State Trustees’ Financial Administration Services

Audit snapshot

Does State Trustees provide financial administration services that support the rights and interests of represented persons?

Why we did this audit

Victorians who cannot manage their own money due to disability, dementia or mental illness rely on State Trustees if they have no-one else.

If State Trustees does not claim their Centrelink benefits or pay their rent on time these people may run out of money or be left homeless.

Changes to the law in 2019 also require State Trustees to make decisions based on what clients with disability actually want, rather than what it considers to be in their best interests.

We did this audit to see if State Trustees is supporting the rights and interests of these vulnerable Victorians.

Profile of State Trustees' financial administration clients

Source: VAGO

What we concluded

State Trustees' financial administration services support the rights and interests of clients with disability, dementia and/or mental illness.

State Trustees has updated its procedures and operations since the changes to the Guardianship and Administration Act came into effect in 2020. These changes require State Trustees to find out its clients' will and preferences and follow them as far as possible, unless there is a risk of serious harm.

State Trustees increased its effort to identify clients’ will and preferences in 2023 and 2024.

Following a funding boost in 2022 it also visited more clients and strengthened its complaints processes. However, it is not always clear to us how State Trustees’ reasons for declining clients’ requests for extra money match the Act’s requirements.

We made 3 recommendations for State Trustees to improve its financial administration services.

Video presentation

1. Our key findings

What we examined

Our audit followed 2 lines of inquiry:

1. Does State Trustees find out and follow represented persons' will and preferences where practicable?

2. Does State Trustees effectively manage represented persons' financial affairs?

Terms used in this report

State Trustees: State Trustees is a company owned by the Victorian Government. It operates as the state's public trustee and provides a range of financial and legal services. In this audit we focused on its financial administration services for clients under Victorian Civil and Administrative Tribunal (VCAT) administration orders.

Administration order: An administration order gives a person or organisation the power to make decisions about another person's financial affairs. VCAT can only make an administration order if the person does not have the capacity to make financial decisions due to disability and needs an administrator to promote their personal and social wellbeing.

VCAT: VCAT decides on applications to place individuals under administration orders. It appoints State Trustees if there is no other suitable administrator (such as a family member) available. According to State Trustees, VCAT appoints it as the administrator for about 40 per cent of orders.

Represented person: A represented person is a person under an administration order where VCAT has appointed State Trustees as the administrator.

Will and preferences: A represented person's will and preferences are what is important to them. For example, a client might want to save money for a holiday or spend money on their pet.

Personal and social wellbeing: According to the Guardianship and Administration Act 2019, State Trustees may promote a represented person's personal and social wellbeing by considering their dignity, individuality, relationships, values and/or culture.

Background information

Recent scrutiny of State Trustees' financial administration services

State Trustees’ performance has been subject to scrutiny over the last 2 decades.

Our 2012 report State Trustees Limited: Management of represented persons and a 2019 Victorian Ombudsman investigation both concluded that State Trustees was not effectively acting in its clients' interests.

Once appointed to represent a person, State Trustees manages all their income, pays their expenses and manages their assets. This includes making significant decisions beyond paying rent or bills, such as purchasing or selling property.

If a represented person does not get timely access to their money, it can have negative consequences. For example, they could miss out on their choice of housing or lose income from poorly managed assets.

The 2023 Royal Commission into Violence, Abuse, Neglect and Exploitation of People with Disability highlighted concerns about the disempowering nature of financial administration.

Key legislative changes

In March 2020, the government repealed the Guardianship and Administration Act 1986 and changed many of State Trustees' obligations.

The key change was for State Trustees to consider the client's will and preferences. As Figure 1 shows, this changed from a requirement to consider a person's best interests.

Figure 1: Key changes from the 1986 Act to the current Act

Source: VAGO.

Victorian Government funding for State Trustees

Under its current (2022–26) agreement with the Department of Families, Fairness and Housing (DFFH), State Trustees receives up to $27 million per year to manage the financial affairs of people under VCAT administration orders.

Clients also pay fees and commissions, which VCAT sets.

What we found

This section focuses on our key findings, which fall into 3 areas:

1. State Trustees has identified the will and preferences for 95 per cent of its clients since the Act was amended in 2020. This gives it a basis to make financial decisions that reflect their rights.

2. State Trustees' reasons for declining clients' requests for extra money are not always clear to clients and may not be consistent with their rights under the Act.

3. State Trustees protects clients' interests when managing their financial affairs to make sure they have enough money to pay their expenses.

The full list of our recommendations, including agency responses, is at the end of this section.

Consultation with agencies

When reaching our conclusions, we consulted with the audited agency and considered its views.

You can read its full response in Appendix A.

Key finding 1: State Trustees has identified the will and preferences for 95 per cent of its clients since the Act was amended in 2020. This gives it a basis to make financial decisions that reflect their rights

State Trustees has:

- identified the actual or likely will and preferences for 95 per cent of its clients

- updated 53 per cent of its clients' will and preferences in the last 12 months

- visited 61 per cent of its clients face to face in the last 3 years.

Identifying will and preferences

In March 2020 the government reformed the Guardianship and Administration Act.

The Act now requires State Trustees to identify and give effect to its clients' will and preferences, rather than make decisions for them in their 'best interests'.

This change intends to uphold the rights of people with disability to influence and participate in decisions that affect their lives.

Since the Act came into effect State Trustees has made significant effort to identify its clients' will and preferences.

As of 7 November 2024, State Trustees has recorded will and preferences for 8,512 (95 per cent) of its 9,007 financial administration clients.

State Trustees told us it does not expect to find out all the remaining clients' will and preferences because some refuse contact or are missing.

Working well: Staff training

State Trustees has developed practical training to help staff assess a person with disability's will and preferences.

This training explains the Act's requirements in plain English. It also provides specific examples of will and preferences and how staff can identify them.

The training also highlights that staff should capture what is important to the client's financial goals rather than basic facts, such as 'the client has a dog’ or 'the client lives in East Melbourne’.

Our file review found that staff's entries about clients' will and preferences are clear and relevant to financial decisions.

Updating will and preferences

A person's will and preferences can sometimes change over time.

State Trustees has updated the will and preferences for 53 per cent of its clients in the last 12 months.

However, for 8 per cent of its clients, it has not confirmed or updated their will and preferences for more than 3 years. This means it does not know if it is still making decisions in line with their current will and preferences.

Visiting clients

Face-to-face visits are important for State Trustees to accurately identify the will and preferences of people with disability, mental illness or dementia. Many of these clients may struggle to communicate via phone, email or video calls.

We found that State Trustees:

- has visited 61 per cent of clients within the last 3 years

- has previously visited another 33 per cent of clients (but not within the last 3 years)

- has no visits recorded on file for 6 per cent of clients.

It may be difficult for State Trustees to accurately identify and update will and preferences for the clients it has not visited recently or at all.

State Trustees told us that since introducing its visiting program for existing clients in 2022, which additional funding enabled, it is now on track to visit 90 per cent of its clients by 2026.

Addressing this finding

To address this finding we made one recommendation to State Trustees about visiting clients and updating will and preferences.

Key finding 2: State Trustees' reasons for declining clients' requests for extra money are not always clear to clients and may not be consistent with their rights under the Act

Between July 2023 and November 2024, State Trustees approved or partly approved 63 per cent of clients' requests for spending money beyond their regular budget.

Since July 2023, it has consistently documented declined requests and why it declined them.

However, not all the documented reasons are clear and directly align with the Act. State Trustees does not clarify when reasons such as 'unaffordable to budget' and 'other' can be used to decline a request.

This means we could not always verify that its decisions to decline spending requests:

- are consistent

- comply with the Act's decision-making principles.

Clients can complain to State Trustees when it declines their requests. But when it responds to these complaints it does not specifically explain why it declined the request.

Declining clients' requests

Between July 2023 and November 2024, State Trustees declined at least 54,543 (or 17 per cent) requests.

The most common reason State Trustees used to decline requests was ‘unaffordable to budget’. This is a practical reality for many of its clients. State Trustees cannot give effect to a client's will and preferences to buy an item if they do not have the funds available.

However, it is unclear what State Trustees' threshold is for declining a request based on affordability.

For example, an item can be ‘unaffordable’ if the cost is higher than a client’s available balance after rent and bills are paid. Or it can be unaffordable because there is a certain reserve amount that the client should keep in their account as a savings buffer for unexpected expenses.

State Trustees' policies and procedures do not clarify this threshold. It told us that staff assess requests on a case-by-case basis.

Key issue: Handling complaints about declined requests

In 2023–24, State Trustees only accepted as valid 39 of the 270 (14 per cent) complaints it got about declined requests for extra money.

In contrast, State Trustees accepted 117 of the 142 (82 per cent) complaints it got about delays to services.

After receiving a complaint about a declined spending request, State Trustees sends the client a standard letter. This generic response does not explain the specific reason why it declined the request.

Clients who have insufficient funds may struggle to understand this situation because unlike other Victorians, they cannot easily check their bank account balance and transactions online in real time.

Addressing this finding

To address this finding we made 2 recommendations to State Trustees about:

- reviewing the reasons it uses to decline clients' requests for extra money in its client management system

- improving how it communicates why it declines spending requests with clients.

Key finding 3: State Trustees protects clients' interests when managing their financial affairs to make sure they have enough money to pay their expenses

State Trustees effectively manages its clients' financial affairs.

Except for some cases in 2019–20, we did not identify any systemic issues relating to bill payments, claiming entitlements or managing property.

Timeliness of bill payments

State Trustees manages almost all its financial administration tasks for clients in a timely way.

However, we found 7 cases of missed, late or overpaid rent and bills in our sample of 30 client files and our review of State Trustees' post July-2023 complaint logs. These cases led to clients potentially losing money or access to basic services.

Managing clients' property

State Trustees protects clients' interests and avoids conflicts of interest when managing their high-value assets.

For property sales, it does this by commissioning independent valuations and using auctions as the preferred sale method.

This is vital to reduce the risk of underselling vulnerable people's homes.

See the next page for the complete list of our recommendations, including agency responses.

2. Our recommendations

We made 3 recommendations to address our findings. State Trustees has accepted all recommendations.

| Agency response | ||||

|---|---|---|---|---|

| Finding: State Trustees has identified the will and preferences for 95 per cent of its clients since the Act was amended in 2020. This gives it a basis to make decisions that reflect their rights | ||||

| State Trustees | 1 | Continue increasing its effort to visit existing clients to update their will and preferences and understand their financial administration needs (see Section 3) | Accepted | |

| Finding: State Trustees' reasons for declining clients' requests for extra money are not always clear to clients and may not be consistent with their rights under the Act | ||||

| State Trustees | 2 | Review the reasons (such as ‘unaffordable to budget’) for declining clients’ requests for extra money and ensure that staff apply them consistently and in line with the Guardianship and Administration Act 2019 (see Section 4). | Accepted | |

| 3 | Provide more detailed reasons why it declines clients’ requests for extra money and/or introduce an option for clients to check their account balance before making a request (see Section 4). | Accepted | ||

3. Identifying clients' will and preferences

State Trustees increased its effort in 2023 and 2024 to visit clients and identify their will and preferences.

This has improved its understanding of what clients want, their individual circumstances and any potential risks of serious harm.

Covered in this section:

- State Trustees has identified the will and preferences for 95 per cent of its clients since the new Act came into effect

- State Trustees is starting to update clients' will and preferences more regularly in case their wishes or circumstances change

- State Trustees is visiting clients more often to better understand what they want

State Trustees has identified the will and preferences for 95 per cent of its clients since the new Act came into effect

2019 reform to the Act

In 2019 the government reformed the Guardianship and Administration Act.

The reform aimed to empower people with disability to influence decisions that affect their lives, rather than have decisions made for them in their ‘best interests’.

Sections 8 and 9 of the Act require administrators, including State Trustees, to identify the represented person’s will and preferences.

If the administrator cannot obtain them directly from the person, they should identify their likely will and preferences based on their past behaviour and/or information from their support network and any other available source.

If this is not possible, the last resort is to promote the person’s personal and social wellbeing.

Operationalising the reform

State Trustees has developed training modules and guidance for staff on how to assess the will and preferences of people with disability.

This guidance explains the Act's requirements in plain English. It also provides specific examples of will and preferences and how staff can identify them.

Identifying will and preferences

State Trustees has made significant effort to identify its clients’ will and preferences since the new Act came into effect.

To comply with the Act, it needs to record evidence that it has identified this information.

State Trustees started routinely recording will and preferences in 2020.

As of November 2024, State Trustees has recorded 34,871 will and preferences for 8,512 (95 per cent) of its 9,007 financial administration clients.

While one client has as many as 24 will and preferences recorded on their file, 495 (5 per cent) clients do not have any will and preferences identified.

State Trustees told us it is continuing to visit and call clients to identify will and preferences. It also said it is coordinating visit schedules more efficiently to reach more clients.

However, it does not expect to identify will and preferences for 100 per cent of its clients. This is because some clients are missing or refuse contact.

State Trustees is starting to update clients' will and preferences more regularly in case their wishes or circumstances change

Timeframes for updating will and preferences

State Trustees has updated 53 per cent of its clients’ will and preferences in the last 12 months. This is a promising sign that it is consulting with clients more often about what they want.

However, it can further improve its work in this area.

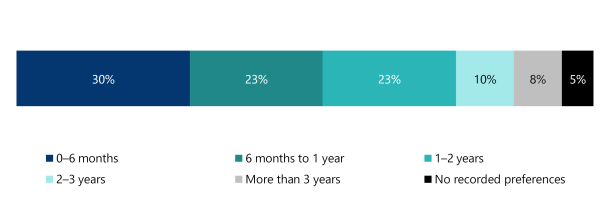

As Figure 2 shows, State Trustees has not updated the will and preferences for 8 per cent of its clients since it identified them more than 3 years ago.

Figure 2: Time since State Trustees last updated clients’ will and preferences as at 7 November 2024

Note: Numbers do not add to 100 per cent due to rounding.

Source: VAGO, based on data from State Trustees.

Source of will and preferences

Since July 2023, State Trustees has categorised if each client’s will and preferences were:

- expressed directly by the client (actual will and preferences)

- obtained from the client’s support network (likely will and preferences)

- State Trustees’ assessment of what is best for the client’s personal and social wellbeing.

The Act says obtaining will and preferences directly from the client is the preferred method.

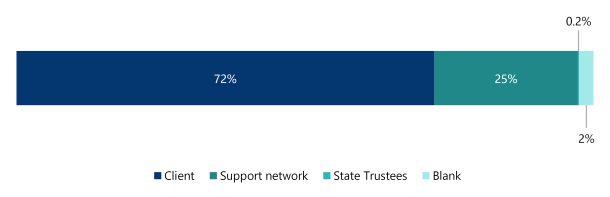

As Figure 3 shows, from 1 July 2023 until 7 November 2024, State Trustees recorded:

- 10,603 (72 per cent) will and preferences directly from the client

- 3,649 (25 per cent) will and preferences from the client's support network.

For fewer than 1 per cent of clients, State Trustees was unable to obtain actual or likely will and preferences and instead assessed what would be best for the clients' personal and social wellbeing.

The Act considers this the least-preferred option.

Since July 2023, State Trustees has recorded 23 will and preferences entries (across 17 clients) using this method as a last resort.

Figure 3: Sources of clients’ will and preferences from July 2023 to November 2024

Note: Numbers do not add to 100 per cent due to rounding. Blank means no text was recorded.

Source: VAGO, based on data from State Trustees.

Categories of will and preferences

State Trustees also categorises will and preferences by type in its customer relationship management (CRM) system, InTrust.

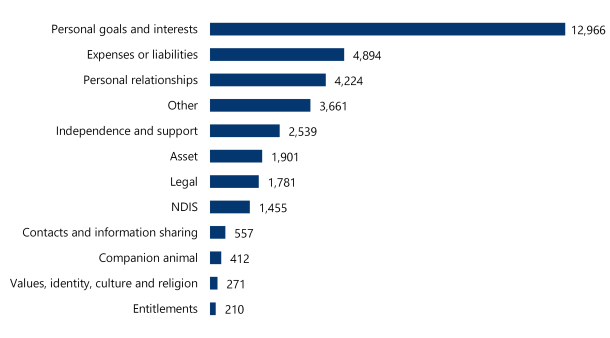

Figure 4 shows the number of clients' will and preferences by category.

Figure 4: Clients’ will and preferences by category as at 7 November 2024

Note: NDIS stands for the National Disability Insurance Scheme.

Source: VAGO, based on data from State Trustees.

The Act does not require State Trustees to collect will and preferences across multiple categories. But this can be a practical step to make sure it captures the main aspects of what is important to a client and their financial goals.

For example, the companion animal category reflects the Act’s requirement for State Trustees to consider the importance of any companion animal to a person with disability.

Relevance of will and preferences

State Trustees’ training material emphasises the importance of capturing what is important to the client’s financial goals, rather than basic facts, such as the ‘client has a dog’ or the ‘client lives in East Melbourne’.

Our file review found that its entries for will and preferences are clear and relevant to financial decisions.

Examples of will and preferences

State Trustees has recorded a range of clients’ will and preferences in InTrust and how it plans to fulfil them. For example, the client:

- ‘enjoys going on day trips and going to large open spaces such as parks and the zoo. Funds should be provided for this purpose if possible’

- ‘has expressed his 2 cats … are important to him and wants to ensure they are looked after'

- ‘does not wish to have any contact with his sisters and did not want them to be provided with any information regarding his whereabouts or financial information’

- ‘identifies as female and would like to have gender re-assignment surgery’.

State Trustees is visiting clients more often to better understand what they want

Value of visits

Face-to-face visits are important for State Trustees to accurately identify the will and preferences of people with disability, mental illness or dementia.

Many State Trustees clients may struggle to communicate via phone, email or video calls.

Face-to-face visits are also important for staff to understand their clients’ needs and build trust. This may be especially important when the client has been put under an administration order due to financial abuse by a family member.

In these cases, staff may need to make nuanced, sensitive judgements about what the client’s will and preferences are, rather than getting this information from a third party.

While State Trustees identified will and preferences for 86 per cent of its clients in the last 3 years, it only visited 61 per cent of clients during the same period.

The gap between these 2 figures suggests that it did not identify will and preferences in person for at least a quarter of clients. State Trustees told us that visits are not the only way to identify will and preferences because some are identified using other methods, such as phone conversations.

Key performance indicators

DFFH has set 2 key performance indicators (KPIs) for client visits:

- State Trustees must visit 90 per cent of new clients within 45 days of getting the VCAT order.

- State Trustees should visit each client at least once during the 3-year term of a VCAT order.

Visiting new clients within 45 days is important so State Trustees can get firsthand information about their will and preferences and financial affairs.

As Figure 5 shows, State Trustees has comfortably met these targets.

Figure 5: State Trustees' performance against its KPI to visit new clients within 45 days

| Financial year | Target | Result |

|---|---|---|

| 2023–24 | 90% within 45 days | 94% |

| 2022–23 | 90% within 45 days | 97% |

| 2021–22 | 80% within 45 days | 97%–99% |

| 2020–21 | 90% within 45 days | 99%–100% |

| 2019–20 | 90% within 45 days | 98%–100% |

Source: VAGO, based on data from State Trustees.

As well as checking clients' living conditions, visiting them every 3 years helps State Trustees ensure it makes decisions in line with their current will and preferences.

State Trustees and DFFH introduced this KPI in 2022 under their current agreement, which included funding for additional staff to visit existing clients.

Before 2022 DFFH only funded State Trustees to visit new clients.

Figure 6 shows that State Trustees has consistently met its targets for this KPI.

Figure 6: State Trustees' performance against its targets for visiting existing clients

| Financial year | Target | Result |

|---|---|---|

| 2023–24 | 2,870 visits per year | 2,896 visits |

| 2022–23 | 1,150 visits per year | 1,200 visits |

Source: VAGO, based on data from State Trustees.

Recent visits

We asked State Trustees for data on the last time it visited its current clients face to face.

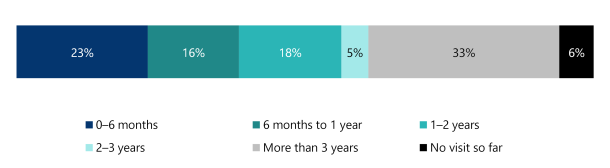

From this data we found:

- it visited 5,486 of its 9,007 clients (61 per cent) in the last 3 years

- it visited 2,981 (33 per cent) clients more than 3 years ago

- 540 (6 per cent) clients had no visits recorded on their file.

For the clients it has not visited in 3 years or at all, it may be challenging for State Trustees to accurately identify their will and preferences.

As Figure 7 shows, of the 61 per cent of clients State Trustees visited in the last 3 years, it visited 39 per cent in the last year.

Figure 7: Time since last client visit as at 7 November 2024

Note: Numbers do not add to 100 per cent due to rounding.

Source: VAGO, based on data from State Trustees.

4. Giving effect to clients' will and preferences

State Trustees gives effect to its clients' will and preferences to a reasonable extent when it sets their budgets and assesses their requests for extra money.

Its budgets for clients are customised and clear. And it approves most requests for extra money.

However, State Trustees does not document how much it consults with clients when it updates their budget. And its top 2 reasons for declining requests for extra money do not clearly align with the Act's requirement that it should only override will and preferences if there is a risk of serious harm or the request is not practicable or appropriate.

The most common type of complaint State Trustees gets from clients is about declined requests for extra money. But when it responds to these complaints it does not specifically explain why it declined the request.

Covered in this section:

- State Trustees completes budgets for almost all its clients, but it is unclear how closely it consults with them to do this

- State Trustees sometimes assesses clients' requests for extra money using inconsistent criteria

- State Trustees responds to complaints in a timely way, but poorly explains some decisions

State Trustees completes budgets for almost all its clients, but it is unclear how closely it consults with them to do this

Personalised budgets

Setting fortnightly budgets is one area where State Trustees gives effect to clients' will and preferences.

Data from InTrust shows that 96 per cent of State Trustees' clients have a budget on file.

The remaining 4 per cent do not have a current budget. State Trustees told us that this may be because some clients are new and State Trustees has not created a budget for them yet.

Clients without a personalised budget:

- may struggle to understand where their money is going

- have less of a voice in how State Trustees allocates their money.

Updating budgets

Regularly reviewing and updating budgets helps State Trustees make sure they accurately reflect clients' spending. This is particularly important for clients with low incomes.

All 30 client files we looked at had a budget that clearly showed the client's income, expenses and personal spending money.

Under its agreement with DFFH State Trustees has a KPI to regularly update clients' budgets.

| In … | the target for this KPI was to update … | and State Trustees … |

|---|---|---|

| 2022–23 | 65 per cent of client budgets within 12 months | met the target with a result of 75 per cent. |

| 2023–24 | 90 per cent of client budgets within 12 months | met the target with a result of 91 per cent. |

Consulting with clients

State Trustees' training material for staff highlights the importance of consulting with clients on their will and preferences when updating their personalised budgets.

The training emphasises ‘it’s not a client budget without a client conversation’.

However, State Trustees does not systematically record how staff consulted with clients to update their budgets (for example, a visit or phone call) in its CRM system. State Trustees told us that it indirectly records this in the CRM's general contact log and that the interactions can be linked using a time stamp.

Only one of the 30 files we reviewed explicitly documented the client's input in the budget development process.

State Trustees sometimes assesses clients' requests for extra money using inconsistent criteria

Requests for extra money

Financial administration clients can contact State Trustees to request access to their money for items ranging from groceries and clothes to electrical goods and holidays.

State Trustees told us that:

- some clients rarely make requests

- some clients call multiple times per day. Due to disability, they may not understand they do not have enough money to pay for the items they want.

We looked at data from InTrust about requests for extra money. The data only goes back to July 2023 when State Trustees started using InTrust. State Trustees told us this is because it did not routinely record data about declined requests before it started using InTrust.

Number of requests

From July 2023 to November 2024, State Trustees assessed 320,775 requests for extra money across 8,035 clients.

While 11 per cent of clients did not make any requests during this period, 10 per cent of clients accounted for 56 per cent of all requests.

One client made 668 requests, of which State Trustees denied 316.

Conversely, 71 per cent of clients did not have any declined requests, which means State Trustees either partially or fully approved all their requests.

Approval rates

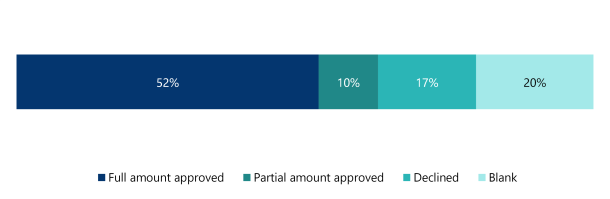

As Figure 8 shows, from July 2023 to November 2024 State Trustees approved or partially approved 201,003 of 320,775 (63 per cent) requests for extra money.

During this period it declined at least 54,543 (17 per cent) requests.

Figure 8: How State Trustees responded to requests for extra money from July 2023 to November 2024

Note: The total for full amount approved and partial amount approved is 63 per cent due to rounding.

Source: VAGO, based on data from State Trustees.

As Figure 8 shows, 20 per cent of request records are blank so it is not clear if State Trustees approved or declined them.

This gap in record keeping means State Trustees:

- may not be accurately reporting approval rates

- may not have complete information to identify issues with InTrust that would enable it to improve how staff accurately document decisions.

Reasons for declining requests

Since introducing InTrust in July 2023, State Trustees has instructed staff to record why they have declined a request and select a reason or reasons from a drop-down menu.

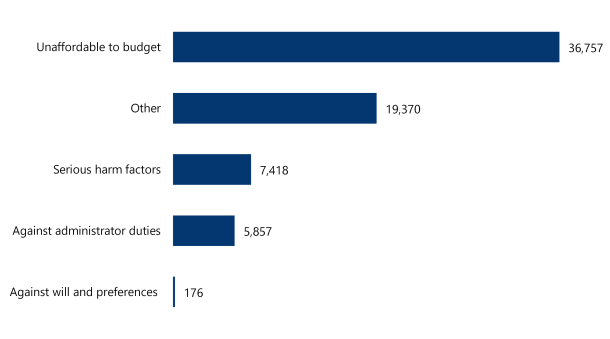

Figure 9 shows the number of times State Trustees used each reason category for declining ad hoc requests.

Figure 9: Number of times State Trustees used each reason category for declining ad-hoc requests from July 2023 to November 2024

Note: Staff can select multiple reasons for each declined request.

Source: VAGO, based on data from State Trustees.

As well as selecting the reason from the drop-down menu, State Trustees trains staff to add further details why they have declined a request in the client's file.

Assessing unaffordability

State Trustees cannot give effect to clients’ will and preferences if they do not have the money available to pay for their desired item or activity.

However, it is unclear what State Trustees' threshold is for declining requests based on affordability.

An item can be unaffordable if the cost is higher than a client’s available balance after rent and bills. Or it can be unaffordable because there is a certain reserve amount that State Trustees thinks clients should keep in their accounts as a savings buffer for unexpected expenses.

State Trustees' policies and procedures do not clearly explain what 'unaffordable to budget' means in practice.

It told us this is because the affordability threshold is different for each client depending on their income, needs and financial obligations.

For example:

- a homeless client may need to spend their last $100 for food and shelter

- a better-off client may need to reserve funds for mortgage payments, bills or an upcoming holiday.

Despite this, the lack of clear guidance for staff creates the risk that they may inconsistently assess affordability.

We also found that staff routinely consider a client's deficit, which is the rate of spending compared to their income, and decline some spending requests even if the client has enough money in their account.

Other reasons for declining requests

After 'unaffordable to budget', 'other' is the most common reason staff use to decline requests. Unless staff provide further detail in the client's file, State Trustees cannot tell if the reason they declined the request aligns with the Act.

This lack of clarity means there is a risk that State Trustees uses this reason category inconsistently. This reduces the effectiveness of the Act's provisions to give effect to a client's will and preferences where practicable.

The reason ‘against administrator duties' refers to State Trustees' responsibilities under the Act to:

- protect the represented person from neglect, abuse or exploitation

- act honestly, diligently and in good faith

- exercise reasonable skill and care.

However, when State Trustees uses this reason it does not specify which duty the request conflicts with.

Case study 1 is an example of how State Trustees uses different reasons to decline requests.

Case study 1: Using different reason categories

Client A is a 35-year-old man who came under State Trustees' financial administration in December 2019. Although Client A receives a full Disability Support Pension, State Trustees describes him as 'living in a deficit'.

In 2023–24 State Trustees recorded 136 requests for extra money from Client A. Of these requests, State Trustees:

- approved 75

- declined 39

- partially approved 22.

'Unaffordable to budget' was the most common reason State Trustees used to decline his requests.

In one instance, Client A requested $500 for a passport. State Trustees declined the request due to concerns about the client's mental health and categorised the reason as 'serious harm factors'.

In this instance, one of Client A's recorded will and preferences was that he wanted 'to go on holiday to Europe and LA to meet and start a business with a specific celebrity'. This will and preference was rated as 'high' priority, which indicates it was extremely important to the client.

This example shows that sometimes State Trustees' requirement to uphold a client's will and preferences can conflict with the Act's principle to act as an advocate for them to prevent the risk of serious harm.

In 2 other instances, State Trustees declined Client A's requests because they were 'unaffordable to budget' and 'other', despite his case file saying both requests were declined because he would not be able to cover upcoming body corporate fees, which he is obliged to pay.

Source: VAGO, based on State Trustees' client files.

State Trustees responds to complaints in a timely way, but poorly explains some decisions

Client complaints

State Trustees responds to complaints in a timely way. But it could more clearly explain its decisions to clients who complain about declined funding requests.

In 2020, State Trustees set up a dedicated complaints team. This team delivers monthly reports on complaint trends to State Trustees' senior management.

State Trustee's client feedback procedure manual requires it to resolve at least 90 per cent of complaints within 28 working days. It achieved this target in 2023–24.

State Trustees has identified service delays, such as wait times for its client call centre, as one driver of dissatisfaction and is working to reduce these delays.

However, it does not clearly explain to clients why it declined their requests for extra money.

Clients cannot view their account balance or transactions online in real time. And when they complain about declined requests State Trustees only sends them a generic letter in response.

Awareness of complaint channels

State Trustees has clear information about complaint and feedback channels on its website, including the option to contact the Victorian Ombudsman if a client is dissatisfied with its initial response.

However, given the complex needs of some clients, these channels may not be enough to ensure they know how and where to complain.

In a 2024 client experience survey, 42 per cent of respondents said they knew how to make a complaint, which was down from 58 per cent in the 2023 survey.

Number of complaints

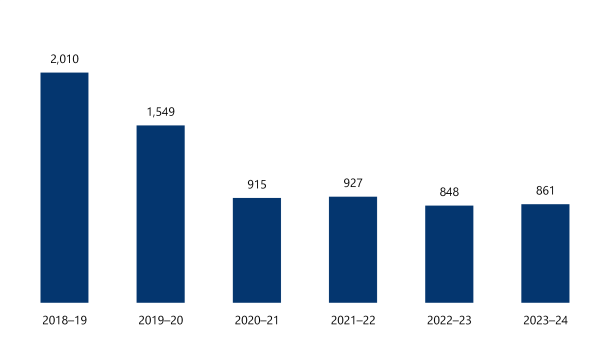

For the last 4 years, State Trustees has received a relatively stable number of complaints.

This follows a substantial drop from 2,010 complaints in 2018–19 to 915 in 2020–21.

Figure 10 shows the number of complaints State Trustees received from 2018–19 to 2023–24.

Figure 10: Complaints received from 2018–19 to 2023–24

Source: VAGO, based on data from State Trustees.

A high number of complaints may indicate there is an issue with the quality of State Trustees' services. However, complaints can also arise from other circumstances where State Trustees has acted to protect a client from financial abuse.

For example, a clients’ family member filed a complaint in 2024 about State Trustees cancelling an ATM card. However, the family member had appeared to be using the card for their own expenses, rather than the client's.

Media coverage, such as coverage on the Victorian Ombudsman’s 2019 report could also lead to increased scrutiny and more complaints.

Types of complaints

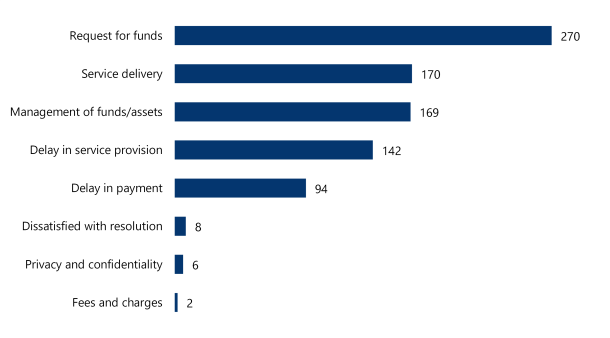

State Trustees sorts complaints into 8 categories.

Figure 11 shows the number of complaints per category for 2023–24. The most common type of complaint was complaints about declined requests for extra money.

Figure 11: Complaints by category in 2023–24

Source: VAGO, based on data from State Trustees.

Complaints about declined funding requests

State Trustees receives the most complaints about declined requests for extra money.

In 2023–24, State Trustees only accepted as valid 39 of the 270 (14 per cent) complaints it got in the ‘request for funds' category. In contrast, it accepted 117 of the 142 (82 per cent) complaints in the ‘delay in service provision’ category.

When State Trustees responds to a complaint about a declined request for extra money it provides a generic response letter that says 'consideration must be given to the variance of your budget and ongoing expenses'. And as a result, 'on this occasion, your request could not be supported'.

This letter does not:

- explain the specific reason why State Trustees declined the client's request

- respond to the client's specific concern.

Clients cannot see their bank account balance in real time. State Trustees told us it is considering offering an SMS balance check function, but it would need to conduct a risk assessment for each client before allowing access. Without access to their account balance, clients may not understand why State Trustees has declined their request for extra money.

Given the Act requires State Trustees to 'give all practicable and appropriate effect to clients’ will and preferences' in financial decision-making unless there is a risk of serious harm, it could better explain to clients why it declines their requests.

Complaints about services

The second most common type of complaint State Trustees received in 2023–24 was complaints about how it delivers services. It has identified this as a focus area to improve in.

It told us it is introducing initiatives to reduce call wait times, including adding an online chat and a call-back function.

In 2023 State Trustees started working on a 'first call resolution' strategy. The aim of this strategy is to increase its service centre staffs' capability to directly resolve client enquiries without needing to wait for a referral to a personal financial consultant.

Despite this initiative, State Trustees' client experience survey shows that satisfaction with the service centre decreased from 74 per cent in 2023 to 59 per cent in 2024.

One of the clients surveyed in 2024 described the following reason for their dissatisfaction: 'It can take half an hour to get into contact with them. They are really hard to reach sometimes, and I am not satisfied with the wait time and the timeliness of email responses. It was not in their capabilities to resolve it'.

Client satisfaction with complaint outcomes

State Trustees' 2023–24 client experience survey indicated that 50 per cent of clients were not happy with how State Trustees responded to their complaint.

State Trustees' report on this survey suggested this may be because clients:

- did not feel that State Trustees recognised their point of view

- did not agree with the resolution to their complaint.

The report recommended that State Trustees more clearly explain its decisions to provide more transparency for clients.

5. Managing clients' financial affairs

State Trustees manages clients' financial affairs to maximise their eligibility for Centrelink and other benefits. It also claims the income that clients with disability, dementia or mental illness need to meet their living expenses.

State Trustees generally pays bills in a timely way and protects clients' interests when managing their assets.

Covered in this section:

- State Trustees mostly pays rent and bills on time

- State Trustees claims clients' concessions and entitlements to maximise their income and meet their expenses

- State Trustees manages clients' assets to protect their interests

State Trustees mostly pays rent and bills on time

Paying rent and bills on time

Paying a client's rent and bills on time is an essential part of State Trustees' financial administration services. State Trustees told us it currently pays about 15,000 bills per month.

Many of State Trustees' clients have low incomes, which means it is even more important that it pays bills correctly and on time.

For example, a low-income client could lose their affordable housing or become homeless if State Trustees does not pay their rent when it is due.

Issues with bill and rent payments

Of the 30 client files we looked at, we found 3 issues with State Trustees paying rent and bills correctly and/or on time.

Two of these issues were in 2019–20, which was before it overhauled its general procedures, including its procedures for paying bills. The other issue was in 2024.

State Trustees' complaint records from June 2023 to November 2024 suggest that late or incorrect payments do occur but are not a widespread or systemic issue. Of the 955 complaints it received during this period, 4 were about substantiated issues with rent or bill payments.

The following table and case study describe the combined total of 7 instances we identified where a client was negatively impacted.

State Trustees told us it has resolved all the issues in the following table.

| In ... | State Trustees ... | which led to … |

|---|---|---|

| 2020 | missed an aged-care resident's annual gold private health cover payment | the risk of the client losing their private health cover. |

| double paid for a client's car insurance | State Trustees overpaying $2,176 from the client's account. | |

| 2023 | did not update a client's rental payments to reflect the increased rate | the client receiving an eviction notice because they were in arrears. |

| 2024 | updated a client's budget to reflect a rental increase but forgot to update the recurring payment amount | the real estate agency complaining to State Trustees about the client being in arrears of $1,825. |

| missed numerous phone bills for a client | the client's phone service being disconnected. | |

| missed a client's internet bill | the client having to follow up with State Trustees twice to get the bill paid. |

Case study 2: Paying bills for emergency accommodation

Client B, who is in her late 60s and has an intellectual disability, was living in a rooming house until a dispute with housemates ended with the police being called.

She moved to a motel in late 2024. State Trustees promptly responded to the client's urgent need for accommodation. It organised with the motel management to pay invoices for the client's room on a weekly basis.

However, State Trustees did not immediately cancel the client's recurring rent payment to the rooming house.

This meant that in addition to the landlord refusing to repay the client's $880 bond due to 'cleaning costs', the client lost an additional fortnight of rent ($440).

In February 2025, State Trustees told us it had discussed the issue with the rooming house owner, who agreed to refund $580 out of the $880 bond. At the time of finalising this report, we had not received evidence that the funds had been reimbursed to the client.

Source: VAGO, based on State Trustees' client files.

State Trustees claims clients' concessions and entitlements to maximise their income and meet their expenses

Claiming benefits

Ninety-six per cent of State Trustees' clients receive pension payments, including:

- 71 per cent on the Disability Support Pension

- 23 per cent on the Age Pension.

We did not identify any issues with State Trustees identifying or claiming a client’s maximum entitlements or concessions.

Notes from the 30 files we reviewed indicated that staff proactively claim clients' entitlements.

InTrust has fields for staff to record the timing, amount and receipts for each client's payments, such as Centrelink payments. This helps staff make sure clients receive the correct amount on time.

State Trustees also prepares annual financial plans for clients with property and other assets to maximise their eligibility for Centrelink entitlements.

State Trustees manages clients' assets to protect their interests

Selling property

State Trustees protects clients’ interests when it sells their property. It does this by:

- commissioning an independent property valuation, which includes a conflict-of-interest declaration

- using auctions as the preferred sale method

- only sharing the reserve price with the real estate agent the day before the auction to reduce the risk of undermining the competitiveness of the bidding process.

During our file review we examined 43 property sales between 2019 to 2024 for 30 clients. Properties were only sold privately in particular circumstances. For example:

- the property did not meet the reserve price, so negotiations continued with the interested parties after the auction (5 of 43 sales)

- the property was jointly owned by a non-client who preferred a private sale (4 of 43 sales)

- the property was in a retirement village (2 of 43 sales). State Trustees used the facility's default selling method.

Of the 43 sales we looked at, we identified one instance in 2021 where State Trustees sold a client's property and disposed of the client's possessions against their will and preferences.

In this instance, the client’s VCAT order was under the previous version of the Act, which only required State Trustees to consider the client's best interests.

State Trustees sold the property and the client permanently moved into aged care because the property was not in a suitable condition to rent out without significant repairs.

State Trustees later apologised for not adequately consulting the client about their property and possessions.

In all the other files we looked at, State Trustees thoroughly documented the client’s will and preferences and sought VCAT's advice in complicated cases.

Case study 3 shows an example of how State Trustees managed possible financial abuse and consulted with VCAT to sell a client's property.

Case study 4 shows an example of how State Trustees sold a client's property under difficult circumstances.

Case study 3: Selling a client's home amid family conflict

VCAT put Client C, who was in her 90s and had dementia, under State Trustees' financial administration due to a family conflict where her 2 sons were both accusing each other of financial abuse.

Due to dementia State Trustees could not identify her will and preferences.

Client C originally lived in her own home, where Son 1 and his young family had also moved in.

Son 2 took his elderly mother on a 'holiday' to Greece, then announced that both would be living there permanently.

As the client would not be returning to her Melbourne house where Son 1 remained living rent and bill-free, State Trustees got approval from VCAT to sell the property.

Source: VAGO, based on State Trustees' client files.

Case study 4: Selling a property with squatters

Client D, who was in his 90s and had dementia, owned multiple million-dollar Melbourne properties and had no family in Australia.

He became a State Trustees client after hospital nursing staff became suspicious of his neighbours, who were visiting him and asking questions about his finances.

All 5 of his homes were in very poor condition because he was too frail to keep up with maintenance in recent years. Two were vacant and another was occupied by squatters.

When Client D permanently moved into aged care State Trustees identified the client's will and preferences to sell the properties.

Staff printed out questions in large font to ensure he understood and got him to hand-write his responses.

State Trustees then auctioned the homes. For the property that was occupied by squatters, State Trustees hired a security firm to patrol the site to make sure they did not return.

Source: VAGO, based on State Trustees' client files.

Appendix A: Submissions and comments

Download a PDF copy of Appendix A: Submissions and comments.

Appendix B: Acronyms and glossary

Download a PDF copy of Appendix B: Acronyms and glossary.

Appendix C: Audit scope and method

Download a PDF copy of Appendix C: Audit scope and method.

Download Appendix C: Audit scope and method