Tertiary Education and Other Entities: Results of the 2011 Audits

Overview

This report covers the results of the annual audit of 106 entities from the tertiary education, sustainability and environment, health, planning and community development and local government sectors, with a financial year end other than 30 June 2011. It focuses principally on 98 tertiary education sector entities, comprising the eight public universities and their 57 controlled entities, 14 technical and further education (TAFE) institutes and their 11 controlled entities, seven training entities and the one controlled entity.

The report informs Parliament about significant issues arising from the audits of financial and performance reports and augments the assurance provided through audit opinions included in the respective entities’ annual reports.

The report comments on the effectiveness of internal controls, and for the tertiary education sector, controls over information technology (IT) security and capital project management. It also comments on the financial sustainability of universities, TAFE institutes and alpine resort management boards, and their financial management and reporting activities.

Parliament can have confidence in 100 of 103 financial reports and all performance reports that received clear audit opinions.

The internal control structures over financial reporting within audited entities were adequate, that is they enabled production of accurate, complete and reliable information for reporting. However, improved information security policies and oversight of IT systems security, including having a dedicated governance committee would improve IT security. The review of capital project management revealed that a third of tertiary education entities are not performing post-project evaluations, and 25 per cent are experiencing budget variances or delays in completion.

Tertiary Education and Other Entities: Results of the 2011 Audits: Message

Ordered to be printed

VICTORIAN GOVERNMENT PRINTER May 2012

PP No 131, Session 2010–12

President

Legislative Council

Parliament House

Melbourne

Speaker

Legislative Assembly

Parliament House

Melbourne

Dear Presiding Officers

Under the provisions of section 16AB of the Audit Act 1994, I transmit my report on Tertiary Education and Other Entities: Results of the 2011 Audits.

Yours faithfully

![]()

D D R PEARSON

Auditor-General

23 May 2012

Audit summary

This report presents the results of the 2011 audits of 106 entities mainly with a 31 December financial year end. It focuses on universities, tertiary and further education (TAFE) institutes and alpine resort management boards (ARMBs), providing detailed analysis of their internal controls, financial results and sustainability.

Clear audit opinions were issued on the financial reports of all but three entities, while all 20 performance reports received clear audit opinions. The three qualified opinions related to the financial reports of The University of Melbourne, Deakin University and the Anti-Cancer Council of Victoria. An ‘emphasis of matter’ comment was included in the opinion for a further seven entities, mainly relating to financial sustainability issues.

Conclusion

Notwithstanding some deficiencies, Parliament can have confidence in the adequacy of financial reporting and the internal controls of the entities audited.

Internal controls

We found that all universities and TAFEs operate adequate internal controls to maintain reliable financial reporting, assist with the efficiency and effectiveness of their operations and to comply with relevant laws and regulations. As part of our annual assessment of internal controls we focused on controls over information technology (IT) security and capital project management. Significant expenditure is incurred in relation to these core business activities, therefore robust systems and documented policies are required to maintain probity and maximise efficient use of public sector resources.

The tertiary education sector spent approximately $415 million on software, hardware, IT contractors and IT staff in 2011. We found that IT systems’ security was strong, as universities and most TAFEs have documented policies and procedures. However, tertiary education sector entities need to improve their information security classification policies and oversight of IT systems security, including having a dedicated committee for the governance of their IT environments. Some TAFEs did not have documented IT security policies, which is concerning given that private student information is stored electronically.

Capital project management frameworks were generally strong and all entities regularly reported to their governing bodies on capital project matters. However, our review indicated that a quarter of capital projects were either not completed within budget or on time. The opportunity to improve the management of capital projects is also being neglected, as post-project evaluations are not being performed in a third of tertiary education entities.

Financial results and sustainability

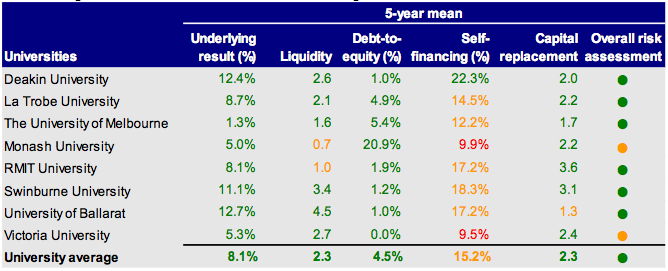

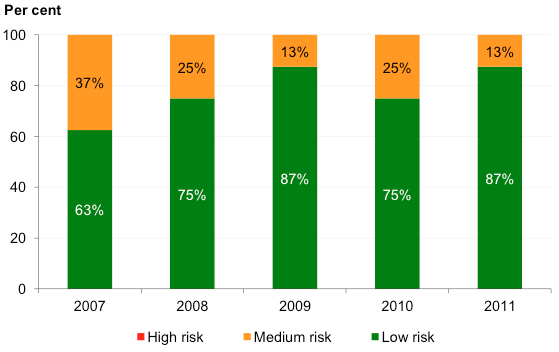

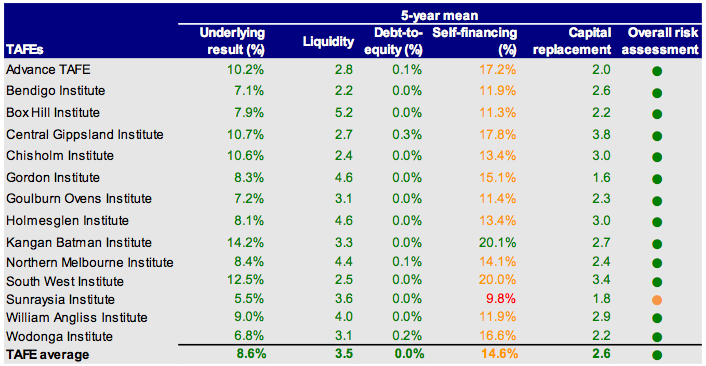

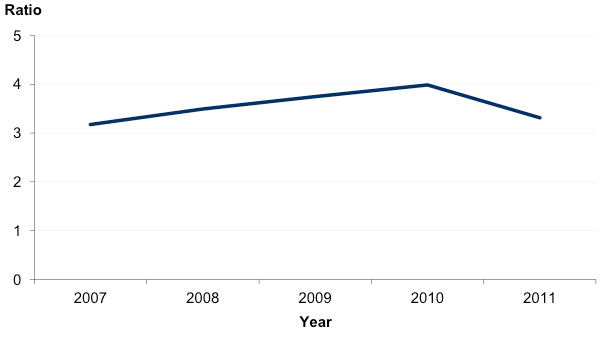

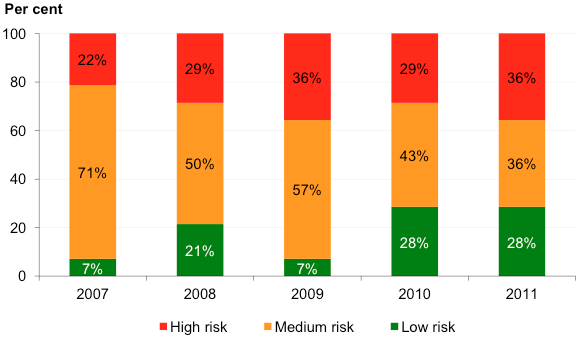

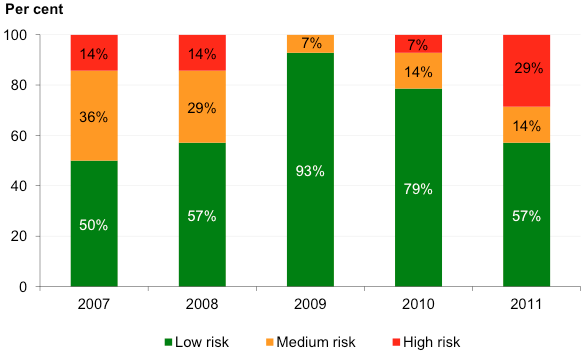

Our financial sustainability assessments of the tertiary education sector indicated that most entities are in the low risk category. However, the sector generally recorded poor self-financing indicators, with 90 per cent of entities recording a medium- or high-risk assessment. This suggests that these entities are not able to effectively fund capital programs with cash generated from their operations. This is problematic given that many of these entities have limited cash reserves to draw upon to fund future capital activities.

Universities continued to record strong financial results, with the sector generating a healthy $478.5 million surplus in 2011. Monash University and Victoria University’s financial sustainability was assessed as medium risk overall due to their poor self‑financing indicators.

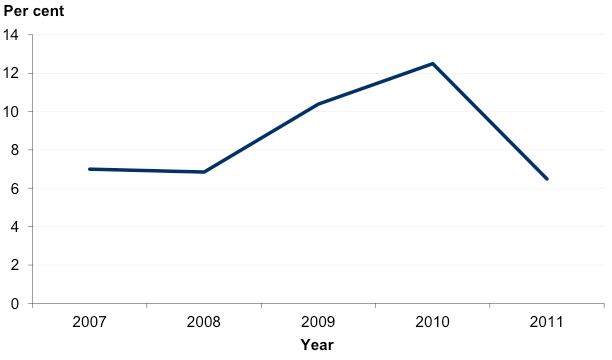

The TAFE sector recorded a surplus of $100.5 million, down 32.5 per cent on 2010, partially due to a decrease in international student fee revenue. We noted that three of the 11 TAFEs that currently provide educational services to international students could not provide infromation on these students’ countries of residence or social demographics. This deficiency impacts on their ability to effectively market and tailor educational programs.

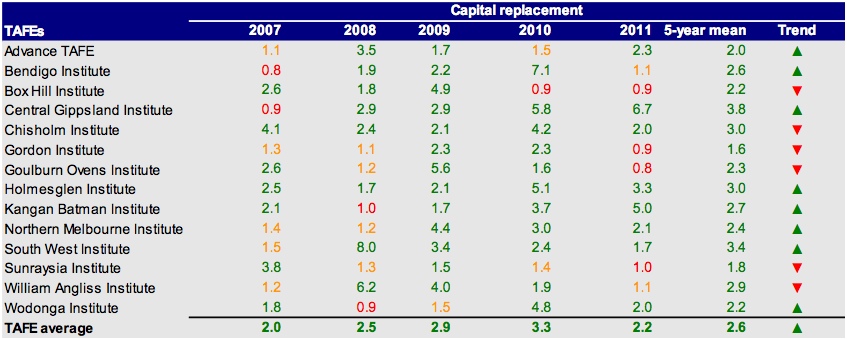

Our analysis of the TAFE funding model shows that capital grants are strategically allocated across the sector rather than progressively to each entity, with funds for asset replacement provided at government discretion. The governing body is accountable for an entity’s financial management and performance but has limited ability to make decisions around asset upgrades and replacement, with adverse implications for the adequacy of the sector’s facilities and impacting on their long-term operational performance.

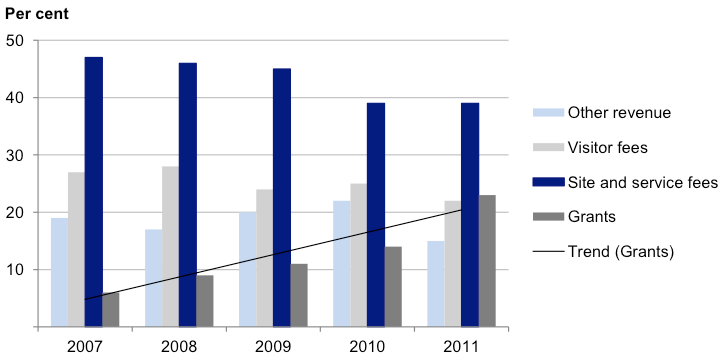

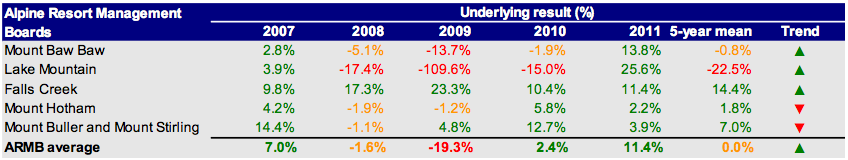

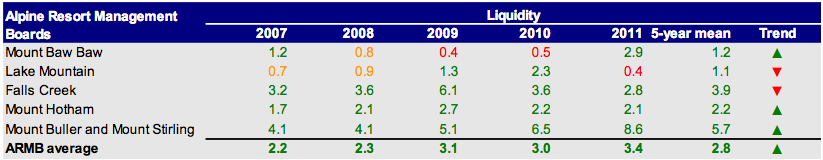

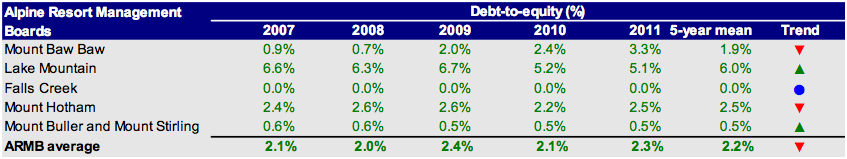

Alpine resort management boards

Substantial support payments of $8.2 million contributed by the Department of Sustainability and the Environment and insurance recoveries of $1.9 million resulted in the sector achieving a $5.2 million surplus. Without these support payments there would have been an overall deficit of $4.9 million. At the smaller ARMBs, expenditure has grown faster than revenue over the past five years, with government grants representing an expanding component of total revenue.

We have concerns with the ongoing financial sustainability of the smaller boards, Lake Mountain and Mount Baw Baw. These entities recorded overall financial sustainability risk assessments of high and medium, respectively. These assessments highlight the ongoing challenge for smaller ARMBs to control their expenditure, particularly given their limited ability to increase revenue streams. The Minister for Environment and Climate Change has directed the ARMBs and the Alpine Resorts Co-ordinating Council to provide advice on an integrated financial sustainability solution for the sector.

Recommendations

- That performance reporting for the TAFE sector be elevated to legislative status.

- That universities and TAFEs continue to refine their financial reporting processes by preparing shell financial statements and adopting rigorous quality control and assurance procedures.

That tertiary education bodies:

- assess their policies and practices against the identified general internal control weaknesses to determine the adequacy of their controls, and whether they are operating reliably, efficiently and effectively

- develop comprehensive policies and procedures over information technology system security which are approved at board or council level and subject to regular review

- develop an information security classification policy that outlines criteria for assigning security classifications to information and the required security controls for each classification

- undertake periodic assessments of the adequacy of, and compliance with, information technology security requirements

- develop capital project management policies and procedures which are approved by the governing body

- undertake post-project evaluations to learn from recent projects and report findings to the governing body

- engage internal audit to conduct periodic reviews of their information technology security policies and capital project management arrangements and outcomes

- develop and maintain the capacity to monitor the country of residence and other socio-economic details of their international students to improve their marketing focus and provide appropriately structured courses.

- The Alpine Resorts Co-ordinating Council together with Lake Mountain and Mount Baw Baw alpine resort management boards should investigate the potential for implementing revised operating arrangements to improve their longer-term financial viability.

- Alpine resort management boards should continue to address commonly identified internal control weaknesses to ensure they are operating in a reliable and sustainable manner.

Submissions and comments received

In addition to progressive engagement during the course of the audit, in accordance with section 16(3) of the Audit Act 1994, relevant extracts from the report were provided to all universities, TAFEs, alpine resort management boards, the Department of Treasury and Finance, the Department of Education and Early Childhood Development and the Department of Sustainability and Environment with a request for submissions or comments.

Agency views have been considered in reaching our audit conclusions and are represented to the extent relevant and warranted in preparing this report. Their full section 16(3) submissions and comments, however, are included in Appendix E.

1 Background

1.1 Introduction

This report covers 106 entities from the tertiary education, sustainability and environment, health, planning and community development, and local government sectors, with a financial year end other than 30 June 2011. Principally it deals with the results of the audits of 98 tertiary education sector entities, comprising universities, technical and further education (TAFE) institutes, training entities and the entities that they control. The profile of these entities is set out in Figure 1A.

Figure 1A

Entities with a financial year end other than 30 June 2011

|

2011–12 |

|||||||

|---|---|---|---|---|---|---|---|

|

Balance date |

|||||||

|

Sector |

Type of entity |

2010 |

30 Sep |

31 Oct |

31 Dec |

31 Mar |

Total |

|

Tertiary Education |

University |

8 |

8 |

8 |

|||

|

Entity controlled by university |

63 |

57 |

57 |

||||

|

TAFE Institute |

14 |

14 |

14 |

||||

|

Entity controlled by TAFE Institute |

12 |

11 |

11 |

||||

|

Training entity |

6 |

7 |

7 |

||||

|

Entity controlled by training entity |

2 |

1 |

1 |

||||

|

Total Tertiary Education |

105 |

98 |

|||||

|

Sustainability and Environment |

Alpine resort |

5 |

5 |

5 |

|||

|

Health |

Charity |

1 |

1 |

1 |

|||

|

Planning and Community Development |

Trust |

1 |

1 |

1 |

|||

|

Local Government |

Company |

1 |

1 |

1 |

|||

|

Total |

113 |

1 |

5 |

99 |

1 |

106 |

|

Note: Controlled entities generally include associated companies, trusts and joint ventures.

Source: Victorian Auditor-General's Office.

This report informs Parliament about significant issues arising from the financial audits within the tertiary education and alpine resort sectors, and augments the assurance provided through audit opinions on financial reports and performance reports included in the respective entities’ annual reports.

The report comments on the quality and timeliness of financial reporting in the sector, and the financial sustainability of tertiary education bodies and alpine resort management boards. It also comments on the effectiveness of information technology security and capital project management controls in the tertiary education sector.

The other reports on the results of financial audits are outlined in Appendix C.

1.2 Financial audit framework

1.2.1 Audit of financial reports

An annual financial audit has two aims:

- to give an opinion consistent with section 9 of the Audit Act 1994, on whether financial reports are fairly stated

- to consider whether there has been wastage of public resources or a lack of probity or financial prudence in the management or application of public resources, consistent with section 3A(2) of the Audit Act 1994.

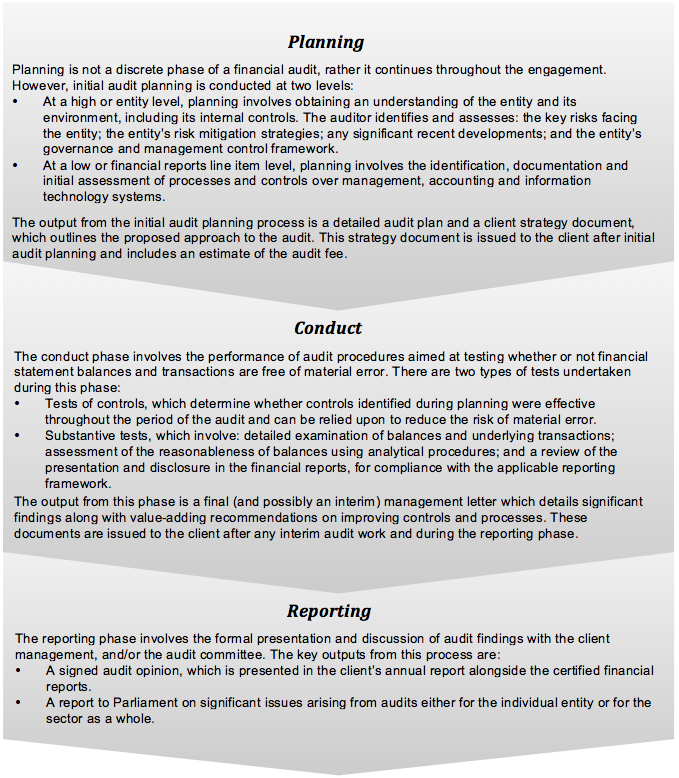

The financial audit framework applied in the conduct of the 2011 audits of tertiary education, alpine resorts and other entities is set out in Figure 1B.

Figure 1B

Financial audit framework

Source: Victorian Auditor-General's Office.

1.2.2 Audit of internal controls

An entity’s governing body is responsible for developing and maintaining its internal control framework. Internal controls are systems, policies and procedures that help an entity to reliably and cost effectively meet its objectives. Sound internal controls enable the delivery of reliable, accurate and timely external and internal financial reporting.

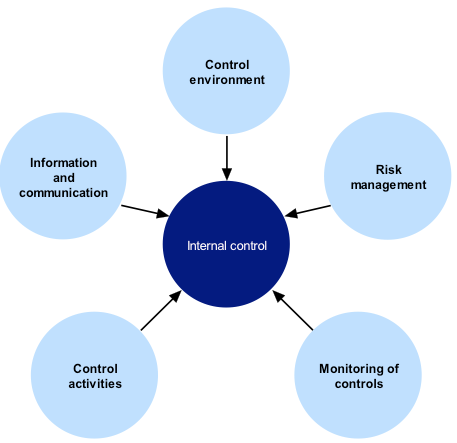

Figure 1C identifies the main components of an effective internal control framework.

Figure 1C

Components of an internal control framework

Source: Victorian Auditor-General's Office.

In the diagram:

- the control environment provides the fundamental discipline and structure for the controls and includes governance and management functions and the attitudes, awareness and actions of those charged with governance and management of an entity

- risk management involves identifying, analysing and mitigating risks

- monitoring of controls involves observing the internal controls in practice and assessing their effectiveness

- control activities are policies, procedures and practices prescribed by management to help meet an entity’s objectives

- information and communication involves communicating control responsibilities throughout the entity and providing information in a form and time frame that allows officers to discharge their responsibilities.

The annual financial audit enables the Auditor-General to form an opinion on an entity’s financial report. An integral part of this—and a requirement of Australian Auditing Standard 315 Understanding the Entity and its Environment and Assessing the Risk of Material Misstatement—is to assess the adequacy of an entity’s internal control framework and governance processes related to its financial reporting.

Internal control weaknesses we identify during an audit do not usually result in a ‘qualified’ audit opinion. A qualification is usually warranted only if weaknesses cause significant uncertainty about the accuracy, completeness and reliability of the financial information being reported. Often, an entity will have compensating controls that mitigate the risk of a material error in the financial report.

Weaknesses we find during an audit are brought to the attention of an entity’s chairperson, chief executive officer and audit committee by way of a management letter.

Section 16 of the Audit Act 1994 empowers the Auditor-General to report to Parliament on the results of audits. This report includes the results of our review of internal controls related to the financial reporting responsibilities of the tertiary education and alpine resort sectors.

1.2.3 Audit of performance reports

Section 8(3) of the Audit Act 1994 authorises the Auditor-General to audit performance indicators included in the annual reports of a public sector entity to determine whether they fairly represent the entity's actual performance.

The Auditor-General uses this authority to audit the performance reports prepared by the TAFE sector.

1.3 Audit conduct

The audits were undertaken in accordance with the Australian Auditing Standards.

The total cost of preparing and printing this report was $195 000.

1.4 Structure of this report

Details of the entities covered within each Part of this report are set out in Figure 1D.

Figure 1D

Report structure

|

Report part |

Description |

|---|---|

|

Part 2: Audit opinions and quality of reporting |

Covers the results of audits of the 2011 financial reports of eight universities, 14 TAFE institutes, seven training entities and the 69 entities that they control. It comments on the timeliness and accuracy of financial reporting in 2011. |

|

Part 3: Internal controls |

Assesses internal controls at eight universities and 14 TAFE institutions and summarises the control weaknesses commonly identified. It also comments on information technology security controls and capital project management across the tertiary education sector. |

|

Part 4: Financial results |

Analyses the financial results of eight universities and 14 TAFE institutes, including financial performance for 2011 and financial position at 31 December 2011. It also comments on movements and trends in international student fee revenue. |

|

Part 5: Financial sustainability |

Provides insight into the financial sustainability of eight universities and 14 TAFE institutes obtained from analysing the trends in five sustainability indicators over a five-year period. |

|

Part 6: Alpine resorts |

Covers the results of five alpine resort management boards which have a 31 October 2011 balance date, including financial performance and position. It also provides insight into the financial sustainability of the sector. |

Source: Victorian Auditor-General's Office.

2 Audit opinions and quality of reporting

At a glance

Background

This Part covers the results of the audits of the 2011 financial reports of eight universities and their 57 controlled entities, 14 technical and further education (TAFE) institutes and their 11 controlled entities, seven training entities and the one entity they control and other entities with a financial year ended on 31 December 2011.

Findings

- Overall, the financial report preparation processes of universities and TAFEs are adequate. They produced accurate, complete and reliable information.

- Financial reporting quality would still improve if entities prepared shell financial statements early to identify issues to be resolved, undertook rigorous analytical review and quality assurance procedures, and prepared materiality assessments.

- The financial reports of all but three entities received clear audit opinions:

- Deakin University and The University of Melbourne were again qualified due to their accounting treatment for non-reciprocal research and capital grants.

- Anti-Cancer Council of Victoria received a qualified audit opinion due to the inherent risks associated with cash donations.

- All 20 performance reports receivedclear audit opinions (20 in 2010).

Recommendations

- That performance reporting for the TAFE sector be elevated to legislative status.

- That universities and TAFEs continue to refine their financial reporting processes by preparing shell financial statements and adopting rigorous quality control and assurance procedures.

2.1 Reporting framework

2.1.1 Financial reporting

This Part covers the results from the audits of 98 universities, tertiary and further education (TAFE) institutes and controlled entities for the 2011 reporting period, as shown in Figure 2A. Each of the audited entities must prepare its financial report in accordance with Australian Accounting Standards, including the Australian Accounting Interpretations.

Figure 2A

Tertiary education entities

|

Type of entity |

2010 |

2011 |

|---|---|---|

|

Universities |

8 |

8 |

|

Entities controlled by universities |

63 |

57 |

|

TAFE institutes |

14 |

14 |

|

Entities controlled by TAFE institutes |

12 |

11 |

|

Training entities |

6 |

7 |

|

Entities controlled by training entities |

2 |

1 |

|

Total |

105 |

98 |

Note: Controlled entities generally include associated entities, trusts and joint ventures.

Source: Victorian Auditor-General's Office.

The principal legislation governing financial reporting by the tertiary education sector is the Financial Management Act 1994 (FMA) and the Corporations Act 2001. Appendix D details the legislative framework applying to each tertiary education sector entity.

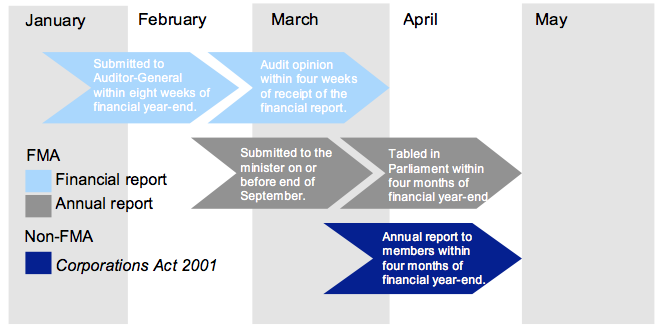

Figure 2B

Legislative reporting time frames

Source: Victorian Auditor-General's Office.

2.2 Audit opinions issued

At 11 May 2012, audit opinions had been issued on 94 education bodies and controlled entities’ financial statements for the financial year ended 31 December 2011. The audits of four of the controlled entities were still to be finalised.

Independent audit opinions add credibility to financial reports by providing reasonable assurance that the information is reliable. A clear audit opinion confirms that the financial report has been prepared according to the requirements of relevant accounting standards and legislation. A qualified audit opinion means that the financial report is materially different to the requirements of the relevant reporting framework or accounting standards, and is less reliable and useful as an accountability document.

Qualifications

Three qualified audit opinions were issued for the 2011 financial year (three for 2010).

The University of Melbourne and Deakin University again received qualified audit opinions because their accounting treatment of non-reciprocal research and capital grant income as a liability was not in accordance with Australian Accounting Standards. Accounting standards require grants which are non-reciprocal in nature to be recognised as revenue in the year they are received—when the entity gains control of the funds.

The ongoing qualified opinion issued to the Anti-Cancer Council of Victoria is generally attached to the financial reports of entities with significant voluntary fundraising activities. The qualification draws attention to the risk inherent in management assuring the complete recording of cash collected through donations. The risk is unavoidable and cannot be cost-effectively mitigated by further internal controls.

Emphasis of matters

In certain circumstances an audit opinion may draw attention to, or emphasise, a matter that is relevant to the users of an entity’s financial report but does not warrant a qualification.

Audit opinions on the financial reports of Monash Educational Enterprises, Monash South Africa Ltd, RMIT Drug Discovery Technologies and the Driver Education Centre of Australia Ltd contained an ‘emphasis of matter’ comment. The comment emphasised each entity’s reliance on continuing financial support from its parent entity to sustain its operations.

At 31 December 2011, Monash Educational Enterprises and Monash South Africa Ltd together owed $41.6 million to Monash University. Monash University has indicated that it is not its current intention to require repayment of these funds. The going concern assumption would be invalid without this continuing financial support.

The Driver Education Centre of Australia Ltd (DECA) had total liabilities of $4 million, a working capital deficit of $2.3 million at 31 December 2011 and reported an operating deficit of $0.1 million for 2011. Skills Victoria, an office of the Department of Education and Early Childhood Development, has agreed to financially support DECA to enable it to meet its current and future obligations.

RMIT Drug Discovery Technologies Pty Ltd has made net operating losses since it was established in 2007, including a $1.1 million operating loss in 2011. The entity has been sold post-signing but the transaction has not yet been settled.

2.2.1 Performance reports

In 2011 and 2010, clear audit opinions were issued on all 20 performance reports submitted for audit.

2.3 Quality of reporting

2.3.1 Introduction

The quality of an entity’s financial reporting can be measured by the timeliness and accuracy of the preparation and finalisation of its financial report. To achieve cost‑effective financial reporting, tertiary education bodies and their controlled entities need to have well planned and managed financial report preparation processes.

Entities should aim for the better practice elements detailed in Figure 2C to assist them to produce a complete, accurate and compliant financial report within the legislative time frame.

Figure 2C

Selected better practice – financial report preparation

|

Key area |

Better practice |

|---|---|

|

Financial report preparation plan |

Establish a plan that outlines the processes, resources, milestones, oversight and quality assurance practices required in preparing the financial report. |

|

Preparation of shell statements |

Prepare a shell financial report and provide it early to the auditors to enable early identification of amendments, minimising the need for significant disclosure changes at year-end. |

|

Materiality assessment |

Assess materiality, including quantitative and qualitative thresholds, at the planning phase in consultation with the audit committee. The assessment assists preparers to identify potential errors in the financial report. |

|

Monthly financial reporting |

Adopt full accrual monthly reporting to assist in preparing the annual financial report. This allows for the year-end process to be an extension of the month-end process. |

|

Rigorous quality control and assurance procedures |

Require review of the supporting documentation, data and the financial report itself by an appropriately experienced and independent officer prior to providing to the auditors. |

|

Supporting documentation |

Prepare high-standard documentation to support and validate the financial report, and provide a management trail. |

|

Rigorous analytical reviews |

Undertake rigorous and objective analytical review during the financial report preparation process to help improve the accuracy of the report. |

|

Reviews of controls/ self-assessment |

Establish sufficiently robust quality control and assurance processes to provide assurance to the audit committee on the accuracy and completeness of the financial report. |

|

Competency of staff |

Require that preparers of the financial report have a good understanding of, and experience in applying, relevant accounting standards and legislation. Require that they also have project management and interpersonal skills. |

|

Financial compliance reviews |

Undertake periodic compliance reviews to identify areas of noncompliance or changes to legislation that impact the financial report. |

|

Adequate security |

Protect and safeguard sensitive information throughout the process to prevent inappropriate public disclosure. |

Source: Victorian Auditor-General's Office and Australian National Audit Office Better Practice Guide: Preparation of Financial Statements, June 2009.

2.3.2 Quality of financial reporting

As shown in Figure 2D, the overall quality of financial reporting has substantially improved in 2011 from 2010.

Figure 2D

Quality of financial reporting in 2011

|

Universities |

TAFEs |

Total |

||||

|---|---|---|---|---|---|---|

|

Quality of financial reporting |

(%) |

(no.) |

(%) |

(no.) |

(%) |

(no.) |

|

Improved from previous year |

50 |

4 |

50 |

7 |

50 |

11 |

|

Same as previous year |

50 |

4 |

43 |

6 |

45 |

10 |

|

Worse than previous year |

0 |

0 |

7 |

1 |

5 |

1 |

|

Total |

100 |

8 |

100 |

14 |

100 |

22 |

Source: Victorian Auditor-General's Office.

The assessment of performance was against better practice criteria using the following scale:

- no existence—function not conducted by the entity

- developing—partially encompassed in the entity's financial reporting preparation processes

- developed—entity has implemented the process, however, it is not fully effective or efficient

- better practice—entity has implemented processes which are effective and efficient.

Despite the improvements that have been made, VAGO found that eight entities (36.4 per cent) have consistently indicated they were still ‘developing’ their financial statement preparation processes over the past three years. This is of concern as these entities show little or no significant progress in the development of financial statement preparation processes over a substantial period of time.

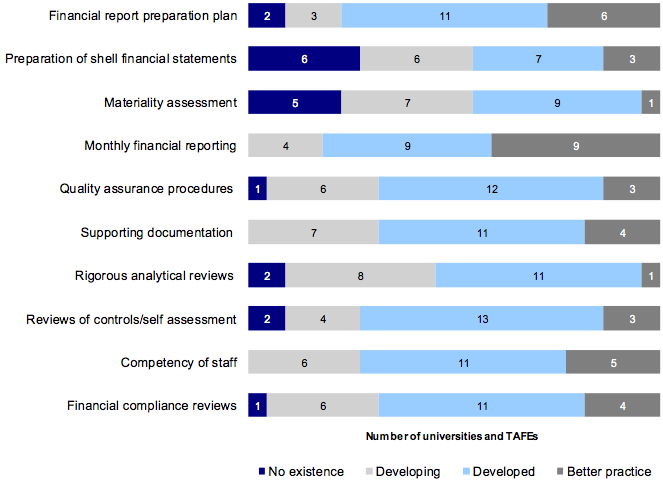

The results of our analysis are summarised in Figure 2E.

Figure 2E

Results of assessment of report preparation processes against better practice elements

Source: Victorian Auditor-General's Office.

The developed or better practice elements commonly shared by university and TAFE entities included:

- monthly financial reporting

- financial report preparation plan

- reviews of controls/self-assessment

- competency of staff.

Further improvement is needed in relation to:

- rigorous analytical reviews

- materiality assessment

- preparation of shell financial statements.

Improving these areas will assist the timely preparation of financial reports and early detection and correction of errors.

2.4 Timeliness of reporting

Recognising the importance of financial reports in providing accountability for the use of public monies, entities should prepare and publish their financial information on a timely basis. The later the reports are produced and published after year-end, the less useful they are for stakeholders and for informing decision-making.

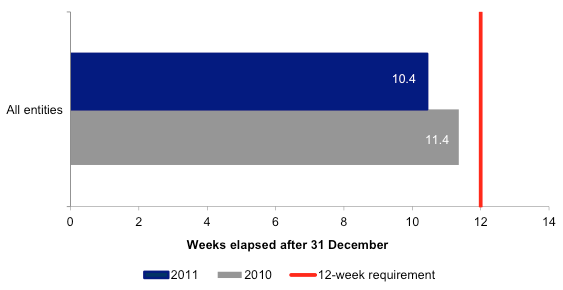

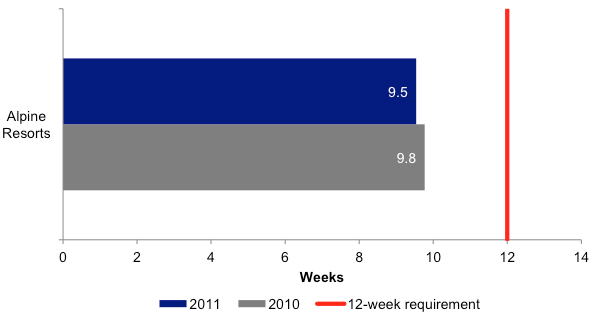

Figure 2F shows that the average time taken by tertiary education entities to finalise their financial reports has improved from 11.4 weeks in 2010 to 10.3 weeks in 2011.

For 2011, 88 per cent or 86 of the 98 tertiary education entities achieved the 12-week time frame. This was an improvement on 2010, when 78 per cent met the 12-week requirement.

Figure 2F

Average time to finalise financial reports for tertiary education entities

Source: Victorian Auditor-General's Office.

Recommendations

- That performance reporting for the TAFE sector be elevated to legislative status.

- That universities and TAFEs continue to refine their financial reporting processes by preparing shell financial statements and adopting rigorous quality control and assurance procedures.

3 Internal controls

At a glance

Background

Comprehensive internal controls help entities reliably and cost-effectively meet their objectives. Effective internal controls are a prerequisite for the delivery of reliable, accurate and timely external and internal financial reports.

Findings

- Internal controls over segregation of duties, maintenance of masterfiles, account reconciliations and employee leave management can be improved.

- Information technology (IT) systems’ security was strong, particularly around documented policies, physical access controls and the adequacy of IT training. Deficiencies were noted mainly at tertiary and further education (TAFE) institutes relating to monitoring compliance, governance, oversight and IT security classification policies.

- Capital project management frameworks are strong, but could be improved by undertaking post-project evaluations to enhance future processes, and engaging internal audit to perform regular reviews of capital project management arrangements.

- A quarter of capital projects across the tertiary education sector were subject to delays in completion or budget overruns.

Recommendations

That tertiary education bodies develop comprehensive policies for IT systems security, information classification security controls and capital project management. These policies should be regularly reviewed by the governing university council or TAFE board.

Universities and TAFEs could improve their processes and practices by engaging management and internal audit to undertake periodic assessments of IT security and capital project management arrangements, and completing post-project evaluations on larger capital projects. The results of these reviews should be reported to the governing body.

3.1 Introduction

Comprehensive internal controls help entities reliably and cost-effectively meet their objectives. Effective internal controls are a prerequisite for the delivery of reliable, accurate and timely external and internal reports.

In our annual audits we focus on the internal controls relating to financial reporting and assess whether entities have managed the risk that their financial statements will not be complete and accurate. Poor controls diminish management’s ability to achieve their entity’s objectives and comply with relevant legislation. They also increase the risk of fraud.

Universities and tertiary and further education (TAFE) governing bodies are responsible for developing and maintaining adequate systems of internal control to enable:

- preparation of accurate financial records and other information

- timely and reliable external and internal reporting

- appropriate safeguarding of assets

- prevention or detection of errors and other irregularities.

The enabling legislation for each of the eight universities we audit is similar and requires management to implement an internal control structure. For TAFE institutes, the Education and Training Reform Act 2006 requires management to implement an internal control structure.

In this Part we report on aspects of internal controls in the state’s eight universities and 14 TAFEs. We specifically address:

- general internal controls

- controls over information technology (IT) security

- controls over capital projects.

3.2 General internal controls

All universities and TAFEs have adequate internal controls to maintain the reliability of financial reporting, the efficiency and effectiveness of their operations and compliance with relevant laws and regulations. Nevertheless, we identified a number of instances where important internal controls need to be strengthened. These matters were reported to the related entity’s governing body and management team.

The commonly identified areas that require improving were:

- segregation of duties

- maintenance of masterfiles

- quality of account reconciliations

- excess leave balances.

3.2.1 Segregation of duties

One of the principal control mechanisms for sound financial management involves the segregation of key accounting roles between multiple personnel. The benefit of segregation of duties is that it maximises accountability and mitigates the risk of fraud or error in processing transactions. Critical accounting functions, such as the maintenance of vendor masterfiles and the payment of employees or suppliers are important roles which should be performed independently by staff.

A key component of segregation of duties is the timely completion of reviews, particularly over data input and processing of sensitive data. Timely reviews decrease the risk that errors may go undetected or may not be resolved in a timely manner, both of which can adversely impact on the accuracy of periodic financial reporting.

Throughout the tertiary education sector, there were a number of control weaknesses in this area, which put the integrity of the underlying financial systems at risk. These included:

- independent review over payroll functions not conducted

- lack of segregation of duties over vendor masterfile changes

- bank reconciliations not reviewed

- bank reconciliations and fixed asset reconciliations not reviewed in a timely manner.

3.2.2 Maintenance of masterfiles

Financial systems, such as accounts payable and payroll systems, rely on the maintenance of standing data on masterfiles to enable reliable processing of individual payments. Masterfile data can include details such as name, address, pay rates and bank account information.

Masterfiles can also include access or authority details for staff, listing who has been granted access to certain functions, or where authority for financial responsibilities has been delegated.

It is important that all changes made to standing data on masterfiles are checked for completeness, accuracy and legitimacy. Otherwise subsequent processing errors can be repeated many times over or data integrity reduced. Further, it is important that masterfiles are kept up to date and data reviewed periodically:

- to maintain accurate and current details

- for the detection and timely correction of unintentional or fraudulent changes

- to guard against payments to unauthorised suppliers or unauthorised adjustments to pay rates.

A number of instances of control weaknesses in masterfile maintenance were identified across the tertiary education sector, including:

- lack of independent review of changes to vendor masterfile

- former employees listed as current signing authorities

- unauthorised staff with uncontrolled access to operating systems and databases

- lack of audit trail for changes made to bank account details in employee masterfile.

3.2.3 Quality of account reconciliations

A financial report is generally prepared based on information captured in an entity’s general ledger, with key balances within the general ledger often supported by information recorded in subsidiary ledgers such as accounts payable, billing, fixed assets and payroll systems. Periodic reconciliation of the general ledger with subsidiary ledger balances is vital to confirm the completeness and accuracy of data.

Timely preparation and independent review of key account reconciliations decreases the risk that errors may go undetected or may not be resolved in a timely manner, both of which can adversely impact on the accuracy of periodic financial reporting.

While entities were generally performing key account reconciliations, we found a number of exceptions across the tertiary education sector, including reconciliations that:

- were not prepared, either in a timely manner or at all

- lacked sufficient detail for them to be meaningful

- although marked as complete and reviewed still contained significant errors

- contained long outstanding unreconciled amounts, with no indication of when they would be cleared or why they were still listed.

3.2.4 Excess leave balances

Universities and TAFE institutions have policies dealing with employee leave balances, which stipulate certain limits to leave balances that an employee can accrue at any given time. These limits are determined in the context of industrial agreements applying to the employer. Leave management is important, as large balances can present significant current and future liabilities to an organisation.

Incidences of excess leave balances may indicate understaffing, or an unhealthy reliance on particular staff to perform their functions. There is also a risk that long periods without absences may not encourage information sharing and can result in significant payouts when staff cease working with an organisation. Where significant leave balances are being accrued, it may also foster an environment where opportunities for fraudulent behaviour are created.

There were instances throughout the tertiary education sector where a significant number of staff had excess annual and long service leave balances. Where these were identified, entities were encouraged to develop leave management policies to reduce these balances, and better manage employee leave accruals in the future.

3.2.5 Other control weaknesses identified

A number of other control weaknesses were identified during the course of the 2011 audits. These included:

- poor controls over the upload of student payment reports into a student management system

- lack of review of repair and maintenance accounts for incorrect capital inclusions

- non-compliance with standing directions of the Minister for Finance in relation to the requirements for investment of cash balances

- poor controls around receipting processes

- flaws in management reporting and budgeting processes.

3.3 Controls over information technology security

IT security controls relate to the protection of computer applications, infrastructure and IT assets from a wide range of security and access threats. Such controls promote business continuity, minimise business risk, reduce the risk of fraud and error and help meet business objectives.

There is extensive reliance placed on information systems across the sector, and a critical aspect of this is the continuous upgrade and replacement of systems to improve information management and the quality of services provided to students.

Information held by universities and TAFEs about students, and the financial and operational aspects of the business can be highly sensitive. It needs to be protected from unauthorised access, theft or manipulation. With the implementation and upgrade of new IT systems, and the increasing sophistication of external threats, new security risks to the IT environment continue to arise.

Inadequate IT security can result in:

- unauthorised access to systems and information

- privacy breaches

- loss of critical business information assets

- material misstatements in financial statements

- disruptions to the delivery of essential educational services that are dependent on IT interfaces

- increased potential for fraud

- damage to the reputation of an agency.

IT systems security in both the University and TAFE sectors was generally strong, particularly around documented policies and procedures, effective physical access controls and the adequacy of IT training. Overall the IT environments were adequate for the security of sensitive data and the reliability of financial information, and the majority of entities IT security processes had been subject to internal audit review.

However deficiencies were noted relating to the governance and oversight of IT systems security and IT security classification policies. Also, some entities did not have approved IT security policies, which is concerning given the size of their operations and IT expenditure programs.

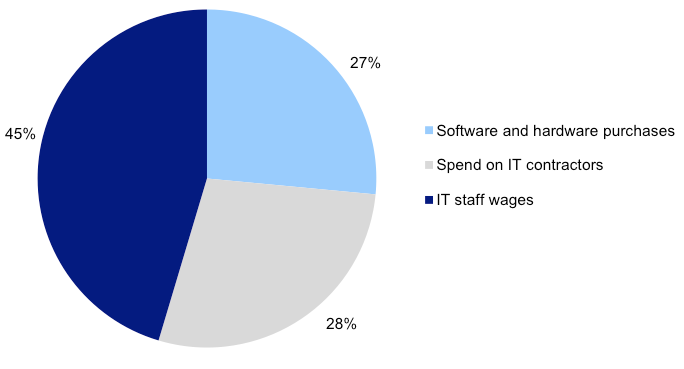

At 31 December 2011 the tertiary education sector reported $167 million of IT infrastructure assets at their depreciated value (31 December 2010, $177 million). Depreciation on those assets for the year was $58 million (2010, $47 million).The significance of IT security is highlighted with the tertiary education sector spending approximately $415 million on software, hardware, IT contractors and IT staff in 2011 (2010, $403 million). The breakdown of IT related expenditure is reproduced in Figure 3A.

Figure 3A

IT expenditure components

Source: Victorian Auditor-General's Office.

The chart highlights that the majority of IT expenditure relates to personnel costs (73 per cent), relating to operating, developing and maintaining infrastructure systems.

3.3.1 Information technology security framework

Controls over IT security can be placed into two categories:

- general controls—entity-wide controls which are pervasive to many applications and support the effectiveness of application controls

- application controls—manual or automated procedures that apply to the processing of transactions through individual applications and serve to protect the completeness, accuracy and security of information.

Our review focuses on the general or entity-wide security controls.

Figure 3B outlines the key components of an effective IT security framework. It draws on the:

- Department of Treasury and Finance’s Whole of Victorian Government Information Security Management Framework

- Standing Directions of the Minister for Finance under the Financial Management Act 1994

- International Standard Organisation’s ISO27001:2006, Specification for Information Security Management

- the Information Systems and Control Association’s best practice guidelines.

The IT security framework provides entities with a comprehensive approach to the management of their IT security arrangements.

Figure 3B

Key elements of an effective IT security framework

|

Component |

Key elements |

|---|---|

|

Policy |

IT security policies that include:

An information security classification policy that provides:

Policies reviewed by the information security committee or the IT steering committee. Policies approved by the board. |

|

Management practices |

Adequate training for staff about IT security. IT risk register developed and maintained. Policies and procedures regularly reviewed and updated. Establishment and monitoring of the operation of:

Periodic reporting on the status of IT systems and security arrangements, to the board. |

|

Governance and oversight |

IT security committee to oversee the development and update of security strategies, standards, policies and procedures, and to monitor mitigation of risks. IT steering committee to advise management on IT acquisitions and provide guidance on the provision of IT services. Adequacy of IT security arrangements reviewed and tested periodically by internal audit or consultants. Monitoring compliance with policies and procedures by management and the board. |

Source: Victorian Auditor-General's Office.

3.3.2 Information technology security policies

Universities and TAFEs store, process and communicate large volumes of information electronically. Effective IT security controls mitigate the risk that this information could be inappropriately accessed, or that information necessary for efficient functioning will be incomplete or inaccurate.

IT systems should be supported by security policies and procedures that control access, and require monitoring and reporting on compliance with organisational policies and procedures.

Existence of information technology security policies

Twenty of the 22 tertiary education bodies (91 per cent) had a documented IT security policy. Documented IT security policies did not exist at two of the TAFEs (14 per cent), however, these entities were in the process of drafting a policy at 31 December 2011.

Where IT security policies had been established, they were generally comprehensive, incorporating most of the better practice elements set out in Figure 3B. Across the tertiary education sector, policies commonly incorporated the following better practice elements:

- consequences of information security policy violations—95 per cent

- compliance with legislative, regulatory and contractual requirements—90percent

- incident management processes—90 per cent

- human resources and user access security—90 per cent

- communication and connectivity management processes—90 per cent

- asset management and allocation processes—80 per cent.

Conversely, the following better practice elements were not incorporated into the IT security policies at a significant number of tertiary education bodies:

- business continuity management practices—35 per cent

- acquisition, development and maintenance—30 per cent

- security education, training and awareness—30 per cent.

Each of these aspects if not properly addressed can have far reaching impacts in the event that IT systems are compromised. Of particular concern was that just four of the eight universities had covered security education, training and awareness in their IT security policies.

Board approval of policy

IT security is a contemporary issue and should be a concern to members of university councils and TAFE governing boards, who are ultimately accountable. Seven of the eight universities (88 per cent) with an IT security policy obtained governing council approval. Nine of the 12 TAFEs (75 per cent) with an IT policy had it approved by their board.

Review of information technology policies

IT policies need to be periodically updated to keep up with changes in the development of IT systems and the increasing complexity of IT environments. It was positive to note that where IT security policies had been established, 80 per cent had been reviewed and updated at least once in the past three years.

Information security classification policy

An information security classification policy outlines criteria for assigning security classifications to information and the required security controls for each classification, to limit access to sensitive information by unauthorised parties.

Eleven of the 22 tertiary education bodies (50 per cent) had an information security classification policy. Five were universities and six were TAFEs. Four of the 22 tertiary education bodies (18 per cent) were developing an information security classification policy.

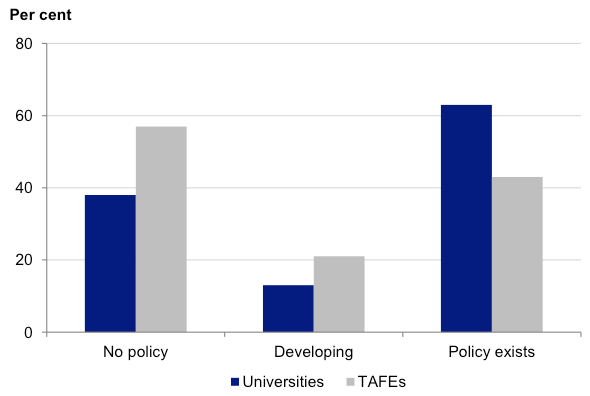

Figure 3C shows the information classification security policy status across the tertiary education sector. This shows that the TAFE sector is lagging in developing and approving information security classification policies.

Figure 3C

Information Classification Security Policy status

Source: Victorian Auditor-General's Office.

This low rate of security classification policy establishment increases the risk of security access violations. Across the tertiary education sector there is a risk that confidential and sensitive information may be easily accessible to parties with no authority to obtain such information, thus compromising student privacy and the security, completeness and accuracy of business information.

3.3.3 Management practices

Training

Training of staff is a critical component of implementing and maintaining IT security. Proper training enhances understanding of endorsed policies and procedures, and enables their correct and consistent application. Training can also highlight to staff the areas of greatest concern.

Fifteen of the 22 tertiary education bodies (68 per cent) had conducted training for staff on IT security policies and procedures. The level of training provided was comparable across both the university and TAFE sectors.

Logical access and physical access controls

Logical access controls such as passwords restrict access to information on computer systems to people with the appropriate level of authorisation.

Physical access controls act to protect unauthorised access to information and hardware. Examples include requiring pass cards to enter buildings, locking offices at night, storing servers in secured data centres and keeping laptop computers locked up when not in use.

Based on a high-level review, physical security controls over IT systems at the 22 tertiary education bodies were generally considered to be adequate.

Change management controls

Replacing and upgrading systems should lead to better management of information. However, the process of implementing changes to existing systems and transferring information from old systems to new poses a significant risk to information security. Effective controls over such changes are important to protect the integrity of data and any information transferred.

Twenty one of the 22 tertiary education bodies (95 per cent) had adequate controls, and processes to manage changes to IT systems. Of these, three of the TAFEs (21 per cent) relied on change management controls established by their external IT service providers. These organisations outsource the hosting of core finance applications, with the service providers responsible for providing an appropriate change management framework. However, each TAFE is still responsible for the change management controls.

In the case of one TAFE institute there were no established controls around the reconciliation of information before and after system upgrades.

Backup and recovery procedures

Tertiary education bodies handle large volumes of important and sensitive information, the loss of which would cause significant problems for both students and these entities. In order to protect this information, it is essential that universities and TAFEs have appropriate backup and recovery procedures in place. These procedures should be tested regularly to check that they work as intended.

The Standing Directions of the Minister for Finance require entities to maintain up‑to‑date backups for all financial management systems and data being used.

We found that the backup and recovery procedures were adequate at all tertiary education bodies. Three TAFE institutes relied on the backup procedures established by their IT service providers, and in most instances these were performed daily.

Management of information technology risks

The Standing Directions of the Minister for Finance outline the government’s expectations with respect to IT risk assessments and financial management impacts. All public sector agencies are also required to identify and manage their risks within the Victorian Government Risk Management Framework.

A risk assessment will identify key information assets and perceived security threats, and assess them based on probability and the risk appetite of the entity. This enables mitigation strategies to be put in place focusing resources on the most highly rated IT risks, reducing the probability of these occurring and the severity of their impact.

Of the 22 tertiary education bodies, we found that 20 (91 per cent) had adequate IT risk management practices, with:

- fourteen (70 per cent) managing IT risks through an IT risk register

- six (30 per cent) including IT risks in the organisation’s overall risk register as part of their risk management framework.

The two remaining tertiary education bodies (9 per cent) had not included IT security as a risk in their risk register. These were moderate to small-sized TAFEs, but given their annual combined turnover of at least $75 million and the sensitive information maintained, it is concerning that a documented and approved IT risk identification process was not in place.

3.3.4 Governance and oversight

Establishment of an information technology steering committee

Best practice across the public sector is to establish specialist committees for the governance of an entity’s IT environment. The functions of an IT steering committee include advising management on IT investment requirements and providing guidance on the provision of IT services.

Of the 22 tertiary education bodies, six (32 per cent) did not have an IT steering committee. These were all TAFE institutes, whereas all eight of the universities had an IT steering committee.

Where there was no separate committee, the function was commonly performed by the respective TAFE board. This does not seem appropriate for these six TAFEs that are responsible for a range of complex activities and expenditure ranging from at least $27 million up to over $150 million per annum. There is a risk that inadequate focus will be given to IT security by the governing body.

Monitoring compliance with policies and procedures

Governing councils and boards are responsible for reviewing the adequacy of IT security and assessing compliance with relevant internal policies. Responsibilities of TAFE boards are contained within the Financial Management Act 1994, while university council responsibilities are stipulated by the individual enabling legislation of each university.

Governing bodies at seven of the 22 tertiary education bodies (32 per cent) had not established arrangements to monitor compliance with IT policies and procedures. This included two of the eight universities (25 per cent), and five of the 14 TAFE institutes (36 per cent). The lack of monitoring increases the risk that any breaches will not be identified and mitigated in a timely manner, or at all.

Where compliance monitoring updates were provided to the governing council or board they were most commonly undertaken through internal audits and monitored by the audit committee.

Internal audit

Reviews of IT security controls and compliance with policies and procedures are necessary for identifying control weaknesses, potential process improvements and training needs. Such reviews can provide management and the governing body with assurance over the entity’s IT security arrangements and assist them in meeting their monitoring obligations.

Five of the 22 tertiary education bodies (23 per cent) had not had an internal audit of their IT security arrangements during the past three years. This included three of the eight universities (38 per cent) and two of 14 TAFE institutions (14 per cent).

3.4 Controls over capital projects

Controls over capital projects relate to the processes involved in undertaking capital expenditure programs and the construction of infrastructure and other fixed assets. Such controls promote effective capital investment, minimise cost inefficiencies, reduce the risk of fraud and error and help meet business objectives.

There are extensive capital project developments across the tertiary education sector, as organisations commit funding for the replacement of existing buildings and expansion of current facilities to improve the quality of services provided to students and research capacity. This increased expenditure largely reflects Commonwealth Government initiatives to increase student participation and access. In 2011 the sector planned to spend approximately $1.0 billion on new capital projects.

Capital project management frameworks in the tertiary education sector were considered to be effective, particularly around the scope and coverage of those documented policies in existence.

However, deficiencies were noted relating to some governance areas and post-project reviews. Also, some entities did not have documented capital project management policies, which is concerning given the size and scope of their capital programs.

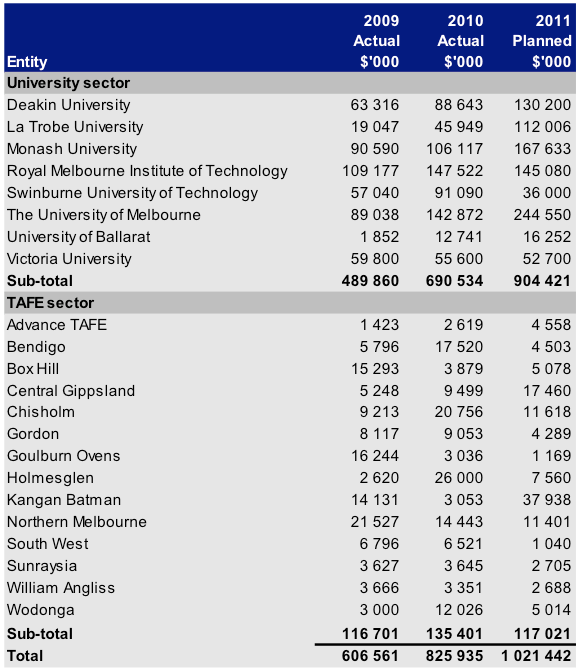

Figure 3D provides a summary of the actual capital expenditure across the tertiary education sector for 2009 and 2010, and the planned capital expenditure for 2011.

Figure 3D

Capital expenditure incurred

Note: Planned figures for 2011 were obtained during the course of the 2011 audits.

Source: Victorian Auditor-General's Office.

Figure 3D highlights the significant level of capital spending undertaken during the past three years, particularly in the university sector. The growth in capital expenditure in 2011 also largely relates to the university sector, which has seen a number of large building and redevelopment projects undertaken, particularly at The University of Melbourne, La Trobe University, Deakin University and Monash University. These high levels of capital expenditure need to be supported by appropriate policies and procedures, to ensure the timely completion of projects within budget, and accurate reporting of costs incurred.

At 31 December 2011, tertiary education entities had total assets of $16.6 billion, with buildings, plant and equipment accounting for $9.0 billion or 54 per cent of the total asset base. Most of the remaining balance consisted of land holdings.

The effective management of capital projects is critical given the materiality of buildings, plant and equipment and the extensive capital expenditure program.

Inadequate management and control over capital projects can result in:

- budget overruns

- delays in project delivery

- inefficient allocation of resources

- project benefits and outcomes not achieved.

Financial and timing outcomes

Our review of the capital expenditure programs across the tertiary education sector for 2011 indicates that a significant number of projects are experiencing delays and budget overruns. Based on our high level review of 158 projects, we were advised that approximately 15 per cent of capital projects had experienced variations from original budgets and 27 per cent of capital projects had experienced delays based on the original planned completion date.

Factors contributing to the delays and budget overruns included:

- underestimation of the size and complexity of the project

- quality and preparation issues

- project defects

- scope changes.

3.4.1 Capital project management framework

Figure 3E outlines the key components of an effective capital project management framework. It draws on the:

- Department of Treasury and Finance’s Gateway Review Process

- Standing Directions of the Minister for Finance under the Financial Management Act 1994.

It provides entities with a comprehensive approach to managing their capital project management arrangements.

Figure 3E

Key elements of an effective capital projects management framework

|

Component |

Key elements |

|---|---|

|

Policy |

Capital project management policies established and include:

Policy regularly reviewed and approved by governing body or subcommittee. Policy and procedures comply with the directions and policy of state government. |

|

Management practices |

Executive management monitors capital projects through checking that:

Project costs are processed timely and accurately within supporting ledgers. Post-project evaluation completed and learnings consolidated and used in practice. Comprehensive and regular reporting to the governing body or subcommittee. |

|

Governance and oversight |

The governing body or subcommittee monitor:

Policies and procedures are regularly reviewed, updated and approved by the governing body or subcommittee. |

Source: Victorian Auditor-General’s Office.

We assessed the universities and TAFEs capital project management frameworks against the above key elements.

3.4.2 Capital project management policies

Capital projects should be supported by policies that effectively control the ongoing capital project management process. These policies should be monitored and reported on to assure compliance, and to identify any necessary changes.

Existence of policies

Eighteen of the 22 tertiary education bodies (81 per cent) had a documented capital project management policy. Formal capital project management policies did not exist at four TAFEs (29 per cent). However, one of these was drafting a policy at 31 December 2011. Given the size of the asset bases of these four entities, totalling $549 million, and their collective annual capital works programs of over $15 million per annum, it is important that all entities have documented capital project management policies.

Of the 10 TAFEs who had a documented capital project management policy, two relied on the Capital Infrastructure Guidelines published by the Victorian Skills Commission, rather than independently developing a capital management framework. While these guidelines represent a sound base for developing policy, they are not tailored to the specific operations of the entity, and have not been reviewed since February 2008. This reinforces the importance of entities developing their own internal policies to ensure ongoing relevance.

Where capital project management policies had been established, they were generally comprehensive, incorporating most of the better practice elements set out in Figure 3E. Across the tertiary education sector, policies commonly incorporated the following better practice elements:

- scope for the preparation of a project plan and specification—100 per cent

- authorisation arrangements—100 per cent

- objectives—94 per cent

- budget setting and approval process—89 per cent

- criteria for project selection—83 per cent

- risk assessment and management plan—78 per cent.

Conversely the following better practice elements were not incorporated into the capital project management policies at a significant number of tertiary education bodies:

- circumstances requiring probity auditors and advisors—50 per cent

- process of assigning a sponsor to a project—33 per cent

- references to legislative requirements—28 per cent.

Each of these elements if not properly addressed can have substantial impacts on the capital project process, resulting in budget overruns and time delays. It is concerning that just four universities and five TAFEs had covered the engagement of either independent probity auditors or advisors prior to the awarding of a contract.

Board approval of policy

Capital project management is a critical business activity and should be a concern to members of university councils and TAFE governing boards, who are ultimately accountable for their operations.

Only 10 of the 18 tertiary education bodies (56 per cent) with a capital project management policy had obtained governing body approval. Six of the eight universities (75 per cent) with a capital project management policy obtained council approval. Four of the 10 TAFEs (40 per cent) with a policy had it approved at board level.

3.4.3 Management practices

Monitoring of capital projects

Regular monitoring of capital projects by executive management teams is central to assessing whether projects are running on time and on budget, as well as determining whether benefits are being achieved and risks are being adequately managed and mitigated.

The majority of tertiary education bodies maintain systems which enable the production of monthly reports relating to work in progress and completed project listings, from which transaction postings to general ledgers are made. These reports allow project managers and executive management to review, and report on, the progress of projects and complete analysis of financial and other outcomes for finalised projects.

We found shortcomings in the underlying capital project systems at eight of the 22 tertiary education bodies (36 per cent), as these entities’ systems were not capable of scheduling payments and projecting cash flows. This is of concern, particularly for the four universities (50 per cent) where these systems were found to be inadequate.

Executive management teams across the sector are monitoring the status of projects, with key project elements and milestones being reviewed at each of the tertiary education bodies. This indicates that while there may have been some deficiencies noted in the composition of capital project management policies and underlying system capabilities, the high-level management oversight of capital projects is operating effectively.

Conduct of post-project evaluations

An important aspect of the capital works process is the experience that can be derived from analysing whether the planned outcomes of the project were achieved, and whether works were completed on time and within budget. The application of this ongoing experience by management to future projects would improve an entity’s ability to deliver projects on time and within budget.

Seven of the 22 tertiary education bodies (32 per cent) do not undertake a post-project evaluation at the completion of capital projects. This important mechanism for driving process improvement should be implemented in the four universities and the three TAFE institutes that currently do not perform this activity.

3.4.4 Governance and oversight

Reporting to the board

To facilitate effective decision-making, internal reports should be prepared on a regular basis, containing complete and accurate information with sufficient commentary included. These reports should be provided to the governing board on a regular basis to enable it to fulfil its oversight obligations.

All of the entities within the tertiary education sector were reporting monthly or quarterly to their governing bodies on overall capital expenditure programs as well as specific projects. While the reports generally focus on the achievement of project outcomes and the management of project risks, greater attention should be given to reporting on the achievement of key milestones.

Emergence of board subcommittees

To facilitate effective monitoring of performance against delivery dates and cost, regular reports should be prepared and provided to board subcommittees with commentary on variations against targets.

These subcommittees provide a sharper focus on the delivery of the capital expenditure program and, in conjunction with management, play an important role by looking to clear any potential disruptions that would impact on the achievement of key milestones.

In response to the expanded capital work programs, we noted that 19 tertiary education bodies (86 per cent) have established a separate subcommittee, directly responsible to the governing board, to overview the management of capital projects from the initiation of contract proposals to post-completion evaluation.

Risk management

With a significant capital works program underway, it is important that the risks associated with contract management and project delivery are monitored by the executive management team and governing body.

Five of the 22 tertiary education entities do not include risks associated with their capital expenditure program in their risk register. Given that the size of these entities’ aggregate programs exceeds $75 million per annum, we would have expected some documented risk assessment to have been completed.

Internal audit

Reviews of capital project management controls and compliance with policies and procedures are necessary for identifying control weaknesses, potential process improvements and training needs. Such reviews can provide management and the board with assurance over the entity’s capital project management arrangements and assist them in meeting their monitoring obligations.

Thirteen of the 22 tertiary education bodies (59 per cent) had not had an internal audit review of their capital project management arrangements during the past three years. Specifically, nine of 14 TAFE institutes (64 per cent) had not commissioned an internal audit review of their capital project management arrangements.

Recommendations

That tertiary education bodies:

- assess their policies and practices against the identified general internal control weaknesses to determine the adequacy of their controls, and whether they are operating reliably, efficiently and effectively

- develop comprehensive policies and procedures over information technology system security which are approved at board or council level and subject to regular review

- develop an information security classification policy that outlines criteria for assigning security classifications to information and the required security controls for each classification

- undertake periodic assessments of the adequacy of, and compliance with, information technology security requirements.

That tertiary education bodies:

- develop capital project management policies and procedures which are approved by the governing body

- undertake post-project evaluations to learn from recent projects and report findings to the governing body

- engage internal audit to conduct periodic reviews of their information technology security policies and capital project management arrangements and outcomes.

4 Financial results

At a glance

Background

Accrual-based financial statements enable an assessment of whether universities and technical and further education (TAFE) institutes are generating sufficient surpluses from operations to maintain services, fund asset maintenance, and retire debt.

Student fees represent a significant portion of own-source revenue for the tertiary education sector, with 84.9 per cent of these fees received from international students.

Findings

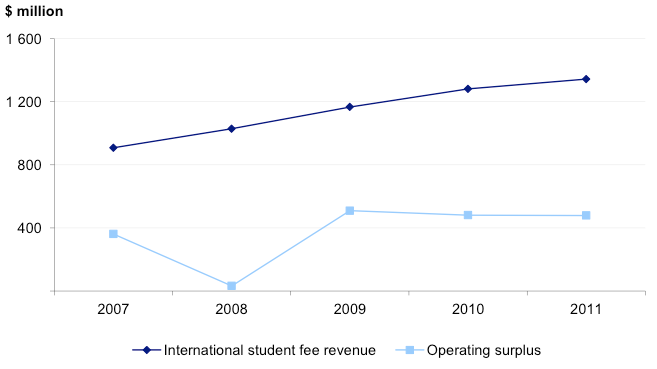

- The university sector generated a surplus of $478.5 million, down 0.5 per cent on the 2010 result, including a $61.7 million increase in international student fee revenue.

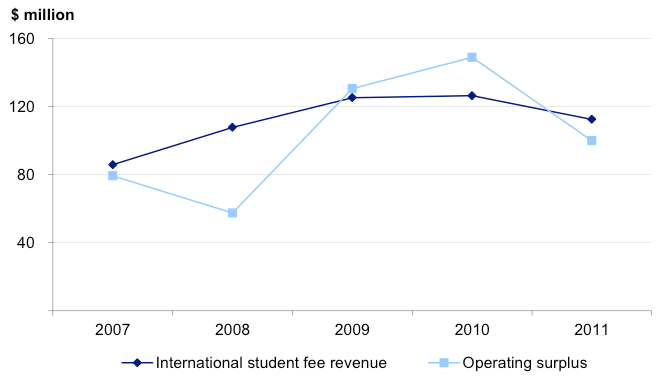

- The TAFE sector generated a surplus of $100.5 million, down 32.5 per cent on the 2010 result, partly as a result of decreased student numbers, including international students.

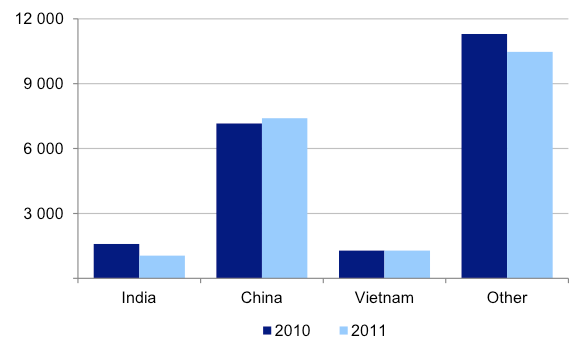

- An 11.7 per cent decrease in onshore international student commencements across the TAFE sector resulted in a $13.9 million decrease in fee revenue from this source.

- Three of the 11 TAFE institutes providing educational services to international students cannot provide information on these students' countries of residence; this deficiency impacts on their ability to effectively market their services.

- In 2011, the first year of the contestable market introduced by the former state government, there was a reduction in domestic student fee revenue across the TAFE sector of $1.4 million (2.1 per cent).

Recommendation

Tertiary education bodies should develop and maintain the capacity to monitor the country of residence and other socio-economic details of their international students to improve their marketing focus and provide appropriately structured courses.

4.1 Introduction

Accrual-based financial statements enable an assessment of whether universities and tertiary and further education (TAFE) institutes are generating sufficient surpluses from operations to maintain services, fund asset maintenance and retire debt.

Universities can generate surpluses to fund asset renewal and acquisitions. The TAFE sector has greater reliance on a funding model that allocates capital grants strategically across the sector.

4.2 Financial performance

Financial performance is measured by an entity's result—the difference between revenue inflows and expenditure outflows.

An entity’s financial position is generally measured by reference to its net assets—the difference between its total assets and total liabilities. However, this measure is less relevant in the public education sector, as most of these entities are ‘not for profit’, and generally do not hold assets that generate revenue. Instead, they mainly hold building and infrastructure assets, which require funds to meet operating costs, repairs, maintenance and replacement.

As the revenue base for universities and TAFEs is not tied to the value of their asset base and they cannot sell most of their assets to obtain funds, their objective should be to maintain and improve their asset base and related service provision, while managing the level of debt so it can be paid from future operations.

The ability of universities and TAFEs to maintain their assets depends on asset and liability management policies, and is reflected in the composition and rate of change in the value of assets and liabilities.

4.2.1 Universities

Operating result

Figure 4A provides a comparison of the total operating results for the eight universities for 2011 and 2010.

Figure 4A

Total operating results of universities for 2010 and 2011

|

Operating result ($’000) |

Movement |

||

|---|---|---|---|

|

2010 |

2011 |

($’000) |

(%) |

|

480 894 |

478 523 |

(2 371) |

(0.5) |

Source: Victorian Auditor-General's Office.

The 2011 overall operating result for universities of $478.5 million was similar to 2010, indicating that the sector again generated strong returns. A 2.4 per cent increase in expenditure was almost matched by a 2.2 per cent increase in revenue recorded during 2011.

Operating revenue

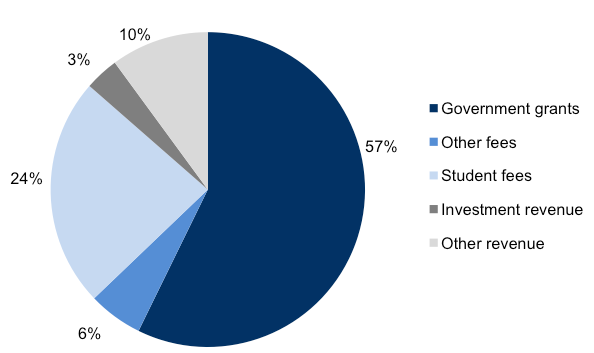

The composition of operating revenue remained consistent with that of the previous year. The composition of university revenue for 2011 is presented in Figure 4B.

Figure 4B

Revenue composition for 2011

Source: Victorian Auditor-General's Office.

Universities collectively generated $6.5 billion in revenue in 2011, an increase of $139.0 million (2.2 per cent) from 2010 ($6.4 billion).

Commonwealth and state government funding accounted for 57 per cent of total revenue in 2011 (55 per cent in 2010). Government funding grew by $225.9 million (6.4 per cent) from 2010.

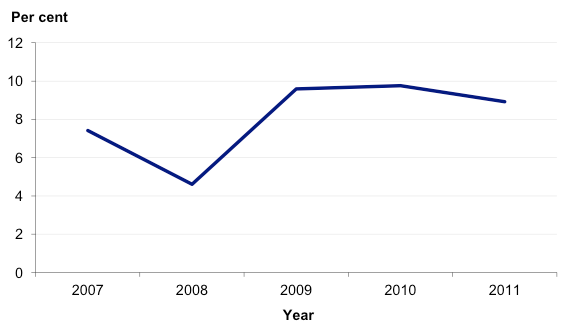

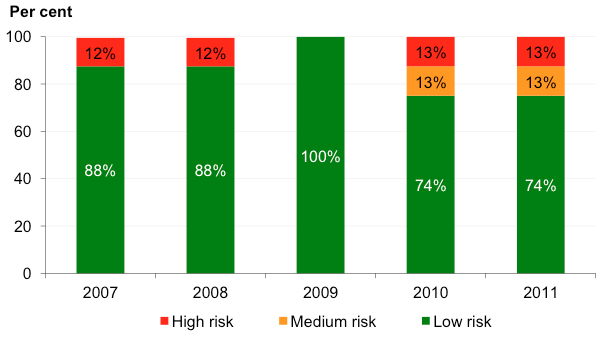

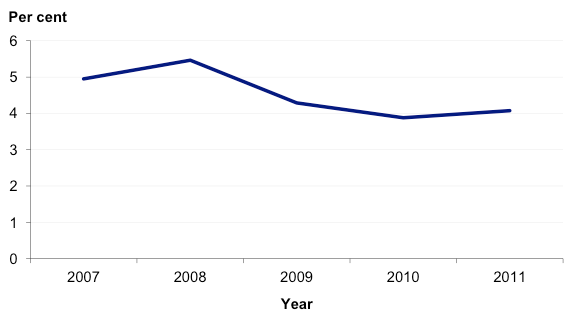

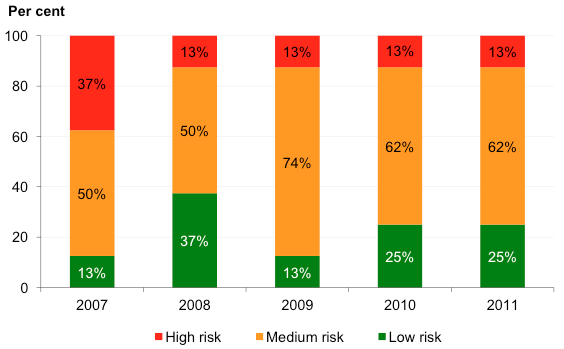

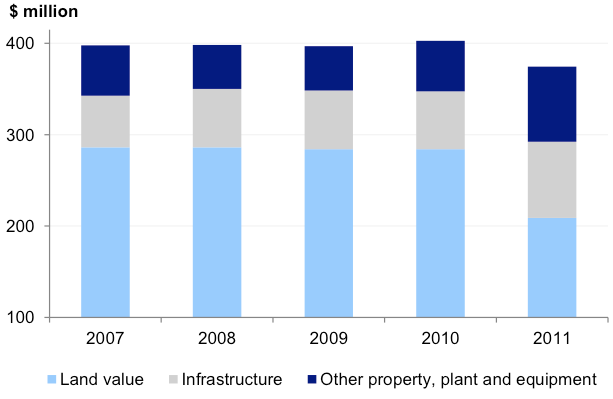

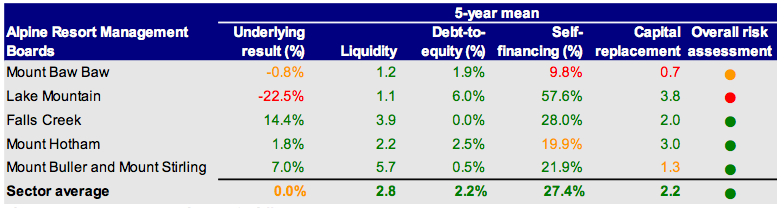

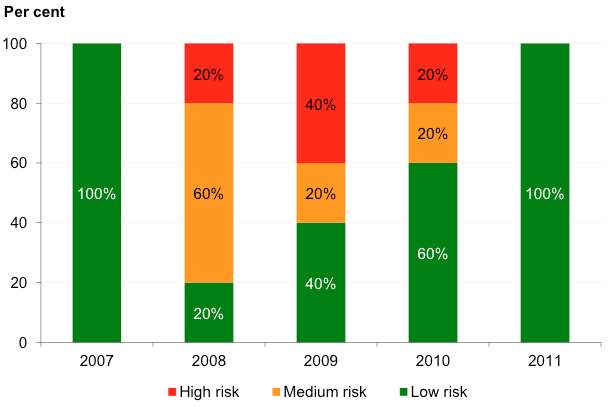

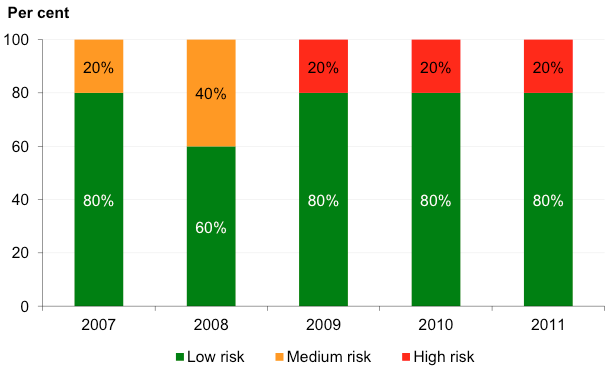

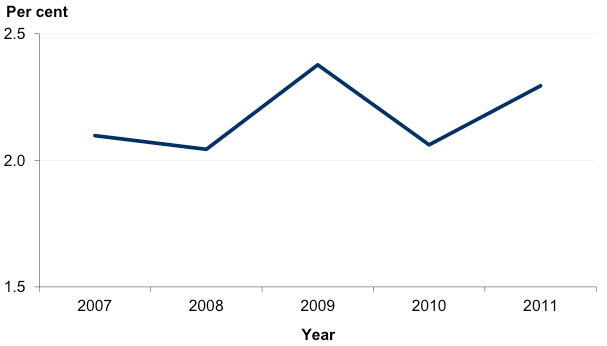

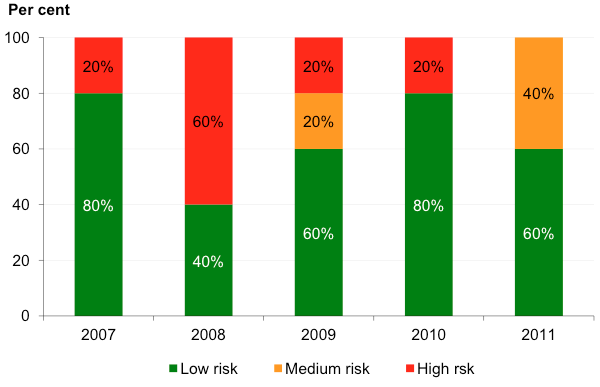

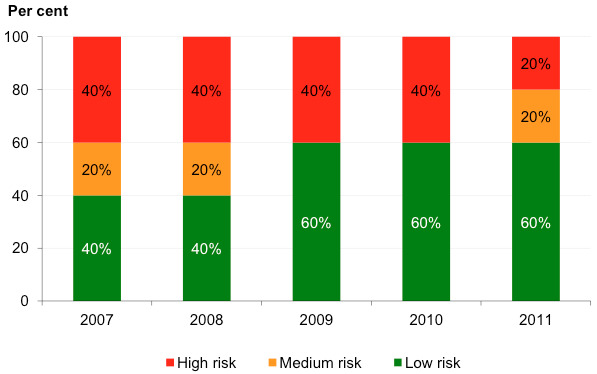

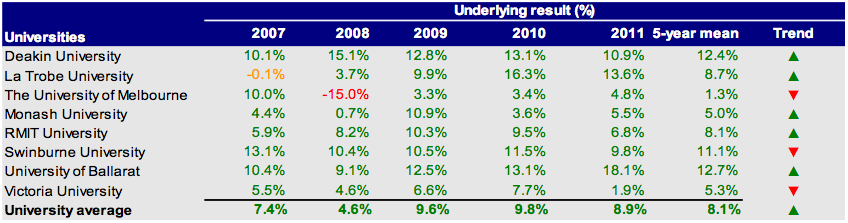

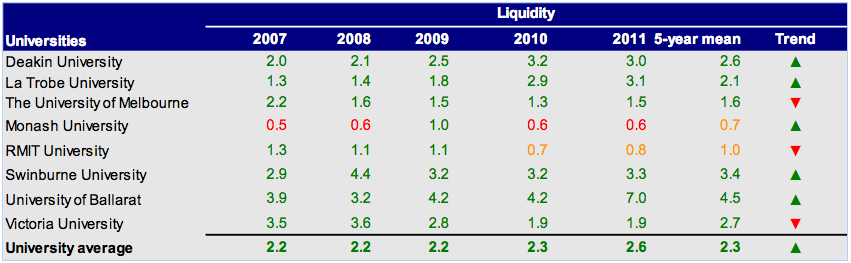

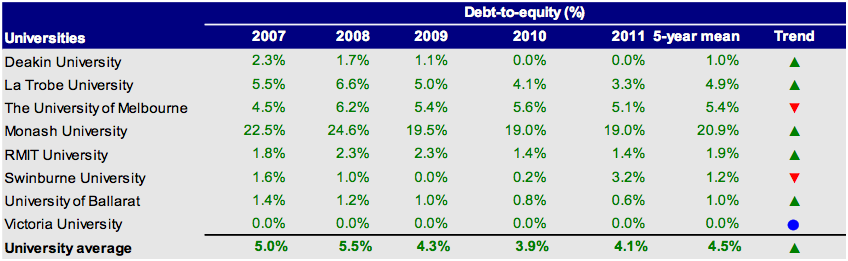

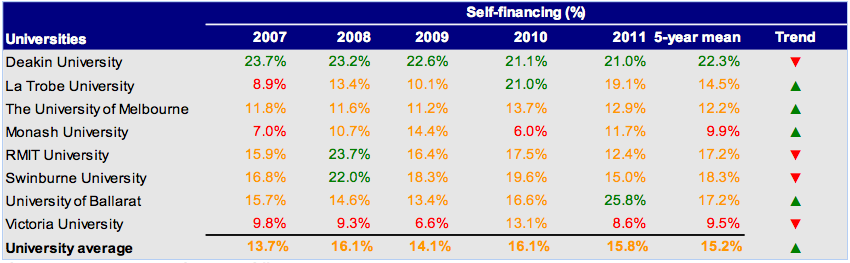

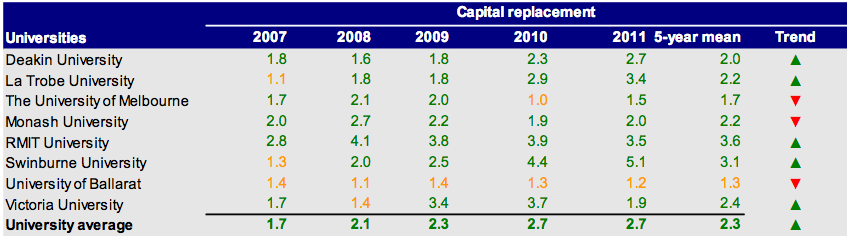

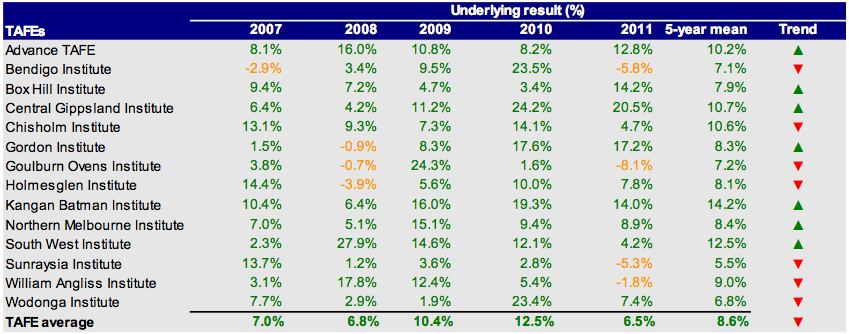

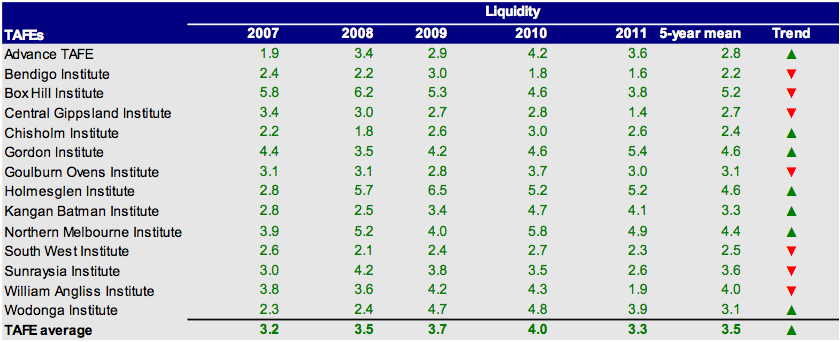

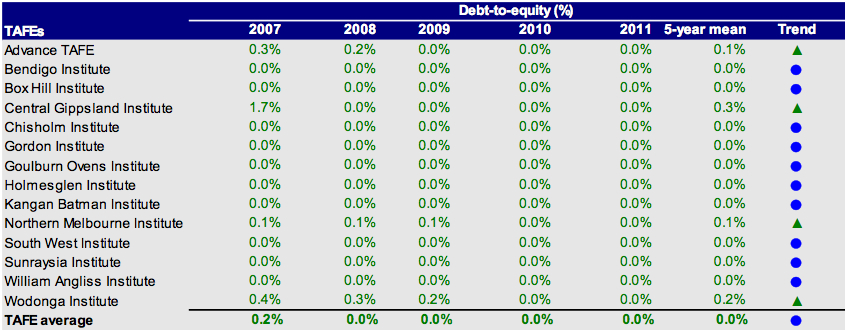

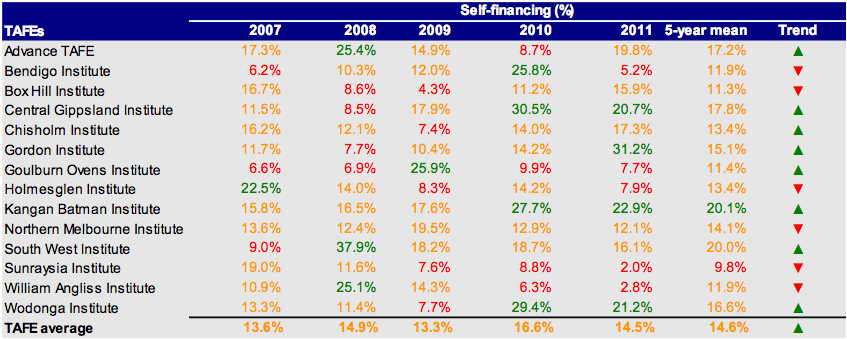

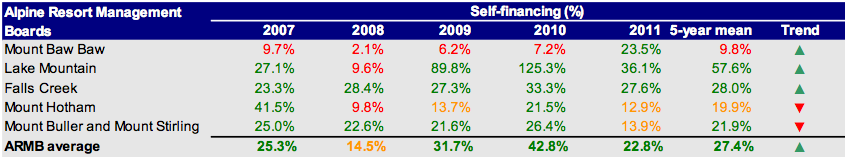

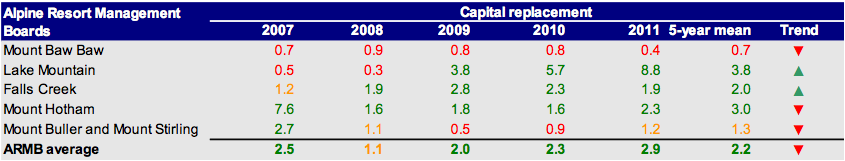

Government funding is provided for two purposes: operating grants, mainly from the Commonwealth government, for delivery of student education services, and capital grants for projects. In 2011, universities received $3.6 billion in operating grants and capital funding of $168.2 million.