4 per cent, compared to the prior year. Property, plant, equipment and infrastructure assets represented 97.1 per cent of total assets.

A $1.0 billion increase in the value of property, plant, equipment and infrastructure assets occurred at 30 June 2015, predominantly driven by:

- significant revaluation increments of the metropolitan water entities:

- $332.3 million at South East Water on infrastructure assets

- $152.4 million at Melbourne Water on land

- $64.9 million at Yarra Valley Water on infrastructure assets

- $65.8 million at City West Water on infrastructure assets and land

- additions to infrastructure assets across all cohorts.

The above revaluation increments to infrastructure assets for the metropolitan water entities are impacted by the error identified in their fair value methodology for infrastructure assets, as noted in Part 1.3.1 Financial audit opinions issued.

Cash and cash equivalents held by water entities decreased by $24 million, or 6.0 per cent, on the prior year due to a reduction in cash and deposits held by Melbourne Water of $70 million—the corporation utilised cash on hand to avoid the use of borrowings across the period as opposed to holding on to deposits.

Goulburn-Murray Water also received lower funding receipts of $17 million compared to the prior year in respect to the Connections Project. Goulburn-Murray Water assumed responsibility of the food bowl modernisation project, now referred to as the Connections Project, on 1 July 2012.

This reduction was partially offset by an increase of $58.9 million in cash and cash equivalents held by the regional urban cohort due to stronger cash flows from operating activities and some entities drawing down on deposits from the Treasury Corporation of Victoria to take advantage of lower interest rates or on previously approved financial accommodation (borrowings) to avoid foregoing access to these facilities.

Liabilities

At 30 June 2015, the water industry had combined liabilities of $20.4 billion, an increase of $262.6 million, or 1.3 per cent, on the prior year. Net deferred tax liabilities increased by $149.0 million, or 3.3 per cent, in 2014–15 and interest-bearing liabilities continued to grow by a further $146.3 million, or 1.0 per cent, during the year, largely used to fund the construction of infrastructure assets and other obligations.

The metropolitan water retail entities' interest-bearing liabilities increased by $255.8 million. South East Water contributed the largest increase primarily to take advantage of low interest rates during the year. In contrast, Melbourne Water reduced its interest-bearing liabilities by $117.3 million due to repayments of maturing loans and a further year's payment of the Victorian Desalination Plant finance lease.

Interest-bearing liabilities across the regional urban water entities increased by $30.9 million, or 1.5 per cent—six of the 13 entities increased their debt levels, while the remaining seven repaid maturing debt. The two rural water entities decreased their interest-bearing liabilities—Goulburn-Murray Water repaid $22.1million in total.

2.4 Risks to financial sustainability

2.4.1 Financial sustainability

To be financially sustainable, entities need the capacity to meet their current and future expenditure as it falls due. They also need to be able to absorb the financial impacts of changes and financial risks that materialise, without significantly changing their revenue and expenditure policies.

Financial sustainability should be viewed from both a short- and long-term perspective. Short-term indicators relate to the ability of an entity to maintain positive operating cash flows, or the ability to generate an operating surplus over the short term. Long-term indicators focus on an entities ability to fund significant asset replacement or reduce long-term debt to minimise intergenerational financial sustainability risks.

In this Section, we provide insight into the financial sustainability risks of the water sector at 30 June 2015, and trends over a five-year period. The indicator results are calculated using the financial transactions and balances of each entity's statutory financial report.

The indicators highlight risks to ongoing financial sustainability in either the short or longer term. However, forming a definitive view of any entity's financial sustainability requires a holistic analysis that moves beyond historical financial considerations to also include the water entity's financial forecasts, strategic plans, and their operations and environment, including the regulatory environment.

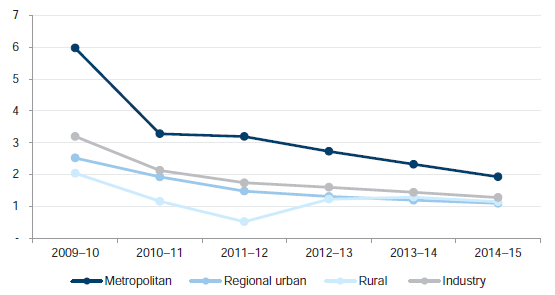

We use seven financial sustainability risk indicators taken over a five-year period to assess the financial sustainability risks in the water sector. Appendix C describes the financial sustainability indicators, risk assessment criteria and benchmarks used.

2.4.2 Overall assessment

Figure 2E provides a 'snapshot' of the seven indicator results in sector aggregate and by cohort, against the industry average for the past five years.

Figure 2E

Financial sustainability snapshot of the sector

| Indicator |

Sector average |

Sector average |

Metropolitan average |

Regional urban average |

Rural average |

|---|---|---|---|---|---|

Net result |

1.36% |

3.29% |

6.80% |

3.81% |

-7.11% |

Interest Cover Ratio |

6.44 |

6.25 |

2.41 |

6.20 |

14.23 |

Liquidity Ratio |

0.82 |

0.99 |

0.54 |

1.08 |

1.34 |

Internal Financing Ratio |

69.13% |

97.63% |

64.90% |

110.68% |

78.25% |

Capital Replacement Ratio |

1.64 |

1.28 |

1.93 |

1.10 |

1.15 |

Debt to Assets |

0.19 |

0.20 |

0.46 |

0.15 |

0.02 |

Debt Service Cover |

N/A |

N/A |

N/A |

N/A |

3.32 |

Note: A

red result shows a high-risk assessment, orange a medium-risk assessment and

green a low-risk assessment.

Note: In

relation to the 'debt service cover indicator', where any entity has not made

an actual repayment of their debt, this indicator will result in an 'NA'

outcome for the sector and relevant cohort. Refer to Appendix C for further

detail.

Source: Victorian-Auditor

General's Office.

The sector results for 2014–15 have been positive for the following indicators:

- Net result—as discussed in Section 2.3.1, the water sector has shown an improvement in financial performance for the 2014–15 reporting period, on an already positive result in the prior year.