Annual Plan 2024–25

Overview

The Victorian Auditor-General’s Annual Plan 2024–25 was prepared pursuant to the requirements of Section 73 of the Audit Act 1994 and tabled in the Parliament of Victoria on 20 June 2024.

1. VAGO’s Annual Plan

The purpose and work of the Victorian Auditor-General

Our role

The Auditor-General is an independent officer of the Victorian Parliament, supported by the Victorian Auditor-General's Office (VAGO). We provide assurance to Parliament and the Victorian community about how effectively public sector agencies provide services and use public money.

Under the Audit Act 1994, the Auditor-General is required to prepare a draft annual plan describing their proposed work program for the next year, consult with the Public Accounts and Estimates Committee (PAEC) and table the plan in Parliament by 30 June.

Our work program examines:

- if government agencies are fairly presenting their annual financial statements and performance statements

- how government agencies manage resources

- if government agencies are complying with legislation and other requirements

- how effective, efficient and economical government agencies, programs and services are

- opportunities for government agencies to improve their management practices and systems

- if there is wastage or a lack of probity in the way that public resources are being managed.

How we do our work

VAGO work program

We deliver our work program by conducting financial and performance audits and undertaking limited assurance reviews of public sector agencies.

A financial audit is an audit of an agency’s financial report. Our audit opinions provide assurance that financial reports fairly present agencies’ financial positions, cashflows and operating results for the year.

Our performance engagements assess if government agencies, programs and services are effectively meeting their performance objectives, and if government agencies are using resources economically and efficiently, and complying with legislation.

Performance audits and financial audits integrate with and support each other. Our financial audits are part of our early warning system. Intelligence obtained from our regular annual contact with agencies feeds into our performance audit program. In turn, our public reporting on the results of financial audits responds to and is shaped by our annual planning for performance audits.

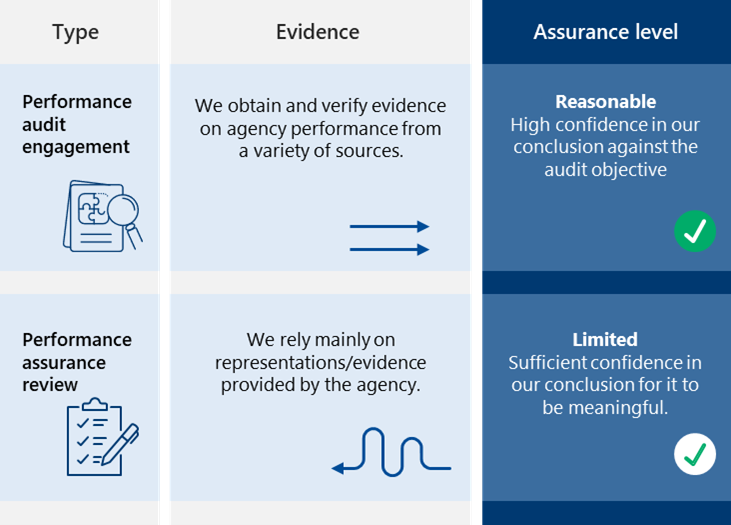

We perform 2 types of performance engagements:

| Our … | Provide … | This means we are … |

|---|---|---|

| performance audits | reasonable assurance about an agency's performance. | highly confident in the accuracy of our conclusions. |

| performance reviews | limited assurance about an agency's performance. | moderately confident in the accuracy of our conclusions. |

Reviews are more efficient than audits because they rely on less persuasive evidence. They also typically have a narrow scope with a focus on waste, probity and compliance. We use reviews to:

- quickly respond to emerging issues

- examine less complex activities.

By contrast, our audits require extensive evidence-gathering and substantiation. They typically focus on system-level issues and examine people-centred, complex or costly activities.

We make recommendations that promote accountability and transparency in government and improve agencies’ service effectiveness and efficiency. In addition to providing assurance about past public sector performance, our auditors provide advice to agencies on how they can improve their future performance.

Reporting our insights to Parliament

Reporting on financial audits

We deliver reports to Parliament, summarising the results of financial audits on public sector entities and the Victorian Government's overall annual financial report.

Our financial audit reports are:

- The Auditor-General's Report on the State of Victoria’s Annual Financial Report

- results of audits reports on the local government, TAFE and university sectors' financial outcomes and risks to financial sustainability.

We also publish dashboards that accompany these reports containing key financial data. These products aim to visualise key financial ratios that speak to financial sustainability, simply and clearly, so that Parliament and other users obtain better insights into the financial management of government.

Reporting on performance engagements

We publish our engagement findings and recommendations in reports, which we table in Parliament and publish online.

A 3-year look ahead

A rolling cycle

The Auditor-General began a second 7-year term in 2023, and this plan builds on VAGO’s work over the last 7 years. Our annual work program for 2024–25 is made up of more than 660 audit opinions and 26 reports to Parliament.

We plan around a 3-year rolling cycle. In this plan, we list the 22 performance and 4 financial engagement topics we intend to report on to Parliament in 2024–25.

As part of our 3-year look ahead, we run a planning process to identify potential topics for our parliamentary reports.

We develop potential topics from a range of sources, including:

- referrals from Members of Parliament

- issues raised by citizens, community groups or advocacy groups through correspondence to the Auditor-General

- issues raised by government departments

- our sector intelligence, gathered from external reports, data analysis, budget papers, annual reports and other sources.

Identifying topics

Consistent with our planning framework (see Developing our performance engagement work program), when potential topics are proposed we undertake research and impact analysis. This approach also helps us identify potential topics from a very broad range of activities and programs across government. It also helps us decide if a topic should become part of the forward program.

In some instances, a topic may be sufficiently urgent to warrant replacing a topic already listed in the published program. If such cases arise and we need to defer a topic to a later year or cancel it altogether, we will list the status of topics from previous years in each annual plan. As this is the first year of the Auditor-General’s new term, we have completed a comprehensive reconciliation of all potential topics published over the period of the last 3-year plan (Appendix B).

Our approach allows us the flexibility to add in important performance engagements that may emerge during the year. It also allows us to inform, and be informed by, Parliament, the public sector and the Victorian community about short and medium-term priorities.

First Nations

We are committed to working with First Nations people and communities to explore potential areas through which VAGO can add value.

Our initial focus in 2024–25 will be exploring if there are performance engagements that can add value. This may be a standalone engagement or incorporating specific considerations into broader themes.

If there are standalone topics, we will prioritise resources to ensure we conduct at least one engagement each year. We will seek to draw on First Nations knowledge and experience in the design and execution of all such engagements.

Auditor-General's priorities

Building our data science capacity

In the performance engagement work program, we have built our data science capacity. This has resulted in a much stronger focus on data analysis in our parliamentary reports and the development of public dashboards.

Over the next 3 years, we will continue to build this capacity and focus on how we can develop insights from the significant datasets available to us and identify whole-of-government or systemic issues that require improvement. We will also look at publishing standalone dashboards, such as data on consultant spend published in departmental annual reports.

Developing recurring reports

We have developed a range of recurring reports to provide transparency on important issues that Parliament and the community cannot easily assess through current reporting standards by agencies, or other means. This includes issues such as progress on infrastructure projects.

Over the next 3 years we will:

- work with agencies to encourage transparency by them publishing the information in our recurring reports

- review our products to see if additional insights can be provided

- identify if new recurring products are needed.

Making our reports more accessible

We have built our editorial and publishing capacity and made a commitment to using plain English to make our reports more accessible for Parliament and citizens.

We have developed new reporting templates to be more user-friendly in an online environment to complement the hardcopy reports we are required to table in Parliament.

Over the next 3 years, we will focus on the online environment, and how we can make our findings and reports both engaging and interactive for citizens and Parliamentarians.

Playing a leadership role in the public sector

We will review previous engagements, in conjunction with current data, to identify relevant trends, and potentially areas of best practice, and publish these to assist public sector performance.

Over the next 3 years we will continue to play a leadership role to influence and shape how well the public sector reports its own performance.

Consulting on our work program

Background

The Audit Act 1994 requires us to submit a draft of our Annual Plan to PAEC for its consideration. We value PAEC's input and suggestions.

PAEC's comments on our draft Annual Plan are included in Appendix A. The Act requires us to indicate in our Annual Plan any PAEC suggestions that the Auditor-General has not adopted. The changes PAEC suggested that we have not adopted are addressed below.

We also consult with the government departments and agencies that we propose to include in our engagements. We give them the opportunity to provide feedback throughout the planning process.

Foster care engagement

We support PAEC's comments on the need to undertake an engagement in the area of foster care.

There is currently reform work underway in this area so 2024–25 would not be the best time to pursue an engagement. However, this area is on our list for inclusion in future years and we will review the current reform agenda with the intent to include an engagement on foster care in our 2025–26 Annual Plan.

Responses to performance engagement recommendations: annual status update 2024

We acknowledge PAEC's comments asking for more scrutiny of agency attestations. Given the number of recommendations reviewed as part of this engagement, providing reasonable assurance rather than accepting an agency's attestation would require significantly more resources. To provide reasonable assurance we would need to reduce the number of engagements we deliver each year.

We will work with PAEC to understand the specific agencies of concern, and feed these into our future follow-up engagements.

2. Our financial audit work program

What we do

Our financial audit services help maintain accountability, transparency and effective financial administration within the Victorian public sector. Our audit opinions provide Parliament and the community with confidence that financial reports and performance statements are reliable for informed decision-making.

Our parliamentary products provide information, insights and recommended improvements to help decision-makers.

Financial report audits

Our audit of an entity’s financial report assesses whether it presents their financial results and information fairly, in accordance with relevant standards and legislation. We provide an independent opinion on the financial report, confirming the reliability of the published financial information.

Performance statement audits

We also audit the reliability and completeness of performance statements prepared in the local government, TAFE and water sectors and provide an independent audit opinion reflecting this.

Performance statements contain target and actual results against mandatory performance indicators established through Ministerial direction. Our assurance confirms the reliability of the published performance information.

Annual Financial Report of the State of Victoria

A significant piece of assurance we provide Parliament and the Victorian community is the Auditor-General’s audit opinion on the Annual Financial Report (AFR) of the State of Victoria.

The AFR is a consolidation of the financial results of over 280 state-controlled entities. While we audit and provide opinions on the individual financial reports of these entities, we also audit and provide an opinion on the consolidated AFR.

Our opinion of the AFR provides assurance that the published financial outcomes of the State of Victoria, and within that the general government sector are reliable, meaning users can confidently use the information to inform their decisions.

Review opinion on the state Budget

Each year, the government prepares Estimated Financial Statements as part of its Budget as required by the Financial Management Act 1994. This is often referred to as the state Budget.

The purpose of the Estimated Financial Statements is to set out the projected financial results for the Victorian general government sector based on the government's stated and expected financial policies and assumptions.

The Audit Act 1994 requires the Auditor-General to conduct a review of the Estimated Financial Statements, to confirm they have been prepared consistent with stated accounting policies, targets specified in the current financial policy objectives and strategies and assumptions outlined. The Auditor-General’s report is included in Budget Paper No. 5: Statement of Finances, Chapter 1 – Estimated financial statements for the general government sector.

Grant acquittals

Where public sector entities are publicly funded, entities can also be given grants to provide specific services to the community. Entities must use these funds appropriately and per the terms and conditions of the grant agreement.

Part of our work is understanding and testing the use of grants to provide confidence that public funds are used as agreed.

Auditor-General's report on the State's Annual Financial Report

This report is the only report to Parliament that we must make under section 57(1) of the Audit Act 1994. The Act provides that we may comment on, and make recommendations about, more effective and efficient management of public resources and about proper accounts and records.

We use this report to provide our independent perspectives on the state of finances. We also prepare a dashboard as a companion product to our AFR report to Parliament. It brings together current and historical financial information for the Victorian general government sector reported in past state budgets and AFRs of the State of Victoria.

Results of audits

Our results of audits reports analyse local government, TAFE and university sectors' financial outcomes and risks to financial sustainability. We highlight common internal control and financial reporting issues and make recommendations for improvement.

The reports provide entities within the relevant sector, and their stakeholders, with recommended areas of improvement to reliably manage resources. We aim to table these reports within 5 months of the relevant sector's financial year end.

As with other reports to Parliament, we produce a dashboard as a companion product to each report. These dashboards allow users to explore the individual financial outcomes of entities as well as gaining an overall sector perspective.

Who we audit

Our clients

We audit:

- public bodies

- any state-owned companies

- any entities that are not public bodies, but we agree to audit as a public–purpose arrangement under the Audit Act 1994.

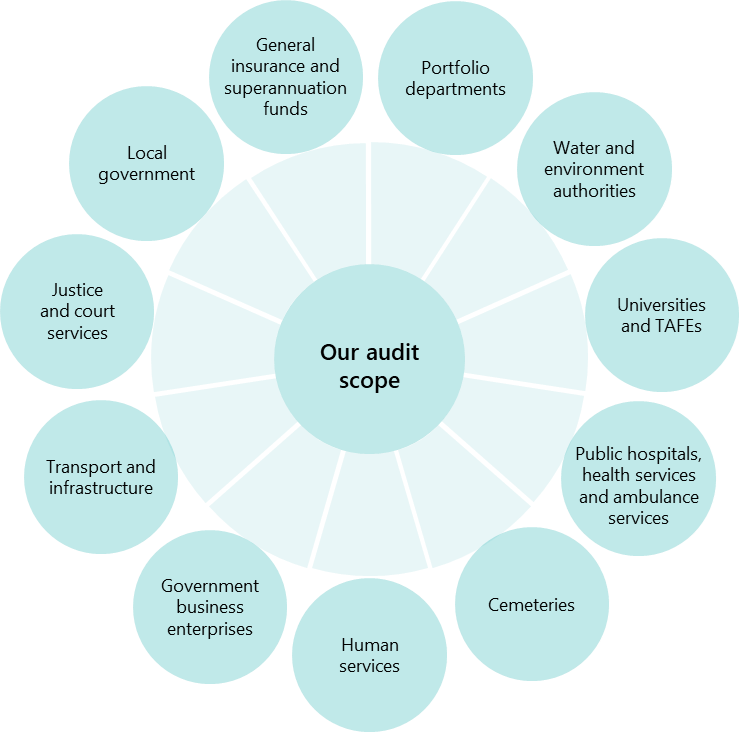

These entities cover a range of sectors.

Figure 1: Sectors within scope of audits

Each year, we list the entities we audited in the latest audit cycle in Appendix B of our Transparency Report.

Our outputs

Based on our entity profile for the latest audit cycle, we expect to deliver the following in 2024–25.

Figure 2: Opinions to be delivered in 2024–25

| Audit opinions | Number |

|---|---|

| Opinions on entities' financial reports | 550+ |

| Opinions on entities' performance statements | 109 |

| Opinions on the AFR | 1 |

| Review opinions | |

| Estimate financial report review opinion | 1 |

| Grant acquittal certifications | |

| Grant acquittal certifications | 160+ |

| Natural Disaster Controls Acquittal | 1 |

How we deliver our work

Our financial auditors

Our Financial Audit division, in conjunction with external audit firms, deliver financial audit services to our clients in the public sector.

We are structured by sector:

- education

- environment

- health and integrity

- human services, hospitals and housing

- infrastructure and transport

- justice and community safety

- local government

- whole of government.

We operate under a hybrid working model, which matches work modes with situations and needs. We combine the best of office-based and virtual work, empowering our staff to decide what works for them. See 'Our clients' below to understand how we work with clients in our hybrid working model.

Our audit service providers

As our work program is significant, we supplement our workforce with 8 empanelled external audit firms from across Victoria. These audit service providers undertake audit work on our behalf.

Our audit service providers are our agents and therefore must adhere to the same capability, ethical requirements, and quality control systems we hold ourselves to. We undertake considerable oversight throughout an audit cycle to ensure their services are consistent with our requirements.

Our financial audit process

Our process

We use a risk-based methodology and conduct our financial audits in accordance with the Audit Act 1994 and the Australian Auditing Standards. As part of an audit, we:

- identify and assess the risks of material misstatement of a financial report (whether due to fraud or error), design and perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for an opinion

- obtain an understanding of internal controls relevant to the audit to design audit procedures that are appropriate in the circumstances

- evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures

- conclude on the appropriateness of using the going-concern basis of accounting

- evaluate the overall presentation, structure and content of the financial report, including the disclosures, and whether the financial report represents the underlying transactions and events in a manner that achieves fair presentation.

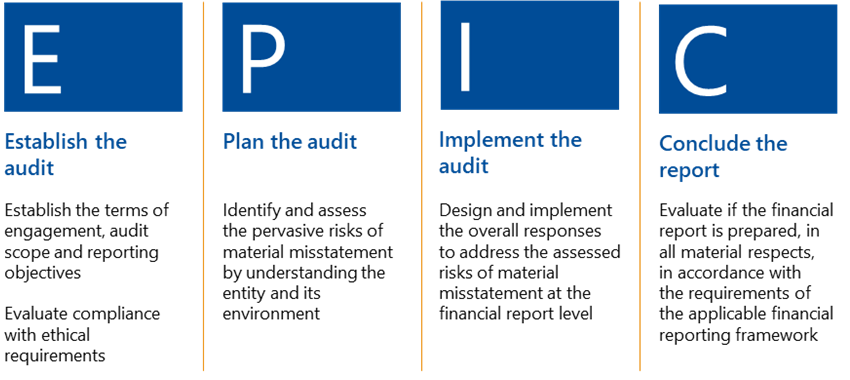

Our methodology – EPIC

To guide us in undertaking our financial audits, we have developed our audit methodology to support compliance with our standards and legislative requirements.

Our EPIC methodology integrates audit policy, guidance and procedures designed for the public sector to ensure we are testing the control systems of an entity's financial administration appropriately. We undertake 4 major processes.

Figure 3: Audit processes

Client communication during our process

We communicate throughout an audit to those charged with governance in each entity. While some of these key deliverables are required by legislation, others play a key role in effectively communicating our insights on the financial performance and position of an entity, and its compliance with relevant reporting requirements.

| Key deliverable documents include our … | Which … |

|---|---|

| engagement letter | sets out the terms on which we undertake our audit, and the respective roles and responsibilities of both the preparer and auditor. |

| audit strategy | demonstrates our understanding of the audit context, our assessment of financial reporting risks and our proposed response to these risks. |

| audit fee letter | provides management with an estimate of the reasonable audit costs based on our audit strategy. |

| management letters | describe significant control and financial reporting weaknesses found during the audit and provide recommendations to address those weaknesses. |

| closing report | details our audit findings and our conclusion on whether the financial report complies with the relevant reporting framework and is free from material misstatement. |

| audit report | includes our audit opinion – this is the statutory report we are required to provide, and it must be appended to the entity’s annual financial report. |

| independence declaration (where required under specific legislation) | declares that we comply with the independence requirements of the Accounting Professional Ethical Standards Board. We are only required to declare our independence for audits of financial reports where certain legislation applies, such as the Corporations Act 2001. |

Timing of services

Most of our annual financial audits relate to entities with financial year-end dates of 30 June and, to a lesser extent, 31 December. This means there is a strong focus on delivering financial audits between July and September. We work progressively across the entire calendar year to enable the efficient and effective utilisation of our workforce and delivery of our services.

Audit fees

The audit work we provide to the Victorian public sector funds our financial audit division. Under section 29 of the Financial Management Act 1994, our audit fees must be determined based on reasonable cost recovery. This means our people and our work must be effective and efficient.

3. Developing our performance engagement work program

The role and functions we need to consider

VAGO’s performance engagement work program is designed to inform Parliament and Victorians about the performance of the public sector and identify ways to improve public services. This means that our starting point is the role and functions of state and local government.

The role of a state government is to:

- provide services to support its citizens and communities

- oversee the infrastructure and built environment of the state

- oversee the natural resources and environment of the state

- manage the finances of the state and create an environment for ongoing economic development

- maintain the institutions that underpin effective public administration and systems of government.

To perform these functions, the Victorian Government spends around $98 billion annually, supported by a public sector of 367,945 people. This is the equivalent of 302,179 full-time positions, and just under 10 per cent of the Victorian workforce.

The role of local government is to manage local issues and plan for a community’s needs. Councils in Victoria spend approximately $11 billion annually and are supported by a workforce of around 45,000 people, or around 1.2 per cent of the Victorian workforce.

Local councils are expected to deliver services to their local communities equitably, with regard to continuous improvement of service delivery and in response to performance monitoring (as set out in section 106 of the Local Government Act 2020).

Developing our program

VAGO can deliver around 22 performance engagements each year, with the number depending on a range of factors including:

1. the complexity and/or breadth of each proposed engagement

2. the availability and timeliness of the provision of data and information by auditees

3. internal resources.

Engagement topics can be standalone, or form part of a series of connected engagements that will take place over the course of the Auditor-General’s term. A series may focus on:

- public sector activity that has multiple components and impacts all agencies, such as cybersecurity

- an area of service delivery or public policy that applies to multiple groups of citizens, such as literacy and numeracy

- specific cohorts of citizens and their experiences across a range of public sector activity, such as children in state care.

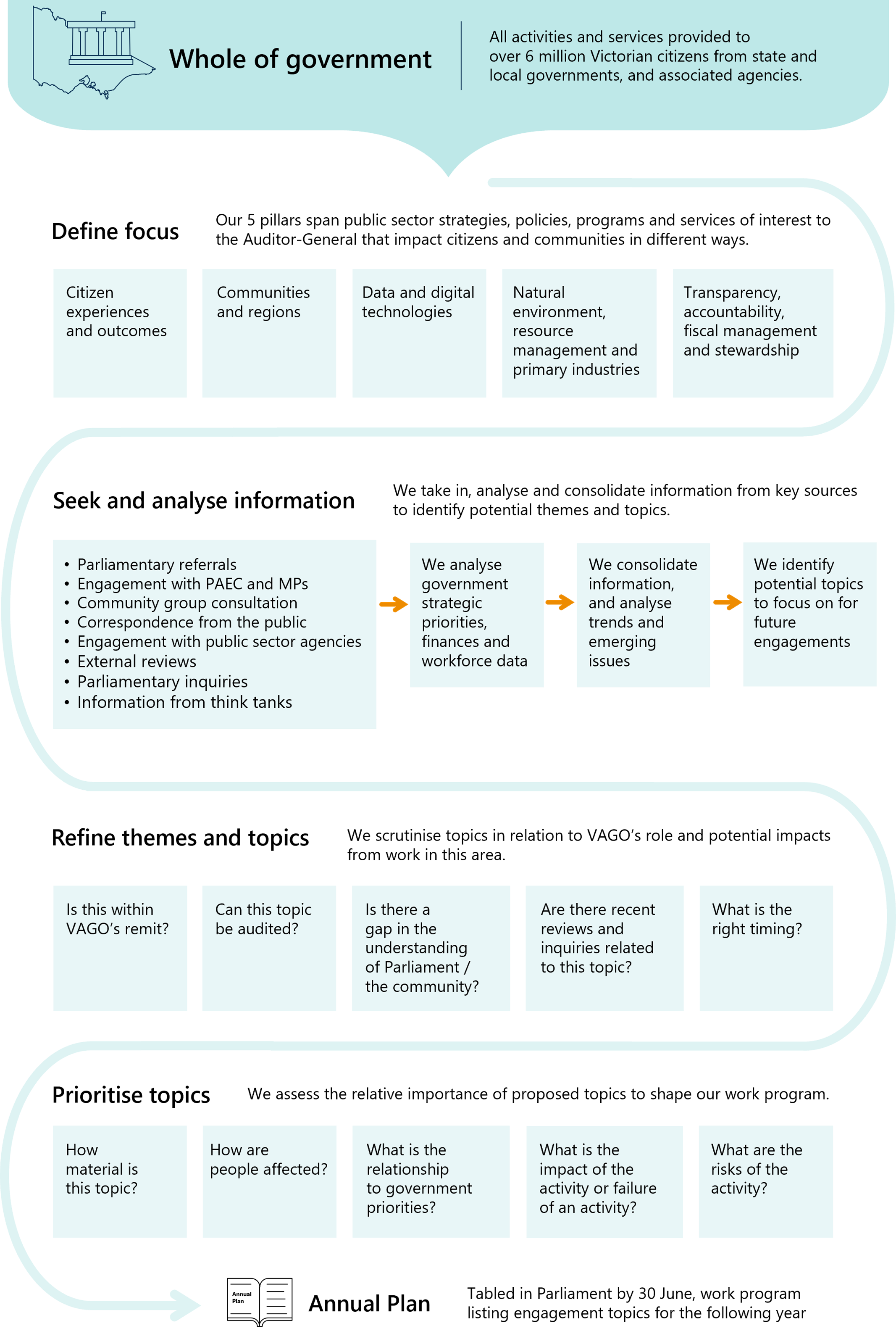

The scope from which VAGO can select engagement topics is vast. We use a planning framework with 5 levels to gradually narrow our focus from all public sector activities down to 5 pillars, which we then refine further to a series across an area of public sector activity or group of citizens, and standalone engagement topics. Data plays a pivotal role in identifying topics, and in planning and undertaking engagements.

Our objective is to design a program that delivers credible and authoritative reports that are relevant, timely and informative for both Parliament and the community. Our framework is detailed in the infographic below.

The 5 pillars

The 5 pillars span a broad range of activities that impact in different ways on citizens and communities. The scope of the 5 pillars is described below.

| Pillar … | Covers … |

|---|---|

| Citizen experiences and outcomes | strategies, policies, programs and services that are designed for or impact citizens. Includes experiences and outcomes for all citizens as well as specific cohorts. |

| Communities and regions | strategies, policies, programs and services that are designed to build and support communities. |

| Data and digital technologies | the uses and impacts of data and digital technologies on public sector activities, performance and service delivery. |

| Natural environment, resource management and primary industries | management and protection of the natural environment, management of renewable and non-renewable energy sources, and primary industries. |

| Transparency, accountability, fiscal management and stewardship | how government performs its role, including system-level, whole of government activities that potentially impact on many citizens, government priorities and management of government finances. |

Our planning framework

Planning the performance engagement work program

Deciding the type and focus of our engagements

Our performance engagement work program consists of topics identified by applying our planning framework described above.

Once we have identified a potential topic, there are several considerations applied to determine the type and focus of the engagement.

What we examine in our performance engagements

Our performance engagements can take 2 forms, and our mandate for both is laid out in the Audit Act 1994:

- performance audit engagements to determine if public bodies are achieving their objectives effectively, economically and efficiently, and in compliance with all relevant Acts, and/or if public bodies are performing their operations or activities effectively, economically and efficiently, and in compliance with all relevant Acts

- performance assurance reviews to consider the operations or activities of a public body or any part of the Victorian public sector.

Figure 4: Types of performance engagements

We state our degree of confidence in the findings of our work using levels of assurance. This refers to the measure of the confidence we have in our conclusions.

Stating the level of assurance helps Parliament, government and the community interpret our conclusions in a meaningful way.

Our mandate

The Audit Act 1994 provides the mandate for our audits and reviews, and VAGO’s Strategic Plan sets the direction for how we approach and explore this mandate.

We adapt our approach in response to changes in the landscape of public sector activities and priorities. An ability and willingness to review and revise our focus underpins our leadership role in understanding how performance is working at a system level, as well as at a program or activity level.

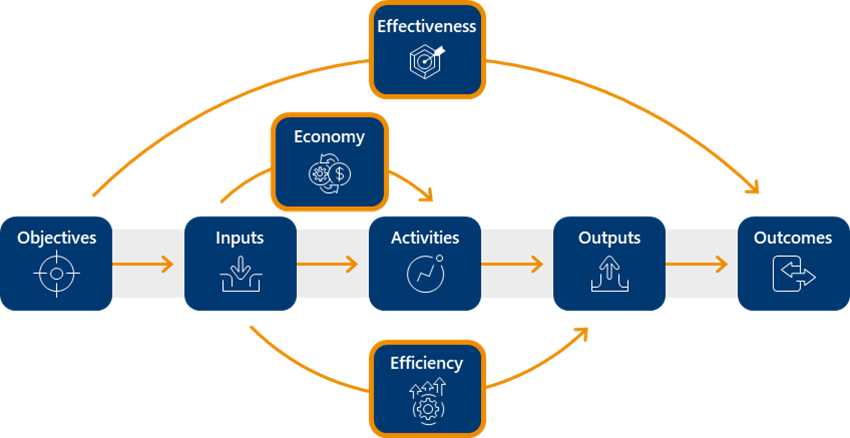

Central to VAGO’s mandate are the ‘three Es’ specified in our legislation and described in the Australian Auditing and Assurance Standards, which enable us to pose questions that we address through our engagements. The three Es are:

- Effectiveness – to what extent were the objectives at the program or entity level achieved?

- Efficiency – to what extent were inputs minimised to deliver the intended outputs or outputs maximised for a given level of input (in terms of quality, quantity and timing)?

- Economy – to what extent were the costs of resourcing the program or activity minimised, within operational requirements (timeliness and availability of required quality and quantity)?

The other performance objective we focus on in our work is compliance of an entity's activities with all relevant legislation. Compliance may be considered as part of effectiveness, economy and efficiency or be a standalone consideration. We also have a mandate to determine whether there has been any wastage of public resources or any lack of probity or financial prudence in the management or application of public resources in the Victorian public sector.

Taken together, these approaches enable us to ask and answer a broad range of questions relating to government activities.

At its broadest, an effectiveness audit enables us to assess whether an agency has achieved its stated objectives and examine the factors relevant to its performance. In undertaking this work, we identify opportunities to drive improvements in public service delivery.

Efficiency and economy audits focus on a narrower, yet important, set of questions regarding the resources used, and activities undertaken, by agencies to assess whether costs have been minimised in the delivery of outputs.

How do the three Es relate?

Figure 5: Relationships between the three Es

The three Es in practice

Figure 6: An example of effectiveness, efficiency and economy engagements for a topic area

| Topic area | Approach | What will it tell us? |

|---|---|---|

| Government grants | Effectiveness | Whether they achieved their objective/s |

| Efficiency | Whether the costs of delivering the grants (the 'output') are efficient (when compared to a benchmark or efficient cost) | |

| Economy | Whether the resources used and activities undertaken in the administration of the grants were delivered at the lowest cost |

Refining our focus for each engagement

As we gather more information and interrogate and research emerging topics, we need to make 3 key decisions for each engagement:

- Is this best suited to a reasonable assurance engagement or a limited assurance engagement?

- Should we focus on public bodies’ objectives, or an area of their operations or activities?

- Should we focus on effectiveness, efficiency, economy, compliance or a combination of these?

VAGO has mainly focused on effectiveness audits because it is a powerful way of examining the factors that influence government service delivery. The 2024–25 audit topics continue this focus, but in the coming years we will seek to have a stronger focus on efficiency and economy, noting the relationship between all 3 (see Figure 5).

These decisions are made during the engagement planning phase, so are not published in the annual plan.

4. 2024–25 parliamentary reports

Our 2024–25 program

Four recurring financial audit parliamentary reports:

1. Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2023–24

2. Results of 2023–24 audits: local government

3. Results of 2024 audits: TAFEs

4. Results of 2024 audits: universities

Nineteen performance engagements:

5. Accessibility of tram services: follow-up

6. Contractors and consultants: management

7. Cybersecurity: infrastructure

8. Domestic building insurance

9. Elective surgery in Victoria

10. Financial decision-making for vulnerable adults

11. Free TAFE

12. HealthShare Victoria procurement

13. Implementation of departmental savings and efficiencies

14. Maintaining the condition of state-managed roads

15. Managing disruptions affecting Victoria's public transport network

16. Managing the transition of energy supply to renewables

17. Natural disaster recovery and resilience

18. The Orange Door: follow-up

19. Quality of Victoria's critical data assets

20. Realising the benefits identified in the Suburban Rail Loop business case

21. Recovering and reprocessing resources from waste: effectiveness of system reforms

22. Reporting on local government performance: follow-up

23. Work-related violence in government schools

Three recurring performance engagements:

24. Fair presentation of service delivery performance: 2024

25. Major projects performance reporting: 2024

26. Responses to performance engagement recommendations: annual status update 2024

1. Auditor-General's Report on the Annual Financial Report of the State of Victoria: 2023–24

Why this is important

Section 57 of the Audit Act 1994 (the Act) requires the Auditor-General to report to Parliament on the outcome of the Auditor-General's audit of the Annual Financial Report of the State of Victoria each year.

This report analyses and comments on key aspects of the state's financial outcomes. In line with the Act, it gives information and recommendations where appropriate for the government to manage public resources more effectively and efficiently.

This is the only report on our financial audits that VAGO must produce each year under the Act.

We must table our report on the Annual Financial Report of the State of Victoria on or before 24 November following the financial year the report relates to.

What we plan to examine

We plan to table the Auditor-General's report on the 2023–24 Annual Financial Report of the State of Victoria in 2024–25.

2. Results of 2023–24 audits: local government

Why this is important

The Victorian local government sector consists of 105 agencies, including 79 councils.

At the end of each financial year, each council and agency prepares a financial report and each council also prepares a performance statement. We audit all these reports and statements.

As part of this audit we analyse the sector's financial outcomes and risks to financial sustainability. We also gain an understanding of councils’ internal reporting processes and corporate governance arrangements, and how these may impact their ability to finalise a financial report and performance statement in good time.

Our results of financial audits report informs Parliament on the outcome of our financial audits of local government.

Our report also informs Parliament about common control and financial reporting weaknesses in the sector and makes recommendations for improvement.

What we plan to examine

We aim to table this report within 5 months of the sector's financial year end.

Further information

The Results of 2022–23 Audits: Local Government financial audits report was tabled on 7 March 2024.

We gave clear audit opinions for financial reports and performance statements across the local government sector. Parliament and the community can confidently use these reports.

3. Results of 2024 audits: TAFEs

Why this is important

There are 12 TAFEs and 14 controlled entities (an entity that another party has the power to govern and make financial and operating decisions about) in the Victorian TAFE sector.

As public bodies, TAFEs must follow the Financial Management Act 1994, which includes preparing a financial report. TAFEs are also required to report mandatory performance indicators in line with the reporting requirements outlined by the Minister for Training and Skills in the statement of priorities.

We audit their financial reports and performance statements.

As part of this audit we analyse the sector's financial outcomes and risks to financial sustainability. Through this audit we can also analyse the internal controls TAFEs use (people, processes and systems) to prepare financial reports and performance statements and how these controls may prevent TAFEs from preparing reliable financial reports.

Our results of audits report informs Parliament on the outcome of our financial audits of TAFEs.

Our report also informs Parliament about common control and financial reporting weaknesses in the sector and makes recommendations for improvement.

What we plan to examine

We aim to table this report within 5 months of the sector's financial year end.

Further information

The Results of 2022 Audits: Technical and Further Education Institutes financial audits report was tabled on 30 June 2023.

We provided clear audit opinions on financial reports and performance statements across the TAFE sector. Parliament and the community can confidently use these reports.

4. Results of 2024 audits: universities

Why this is important

Victoria’s public university sector is made up of 8 universities and the 44 entities they control (as at 31 December 2022).

In Victoria, public universities are established by their own legislation. The Financial Management Act 1994 defines them as public bodies, and they must follow its requirements for preparing financial reports.

We audit their financial reports.

As part of this audit we analyse the sector's financial outcomes and risks to financial sustainability. We also assess if universities’ internal controls (people, systems and processes) allow them to prepare reliable financial reports.

Our results of audits report informs Parliament on the outcome of our financial audit of universities.

Our report also informs Parliament about common control and financial reporting weaknesses in the sector and makes recommendations for improvement.

What we plan to examine

We aim to table this report within 5 months of the sector's financial year end.

Further information

The Results of 2022 Audits: Universities financial audits report was tabled on 30 June 2023.

We provided clear audit opinions on financial reports and performance statements across the Victorian university sector. Parliament and the community can confidently use these reports.

5. Accessibility of tram services: follow-up

Why this is important

In October 2020, VAGO released a report on whether tram services were meeting the accessibility needs of passengers with mobility restrictions (Accessibility of Tram Services). The report examined the Department of Transport (DoT) and Yarra Trams’ progress on complying with tram accessibility requirements. This included strategies, plans and programs in place to achieve compliance with legislated disability standards.

We found that tram services were failing to meet the accessibility needs of passengers with mobility restrictions, with only 15 per cent of services in 2018–19 delivering a low-floor tram at a level-access stop.

Additionally, we found that DoT had failed to meet legislated targets for accessible tram infrastructure and was at risk of failing to meet future tram compliance requirements. DoT did not have a finalised strategy or a funded plan in place and did not know when all tram services would be fully compliant with the Disability Discrimination Act 1992 and the Disability Standards for Accessible Public Transport 2002. This posed both a legal and financial risk to the state for not meeting legislative requirements.

This engagement will be a follow-up of the 2020 audit to determine the extent to which progress has been made against the recommendations since the release of the report. This will include assessing whether the Department of Transport and Planning (DTP) (formerly DoT) and Yarra Trams have identified the root causes of the issues uncovered in the 2020 audit.

What we plan to examine

We plan to examine whether the audited agencies have effectively addressed the recommendations from our 2020 audit Accessibility of Tram Services. This will also include whether agencies have addressed the root causes of the issues uncovered in the 2020 audit.

Who we plan to examine

DTP, Yarra Trams.

6. Contractors and consultants: management

Why this is important

There is significant public interest in how much the public service spends on contractors and consultants. Our 2023 report Contractors and Consultants in the Victorian Public Service: Spending raised concerns about how resourcing and expenditure decisions are managed and reported.

The Victorian Government’s spending on contractors and consultants increased by 47 per cent between 2018–19 and 2021–22. In 2021–22 alone, the total spend on contractors and consultants cost the state $4.2 billion.

Consistently outsourcing work that has traditionally been done by the public sector can deskill the Victorian Public Service. This can create significant long-term risks and lead to fewer opportunities for skills and capabilities to be developed internally.

Additionally, these external services can cost significantly more than using public service employees. Effective management of contractors and consultants is necessary to ensure the government is receiving value for money for these outsourced services.

The Department of Premier and Cabinet's Administrative Guidelines on Engaging Professional Services in the Victorian Public Service, released in 2019, requires government agencies to consider the validity of their use of contractors and consultants. These guidelines are crucial in ensuring that agencies are taking necessary steps to minimise spending in this area.

What we plan to examine

We plan to examine how contracts and consultancies are being managed by the Victorian Public Service and the extent to which those management practices are consistent with the relevant guidelines.

Who we plan to examine

All departments.

7. Cybersecurity: infrastructure

Why this is important

Victorian Government agencies are increasingly migrating into the digital world. As they do so, they become more exposed to the threat of cybercrime. In 2022, cybersecurity was classified as the 7th most significant state risk in Victoria.

In 2021, the Victorian Government released 2 key strategies: Victoria’s Cyber Strategy 2021 and A future-ready Victoria – Victorian Government Digital Strategy 2021–2026. These strategies highlight the need to adopt new digital technologies and ensure that Victorian Government services are secure. The release of these strategies was accompanied by $50.8 million to bolster the state’s cybersecurity resilience, support local cyber businesses and develop a more dynamic and competitive cyber sector.

Applying best-practice cybersecurity controls is paramount to mitigate the risks of cybersecurity incidents. Public sector bodies vary in the extent to which they have transferred their in-house software services to those offered in the cloud.

Our 2023 report Cybersecurity: Cloud Computing Products highlighted the prevalence of cybersecurity incidents, noting that 90 per cent of Victorian Government agencies experienced a cybersecurity incident in 2022. We also found widespread issues with multi-factor authentication, with 94 per cent of user accounts at audited agencies not registered for this function.

Understanding the extent to which foundational controls for infrastructure compliance are in place and working effectively is important because this information shows whether controls are working as intended and successfully mitigating against the risk of cybersecurity incidents.

What we plan to examine

We plan to examine the effectiveness of agencies’ asset management in relation to the cloud environment and the effectiveness of controls associated with cloud-based infrastructure.

Who we plan to examine

All departments and Cenitex.

Further information

This is the second in a series of engagements examining cybersecurity in the Victorian Public Service.

8. Domestic building insurance

Why this is important

Domestic building insurance (DBI) covers homeowners in the instance that their builder dies, disappears, becomes insolvent or has failed to comply with a Victorian Civil and Administrative Tribunal order. DBI is compulsory for builders to purchase before taking a deposit on a domestic build over $16,000.

Responsibility for DBI is shared between several agencies:

- Department of Government Services (DGS) – Consumer Affairs Victoria has regulatory responsibility for the disclosure requirements related to domestic building insurance.

- The Victorian Building Authority can take regulatory action against builders if they breach conditions of registration, including prosecution or other regulatory action if they engage in work without DBI in place. Penalties for offences were increased in early 2024.

- The Victorian Managed Insurance Authority is the primary provider of DBI in Victoria since 2010, following a Victorian Government direction after private insurers exited the market.

While DBI is an established product, risks to adequately protecting and meeting the needs of consumers are increasing. Several builders have recently gone into liquidation, including Porter Davis, which did not have appropriate DBI cover, and there are concerns around the timeliness and adequacy of claims management practices.

What we plan to examine

We plan to examine whether DBI in Victoria is adequately protecting consumers building or renovating a home.

Who we plan to examine

DGS, Department of Transport and Planning, Department of Treasury and Finance, Victorian Building Authority, Victorian Managed Insurance Authority.

9. Elective surgery in Victoria

Why this is important

Elective surgery is planned surgery that can be booked in advance because of a specialist clinical assessment resulting in placement on an elective surgery waiting list. Patients are given clinical priority depending on the seriousness of their condition. As at April 2024, 67,207 Victorians were on the elective surgery waiting list.

The Department of Health (DH) reports publicly on the number of patients admitted from the elective surgery waiting list through Budget Paper No. 3: Service Delivery and its annual report. DH has failed to meet its target since the measure was introduced in 2019–20.

DH also reports on timeliness of elective surgery. In 2022–23 DH missed 2 of its 3 timeliness targets:

- 74.3 per cent of Category 3 (non-urgent) patients were admitted within 365 days (compared with a target of 95 per cent)

- 55.2 per cent of Category 2 (semi-urgent) patients were admitted within 90 days (compared with a target of 83 per cent).

During the pandemic, the Victorian Government reduced the number of elective surgeries to maximise the health system’s capacity to respond to COVID-19. In the 2023–24 Budget, the Victorian Government announced a $1.5 billion COVID Catch-Up Plan to address elective surgery backlogs. The plan included funding public use of private surgical capacity, increasing activity in public hospitals, setting up Rapid Access Hubs that only perform specific surgeries, and transforming Frankston Private Hospital into a public surgery centre.

The plan aimed to increase the number of elective surgeries to 25 per cent above pre-pandemic numbers. However, DH expects it will only deliver 207,000 elective surgeries against a target of 240,000 for 2023–24.

As part of the 2024–25 Budget, the Victorian Government reduced the elective surgery target to 200,000 for 2024–25. The government said that it lowered the target because the COVID Catch-Up Plan has ended. However, it also noted that there are continuing post-pandemic pressures on hospitals, including high demand for emergency surgery and workforce challenges.

DH need to understand whether the COVID Catch-Up Plan met its objectives and increased the health system’s capacity to perform elective surgeries.

What we plan to examine

We plan to assess whether the COVID Catch-Up Plan increased the number of Victorians receiving timely elective surgery.

Who we plan to examine

DH and selected health services (including hospitals and specialist clinics undertaking elective surgery).

10. Financial decision-making for vulnerable adults

Why this is important

State Trustees can be appointed as financial administrators for people who do not have the capacity to manage their own money due to disability, age or mental illness. Once appointed, State Trustees has extensive power to manage financial affairs including the payment of bills, rent, aged-care services and other daily expenses.

Under changes to the Guardianship and Administration Act 2019 (Vic), State Trustees must support a person to make their own decisions where they are able, and work with them to make decisions on their behalf if they are unable.

Each year, the Victorian Government invests substantial funding to improve State Trustees' service delivery and operations to meet the requirements of the Guardianship and Administration Act 2019. State Trustees must effectively oversee the financial matters of the vulnerable adults it has been entrusted to assist, otherwise these individuals may suffer significant disadvantages including missing out on services and loss of income from poorly managed assets.

In 2021–22, State Trustees did not meet its client satisfaction target. A new client experience index, introduced in 2022–23, provides more detail about service performance and client satisfaction. Initial results for this index, 0.87 against a target of 0.80, are positive.

What we plan to examine

We plan to examine whether State Trustees provides financial administration services that support the rights and interests of vulnerable adults.

Who we plan to examine

State Trustees.

11. Free TAFE

Why this is important

Free TAFE has been a significant policy platform of the Victorian Government since its establishment in 2019. It is within the responsibility of the current Department of Jobs, Skills, Industry and Regions (DJSIR). As of November 2023, there were more than 80 Free TAFE qualifications and short courses available at 12 standalone Victorian TAFE institutes and 4 dual-sector universities.

Since the initiative's inception, there has been a consistent emphasis on its role in addressing Victoria's skills shortage, in addition to driving economic recovery, creating more opportunities for Victorians and improving access to training for priority cohorts.

In the 2023–24 state Budget the Victorian Government allocated $90.5 million to DJSIR for the Free TAFE and skills demand initiative to meet expected demand for subsidised accredited training. DJSIR received an additional $186 million under the Backing TAFE for the Skills Victoria Needs initiative to amend training subsidy eligibility criteria to make subsidised training courses, including Free TAFE, more widely available to people returning to study. In the 2024–25 state Budget an additional $394.3 million was allocated through the Boosting access to Free TAFE and training services initiative.

Despite Free TAFE being a significant policy platform of the Victorian Government, there is little publicly available data on enrolment and course completions, total state expenditure and key outcomes. It is also not transparent how the Victorian Government identifies and prioritises Free TAFE courses to satisfy skills demand.

What we plan to examine

We plan to examine whether Free TAFE has delivered intended outcomes for Victorians by helping address demand for priority skills and delivering public benefit.

Who we plan to examine

Department of Education, DJSIR and selected Victorian TAFE institutes.

12. HealthShare Victoria procurement

Why this is important

HealthShare Victoria (HSV) is an independent statutory authority with responsibility for managing procurement and logistics for Victoria's public health system. In its procurement role it negotiates 'collective agreements' – single-source contracts for goods and services that health services then must use if one exists for the relevant good or service.

In 2023 HSV stated it had $1.4b of value under its collective agreements. Use of collective agreements is continuing to expand. HSV is both building the portfolio of collective agreements and bringing further health services into those agreements, as health services’ legacy contracts expire.

For 2022–23 HSV claimed its operations had delivered $202.3m in 'sector wide benefits', including a $27.4m cost reduction for health procurement.

Given that public health services must use collective agreements and the ongoing expansion of their coverage it is appropriate to consider the extent that the savings from collective agreements can be quantified when compared to equivalent market prices.

What we plan to examine

We plan to examine the extent to which collective agreements are delivering cost savings to health services, and the robustness of HSV’s method for assessing benefits realisation.

Who we plan to examine

HSV and selected health services.

13. Implementation of departmental savings and efficiencies

Why this is important

In the 2023–24 state Budget, departments and agencies were allocated $2.1 billion in savings over 4 years. According to the Budget Papers, these savings are to be achieved through efficiencies in corporate and back-office functions and reductions in expenditure on labour hire and consultants and are not intended to impact frontline workers and service delivery.

The quantum of these savings is significant, with an expected reduction of 3,000 to 4,000 public service positions. This is an estimated 5 to 7 per cent of the Victorian Public Service.

The government indicated that departmental secretaries will be responsible for determining how the savings will be achieved by their organisations. This approach can lead to a lack of transparency regarding the decisions taken by agencies.

Given the scale of savings to be achieved it is important that changes are implemented in a way that minimises disruption to agencies and avoids unintended consequences to the community.

What we plan to examine

We plan to examine whether departments and agencies implemented the savings and efficiencies, outlined in the COVID Debt Repayment Plan – savings and efficiencies initiative in the 2023–24 Budget Paper No. 3: Service Delivery, in a way that protected frontline staff and maintained service delivery.

Who we plan to examine

All departments.

Further information

The Auditor-General’s Report on the Annual Financial Report of the State of Victoria: 2022–23 identified employee cost growth as a key financial risk to the general government sector, with the government forecasts predicting that employee costs will grow by 13.8 per cent over the next 4 years ($38.3 billion in 2026–27). If targeted cost-savings initiatives through staff reductions are not implemented and realised as planned, the actual employee cost may be greater than forecast.

14. Maintaining the condition of state-managed roads

Why this is important

Roads play a vital role in people's daily lives and a critical role in the economy by supporting the movement of goods and services.

Victoria has more than 200,000 kilometres of roads. This includes freeways and arterial roads, local roads and minor roads, and tracks in parks and forests. Of these, approximately 23,000 kilometres are classified as state roads and managed by the Department of Transport and Planning (DTP).

Roads that are in poor condition increase the cost to the community through increased vehicle costs and longer travel times. They are also more costly to maintain and repair.

In its financial statements for 2022–23, DTP included an accumulated impairment for roads and bridges of $1.18 billion at 30 June 2023 – an upward adjustment of $412.1 million from the previous year. This impairment was driven by declining asset condition, which significantly exceeded restoration works ($128.2 million).

It is vital that DTP has in place effective policies and practices for road maintenance. This includes comprehensive asset information to support investment decisions, asset standards and efficient maintenance practices.

What we plan to examine

We plan to examine whether DTP is effectively maintaining state-managed roads and identify areas where asset management practices could be improved.

Who we plan to examine

DTP.

Further information

Our Maintaining State-Controlled Roadways report, tabled in 2017, looked at whether VicRoads’ road pavement maintenance program was soundly based and efficiently managed to achieve the desired outcomes for the state. The report identified an increasing road maintenance backlog and lower levels of service for road users, and the need for VicRoads to take a more strategic approach to road pavement maintenance.

15. Managing disruptions affecting Victoria's public transport network

Why this is important

We will assess whether public transport agencies and operators effectively manage disruptions affecting Victoria’s public transport network. This encompasses disruptions caused by planned and unplanned situations.

Our engagement will focus on whether transport bodies and public transport operators are prepared to effectively respond to disruptions. This includes their policies, plans and procedures, and how effectively they have responded to disruptions.

The audit period is from 2021–22, which marks the end of COVID-19 restrictions and a return to higher use of public transport.

What we plan to examine

We plan to examine whether public transport agencies and operators effectively manage disruptions affecting Victoria’s public transport network.

Who we plan to examine

Department of Transport and Planning, Major Transport Infrastructure Authority, Department of Justice and Community Safety (Emergency Management Victoria), Metro Trains, V/Line, VicTrack, Yarra Trams, and the bus operators CDC Victoria and Kinetic.

Further information

This topic was in the Annual Plan 2023–24, referred to as Compliance with emergency management requirements: transport. The topic was replaced in the 2023–24 work program with our engagement on the 2026 Commonwealth Games.

Preliminary research identified that managing public transport disruptions is broader than just compliance with emergency obligations as reflected in the original topic published in the Annual Plan 2023–24. This research found that while transport bodies have compliance obligations around transport-related vital critical infrastructure, there have been few incidents resulting in disruption to public transport services that classify as emergencies.

Furthermore, to date, the responses to emergencies that have disrupted transport services have not been under the control of Department of Transport and Planning or public transport operators, under the arrangements in the State Emergency Management Plan.

Therefore, the scope now includes the management of planned and unplanned disruptions. The analysis of unplanned disruptions will still encompass emergencies but also non-emergency situations that cause unexpected disruption to public transport services.

Relevant agencies have been consulted on the revised scope.

16. Managing the transition of energy supply to renewables

Why this is important

The concentration of greenhouse gases in the atmosphere drives climate change with carbon dioxide (CO2) produced by humans the largest contributor. In May 2023, Victoria committed to a set of interim emissions reduction targets to reduce greenhouse gas emissions from human activities and transition to net zero by 2045. As part of this target, Victoria has committed to a target of 95 per cent renewable energy generation by 2035.

Victoria’s largest source of emissions is from electricity generation. To meet its renewable energy targets, Victoria is accelerating the transition from fossil fuels to clean, renewable sources.

A parliamentary inquiry completed in May 2022 found that the demand for energy in Victoria is likely to double by 2050. A substantial level of investment will be required to achieve energy transition targets. This is a significant challenge that requires considerable planning, coordination and the development of infrastructure to generate and transmit a reliable supply of renewable electricity across the state.

The proper management of the transition to a renewable energy future is crucial to prevent major disruptions to the Victorian economy, community, and environment. Understanding how effectively the Department of Energy, Environment and Climate Action (DEECA), the recently revived State Electricity Commission and VicGrid are planning, governing and managing the transition will provide assurance as to whether Victoria is on track to meet its renewable energy targets. This will also play an important role in informing future decisions in the government's plan to achieve net-zero emissions by 2045.

What we plan to examine

We plan to examine whether the Victorian Government is effectively planning for, governing and managing Victoria's transition to renewable energy.

Who we plan to examine

DEECA, including VicGrid and State Electricity Commission.

17. Natural disaster recovery and resilience

Why this is important

The Victorian floods in October 2022 had devastating social and economic impacts across several Victorian communities. It is estimated that the floods caused $432 million in damages across affected areas.

The event and the ensuing months highlighted the obstacles faced by communities when recovering from a natural disaster. The 2023–24 state Budget reported $2.1 billion over 5 years in operational funding to meet the immediate emergency response and recovery needs of flood affected communities. Many regional communities are still grappling with lasting impacts to their social, economic, built and natural environments.

Emergency management in Victoria takes an ‘all communities all emergencies’ approach, emphasising that emergency management is a shared responsibility across all of Victoria's diverse communities. Emergency Management Victoria is responsible for the State Emergency Management Plan, which identifies 'recovery' as an emergency management phase. Emergency Recovery Victoria, established in October 2022, is focused on building stronger and more resilient individuals, communities and regions through community recovery.

For people living in regional communities, recovery can be complicated by centralised decision making, critical dependence on local infrastructure and reduced access to recovery supports and services. Victoria's emergency recovery frameworks need to demonstrate they can adapt to the unique needs of people living in regional Victoria and offer a place-based approach that supports the recovery of resilient communities, regardless of the level of coordination (local, regional or state).

What we plan to examine

We plan to examine whether governance arrangements described in Victoria's Recovery Framework effectively support recovery efforts in regional communities following a major emergency. The October 2022 floods will be the test case for the effectiveness of the governance arrangements.

Who we plan to examine

Department of Justice and Community Safety including Emergency Management Victoria and Emergency Recovery Victoria and selected local councils.

18. The Orange Door: follow-up

Why this is important

Family violence remains a significant social and public policy issue in Victoria, with 93,115 family violence incidents reported in 2022–23 (compared to 82,647 in 2018–19).

In 2016, the Royal Commission into Family Violence (the Royal Commission) recommended that the Victorian Government establish Support and Safety Hubs (Hubs) to consolidate support provision for both victims and perpetrators of family violence into a single service.

The program was publicly renamed 'The Orange Door' in 2020 to create simplified and consistent statewide branding. In 2022–23, The Orange Door provided services to 190,000 Victorians, including 81,000 children (up from 128,000 Victorians, including 53,000 children, in 2021–22).

The Orange Door network providers must comply with common standards of service delivery, quality, data reporting and governance as set by the Department of Families, Fairness and Housing (DFFH) through Family Safety Victoria. The delivery model is underpinned by a standardised Multi-Agency Risk Assessment and Management Framework, which sets common assessment, referral and case management standards and approaches.

Successful implementation of The Orange Door, as a single point of access and immediate multi disciplinary response to family violence, is a foundational element of the government's family violence reforms.

In 2020, VAGO undertook an audit of the first 5 established Hubs in Barwon, Mallee, North East Melbourne Area, Bayside Peninsula and Inner Gippsland (Managing Support and Safety Hubs). This audit made 9 recommendations covering service planning, operations, performance monitoring and governance.

The program has since been fully rolled out, with Hubs operating across all 17 of the DFFH departmental regions. As DFFH has reported that it has implemented the recommendations from the 2020 audit, a follow-up is timely.

What we plan to examine

We plan to examine DFFH’s implementation of the recommendations from the 2020 engagement Managing Support and Safety Hubs.

Who we plan to examine

DFFH.

19. Quality of Victoria's critical data assets

Why this is important

The ability of government to make informed decisions is critical. Trusted high-quality data across government provides a foundation for confident decision-making, informs policy development, promotes data re-use and supports service delivery.

All Victorian Government departments and Victoria Police are required to comply with the government's Information Management Framework (IMF) and Data Quality Standard (DQS). Responsibility for the IMF and the DQS sits with the Department of Government Services.

The IMF and DQS define an approach to establishing and maintaining the quality of data assets within the Victorian Government by setting out minimum requirements for managing data quality for critical data assets. The DQS defines critical data assets as essential or important assets, which if severely compromised, degraded, rendered unavailable for an extended period or destroyed, would significantly impact the social or economic wellbeing of the organisation or Victorian community.

Despite compliance requirements, a recurring theme of our performance engagements is the presence of low-quality data or data of unassured quality. We have previously identified data quality issues in several critical datasets across the Victorian Public Service.

What we plan to examine

We plan to examine whether relevant Victorian Government agencies assure the quality of their critical data assets.

Who we plan to examine

All departments (with a particular focus on Department of Government Services as the department with oversight responsibilities) and Victoria Police.

20. Realising the benefits identified in the Suburban Rail Loop business case

Why this is important

The Suburban Rail Loop (SRL) is a planned 90-kilometre orbital rail loop that will link Melbourne's eastern and western suburbs via Melbourne Airport. The Suburban Rail Loop Authority is responsible for planning and delivering the SRL, which in 2022 the Parliamentary Budget Office estimated will cost $125 billion.

In addition to being a significant infrastructure project, the SRL is intended to transform land use across suburban Melbourne with a particular focus on delivering housing and employment outcomes in the precincts surrounding SRL stations. The SRL business case estimates that the precinct development will deliver an additional 47,500 households and 165,000 jobs in SRL East and SRL North precincts.

Our 2022 Quality of Major Transport Infrastructure Project Business Cases audit found that planning and approval processes for the SRL had not followed usual government protocol, with the costs associated with developing these precincts not having been fully explored.

The process for planning SRL precincts commenced in mid-2023 with the release of the SRL Precincts: Discussion Paper, followed by the release of the Draft Precinct Vision in November 2023. While highlighting the importance of housing affordability and choice, these documents do not include any specific references to the scale of housing anticipated by the business case.

In the context of realising the wider economic benefits anticipated by the SRL business case, it is vital that the precinct planning process for SRL precincts is undertaken in a manner that can achieve the projected population and employment estimates. Failure to do so will reduce the benefits associated with SRL and add to the costs borne by the community.

What we plan to examine

We plan to examine whether SRL East precincts are being planned in a way that the benefits identified in the SRL business case can be realised.

Who we plan to examine

Suburban Rail Loop Authority, Department of Transport and Planning, Department of Treasury and Finance and selected local councils.

21. Recovering and reprocessing resources from waste: effectiveness of system reforms

Why this is important

In 2020–21, Victoria generated 15.8 million tonnes of waste. Programs and services in place to recover and reprocess resources from this waste are overseen by the Victorian Government and local councils.

The waste and recycling industry is facing many economic and regulatory challenges. These include the collapse of offshore markets for recycled waste, rising costs to safely dispose of waste and limited options to re-use recovered materials.

Many of these challenges were identified in our 2019 report Recovering and Reprocessing Resources from Waste. Since this audit, the Victorian Government released a 'circular economy' policy and plan called Recycling Victoria: A new economy in February 2020.

A key part of this reform was the passing of the Circular Economy (Waste Reduction and Recycling) Act 2021 (Vic). This new legislation set up a new waste and resource recovery coordinating body called Recycling Victoria and established a container deposit scheme.

The Victorian Government committed over $300 million under Recycling Victoria: A new economy to address urgent issues facing the recycling sector and make fundamental changes to prevent future disruptions. Among other benefits, the plan claimed it would ‘potentially boost Victoria’s economy by up to $6.7 billion [and] ... help to create more than 3,900 new jobs’.

What we plan to examine

We plan to examine whether relevant state authorities and local governments are implementing system reforms and effectively managing emerging waste and recycling challenges.

Who we plan to examine

Department of Energy, Environment and Climate Action (including Recycling Victoria), Environment Protection Authority Victoria, Sustainability Victoria and selected local councils.

22. Reporting on local government performance: follow-up

Why this is important

Relevant and reliable performance information is essential to improve the efficiency and effectiveness of council services and decision-making.

In our 2019 engagement, Reporting on Local Government Performance, we examined how effectively councils used the Local Government Performance Reporting Framework (LGPRF) to communicate performance information.

We also examined the role of Local Government Victoria, part of the then Department of Environment, Land, Water and Planning (DELWP) – now the Department of Energy, Environment and Climate Action (DEECA) – in developing the LGPRF and providing ongoing support and guidance to councils. Local Government Victoria has since moved to the Department of Government Services (DGS).

We found that the LGPRF was not realising its full potential because it lacked good outcome measures, data was reported inconsistently between councils and some of the reported data was unreliable.

We made 11 recommendations for DELWP and selected councils to improve their performance reporting through use of the LGPRF. All recommendations were accepted, and as of the end of 2023, were reported to have been completed.

What we plan to examine

We will assess acquittal of the recommendations from the 2019 engagement Reporting on Local Government Performance.

Who we plan to examine

DGS, DEECA, Moonee Valley City Council, City of Casey, Horsham Rural City Council, Baw Baw Shire Council and the Borough of Queenscliffe (councils in scope of the 2019 engagement).

23. Work-related violence in government schools

Why this is important

Violence in school environments can negatively affect the health and wellbeing of students, staff and the wider school community. Unsafe working environments can also put pressure on the school workforce, which is already facing shortages due to low recruitment and attrition.

The Department of Education (DE) is required by the Occupational Health and Safety Act 2004 (Vic) to ‘provide or maintain plant or systems of work that are, so far as is reasonably practicable, safe and without risks to health’. This includes work-related violence.

Data from the most recent Australian Principal Occupational Health, Safety and Wellbeing Survey (2022) shows that the percentage of school leaders subjected to physical violence has increased since 2011. In 2022, 31.3 per cent of Victorian school leaders reported that they had been subjected to physical violence. This is the lowest of any Australian state or territory.

Results from this survey also indicate that students are the main perpetrators of violence in schools. Student-initiated violence, which ranges from kicking and biting to smashing school equipment and furniture, can stem from dysregulation caused by a range of personal and/or external influences.

Responses to violence in schools, whether initiated by students or others, need to be effective and appropriate, considering the nature of the behaviour and the initiator of the violence.

What we plan to examine

We plan to examine whether DE is reducing the incidence and impact of work related violence in government schools.

Who we plan to examine

DE, WorkSafe Victoria and a selection of government schools.

24. Fair presentation of service delivery performance: 2024

Why this is important

The Department of Treasury and Finance (DTF) delivers Budget Paper No. 3: Service Delivery and department performance statements in May each year.

This budget paper outlines the Victorian Government’s priorities for the goods and services (outputs) it will provide to Victorians. The department performance statements set the expectations for service delivery by specifying performance measures and targets that departments intend to meet.

Parliament and the community are interested in the fair presentation of service delivery performance as well as the accuracy of the reported results. Department performance statements must provide an accessible understanding of a department's performance.

Our reviews, however, continue to find significant and persistent weaknesses in departments’ performance reporting, thereby weakening the transparency and reliability of reported information.

In this review, we will explore whether new measures provide an accessible understanding of a department’s output performance. We will also explore how performance measures and targets are developed, how departments report changes to their performance information, and how departments use performance information to manage their performance.

What we plan to examine

We plan to examine whether departments fairly present their service delivery performance.

Who we plan to examine

All departments, with DTF as our agency in focus.

25. Major projects performance reporting: 2024

Why this is important

The Department of Treasury and Finance delivers Budget Paper No. 4: State Capital Program in May each year. It outlines the Victorian Government’s asset investment program.

As of May 2023, Victoria has committed to investing $200.6 billion in public sector capital projects. This includes transport and water infrastructure, hospitals, schools and other community facilities.

Parliament and the community are interested in accessing transparent information about changes to the cost, time, scope and benefits of major projects.

Our previous audits and reviews have found that departments do not consistently and transparently report on their major projects' performance.

What we plan to examine

We plan to examine whether the information that departments publicly provide can be used to assess the impact of changes to major projects. We also plan to assess the factors driving significant project variations to better understand the risks to effective project delivery.

Who we plan to examine

All departments and entities with projects worth $100 million or more.

26. Responses to performance engagement recommendations: annual status update 2024

Why this is important

Our performance engagements identify opportunities for public agencies to improve how they work.

We do this by uncovering risks, weaknesses and poor performance, as well as by sharing examples of better practice. We then make recommendations to agencies to address areas for improvement.